3901 FLORAL 2024

“OUR COMMITMENT IS TO HELP OUR CLIENTS CREATE AND PRESERVE WEALTH BY PROVIDING THEM WITH THE BEST REAL ESTATE

GLOBAL REACH, LOCAL EXPERTISE

$86.3B

VALUE OF RECENTLY CLOSED TRANSACTIONS

12,272

CLOSED SALES IN MOST RECENT YEAR

$12.8B

TOTAL VALUE OF RECENT LISTINGS

2,143

CLOSED FINANCINGS IN MOST RECENT YEARS

YOUR TEAM

JORDAN DICKMAN

FIRST VICE PRESIDENTS DIRECTOR, NMHG

NICK ANDREWS

FIRST VICE PRESIDENTS DIRECTOR, NMHG

AUSTIN SUM

SENIOR INVESTMENT ASSOCIATE

AUSTIN Hall

INVESTMENT ASSOCIATE

ALDEN SIMMS

INVESTMENT ASSOCIATE

CORPORATE SUPPORT

LIZ POPP

MIDWEST OPERATIONS MANAGER

JOSH CARUANA

VICE PRESIDENT

REGIONAL MANAGER

INDIANAPOLIS | CINCINNATI | LOUISVILLE | ST LOUIS | KANSAS CITY

JOHN SEBREE

SENIOR VICE PRESIDENT

NATIONAL DIRECTOR

NATIONAL MULTI HOUSING GROUP

MICHAEL GLASS

SENIOR VICE PRESIDENT

MIDWEST DIVISION MANAGER

NATIONAL DIRECTOR, MANUFACTURED HOME COMMUNITIES GROUP

BROKER SUPPORT

SAM PETROSino

VALUATION & RESEARCH

BRETT MARTIN

INTERNAL ACCOUNTANT

BRITTANY CAMPBELL-KOCH DIRECTOR OF OPERATIONS ALEX PAPAMARKETING COORDINATOR

DATA SUMMARY

Property Address: 3901 Foral

City, State, Zip: Cincinnati, OH 45212

Submarket: Norwood

County: Hamilton

Year Built: 1900

Number Of Units: 4

Lot Size (Acres): .17

# of Buildings: 1

# of Stories: 2

# of Parcels: 1

Current Occupency: 100%

HVAC Type: Central

Parking Surface: Concrete Driveway

Garage/ Carport: 3

Parking Type: 3 Convered Off-Street

Average Unit Size: 1,500

Laundry: Community Laundry

SECTION - THE INVESTMENT

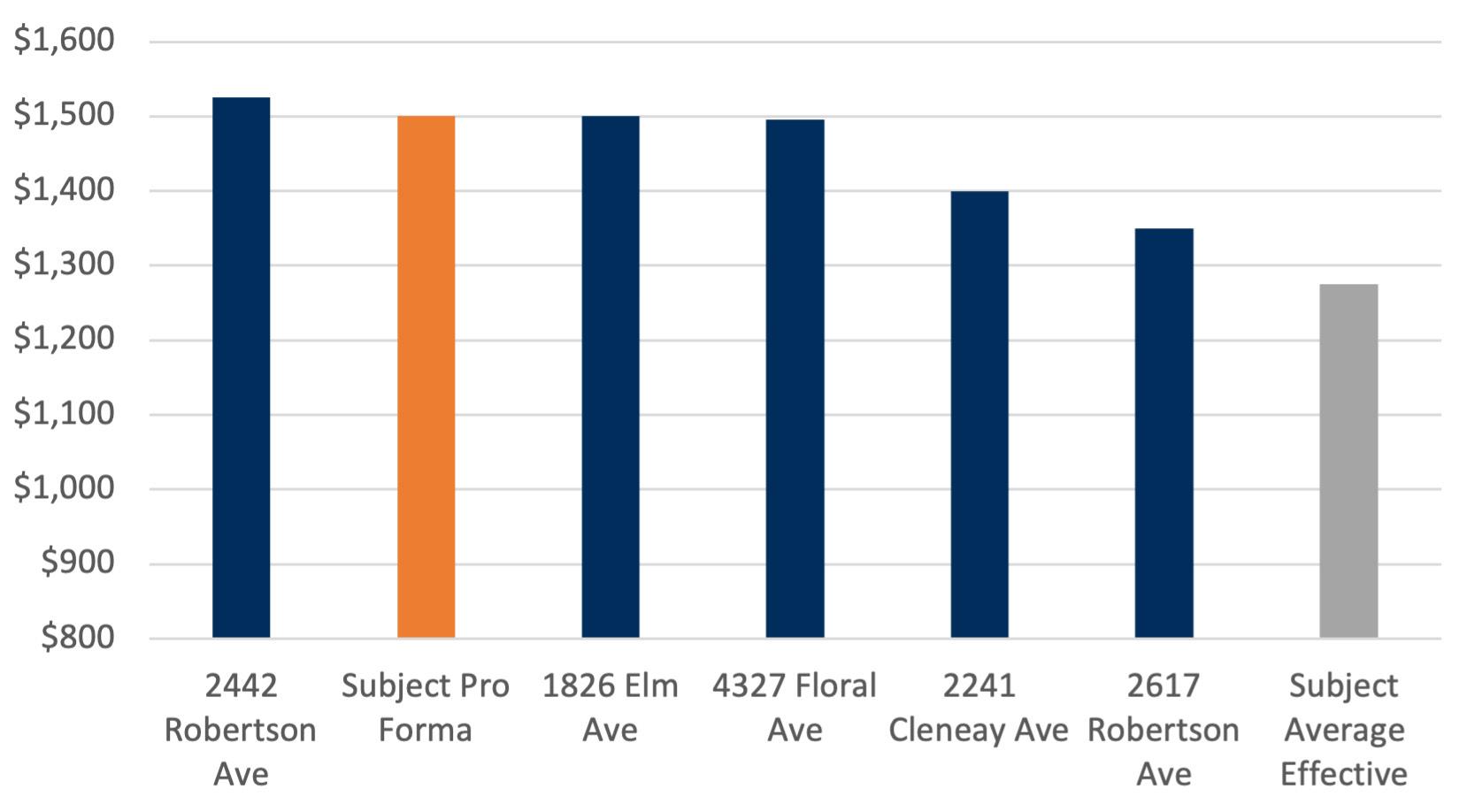

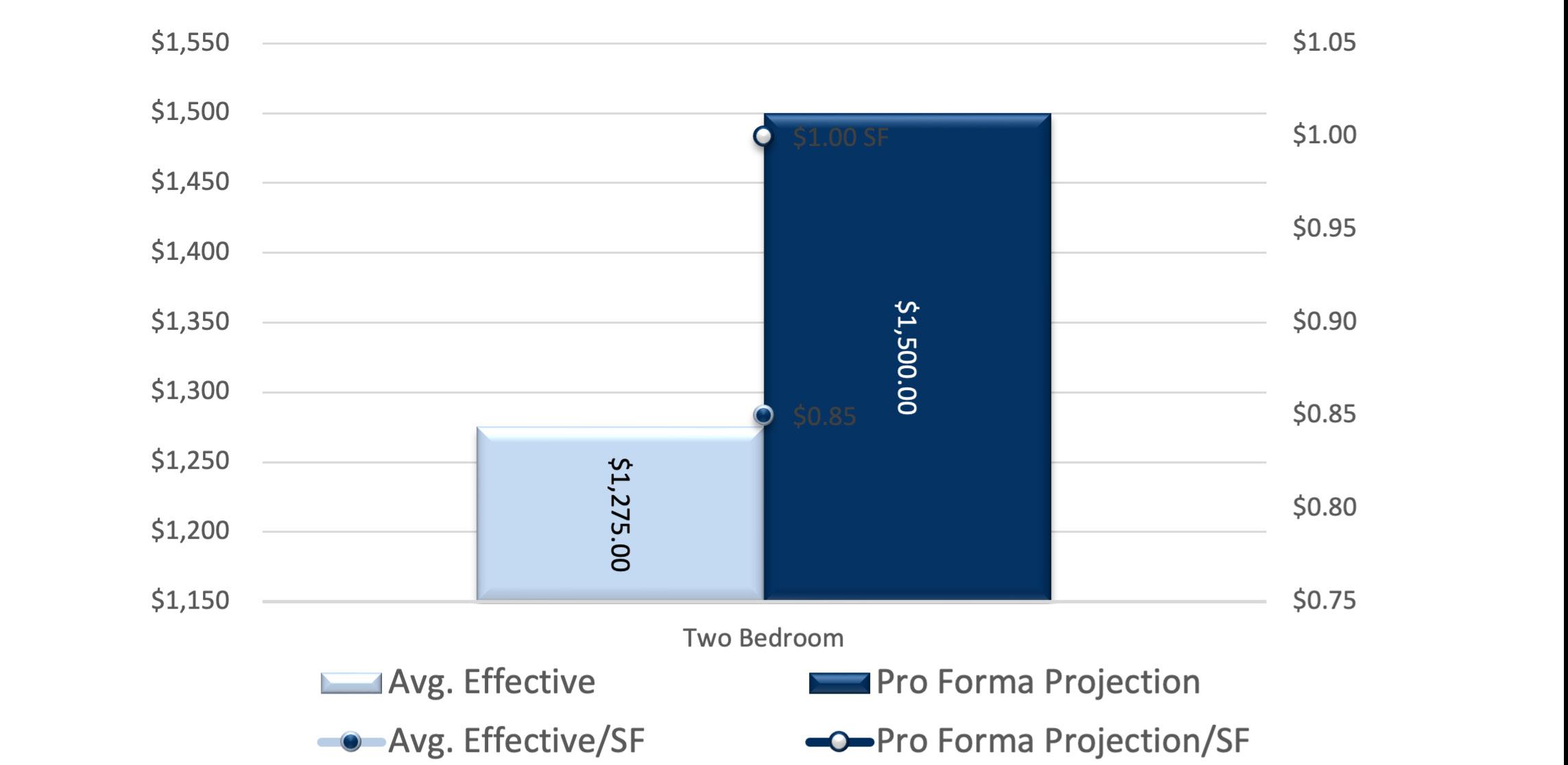

RENT MATRIX | Two Bedrooms

UNIT MIX BREAKDOWN

UNIT RENTS

UNIT DISTRIBUTION

CINCINNATI

THE ECONOMY

1| Prior to the pandemic, Cincinnati’s real gross metropolitan product grew at an average annual rate of 2.1% from 2015 to 2019. During that same five-year period, job growth averaged 1.4% annually, with roughly 15,500 jobs added on average each year. In 2020, COVID-19 mitigation measures and limited business activity caused the local economy to contract as much as 8.4% year-over-year in 2nd quarter. 2| In 2023, the metro’s inflation-adjusted economic output expanded 2.3%. 3| The metro recorded a net gain of 21,100 jobs, expanding the employment base 1.8%. 4| Cincinnati’s unemployment rate in November 2023 was unchanged year-over-year at 3.0%, below the national average of 3.5%. 5| Despite job losses stemming from the pandemic, Cincinnati’s current employment base now sits roughly 63,700 jobs or about 6% above the pre-pandemic level in February 2020.

3,263 units completed in past 12 months 5,184 units currently in progress

HIGHEST OVERALL PERFORMING SUBMARKET

RENT

1| Over the past five years, annual change in effective asking rents in Cincinnati ranged from 2.0% to 11.9%. 2| In 4th quarter 2023, effective asking rents for new leases were up 3.6% year-over- year. That annual rent performance was below the market’s five-year average of 5.7%. 3| Cincinnati’s recent annual rent change performance ranked #10 in the Midwest region and #27 nationally. 4| Looking at product classes in Cincinnati, Class B led for rent performance over the past five years. In 4th quarter 2023, annual effective rent change registered at 2.5% in Class A units, 3.4% in Class B units and 5.8% in Class C units. 5| Among submarkets, the strongest annual rent change performances over the past year were in West Cincinnati and Southeast Cincinnati. 6| The weakest performances were in Central Cincinnati, Butler County and North Central Cincinnati. Over the past five years, rent growth was strongest in Southeast Cincinnati.

SCAN FOR MORE

1| New apartment completions in Cincinnati were moderate recently, as 3,263 units delivered in 2023. That annual completion volume was a 24-year high. 2| With 150 units removed from existing stock over the past year, the local inventory base grew 1.9%. In the past year, supply was greatest in North Central Cincinnati. 3| Annual new supply averaged 1,754 units, and annual inventory growth averaged 1.0% over the past five years. During that period, new supply was concentrated in Central Cincinnati and Campbell/Kenton Counties, which received 42% of the market’s total completions. 4| At the end of 2023, there were 5,184 units under construction with 3,531 of those units scheduled to complete in the next four quarters. Scheduled deliveries in the coming year are expected to be concentrated in Central Cincinnati.

OCCUPANCY

1| Occupancy in the Cincinnati apartment market has ranged from 94.9% to 98.2% over the past five years, averaging 96.4% during that period. 2| Over the past year, occupancy lost 1.2 points, with the 4th quarter 2023 rate landing at 94.9%. 3| Looking at product classes in Cincinnati, 4th quarter 2023 occupancy registered at 94.1% in Class A units, 94.9% in Class B units and 95.6% in Class C units. 4| Occupancy in Class C product was generally tightest over the past five years. 5| Among submarkets, 4th quarter 2023 occupancy was strongest in Southeast Cincinnati and Campbell/Kenton Counties. 6| The weakest readings were seen in Central Cincinnati and North Central Cincinnati. During the coming year, occupancy in Cincinnati is expected to register around 95%.

HIGHEST OVERALL PERFORMING SUBMARKET

LOWEST OVERALL PERFORMING SUBMARKETS

UNITS UNDER CONSTRUCTION

3901 FLORAL