1 minute read

SNAPSHOT

Cincinnati recorded net move-outs from 764 units during 4th quarter 2022, in what is usually a seasonally strong period, while inventory grew by 457 units. Annually, the market recorded net moveouts from 1,253 units and inventory expanded by 2,249 units. In turn, occupancy fell 0.7 points quarter-over-quarter and 2.0 points year-over-year, with the 4th quarter 2022 occupancy rate land- ing at 96.2%. On the pricing side, effective asking rents increased 0.4% quarter-over-quarter and 9.9% year-over-year. As of 4th quarter 2022, effective asking rental rates in Cincinnati averaged $1,304 per month, or $1.399 per square foot.

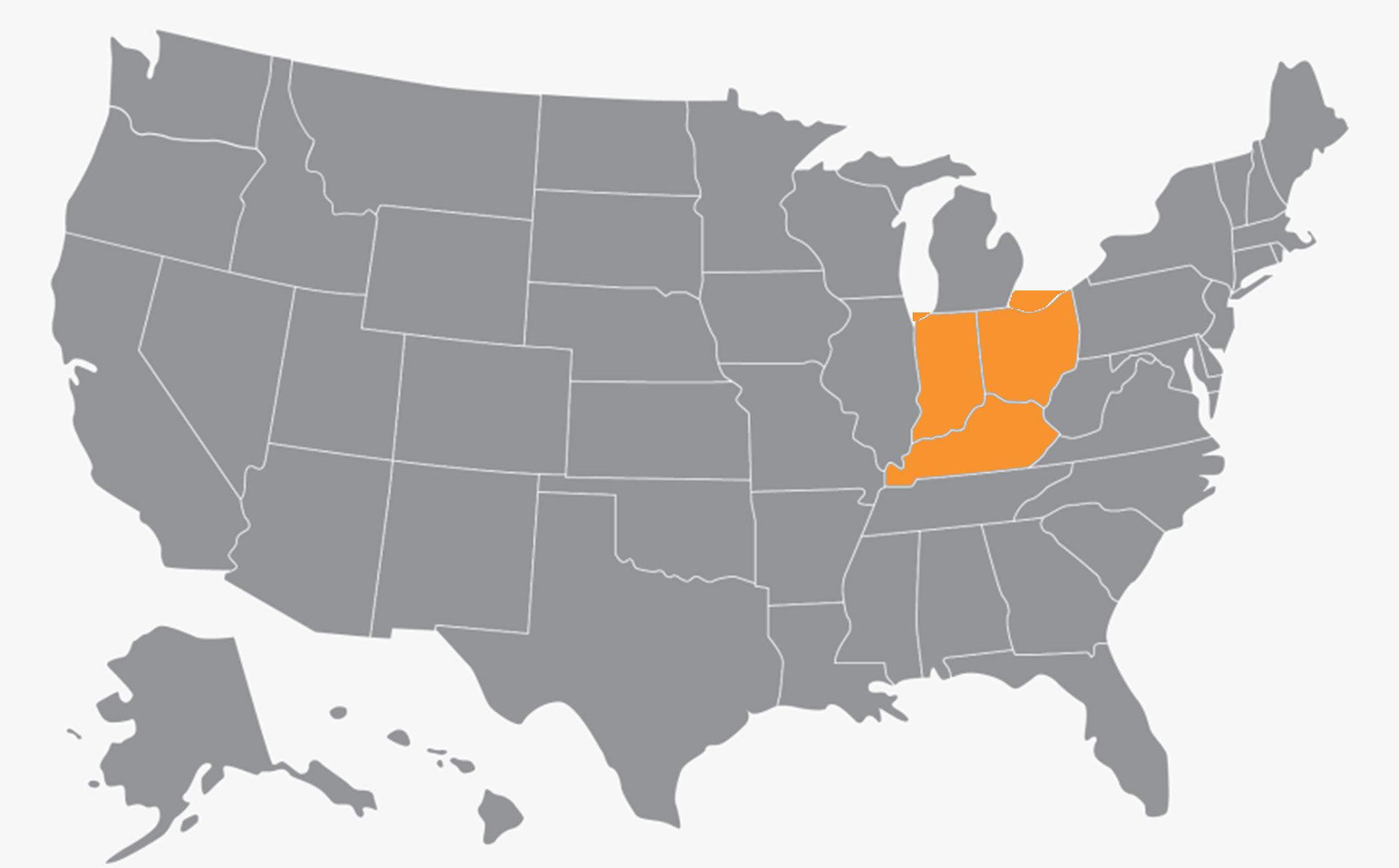

Cincinnati

Quarterly Rent Growth- 0.4% Rent- $1,304

Rent/SF- $1.399

Occupancy- 96.2%

Units Completed in last 4 quarters- 2,249

Annual Supply Growth- 1.3%

Units under construction- 6,462

Projected Supply growth- 2.82%

YTD 2022 Job Change- 12,800

Dayton

Quarterly Rent Growth – 0.3%

Rent- $1,077

Rent/SF- $1.182 Occupancy- 96.2%

Units Completed in last 4 quarters- 412

Annual Supply Growth- 0.7%

Units under construction- 886

Projected Supply growth- 1.17%

YTD 2022 Job Change- 2,900

LOUISVILLE

Quarterly Rent Growth: -0.3% Rent- $1,154

Rent/SF- $1.219

Occupancy- 95.0%

As seen in many markets around the country, the Cincinnati apartment market gave back much of the absorption gains achieved in 2021 following the COVID-19 pandemic lockdowns. In the first two quarters of 2022, Cincinnati recorded basically no demand, followed by net move outs in 3rd quarter and 4th quarter. Net move-outs totaled 1,253 units in 2022, driven down by 764 net move-outs recorded in the October to December time period. Although down from doubledigit growth in the previous three quarters, annual rent growth has been at record highs for the past six quarters. Class B led the market with an 11.0% year-overyear increase in effective asking rents, followed by a 9.2% bump in Class A rents and a 9.1% increase (a record high) in Class C units. Every submarket continued to post hefty rent hikes, ranging from 7.0% in West Cincinnati to 11.9% in North Cincinnati. Completions in Cincinnati totaled 2,249 units in 2022, and with 176 units removed from stock, inventory grew 1.3%, on net.

Units Completed in last 4 quarters- 2,157

Annual Supply Growth- 2.3%

Units under construction- 1,159

Projected Supply growth- 1.12%

YTD 2022 Job Change- 28,200

LEXINGTON

Quarterly Rent Growth-: -1.1%

Rent- $1,140

Rent/SF- $1.239

Occupancy- 95.2%

Units Completed in last 4 quarters- 369

Annual Supply Growth- 0.8%

Units under construction- 920

Projected Supply growth- 0.8%

YTD 2022 Job Change- 6,200