CLIENT Informational PACKET

Jordan Dickman

First Vice President Investments

Cincinnati Office

D. 513.878.7735

jordan.dickman@marcusmillichap.com

Nick Andrews

First Vice President Investments

Cincinnati Office

D. 513.878.7741

nicholas.andrews@marcusmillichap.com

Austin Sum

Senior Associate Cincinnati Office

D. 513.878.7747

austin.sum@marcusmillichap.com

“OUR COMMITMENT IS TO HELP OUR CLIENTS CREATE AND PRESERVE WEALTH BY PROVIDING THEM WITH THE BEST REAL ESTATE INVESTMENT SALES, FINANCING, RESEARCH AND ADVISORY SERVICES AVAILABLE.”

JORDAN DICKMAN

FIRST VICE PRESIDENTS DIRECTOR, NMHG

NICK ANDREWS

FIRST VICE PRESIDENTS DIRECTOR, NMHG

AUSTIN SUM

SENIOR INVESTMENT ASSOCIATE

BRIAN JOHNSTON

INVESTMENT ASSOCIATE

Austin Hall

INVESTMENT ASSOCIATE

Alden Simms

INVESTMENT ASSOCIATE

SAM PETROSino

VALUATION & RESEARCH

LIZ POPP

MIDWEST OPERATIONS MANAGER

JOSH CARUANA

VICE PRESIDENT

REGIONAL MANAGER

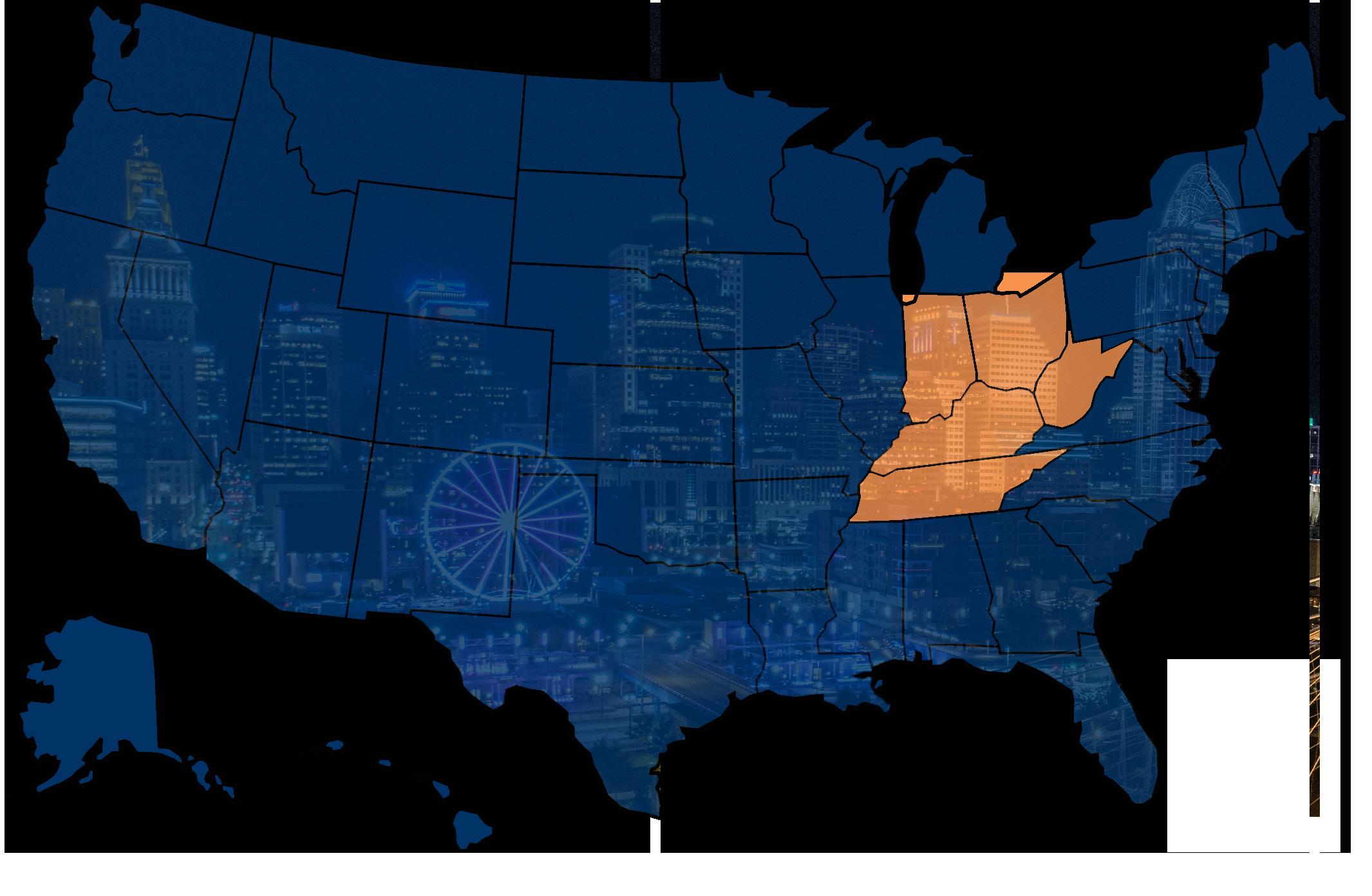

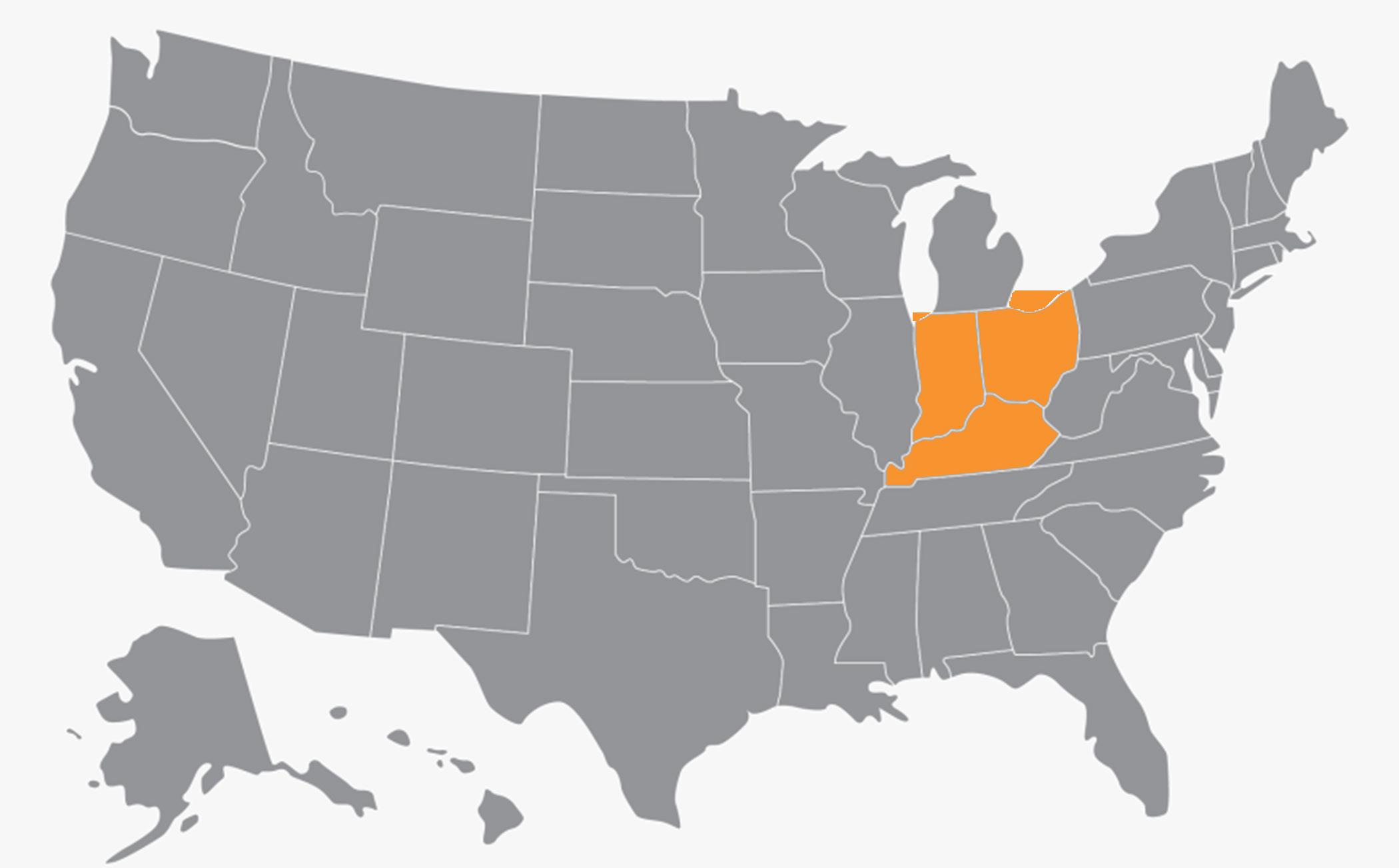

INDIANAPOLIS | CINCINNATI | LOUISVILLE | ST LOUIS | KANSAS CITY

JOHN SEBREE

SENIOR VICE PRESIDENT

NATIONAL DIRECTOR

NATIONAL MULTI HOUSING GROUP

MICHAEL GLASS

SENIOR VICE PRESIDENT

MIDWEST DIVISION MANAGER

NATIONAL DIRECTOR, MANUFACTURED HOME COMMUNITIES GROUP

skyler WILSON

CLIENT RELATIONS MANAGER

BRITTANY CAMPBELL-KOCH

DIRECTOR OF OPERATIONS

ALEX PAPA

MARKETING COORDINATOR

value of recently closed

$84.4 billion transactions in most recent year

Marcus & Millichap is the premier commercial real estate investment services firm in the United States. Founded in 1971 on a unique model that matches each property with the largest pool of pre-qualified investors, we leverage nearly five decades’ worth of experience and relationships to handle all of your commercial real estate needs. Our team of more than 2,000 professionals in the U.S. and Canada focuses exclusively on real estate investment sales, financing, research, and advisory services.

ACCESS TO THE INDUSTRY’S

FOUNDED IN 1971 ON A UNIQUE METHODOLOGY

LARGEST POOL OF PRE-QUALIFIED INVESTORS IN THE INDUSTRY

MOVES CAPITAL ACROSS OUR NETWORK OF INVESTMENT PROFESSIONALS

MORE THAN 2,000 INVESTMENT PROFESSIONALS IN THE U.S. & CANADA

LARGEST POOL OF PRIVATE & INSTITUTIONAL INVESTORS

RESULTING IN THE MOST EFFICIENT PROCESS OF LOCALLY, REGIONALLY & NATIONALLY.

MATCHING BUYERS & SELLERS

WITH AN EXCLUSIVE FOCUS ON REAL ESTATE INVESTMENT SALES, FINANCING, RESEARCH, AND ADVISORY SERVICES

Marcus & Millichap is the premier commercial real estate investment services firm in the United States. Founded in 1971 with a unique model that matches each property with the largest pool of pre-qualified investors, we leverage nearly five decades of experience and relationships to handle all your commercial real estate needs. Our team of more than 2,000 professionals in the United States and Canada focuses exclusively on real estate investment sales, financing, research and advisory services.

13,255 Transactions

In most recent year

6.74 Transactions closed Every Business Hour

We execute more tax-deferred exchanges than any other firm in the United States (32% of total transactions), and our market share is a direct benefit to clients. Over the years, we have developed the skills and expertise to maximize value and meet sensitive timelines required in a 1031 Exchange. With billions of dollars of commercial real estate exclusively listed with us at any time, motivated exchange buyers seek out Marcus & Millichap for quality investment opportunities. Through our industry-leading inventory, we deliver the best of both worlds – we maximize the value of your asset through our unparalleled marketing. We then help identify appropriate upleg options to execute a successful tax deferral acquisition.

The success of Marcus & Millichap is based on our collaborative culture of information sharing across our network of more than 2,000 investment professionals, which maximizes value for each of our clients.

Working with a unique platform that is antithetical to the concept of “pocket listings,” our investment professionals share all listings with the entire Marcus & Millichap team. Each professional specializes in a property type and has a database of local properties and owners, which is leveraged in every client assignment. Because each local agent specializes in a single product type in a specific geographic region, our clients have exposure across the U.S. and Canada with every investment..

Our foundation of information sharing maximizes pricing for our clients and gives us the largest inventory of any firm in the industry.

THE SIZE AND ACCESSIBILITY OF OUR INVENTORY ENABLES YOU TO SELL YOUR PROPERTY AND QUICKLY MOVE INTO ANOTHER PROFITABLE INVESTMENT.

2,000+ $84.4B

VALUE OF RECENTLY CLOSED TRANSACTIONS IN MOST RECENT YEAR

3,859 3,378

4,400

EXCLUSIVE LISTINGS IN MOST RECENT YEAR

TO THE NATION’S

INBOUND / OUTBOUND

$2.1B - MW. OUTBOUND

$3.8B - MW. INBOUND

$9.2BB - W. OUTBOUND

$1.6B - W. INBOUND

$3.1B - S. OUTBOUND

$7.8B - S. INBOUND

$1.8B - TX/OK OUTBOUND

$6.4B - TX/OK INBOUND

$6.4B - NE. OUTBOUND

$1.4B - NE. INBOUND

$3.3B - MOUNTAIN OUTBOUND

$5.0B - MOUNTAIN INBOUND

The Marcus & Millichap GLOBE Capital Group provides the opportunity to expose your property to more foreign buyers with the guided expertise of our senior investment specialists. Our firm is comprised of 80+ offices throughout the US and Canada, and we provide investors with exclusive investment opportunities, financing capabilities, research, and advisory services.

With more inventory than any other firm, buyers seek Marcus & Millichap to fulfill their investment acquisition needs.

Our structured marketing process, coupled with the industry’s largest sales force, creates a competitive bidding environment for your listing

We maintain active relationships with the industry’s largest pool of 1031 exchange buyers, the most coveted buyers in the market.

This is why clients choose Marcus & Millichap over local, regional, or other national firms

Marcus & Millichap’s National Multi Housing Group (NMHG) provides the industry’s most dynamic and effective marketplace for the acquisition and disposition of apartment properties. With multifamily specialists in offices throughout the U.S. and Canada, NMHG is the industry leader in apartment transactions, having successfully executed on our clients’ behalf more than $106 billion of sales volume in the past five years.

13,255

TRANSACTIONS IN MOST RECENT YEAR

$84.4B

VOLUME IN MOST RECENT YEAR

6.73 TRANSACTIONS CLOSED EVERY BUSINESS HOUR

Whether you’re looking to buy, sell, refinance, or hold, Marcus & Millichap leverages real-time market research to assess local and national trends, with specialized focus on individual property types. Backed by the collaborative culture of industry experts, your local investment professional will walk you through each phase of your investment strategy.

• Is holding my asset the most profitable choice in this market?

• How can I best take advantage of the capital markets to maximize my returns?

• Based on my investment risk tolerance and objectives, what opportunities should I consider?

• Is now the right time to sell?

• How can I leverage the capital markets to maximize my results?

• How do I optimize my position via a disposition?

• What alternatives and associated

• When is the right time to buy?

• What investment opportunities are available for my consideration?

• What are the risks in the current market?

• What are my financing options?

• How will an acquisition impact my portfolio’s returns?

• Strategic “hold” analysis

• Refinance and capitalization options

• Quarterly investment return analysis

• Ongoing market and submarket research

• Ongoing product-specific research

• Value and market positioning analysis

• Disposition buyer financing

• New acquisition financing

• 1031 exchange investment alternatives analysis

• Pre-acquisition analysis

• Financial investment analysis

• Market and submarket research

• Product-specific research

MMCC—our fully integrated, dedicated financing arm—is committed to providing superior capital market expertise, precisely managed execution, and unparalleled access to capital sources, providing the most competitive rates and terms.

We leverage our prominent capital market relationships with commercial banks, life insurance companies, CMBS, private and public debt/equity funds, Fannie Mae, Freddie Mac, and HUD to provide our clients with the greatest range of financing options.

Our dedicated, knowledgeable experts understand the challenges of financing and work tirelessly to resolve all potential issues for the benefit of our clients.

Optimum financing solutions to enhance value

Enhanced control through MMCC’s ability to qualify investor finance contingencies

Enhanced control through quickly identifying potential debt/equity sources, processing, and closing buyer’s finance alternatives

CLOSED 1,943 DEBT AND EQUITY FINANCINGS IN MOST RECENT YEAR

NATIONAL PLATFORM OPERATING WITHIN THE FIRM’S BROKERAGE OFFICES

$7.67 BILLION TOTAL NATIONAL VOLUME IN MOST RECENT YEAR

Enhanced control through MMCC’s ability to monitor investor/due diligence and underwriting to ensure timely, predictable closings

ACCESS TO MORE CAPITAL SOURCES THAN ANY OTHER FIRM IN THE INDUSTRY

Our cutting-edge market research helps us advise our clients of existing asset performance and future opportunities.

To successfully execute a marketing campaign, it is critical to understand the likely buyer profiles that will be attracted to the asset, in addition to their respective approval process, corporate structure and underwriting methodology.

Whether it be a private investor, pension fund advisor, sponsored capital group, family office, or a discretionary fund manager, every investment group has an approval process/corporate structure that dictates their ability to process with a transaction. We pride ourselves on maintaining vast and deep relationships with each of the buyer profiles that are active in the market place today coupled with a thorough under standing of their required investor returns and standards of underwriting.

Pension funds, advisors, banks, REITs, and life insurance companies

Syndicates, developers, merchant builders, general partnerships, and professional investors

Foreign investors seeking domestic opportunities and technology enablers that direct foreign demand

1031

Investors seeking acquisition opportunities for capital gains tax deferral

Opportunistic investors seeking diversification in other real estate property types

Private, individual investors who account for the majority of transactions in the marketplace

days

ProActive In-Person Meetings

Direct Phone Calls & Emails

Strategic Property

E-Campaigns

Distribution of offering Materials

On-site Property Tours

Weekly Seller Updates

Offering Procurement

Field Initial Offers

Best & Final Offering Round

Conduct Buyer Interviews Select Buyer Negotiate Contract

days

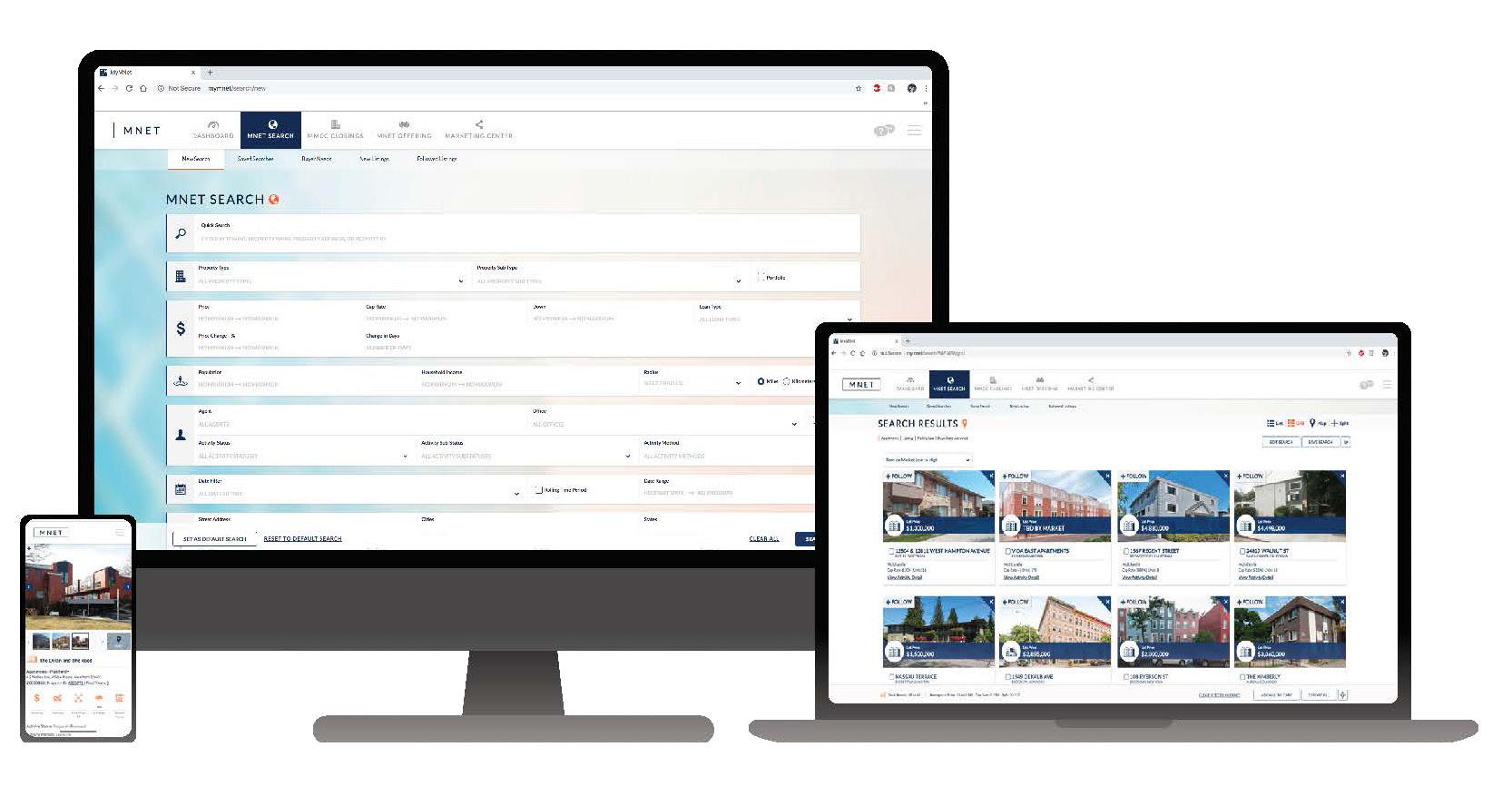

OUR PROPRIETARY TECHNOLOGY PLATFORM, MNET, IS A GAME-CHANGER. NO OTHER FIRM OFFERS ANYTHING LIKE IT OR THE POWERFUL PROPERTY SEARCH TOOLS AND AUTOMATED PROPERTY MATCHING CAPABILITIES IT FEATURES.

ADVANCE SEARCH CAPABILITIES

$18B +

SEARCHES ANNUALLY

3,500

1.2M OF CURRENT INVENTORY EXCLUSIVE LISTINGS

Commercial Real Estate Exchange, Inc. (CREXI) is the commercial real estate industry’s fastest-growing marketplace, advanced technology and data platform dedicated to sup porting the CRE industry and its stakeholders. Crexi enables commercial real estate pro fessionals to quickly streamline, manage, grow their businesses, and ultimately close deals faster. Since launching in 2015, Crexi has quickly become the most active market place in the industry. With millions of users, the platform has helped buyers, tenants and brokers transact and lease on over 500,000 commercial listings totaling more than $1 trillion in property value.

Real Capital Markets (RCM) is the GLOBE marketplace for buying and selling CRE. RCM increases the speed, exposure, and security of CRE sales through its streamlined online platform. Solu tions include integrated property marketing, trans action management, and business intelligence tools to unify broker-level and firm-level data and work flows.

The main advantage of digital marketing is that a targeted audience can be reached in a cost-effective and measurable way. Over the course of the past several years, our team has managed to collect over twenty thousand emails of potential investors, in a variety of states across the US. This database allows us to tailor future investment opportunity to each investor, and their desired goal. Not only does this database allow us to personalize emails, but it also allows us to measure the results of our out reach.

EMAILS SENT THIS CURRENT MONTH

EMAIL OPENS OVER 60K CLICK THROUGH OVER 1.2K

INDUSTRY AVERAGE

OPEN RATE: 29.97%

CLICK RATE: .75%

ADG OPEN RATE

34%

ADG CLICK RATE

1.5%

“Email has an ability many channels don’t: creating valuable personal touches - at scale.”

Social media helps us engage with our potential clients and find out what is being said about our business. We also use social media for advertising, attracting clients, get client feedback, build better customer loyalty, increase our market reach, develop our brand etc. Social media is a great tool to use in our industry, especially for building new relationships and keeping up with the market.

ADG IS ON

6

OVER 1K NEW RELATIONSHIPS MADE

MONTHLY IMPRESSIONS ON ISSUU

OVER 1.2K

OVER 3K IMPRESSIONS ON LINKEDIN