FOIL THE GRINCHES THIS HOLIDAY SEASON

It’s the season of giving, but scammers and fraudsters spoil more Christmases than the Grinch.

Criminal behavior happens year-round, but it definitely increases this time of year. As you do your holiday shopping, please be aware of the many ways that the thieves are targeting consumers.

Criminals know that texts are a quick way to get the attention of large numbers of potential victims. Most texts are opened within minutes of receipt.

USE THESE TOOLS IN OUR MOBILE APP FOR YOUR PROTECTION:

✔ AdamsAlerts: Personalized alerts make it easy to stay on top of your finances and detect any fraudulent activity.

Alerts can provide notifications about account activity, current balances, recent transactions, account security, and more. Receive alerts via email, text, or push notification.

by TODD S. ADAMS chief executive officer

Information criminals will often target a specific area code and use a recognizable entity as the purported sender. You may even see the sender identified as Adams Bank & Trust in your caller ID, even though we didn’t send the message. The scammers have falsified or “spoofed” the caller ID information.

✔ CardControl: CardControl lets you turn off lost or stolen cards, set alerts, controls, and limits based on location, merchant category, and transaction type, and view recent transactions and linked accounts.

Scam artists use computers to send mass text messages (known as SMS phishing or smishing) to thousands of numbers at a time, impersonating retailers, banks, or government agencies.

Fraudulent texts about package delivery delays or changes are common examples. They’ll use a link in some sort of urgent alert, asking consumers to provide usernames, passwords, credit or debit card numbers, PINs, or other sensitive information that can be used to commit fraud.

Scam artists also use emails with fraudulent links to target consumers. Again, the emails can be made to appear as though they’re coming from a merchant, bank, or other trusted entity.

The bottom line? Never enter personal or financial information into a link in a text message or email. Delete the messages instead.

Remember, we at the bank will never ask you to enter items like your Social Security Number, account number, or card number in a text or email link because we have that information.

Don’t hesitate to reach out to the bank directly with any questions or concerns.

QUICK TIP: Our new contactless debit cards protect you from card skimmers used by thieves. Just tap your card to pay wherever you see the Contactless symbol. For added security, remember that Adams Bank & Trust debit cards are compatible with Apple Pay, Google Pay, and Samsung Pay mobile wallets.

SERVING NEBRASKA, COLORADO & KANSAS | 800.422.3488 | INFO@ABTBANK.COM

4th Quarter, 2022

OUR SMALL BUSINESS BANKING GROUP IS HERE TO HELP

No one ever said that small business ownership is easy. The challenges are very real, especially in the current environment.

With inflated input costs, ongoing supply chain interruptions, labor shortages, and other uncertainties in the mix, businesses will continue to have their hands full in 2023.

That’s why it’s so important to be able to leverage every available opportunity. And make no mistake, there are still many opportunities to grow and improve your business.

In order to offer the best support for our small business customers, we’ve created an in-house team that is dedicated to your needs.

Our Small Business Banking Group specializes in the underwriting and administration of smaller commercial loans as well as facilitating Small Business Administration (SBA) loans.

Because of our bankers’ expertise and familiarity with the complex SBA process, we can cut through a lot of the red tape, making it a better experience for you.

by STEVE KRAUSE president

In addition, you’ll have access to our small business team for analysis and brainstorming. We have a relationship with you and familiarity with your operation and needs.

There are many ways to pursue financing for your small business, but will you have that relationship with people who know you? Where will an online lender be when you have a problem or just want to bounce ideas? At Adams Bank & Trust, we’ll be right here. Here’s to your success in 2023.

DREW JOHNSON vp - commercial banking

Small business lending is a niche that Adams Bank & Trust occupies well. Drew Johnson says, “It really comes down to knowing our customer. Because of that familiarity, we can provide expedited service when you’re ready to grow or diversify your business.”

The Small Business Banking Group can initiate financing for everything from equipment upgrades, vehicle purchases, and lines of credit to start-up expenses for new businesses.

Offering this type of specialized small business lending approach is fairly rare for a community bank, Johnson says. “We’re able to offer the best of both worldsour generalist lenders can quickly direct business loans of $100,000

and under to a team that can turn them around very efficiently.”

Some small business loans are completed in-house at Adams Bank & Trust; SBA loans are used for others. Depending on the scope of their needs, some customers will end up with a combination of both kinds of financing.

This is our area of expertise, and we’ve really streamlined the process.”

Johnson agrees that, despite the current challenges, there are many opportunities for small business owners who want to grow. “We’re fortunate in the markets the bank serves. The local economies are strong and there are a lot of positive metrics. Anyone who is looking to start or expand a business or refinance existing debt is a great candidate for a small business loan or SBA financing through Adams Bank & Trust.”

Johnson says they take a consultative approach in each situation. “If you tell us what you’re trying to do, we can narrow it down to your best options. If the SBA is the right avenue, we can help you navigate the available programs.

To explore options, stop in at your branch or scan the QR code on page 4 of this issue to go to the Financing Initiation Request form at abtbank.com. Just answer a few quick questions to help us understand what you’re looking for, and someone from the Small Business Banking Group will reach out promptly.

adams bank & trust | PAGE 2

“Anyone who is looking to start or expand a business or refinance existing debt is a great candidate for a small business loan or SBA financing through Adams Bank & Trust.”

PAGE 3 | your foundation for financial success

NEBRASKA

BRULE 308.287.2344

CHAPPELL 308.874.2800 GRANT 308.352.2114

IMPERIAL 308.882.4286 INDIANOLA 308.364.2215 LODGEPOLE 308.483.5211

MADRID 308.326.4223 NORTH PLATTE 308.532.5936

OGALLALA 308.284.4071 SUTHERLAND 308.386.4345

COLORADO BERTHOUD 970.532.1800 COLORADO SPRINGS 719.448.0707 FIRESTONE 303.833.3575

FORT COLLINS 970.667.4308 GREELEY 970.330.8018 LONGMONT 303.651.9053 STERLING 970.522.0698

KANSAS COLBY 785.460.7868

TOLL FREE 800.422.3488 ABTBANK.COM

OUR LOCATIONS

ADAMS BANK & TRUST BALANCE SHEET AS OF SEPTEMBER 30, 2022 CASH Cash in our vault, plus cash on demand from other banks where funds are deposited. $ 57,388,092 GOVERNMENT AND AGENCY BONDS Marketable investments in bonds and other securities of the U.S. Government and its agencies. 425,227,950 FEDERAL FUNDS SOLD Funds loaned to other banks for daily cash needs and payable on demand. 0 LOANS AND LEASES Total of all money loaned to customers for all types of loans, such as agriculture, commercial and consumer. 773,614,903 BUILDINGS, FURNITURE AND FIXTURES Book value (after depreciation) of buildings, computers, equipment, etc. 18,733,029

ASSETS Interest on loans earned but not collected, expenses that have been prepaid, etc. 17,719,077 TOTAL ASSETS

Money on deposit by customers of the bank in the form of checking accounts, savings accounts, and certificates of deposit.

LIABILITIES

by the bank, interest on deposits that has accrued, payable at a future date, other expenses accrued but not yet paid, deferred taxes, etc. 73,516,899

value of the investment of the stockholders for the purchase of stock. 23,000,000

money contributed by stockholders to provide extra financial strength. 17,000,000

PROFITS AND RESERVES

earnings left in the bank to provide added strength to meet possible future losses on loans and to replace buildings and equipment as they wear out.

CAPITAL ACCOUNTS

capital available for the safe operation of Adams Bank & Trust.

TOTAL LIABILITIES AND CAPITAL ASSETS

OTHER

1,292,683,051 DEPOSITS

1,086,518,825 OTHER

Borrowings

CAPITAL Par

SURPLUS Additional

UNDIVIDED

Bank

92,647,327 TOTAL

Total

132,647,327

1,292,683,051

STAYING INVESTED WHEN MARKETS ARE VOLATILE

“The stock market is a device for transferring money from the impatient to the patient.” (Warren Buffet)

Faced with unsettling or stressful news, it can be difficult to be patient. It’s human nature to want to take action. But for investors, impatience can be the wrong response, especially if it takes you off course of your careful investment planning.

2022 has seen its share of volatility in the stock market. There were many contributing factors to the ups and downs, including sustained inflation and the Federal Reserve’s responding cycle of interest rate hikes.

Market turbulence can make investors nervous, and that’s not surprising.

However, looking back over history, we can see that volatility isn’t unusual. And with factors such as continued inflation, tightening liquidity, and higher interest rates, experts don’t expect market volatility to disappear in 2023.

So what is the best response? It comes down to understanding what you own and why. What is the goal or purpose of each asset bucket in your portfolio?

If your portfolio is well-diversified and your investments line up with your time horizon and tolerance for risk, you can find your comfort level whether the market

by JACOB HOVENDICK rjfs branch manager

is going up or down. Here are some thoughts to keep in mind:

Staying invested through turbulent times in the market has historically led to success over the long term.

Long-term perspective is helpful. It may sometimes feel like the market just goes from one crisis period to another, but data over time tells a different story.

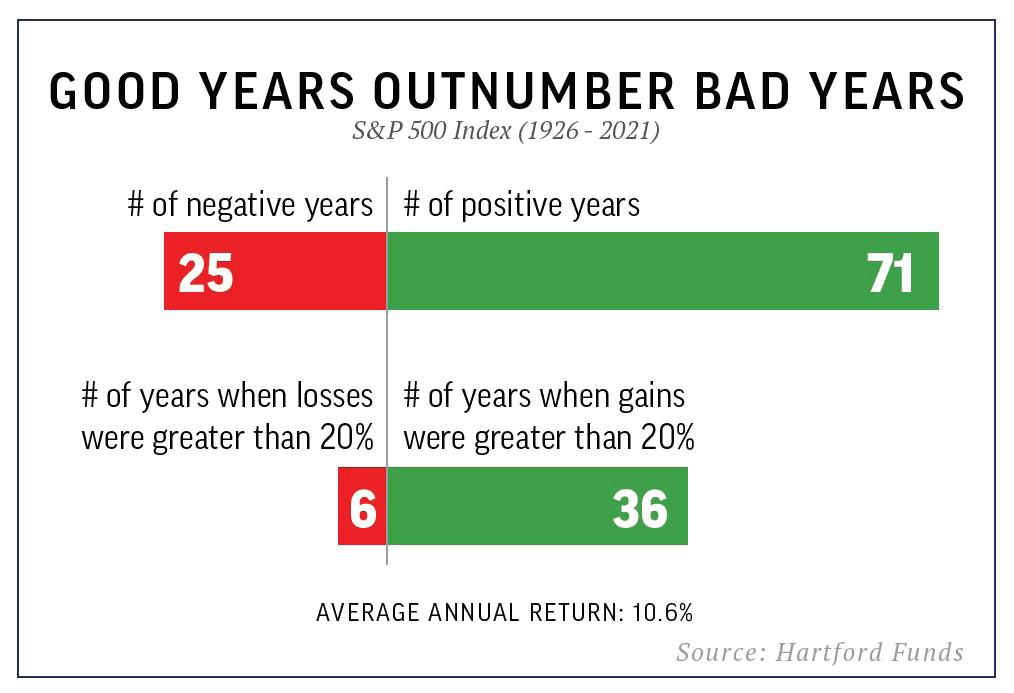

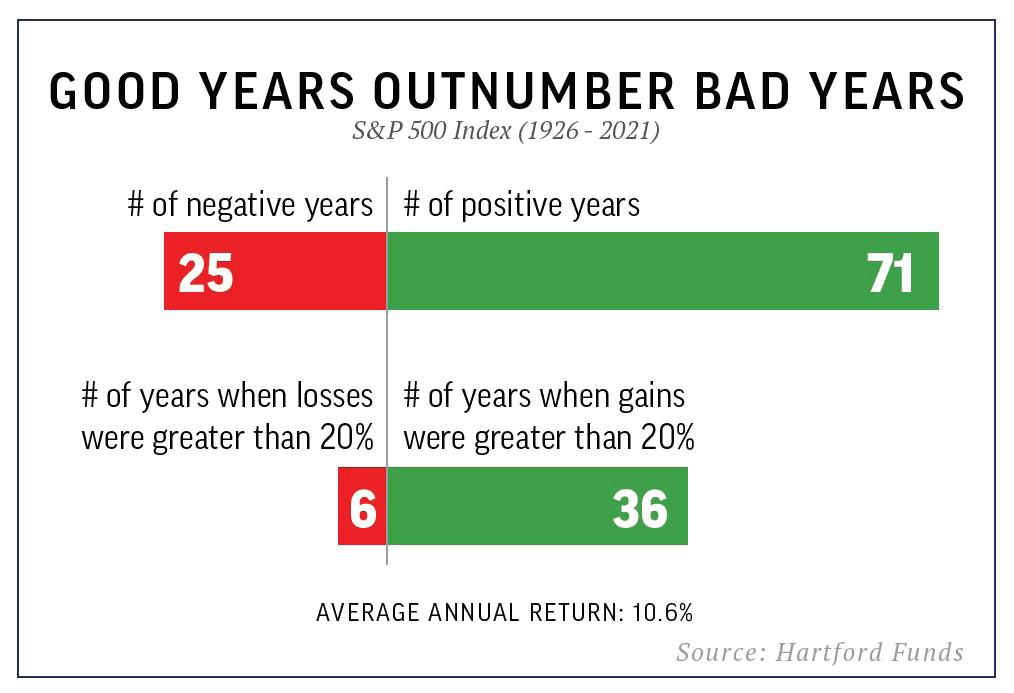

Looking at this graph of the Standard & Poor’s 500 Index (S&P) from 1926-2021, we can see that the good years outnumbered the bad years. There were more years when gains were greater than 20% than years when losses were greater than 20%.

Intra-year dips and market corrections are a normal, regular part of long-term investing.

An intra-year drop is when the market goes rapidly from a peak to a trough within a given year. These drops happen even in years where the market showed positive year-end returns. It has always been the nature of the stock market to ebb and flow. Without periodic corrections, the stage is set for bigger and more painful resets to occur. The market and the economy must periodically “stop for gas.” But when the dips occur, it’s important not to be triggered into short-term,

RAYMOND JAMES FINANCIAL SERVICES, INC. MEMBER FINRA/SIPC

Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject to risk, including the possible loss of principal. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

4th Quarter, 2022

emotional decisions that could hurt your long-term results.

If you’re not fully invested when the market rebounds, you won’t experience the benefits.

You won’t know in the moment when the market hits bottom; it will only be evident in hindsight. Since it’s nearly impossible to time the market, spending time in the market can be a better strategy.

Historically, stocks tend to bounce back relatively quickly after sharp market declines. If you’ve panicked and pulled out during a low point, you won’t be there to experience the gains when the market starts to rise. The toughest decision is when to put money back in after making the emotional one to pull it out. Also, if your exit and entry are ill-timed, you may open yourself up to even further losses if the market declines again after reentering.

Systematic investing strategies like dollar-cost averaging may be even more important during times of market volatility.

One strategy that can be helpful to navigate turbulent times is dollar-cost averaging. The same amount of money is invested in a security over a fixed period of time, regardless of its share price. It’s one way to invest regularly and stay invested even as the market goes up and down. The impact of volatility is reduced, and the emotional stress of timing entry is alleviated.

By automating the process, you can systematically acquire more shares without worrying if you’re “timing the market” correctly. You’re freed from the mindset of chasing shortterm returns.

Your financial professional can help provide perspective for your concerns during volatile times. This isn’t the first time these particular economic and market conditions have occurred, and it won’t be the last. We don’t know what the future holds. But while history doesn’t repeat exactly, it does tend to rhyme. The lessons and strategies that have contributed to success in the past will help us navigate 2023 together.

While 2022 has been a volatile and possibly stressful year, there are reasons to be optimistic about the future. The hardest time to see clearly is in the midst of the darkness. The holiday season is great at reminding us what is truly important.

From our families at Raymond James Financial Services to your family, a very Merry Christmas and a healthy and prosperous New Year.

Opinions expressed are those of the author and are subject to change. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation. The material is general in nature. Investing involves risk; investors may incur a profit or loss regardless of the strategy or strategies employed. There is no assurance that any investment strategy will ultimately meet its objectives. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against a loss.

For assistance in reviewing or creating your investment plan, please call any Adams Bank & Trust office or call toll free at 800.422.3488 for an appointment with a Raymond James Investment Representative. Jacob Hovendick , RJFS Financial Advisor and Branch Manager Jan Acker, RJFS Financial Advisor 308.284.4071 | 315 N SPRUCE STREET, OGALLALA, NE 69153

Jacob & Meagan Hovendick with Huxton, Henley, Harper & Heath (Tiffany Williams Photography)