DECLUTTERING YOUR FINANCIAL LIFE

It’s no wonder that decluttering is a common resolution that people make at the beginning of the year. Whether it’s physical or digital, clutter can be overwhelming. In some cases, it can compromise the security of your personal information and leave you more vulnerable to identity theft.

One of our resolutions here at the bank this year is to help you be proactive about reducing unsolicited offers through phone calls, texts, email spam and junk mail. It’s part of our ongoing effort to aid you in keeping your financial information safer.

CHECK THESE WEBSITES FOR WAYS TO OPT OUT

by TODD S. ADAMS chief executive officer

to opt out of receiving these unsolicited offers.

✔ www.OptOutPrescreen.com: Under the Fair Credit Reporting Act (FCRA), you may opt out from receiving unsolicited offers for five years through the website, or permanently by mailing a form available through the website.

✔ www.fcc.gov/consumers/guides/ stop-unwanted-robocalls-and-texts: The Federal Communications Commission (FCC) offers many tips for reducing the volume of unwanted offers that come through your phone, especially illegal and spoofed robocalls.

✔ www. donotcall.gov: The Federal Trade Commission’s (FTC) Do Not Call registry gives you a choice about whether to receive telemarketing calls.

How do your inbox, mailbox, and phone get so clogged up with solicitations in the first place? The bank will never pass on your personal information, but other companies do. For example, when your credit is checked by the major consumer credit reporting companies (Equifax, Experian, Innovis, and TransUnion), they are allowed to sell your information to companies for preapproved offers of credit or insurance. However, you can choose

Using the opt-out services won’t eliminate all unwanted solicitations. Not every type of organization must abide by the FCRA, and some of the companies who send these offers aren’t noted for following the rules. However, there are many benefits to reducing the sheer volume of messages:

• Fraudulent offers will be easier to detect.

• Your information will be stored on fewer lists that have the potential to be hacked or stolen. Lists that are shared among agencies or companies are especially vulnerable to data breaches.

• Less junk mail makes it harder for thieves to obtain personal information about you and your family to try to open new credit accounts.

Resolve today to declutter your financial life for a simpler, safer and less stressful future. Don’t delay, get started today.

QUICK TIP: If you have one of our Smart Checking Accounts, powered by BaZing, you automatically get several ID theft protection services, including ID monitoring, payment card protection, and personal ID protection. Talk to your branch for assistance or to learn more.

SERVING NEBRASKA, COLORADO & KANSAS | 800.422.3488 | INFO@ABTBANK.COM

1st Quarter, 2023

SIMILAR CHALLENGES; NEW OPPORTUNITIES IN 2023

The new year is off to a great start. I’m excited to serve our customers and banking team as we all look forward to the opportunities of 2023.

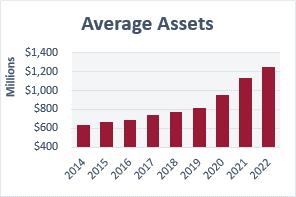

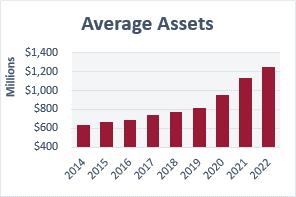

Bank Expansion

2022 saw the opening of two new branches of Adams Bank & Trust. We opened our third branch in Colorado Springs on Interquest Parkway, and we opened our first branch in Greeley, Colorado. The bank’s position is strong, and we plan to continue to expand our footprint in the coming year.

it’s fuel, seed, fertilizer or animal feed, inflation is hitting farmers and ranchers where it hurts.

Several years of drought conditions are still having an impact. Stressed pastures produce less forage and feed costs are higher. Cow/calf producers must make difficult decisions. Do you keep herds intact and pay higher feed bills or do you sell cows to reduce expenses? Ranchers still aren’t expanding herds, and cattle numbers are still dropping.

by STEVE KRAUSE president

Mortgage

We saw a sharp increase in home prices in 2022, but values have leveled out and have even begun to decline in many areas. Higher interest rates mean fewer buyers qualify for loans, making the environment less competitive. What should home buyers keep in mind? It’s still important to keep housing needs versus wants in perspective. You don’t want to overspend the budget that makes sense for your household.

Opportunities

We may be growing, but our vision remains the same. Adams Bank & Trust is here to serve customers through a personal banking relationship that is centered on your unique needs.

Challenges

As we look at the overall economy and business environment, it’s “second verse, same as the first” in many ways. As we saw in 2022, inflation and higher interest rates continue to be the headwinds that impact every sector.

Agriculture

The positive news is that prices for commodities have been good, and the overall ag economy continues to improve. However, input costs are higher across the board. Whether

Business

Businesses continue to navigate inflation and higher input costs, as well. Construction costs have gone up, and the higher interest rates influence decisions about expansion and improvement of facilities and equipment.

The biggest elephant in the room remains the problem of finding and retaining staff. If you’re facing this challenge in your business, you’re not alone. We hear this from nearly all our business customers.

Businesses that need in-person workers are having to make adjustments, including hours of operation. It’s a complex problem, and all industries are having to approach it with flexibility and creativity.

Despite ongoing challenges, there are always opportunities if you keep your powder dry. Here are some things to think about: Is your idea affordable? Does it “cash flow?” And does it provide a return on your investment? If you’re stretched too thin, you limit your ability to respond to other opportunities and circumstances in the future.

Despite ongoing challenges, there are always opportunities if you keep your powder dry.

Details are still coming out on programs associated with the Inflation Reduction Act that passed last year. Businesses may be able to receive tax credits for making green energy improvements. Farmers and ranchers may have incentives for participating in conservation programs. The bank is monitoring the rollout closely for any opportunities that could benefit our customers.

adams bank & trust | PAGE 2

As we saw in 2022, inflation and higher interest rates continue to be the headwinds that impact every sector.

PAGE 3 | your foundation for financial success

NEBRASKA

BRULE

308.287.2344

CHAPPELL

308.874.2800

GRANT

308.352.2114

IMPERIAL 308.882.4286

INDIANOLA 308.364.2215

LODGEPOLE 308.483.5211

MADRID 308.326.4223

NORTH PLATTE 308.532.5936

OGALLALA 308.284.4071

SUTHERLAND 308.386.4345

COLORADO

BERTHOUD 970.532.1800

COLORADO

SPRINGS

719.448.0707

FIRESTONE 303.833.3575

FORT COLLINS 970.667.4308

GREELEY 970.330.8018

LONGMONT 303.651.9053

STERLING 970.522.0698

KANSAS COLBY 785.460.7868

TOLL FREE 800.422.3488

ABTBANK.COM

ADAMS BANK & TRUST BALANCE SHEET AS OF DECEMBER 31, 2022

Total of all money loaned to customers for all types of loans, such as agriculture, commercial and consumer.

Book value (after depreciation) of buildings, computers, equipment, etc.

Interest on loans earned but not collected, expenses that have been prepaid, etc.

Money on deposit by customers of the bank in the form of checking accounts, savings accounts, and certificates of deposit.

Borrowings by the bank, interest on deposits that has accrued, payable at a future date, other expenses accrued but not yet paid, deferred taxes, etc.

Par value of the investment of the stockholders for the purchase of stock.

Additional money contributed by stockholders to provide extra financial strength.

UNDIVIDED PROFITS AND RESERVES

Bank earnings left in the bank to provide added strength to meet possible future losses on loans and to replace buildings and equipment as they wear out.

OUR LOCATIONS

$ 47,815,379 GOVERNMENT AND AGENCY BONDS

CASH Cash in our vault, plus cash on demand from other banks where funds are deposited.

422,912,345 FEDERAL FUNDS SOLD Funds loaned to other banks for daily cash needs and payable on demand. 0 LOANS AND LEASES

Marketable investments in bonds and other securities of the U.S. Government and its agencies.

783,870,268

BUILDINGS, FURNITURE AND FIXTURES

18,515,362 OTHER

ASSETS

17,260,444 TOTAL ASSETS 1,290,373,798 DEPOSITS

1,063,322,009

OTHER LIABILITIES

90,424,976 CAPITAL

23,000,000

SURPLUS

17,000,000

96,626,813 TOTAL

ACCOUNTS Total

of

Trust. 136,626,813 TOTAL LIABILITIES AND CAPITAL ASSETS 1,290,373,798

CAPITAL

capital available for the safe operation

Adams Bank &

THE SECURE ACT 2.0

Just before the end of last year, Congress passed an expanded version of the SECURE Act of 2019, its major retirement plan legislation. President Biden signed the bill into law on December 29, 2022. Known as the SECURE Act 2.0, this update continues with the intent to improve retirement security for more Americans.

What do you need to know about the latest version? How will it affect your retirement planning?

As usual, lawmakers passed the update at the last moment before year end, and there’s a lot to unpack in its 92 provisions. Financial advisors and employers are working through all the information so we can communicate the broad-reaching implications to customers and employees.

The bigger takeaways include:

• Another increase of the starting age for Required Minimum Distributions (RMDs)

• More employer plan options and contribution opportunities

• New and enhanced tax credits

• Certain rollovers from 529 accounts to Roth IRAs

What has changed on RMDs?

The initial SECURE Act raised the age at which retirement plan distributions must begin from 70 ½ to 72. SECURE 2.0 further increases the age to 73 for individuals who reach age 72 after 2022.

So if you’ll celebrate your 72nd birthday any time after December 31, 2022, you won’t have to take an RMD from your retirement plan until your 73rd birthday.

by JACOB HOVENDICK rjfs branch manager

For those who reach age 74 after 2032, the age will be increased to age 75. So if you’re 64 or younger now, your RMD age will be 75.

Here is a quick look at some of the provisions, applicable plans, and effective dates:

PROVISION APPLICABILITY EFFECTIVE DATE

Increase the starting age for RMDs

Enhance the new plan startup credit for small employers

Provide tax credits for plan contributions made by small employers

Permit employer matching contributions on a Roth basis

Give small incentives for contributing to a plan

Require catch-up contributions to be made on an after-tax Roth basis

Permit matching contributions on behalf of employees who are repaying student loans

Increase the catch-up amount for individuals aged 60, 61, 62 and 63

Create in-plan emergency savings accounts

Permit certain rollovers from 529 accounts to Roth IRAs

Qualified plans (e.g., 401(k) plans), traditional IRAs, 403(b) and 457(b) plans

Qualified plans, SIMPLE IRA and Simplified Employee Pension (SEP) plans

Qualified plans, SIMPLE IRA and Simplified Employee Pension (SEP) plans

401(k), 403(b) and 457(b) plans

401(k) and 403(b) plans

401(k), 403(b) and 457(b) plans

401(k), 403(b), 457(b) and SIMPLE IRA plans

401(k), 403(b), 457(b) and SIMPLE IRA plans

401(k), 403(b) and 457(b) plans

529 plans

Age 73 for individuals who reach age 72 after 2022; age 75 for those who reach age 74 after 2032

Tax years beginning after 2022

Tax years beginning after 2022

December 29, 2022

Plan years beginning after December 29, 2022

Tax years beginning after 2023

Plan years beginning after 2023

Tax years beginning after 2024

Plan years beginning after 2023

Distributions after 2023

Source: JPMorgan.com

to risk,

the possible

of

Investment Advisory Services

Financial Services

Inc.

RAYMOND JAMES FINANCIAL SERVICES, INC. MEMBER FINRA/SIPC Adams Bank & Trust is not a registered broker/dealer, and is independent of Raymond James Financial Services. Securities offered through Raymond James Financial Services, Inc., Member FINRA/SIPC, are not insured by bank insurance, the FDIC or other government agency, are not deposits or obligations of the bank, are not guaranteed by the bank, and are subject

including

loss

principal.

offered through Raymond James

Advisors,

1st Quarter, 2023

SECURE 2.0 contains more employer plan options and contribution opportunities.

Catch-Up Contributions: If you’re 50 or older, you may already make catch-up contributions to your 401(k), 403(b) or 457(b) plan. The catch-up limit for 2023 is $7,500.

Beginning in 2025, the Act raises that limit to 50% more than the regular catch-up limit individuals aged 60 to 63. For example, if the regular catch-up limit in 2025 is $8,000, a 60-year-old participant’s limit will be $12,000.

529 Rollovers to Roth IRAs:

Contributions For Employees With Student Loans

Match

: The Act provides extra help for student loan borrowers. Many younger employees are unable to participate in their employer’s retirement savings plan because they’re still paying off their student loans. They may be missing out on any matching contributions their employer may make. Starting in 2024, the Act lets employers make matching contributions to 401(k), 403(b), 457(b) and SIMPLE IRA plans to benefit those employees.

New

and Enhanced Tax Credits:

Smaller employers that create a retirement plan will be entitled to a new tax credit. This applies to companies with up to 50 employees. For the first five years of the plan, the employer will be entitled to a credit for contributions made on behalf of employees who don’t earn more than $100,000 a year.

There’s an interesting provision in the SECURE Act 2.0 for 529 college savings plans. If a student doesn’t use all of the funds that were placed in a 529 plan, money may be rolled over tax- and penalty-free into a Roth IRA in the student’s name. These rollovers will be permitted beginning in 2024.

While there is some flexibility with 529 plans if a child doesn’t go to college, the new SECURE 2.0 act will allow for more flexibility and the possibility of helping a child start saving for retirement much earlier than their peers. Funds, up to the annual and lifetime limits, that aren’t used for higher education may be rolled over to benefit the child later in life. This change could allow for the 529 account to become an even more powerful planning tool than it was in prior years.

The maximum amount that can be rolled over is $35,000 over the beneficiary’s lifetime. The 529 plan must have been open for at least 15 years, and rollovers are subject to the annual Roth IRA contribution limit.

More details about this major retirement legislation will continue to emerge in the coming year, so stay tuned. Be sure to consult your financial advisor and tax professional with any questions. We hope that the provisions in the SECURE 2.0 Act help and encourage more people to save for their retirement years.

Opinions expressed are those of the author and are subject to change. This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation. The material is general in nature. Investing involves risk; investors may incur a profit or loss regardless of the strategy or strategies employed. There is no assurance that any investment strategy will ultimately meet its objectives. Past performance may not be indicative of future results. Asset allocation and diversification do not guarantee a profit nor protect against a loss.

For assistance in reviewing or creating your investment plan, please call any Adams Bank & Trust office or call toll free at 800.422.3488 for an appointment with a Raymond James Investment Representative.

Jacob Hovendick , RJFS Financial Advisor and Branch Manager

, RJFS Financial Advisor

308.284.4071

69153

Jan Acker

| 315 N SPRUCE STREET, OGALLALA, NE

More details about this major retirement legislation will continue to emerge in the coming year, so stay tuned.