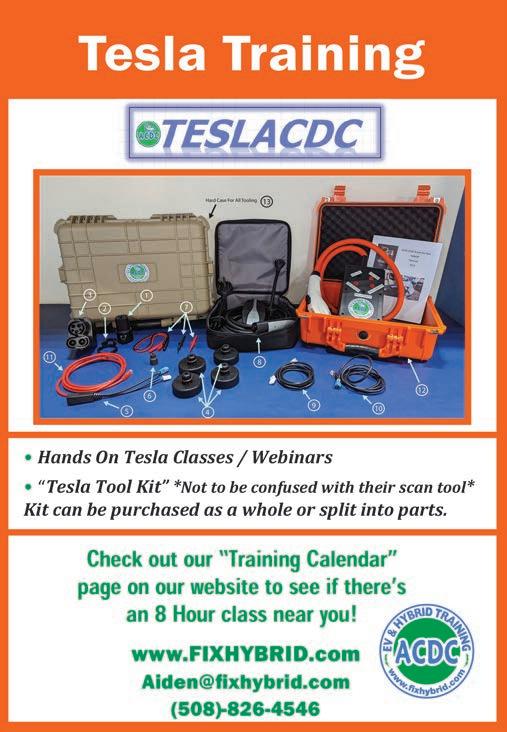

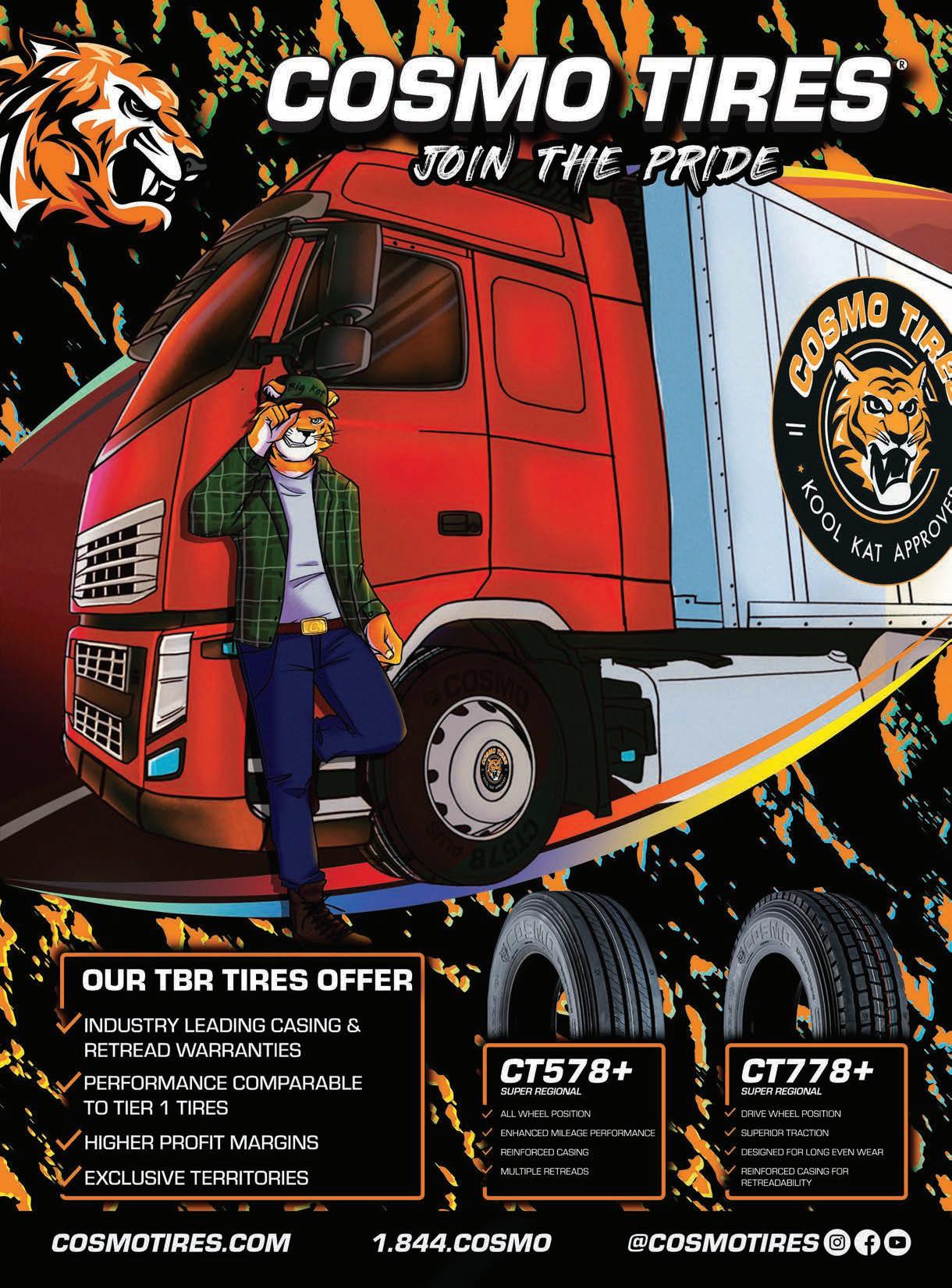

ADVERTISEMENT

MID-YEAR

HOW TO MAKE $10 MILLION WITH ONE STORE

COOLANT SYSTEM SERVICE BEST PRACTICES

Why the truck tire market is slowing down

Why the truck tire market is slowing down

RETAIL TIRE

AT

PRICING

June 2023 | Vol. 104, No. 6 | $10 | www.moderntiredealer.com

How

3 www.ModernTireDealer.com The Industry’s Leading Publication June 2023, Volume 104, Number 6 Modern Tire Dealer is a proud member of: 20 Tire pricing at mid-year

out’ is underway, says Fitment Group 24 Dealers take action on tire pricing

consumers continue to look for lower-tier tires 26 Going wide

Tire nds riches in new niches, while staying true to its roots 30 $10 million out of one store

‘Leveling

Meanwhile,

Atturo

Hank’s Tire generates big numbers

Coolant system best practices

32

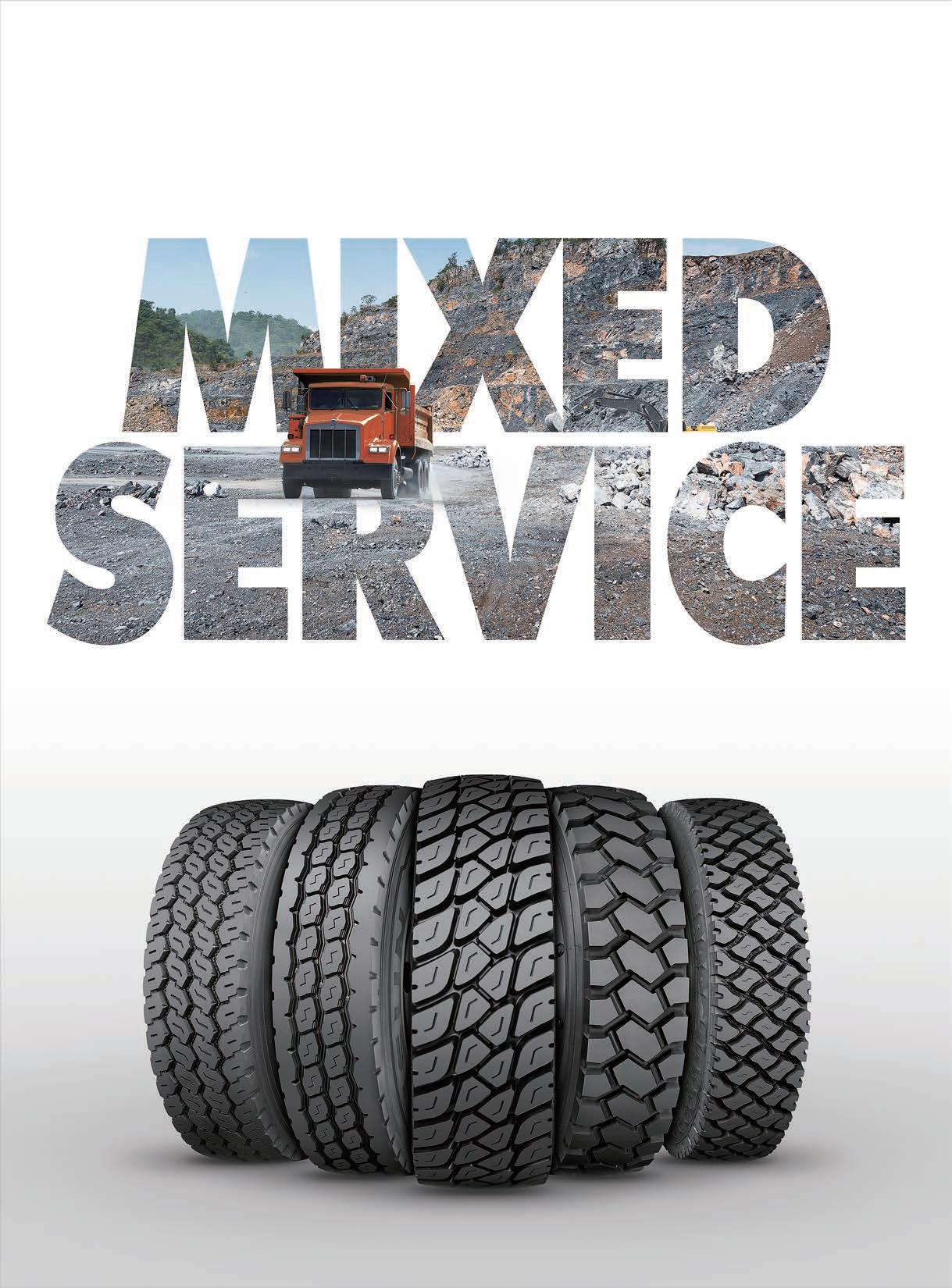

Commercial Tire Dealer™ 34 Big downshift

of the year 36 Hitting the brakes

When it comes to antifreeze, dealer says one type doesn’t t all

Truck tire shipments declined during rst half

Here’s

46 Andrews Tire Service wins with speedy service

customer loyalty are dealership’s secrets to success 50 AG Tire Talk: How low can you go?

The truck tire market is slowing down.

why

Quickness,

tires

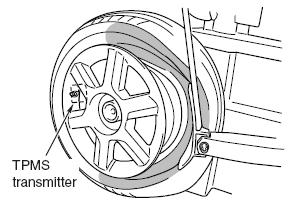

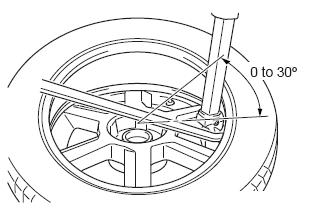

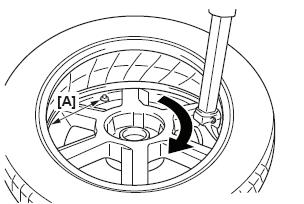

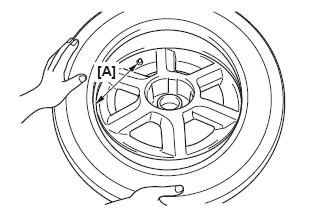

4 Editorial Unsung heroes Commercial tire dealers, techs keep America rolling 6 moderntiredealer.com News and navigation tools for MTD’s website 8 Industry News Ralson brings new truck tire brands to U.S. Company looks to build dealer network 16 Numbers That Count Relevant statistics for an industry in constant motion 18 Your Marketplace In ation and tax returns Monthly volume declines matched that of April 2020 54 Focus on Dealers Marks leaves ITDG primed for more growth Group has grown to 167 members with 1,051 locations 56 Focus on Dealers Ohio dealers ght catalytic converter theft State considers law that would remove incentive to sell converters 58 Business Insight A guide to holding successful meetings Have an agenda, stay on-topic and look forward 60 Mergers and Acquisitions The single store acquisition challenge It’s a lot harder than it looks 62 Dealer Development How to work on your business — not in it Don’t get stuck in the ‘ask role’ 63 EV Intelligence All-in or part-time? Don’t miss your window of opportunity to service EVs 64 TPMS Mitsubishi Mirage – 2022 66 Ad index On the cover: 220037406 © Vitpho | Dreamstime.com FEATURES DEPARTMENTS 34 Multiple factors are

the

market in 2023. Turn to page 36 to fi nd out why.

Why farmers are hesitant to run ag

at single-digit psi

putting

brakes on the medium truck tire

Photo:

Bridgestone Americas Inc.

Unsung heroes COMMERCIAL TIRE DEALERS, TECHS KEEP AMERICA ROLLING

Mike Manges By

This is MTD’s annual commercial truck tire issue — an ideal opportunity to recognize commercial truck tire dealers and technicians and the important role they play in keeping our economy and way of life moving. Where would we be without truck tires, the vehicles that roll on them and the people who sell and install them?

Check out these numbers from the American Trucking Associations (ATA), a trade group that represents for-hire motor carriers, private trucking eets and other companies:

• Commercial trucks move 72.2% of all freight in the U.S., traveling 300 billion-plus miles annually;

• Trucking generated $875.5 billion in gross freight revenue in the U.S., according to the latest gures;

• Commercial trucks make up 14.1% of all registered vehicles;

• Nearly $48.5 billion in federal and state highway user taxes are paid though the operation of commercial trucks;

• Trucks transported 66% of the value of all surface trade between the U.S. and Canada during 2021 and nearly 83% of the value of surface trade between the U.S. and Mexico;

• Nearly eight million people, including more than three million drivers, are employed in trucking-related jobs.

According to the U.S. Department of Transportation, there are around 1.1 million for-hire carriers and more than 718,00 private carriers. (Trucking companies that self-identify as both total around 37,500.)

ese numbers underscore just how important truck tires — and the people who sell them — are. (By the way, 2022 was a red-hot year for medium truck tire sales. Replacement shipments in the U.S. grew by more than 20% versus prior-year levels, according to MTD data. Turn to page 36 of this issue of MTD to nd out if that momentum carried over into 2023.)

Commercial truck tire dealers make all of the above happen. But I also would be remiss if I forgot to mention the highly skilled, dedicated professionals who install commercial truck tires — never an easy task.

ese individuals understand better than most that there’s much more to installing a medium truck tire than just tightening a few lug nuts. Under federal law, the maximum allowed weight for a tractor-trailer is 80,000 pounds. Truck tire technicians are entrusted with an awesome amount of responsibility. And they make it look easy!

Let’s also hear it for those technicians who walk truck lots and terminals, carefully examining tires for irregular wear patterns, cuts, chips and other conditions that warrant removal from service.

Despite increasingly sophisticated tools and methods that

make capturing this data easier, yard checks remain perhaps the most unheralded job in the world of truck tire service.

And we should all tip our hats to roadside service technicians, who help get hobbled trucks up and running, regardless of weather, time of day (or night) and other conditions.

e famous postal carriers’ motto, “Neither snow nor rain nor heat nor gloom of night stays these couriers from the swi completion of their appointed rounds,” just as easily applies to these brave, hardworking “knights of the road,” who spring into action whenever the phone rings.

Truck tire dealers and everyone who works with commercial truck tires should take a bow. You’ve earned it! ■

If you have any questions or comments, please email me at mmanges@endeavorb2b.com.

MTD June 2023 4

Editorial

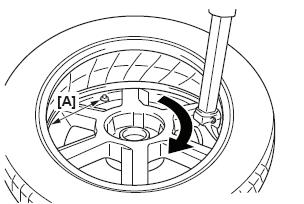

Where would we be without the commercial truck tire dealers and technicians who keep America rolling?

Photo: MTD

ModernTireDealer.com

DIGITAL RESOURCES FOR THE INDEPENDENT TIRE DEALER

Stay tuned to MTD’s podcast!

The Modern Tire Dealer Show is available on Stitcher, Spotify, Apple Podcasts, Google Podcasts, iHeart Radio, Amazon Music, Audible and MTD’s website. Download it today!

Sign up for Modern Tire Dealer’s eNewsletters to receive the latest tire news and our most popular articles. Go to www.moderntiredealer.com/subscribe

3515 Massillon Rd., Suite 200 Uniontown, OH 44685

(330) 899-2200, fax (330) 899-2209 www.moderntiredealer.com

PUBLISHER

Greg Smith gsmith@endeavorb2b.com

(330) 598-0375

EDITORIAL

Editor: Mike Manges, (330) 598-0368, mmanges@endeavorb2b.com

Managing Editor: Joy Kopcha, (330) 598-0338, jkopcha@endeavorb2b.com

Associate Editor: Madison Gehring, (330) 598-0308, mgehring@endeavorb2b.com

PRODUCTION

Art Director: Erica Paquette

Production Manager: Karen Runion, (330) 736-1291, krunion@endeavorb2b.com

ACCOUNT EXECUTIVES

Bob Marinez rmarinez@endeavorb2b.com (330) 736-1229

Marianne Dyal mdyal@endeavorb2b.com (706) 344-1388

Dan Thornton dthornton@endeavorb2b.com (734) 676-9135

Sean Thornton sthornton@endeavorb2b.com (269) 499-0257

Kyle Shaw kshaw@endeavorb2b.com (651) 846-9490

Martha Severson mseverson@endeavorb2b.com (651) 846-9452

In one of the largest retail shakeups in many years, TBC Corp. has sold its Tire Kingdom and NTB Tire & Service Centers chains to Mavis Tire Express Services Corp.

Dealers look for insights

Here’s a new idea when trying to recruit bright young minds to the tire industry. If they worry that the industry is slow or stagnant or that there might not be new things for them to pursue down the road, tell them about the last 30 days. One dealership bought nearly 600 stores in a single deal. A group of investors is calling for a massive transformation of a major tiremaker. And on the commercial front, tire dealers are expanding and nding new partners. There’s nothing boring to see here — just businesses adapting for their next frontier.

1. TBC sells retail stores to Mavis

2. Best-One of Indy employees save a coworker’s life

3. Group calls for big changes at Goodyear

4. Who are the biggest retreaders in the U.S.?

5. Southern Tire Mart continues to expand

6. Burt Brothers founder Wendel Burt has died

7. Photos: ITDG moves it forward at annual meeting

8. Callaghan Tire joins Best-One network

9. Photos: Flynn’s Tire lms TV spot to promote new store

10. Tupelo could cost Goodyear $130 million

DIGITAL EDITION

Check out MTD’s digital edition at the top of our website’s homepage.

SOCIAL MEDIA

Like us Facebook: facebook.com/ ModernTireDealer

Follow us Twitter: twitter.com/ MTDMagazine @MTDMagazine

Chad Hjellming chjellming@endeavorb2b.com (651) 846-9463

MTD READER ADVISORY BOARD

Rick Benton, Black’s Tire Service Inc.

Jessica Palanjian Rankin, Grand Prix Performance

John McCarthy Jr., McCarthy Tire Service Co. Inc.

Jamie Ward, Tire Discounters Inc.

CUSTOMER/SUBSCRIPTION SERVICE (800) 260-0562

moderntiredealer@omeda.com

ENDEAVOR BUSINESS MEDIA, LLC

CEO: Chris Ferrell

President: June Griffin

CFO: Mark Zadell

COO: Patrick Rains

CRO: Reggie Lawrence

Chief Digital Of cer: Jacquie Niemiec

Chief Administrative and Legal Of cer: Tracy Kane

EVP Transportation: Kylie Hirko

VP Vehicle Repair: Chris Messer

Modern Tire Dealer (USPS Permit 369170), (ISSN 0026-8496 print) is published monthly by Endeavor Business Media, LLC.1233 Janesville Ave., Fort Atkinson, WI 53538. Periodical postage paid at Fort Atkinson, WI, and additional mailing of ces. POSTMASTER: Send address changes to Modern Tire Dealer, PO Box 3257, Northbrook, IL 60065-3257. SUBSCRIPTIONS: Publisher reserves the right to reject non-quali ed subscriptions. Subscription prices: U.S. ($81.25 per year). All subscriptions are payable in U.S. funds. Send subscription inquiries to Modern Tire Dealer, PO Box 3257, Northbrook, IL 600653257. Customer service can be reached toll-free at 877-382-9187 or at moderntiredealer@omeda.com for magazine subscription assistance or questions.

Printed in the USA. Copyright 2023 Endeavor Business Media, LLC. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopies, recordings, or any information storage or retrieval system without permission from the publisher. Endeavor Business Media, LLC does not assume and hereby disclaims any liability to any person or company for any loss or damage caused by errors or omissions in the material herein, regardless of whether such errors result from negligence, accident, or any other cause whatsoever. The views and opinions in the articles herein are not to be taken as of cial expressions of the publishers, unless so stated. The publishers do not warrant either expressly or by implication, the factual accuracy of the articles herein, nor do they so warrant any views or opinions by the authors of said articles.

MTD June 2023 6

Photo: TBC Corp.

! 6WURQJ PXG WUDFWLRQ ! +LJK VWUHQJWK VLGHZDOO ! 6WURQJ URFN WUDFWLRQ ! 9DULDEOH SLWFK UHGXFHV QRLVH /LQJ/RQJ $PHULFDV� ,QF� ���� 0HGLQD 5RDG� 6XLWH ��� 0HGLQD 2+ ����� (PDLO� OXF\ VKL#OLQJORQJ�FQ

Ralson brings new truck tire brands to U.S. COMPANY

LOOKS TO BUILD DEALER NETWORK

Ralson Tire North America Inc. is now shipping commercial truck tires to the U.S. as it builds its domestic distribution network.

e company, which made its U.S. debut at the 2022 Specialty Equipment Market Association (SEMA) Show, is making its Ralson and Accelus truck tire lines available to distributors and dealers.

Ralson Tire North America is already receiving positive feedback about the products’ quality and performance, says Brian Sheehey, the company’s senior vice president.

Ralson brand products — which are “more application-based,” according to Sheehey — are designed for full-service commercial tire dealerships that buy directly from the company.

e company plans to sell Accelus tires through wholesale-distributors that reach smaller dealerships.

The Accelus lineup includes “the bread-and-butter of what any commercial tire dealer of any size would sell — a core of maybe 40 SKUs in regional, pickup and delivery and steer/drive/trailer tires,” says Sheehey.

“With Ralson, we’ll produce anything the customer wants,” says Manjul Pahwa, managing director of Ralson Tire North America’s parent company, Ralson Tyres Ltd.

e company’s brand segmentation is “very simple and rational, so (distributors and dealers) don’t have to worry about carrying too many sizes, since shelf space is at a premium,” says Sheeley.

“We (also) do not want our dealers and distributors to compete against each other with the same brand.”

All Ralson brand products come with a seven-year, three-retread warranty, while all Accelus brand tires have a six-year, two-retread warranty.

Both brands are manufactured at Ralson Tyre’s factory in India, which Sheehey says is “the newest truck tire plant in the world.”

e facility, which spans slightly more than one million square feet and has the capacity to manufacture one million truck tires per year, started production in May 2022. (Located near several ports, the plant will be able to produce four million units annually, according to Pahwa.)

“Between May 2022 and the rst quarter of this year, we tested product in-house and via eld evaluations,” says Pahwa.

Ralson Tire North America’s original U.S. distribution plan was to sell only by container, “but we realized that in order to better service our customers, we needed local distributors and dealers.”

e rst batch of Ralson and Accelus brand tires hit the U.S. in March 2023, says Jim May eld, president of Ralson Tire North America.

“ at was a container of what we call ‘seed tires.’ We sent them to customers we had been talking to. Now we have multiple containers on the water.”

ESTABLISHING A POSITION

Ralson Tyres was founded in the 1950s as a bicycle parts manufacturer and graduated to producing bicycle tires in the 1960s, according to Pahwa.

As the company grew, “we entered other product categories,” he says. “Around 10 years ago, we started toying with the idea of building a new business and started developing (commercial truck tire) technology. From there, we began looking at multiple markets for the product. e U.S. market was prioritized as one of our entry markets.”

e next step was construction of Ralson’s plant, a process that started before COVID-19 and continued through the pandemic.

“Now is as good of a time as any” to establish a position in the U.S. market, says Pahwa.

“We’re not a factory operation. We’re trying to build long-term relationships with end users and our dealer partners.”

Mayfield says Ralson Tire North America is growing its sales team. “We brought Brian onboard in October 2022. We’re recruiting other people. We have to have boots on the ground and people who can sit down with dealers and work with their people to sell the quality of our product. We’re a brand that’s fully committed to the U.S. market.

“We’re having conversations with distributors and dealers across the country,” he continues. “We also know that having excellent customer support and the infrastructure in place to service distributors and dealers will be very important.

“We’re starting that process and are putting a team together” at Ralson Tire North America’s base in Franklin, Tenn. e company is using “third-party warehousing” at the moment, says May eld. “We have tires located within a couple of hours of the Nashville area, which is a good, central location to reach the majority of the eastern U.S.

“We’re also investing in marketing. We have a signi cant presence on social media and will continue to utilize that. And we’ll be back at the SEMA Show this year.” — Mike

Manges

MTD June 2023 8 Industry News

“We’re having conversations with distributors and dealers across the country,” says Jim Mayfield, president of Ralson Tire North America Inc., whose tires are now available.

Photo: Ralson Tire North America Inc.

AFTERMARKET SENSOR ALUMINUM RUBBER > ORIGINAL EQUIPMENT FIT FORM & FUNCTION PROGRAMMABLE UNIVERSAL TPMS MAX SIGNAL STRENGTH 99 % VEHICLE COVERAGE FAST INSTALLATION PRESS RELEASE INTERCHANGEABLE VALVE STEMS TPMS SERVICE TOOL • Perform OBDII Relearns • Four 1-Sensor Programming Methods • FREE Updates for the Life of the Tool TS508WF TPMS DIAGNOSTICS & SERVICE • Print/Email/Text TPMS Health Report • OLS, BMS, SAS, EPB Service Resets • FREE TPMS Updates for the Life of the Tool ITS600 ® 1 SKU SENSOR INVENTORY : 314.9MHZ, 315MHZ & 433MHZ UPDATE VIA WI-FI NO PC NEEDED COMPLETE SOLUTION OE QUALITY SENSORS POWERFUL SCAN TOOLS WEB: AUTEL.COM | SUPPORT: 1.855.288.3587 EMAIL: USSUPPORT@AUTEL.COM FOLLOW US @AUTELTOOLS

Bites

Goodyear plant still down

Goodyear Tire & Rubber Co.’s Tupelo, Miss., consumer tire plant is still offline as the result of an April 1 tornado. Goodyear expects to lose $110 million to $130 million due to the shutdown. Full production isn’t expected to resume until the third quarter of 2023.

Sam Kato named TBC CEO

TBC Corp. has named Sam Kato its new president and CEO. He replaces Laurent Bourrut, who is retiring. A 30-plus year automotive industry veteran, Kato most recently served as TBC’s chief administrative officer for the last two years.

Endeavor buys IMR

Endeavor Business Media, parent company of Modern Tire Dealer, has acquired IMR Inc., a full-service automotive market research fi rm. IMR is known throughout the automotive industry for curating thoughtful, compelling and actionable insights that companies can use to make informed decisions about various marketplaces, brands and products.

Bridgestone breaks ground

Bridgestone Americas Inc. has broken ground on the $60 million expansion of its tread rubber manufacturing plant in Abilene, Texas. The 50,000 square-foot expansion is driven by the “rapid growth” of the company’s retread business.

Subaru picks Falken

Subaru has picked the Falken Ziex ZE001A all-season as a tire of choice for its 2024 Subaru Crosstrek. Two trim lines, Sport and Limited, come with the tire in size 225/55R18 98V.

TireHub adds Mickey

TireHub says it is now an authorized national distributor for Mickey Thompson Tires & Wheels. The company began selling Mickey Thompson brand tires on May 1.

Tire Discounters grows in GA

Tire Discounters Inc. has added to its list of Georgia locations with the purchase of The Tire Barn in Gainesville. Two generations of the Roper family have owned The Tire Barn since it opened in 1971. The recent acquisition gives Tire Discounters 22 locations throughout Georgia.

TBC sells retail stores to Mavis

TBC Corp. has sold its company-owned retail stores — a network of 595 NTB Tire and Service Centers and Tire Kingdom Service Centers — to Mavis Tire Express Services Corp. e two companies have entered into an agreement where TBC will provide wholesale and distribution services for Mavis’ retail stores.

e deal includes 392 NTB outlets and 203 Tire Kingdom Service Centers, with locations in Florida, Texas and other states across the Mid-Atlantic, Midwest and South.

In a statement, TBC noted “all NTB and Tire Kingdom retail store and retail eld management associates will have the opportunity to continue their careers with Mavis.”

TBC had earlier sold 112 NTB locations to Mavis in 2020.

e latest deal gives Mavis a retail footprint of more than 2,000 locations, say Mavis o cials.

“As we execute our growth plans and strategies, we continuously analyze the assets in our portfolio and periodically ne tune them to drive superior performance in our core focus areas,” says Sam Kato, president and CEO of TBC Corp.

“Divesting our company-owned retail business allows us to focus and strengthen our wholesale business, pursue growing our distribution and ‘supply chain as a service’ solutions, while bolstering our market-leading Midas and Big O Tires franchise businesses.

“We have never been in a stronger position to o er best-in-class solutions that address a full range of customer priorities, while driving innovation and long-term sustainable growth.”

Stephen Sorbaro, co-CEO of Mavis, says the deal “represents a signi cant milestone in the continued acceleration of Mavis’s growth strategy, enabling us to deepen our presence in existing markets and expand our Mavis brand into new markets throughout the Midwest, Mid-Atlantic and in Texas.

“We have a strong working relationship with TBC and a history of successfully integrating NTB locations into our platform and we look forward to partnering with them again to welcome the talented NTB and Tire Kingdom teams to the Mavis family.”

Nexen will build tires in the U.S.

Nexen Tire Corp. plans to build a manufacturing plant in the southeastern United States that will start producing tires by 2029.

e plant will represent an investment of $1.3 billion. Investment will begin during the second half of 2023.

When up and running, the plant will have a daily production capacity of 30,000 units, according to Nexen o cials.

“ is marks Nexen’s rst establishment of an overseas factory in nine years,” the company said, and its rst manufacturing facility in the U.S.

“By possessing production facilities in South Korea, China, Europe and the U.S. (and) through the establishment of the U.S. factory, Nexen will be able to strengthen its sales activities with global original equipment manufacturers and meet the demands for localization amid (the) changing global supply chain environment,” say Nexen o cials.

As part of its medium-term strategy, Nexen also stated that it plans to achieve sales of $2.7 billion in 2027.

“Based on gures from 2022, this ambitious plan aims to achieve approximately 40% revenue growth” within ve years.

e company also plans to boost its current production capacity, which stands at around 45 million units a year, to 52 million units by 2025. “ is will involve expanding annual production capabilities by 5.5 million units in Europe and 1.5 million units in Korea.”

MTD June 2023 10

Industry News

TBC has sold nearly 600 company-owned retail stores to Mavis.

Photo: MTD

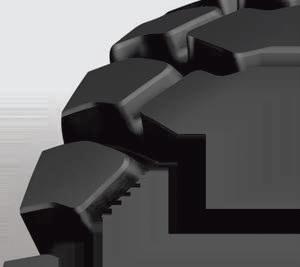

A LONG WAY TOGETHER

MULTIMAX MP 522

No matter how challenging your needs, MULTIMAX MP 522 is your best ally for agroindustrial applications with telehandlers and compact loaders. MULTIMAX MP 522 features indeed a steel-belted casing and a special compound providing extraordinary stability and traction in addition to great cut and chip as well as puncture resistance.

MULTIMAX MP 522 is BKT’s response to the need of a versatile multi-purpose tire under toughest conditions.

OH 44333

Toll free: (+1) 888-660-0662 - Office: (+1) 330-836-1090

Fax: (+1) 330-836-1091

BKT USA Inc. 2660 West Market St., Suite 100 Fairlawn (Akron) -

Bites Industry News

Callaghan joins Best-One

Callaghan Tire in Bradenton, Fla., has joined the Best-One Tire & Service network and has a new name, Callaghan’s Best-One. The dealership has 10 commercial truck tire centers, two Bandag retread plants, a full-service retail tire and auto service location and the fivelocation Callaghan Industrial Tire division. Partners Don Mead, Todd Severson, Guy Virgilio and Jane Callaghan Trinci will continue to lead the business.

Flynn’s opens Ohio store

Flynn’s Tire & Auto Service has opened its 27th retail tire location, a store located in the Akron, Ohio, suburb of Montrose. The outlet opened on May 22 and is the dealership’s ninth store in Ohio.

New retail brand coming

Another private equity group, Dallas, Texasbased The Sterling Group, is getting into the tire retail business with its own retail brand. It calls Premier Tire & Service “a new platform” that will provide “one-stop tire and auto solutions.” The company says it will acquire independent tire and service locations across the country.

Dawson Tire expands

Dawson Tire & Wheel in Gothenburg, Neb., has acquired F&F Tire & Service, a single-store dealership in Wisner, Neb. The purchase gives Dawson Tire & Wheel — which specializes in tires and wheels for agricultural applications — its fourth Nebraska location. Dawson Tire’s owner says the companies’ cultures are similar.

Shell picks Bridgestone

Bridgestone Americas Inc. will provide original equipment tires for the Shell Starship, a new, super fuel-efficient heavyduty concept truck. The Starship 3.0 will ride on Bridgestone R213 Ecopia steer tires and Bridgestone Greatec R197 drive and trailer tires.

Eastern Tire creates ESOP

Eastern Tire & Auto Service Inc. in Rockland, Maine, is now 100% employeeowned through its newly created Employee Stock Ownership Plan. The 77-year-old tire dealership says the ownership transfer to employees “is a natural progression” of what the business has achieved throughout its history.

Trimax CEO details U.S. growth plans

Trimax Tire is on the move. e company, which is owned by Maxion International, is rolling out two new products — its rst all-weather o ering, plus a dedicated winter tire — this year. e rm also continues to expand existing lines.

Trimax’s new distribution center in Qingdao, China, is shipping product. And the company is adding to its U.S. dealer base.

“We need to have distribution in all 50 states,” says Trimax CEO Stanley Wang, who shares more about his company’s plans in this MTD exclusive.

MTD: What are your company’s longterm and short-term plans for the U.S. market?

Wang: We have successfully secured Chinese brands that needed representation in the U.S. To do this, we established Trimax Tire in the U.S., which is the importer of record, handling all the logistic needs, plus (Trimax) pays all duties, federal excise tax, tari s and other taxes.

In turn, Chris Tolbert, our director of sales, has hired an experienced team with feet on the ground, expanding distribution.

We are still a small, young company that has many opportunities to grow with current distribution and many areas of open distribution.

MTD: Trimax continues to expand its product o erings across all of its brands, including Farroad, Haida, Saferich, MileKing and Kapsen. Why is it important to maintain a steady cadence of new tire introductions?

Wang: e U.S. is an important market for replacement tires. We currently do not intend to add any more tire brands. Our goal is to grow the quality tire brands that we represent.

With the Haida brand, we partnered and invested in some of the newer pattern molds — the Haida MT HD869 and Haida UHP HD937. We are also involved with the development of new patterns and sizes.

“We will continue to invest in molds for new products this year,” says Stanley

MTD: What is Trimax’s brand strategy in the U.S.? How do you position each of your brands?

Wang: Our market niche is quality opening price point, sold (and) delivered-duty-paid, in a timely manner — less than 90 days. Haida is our agship go-to, with Farroad, Kapsen, MileKing and Saferich closely behind.

MTD: During the 2022 SEMA Show, you mentioned that Trimax’s parent company was opening a 100,000-squarefoot mixing warehouse in Qingdao, China, that will give Trimax the ability to mix brands in single containers. How is the new distribution center coming along? Are you shipping out of it?

Wang: We are now working out of the new, 100,000-square-foot warehouse in Qingdao, China. is has helped us with staging product orders closer to the shipping port to manage much quicker lead time logistics. As time progresses this year, we will move further into mixing distribution needs with multiple product o erings.

MTD: Are you planning any investments in your manufacturing plants this year or next year? If so, are you able to provide details?

Wang: We will continue to invest in molds for new products this year (and) next year if there are tires the replacement market needs. Later this year, we will share products introduced at SEMA.

MTD June 2023 12

Wang, CEO of Trimax Tire.

Photo: MTD

Bites

J.D. Power posts results

Consumers are less satisfied with their aftermarket service providers, according to the J.D. Power 2023 U.S. Aftermarket Service Index Study. Users gave tire replacement providers lower scores in six of seven measures. The survey included responses of 11,194 vehicle owners who had aftermarket service performed on their vehicle in the previous 12 months.

Dealership rebrands

After 23 years in business, Jarid Lundeen has rebranded his four Tires Plus locations in North Dakota as Trusted Tire & Auto. He had planned to rebrand in 2020, but says the COVID-19 pandemic delayed the rollout of the new name.

Continental CEO to stay

Nikolai Setzer will serve Continental AG as its CEO and chairman for the next five years. The company recently extended his appointment, which began three years ago.

RNR gifts a Jeep

RNR Tire Express recently gave a new Jeep Renegade to customer Shayla Deppen, a U.S. Air Force veteran and mother of two who lives in Riverview, Fla., as part of its annual Mother’s Day Giveaway. RNR received 15,000 nominations for the giveaway.

TIA opposes emissions rules

The Tire Industry Association opposes two recently proposed rules that would dramatically increase the number of zero-emission vehicles (ZEVs) on the road. One rule proposed by the U.S. Environmental Protection Agency could require two-out-of-three new vehicle sales in 2032 to be a ZEV.

Rick Pearson has died

Richard Pearson, longtime owner of Fleet Equipment Corp., died on May 3 after a three-year battle with cancer. He was 89. In 1965, with $300, he started Fleet Equipment Corp. from the home he shared with his wife, Mary Ann, and later opened a manufacturing plant in Pennsylvania.

Chapel Hill Tire adds store

Chapel Hill Tire has acquired a Durham Tire store in Durham, N.C. This location is Chapel Hill’s second in the Durham area. It gives Chapel Hill Tire 11 total locations. Durham Tire still owns and operates another store in its namesake city.

Brothers Tire Co-Founder Wendel Burt dies

Burt

Wendel Burt, one of the two brothers who founded Burt Brothers Tire & Service in Bountiful, Utah, in 1991, died unexpectedly in California on April 26. He was 68.

Wendel and his brother, Ron, started Burt Brothers with a simple goal, which he had shared with MTD in one of many interviews over the years: “Sell at least one tire every day. Fortunately, we met that goal with only a few misses.”

e Burts grew their single store in Bountiful into an operation that serves all of Utah, but remains mostly concentrated around Salt Lake City and along the Wasatch Front. e company has 19 locations and with the second generation of Burts now leading the business, a 20th store is scheduled to open in September.

Wendel’s sons, Jake, Jeremy and Jason, took over as owners and general managers of the business in January 2019, alongside Ron’s sons, Cory and Brandon. Wendel and Ron remained on the company’s board of directors even a er their retirement.

Ron told MTD that he and his brother actually started working together when they were still in elementary school — at a dairy farm. en they joined a painting crew and it was Wendel who rst joined the tire industry. He enticed his brother to join him working for David Early Tire in Salt Lake City and eventually the two decided to strike out on their own.

“Probably the greatest blessing that ever happened to us was that our dad taught us to work,” said Ron. “ at proved to be our saving grace.”

ey centered their business on providing customer service. Known as the gregarious one of the brother duo, Wendel was a natural with customers. And according to his obituary, that personality extended far beyond the business.

Ron said he and Wendel shared a vision for their business, but Wendel was better at seeing the bigger picture, while Ron’s practical, dollars-and-cents brain always wondered, “How are we going to a ord this?”

“We know that we were blessed beyond our own ability,” said Ron.

Investment group demands big changes at Goodyear

An investment group that says it represents 10% of Goodyear Tire & Rubber Co.’s “economic interest” is calling for some major changes.

Elliott Investment Management LP sent a letter and presentation to Goodyear’s board of directors on May 11, with the goal of outlining “the right path forward to create value at Goodyear and realize its full potential,” according to a press release that Elliott Investment Management distributed on the same day. e group is calling for the addition of “ ve new, highly quali ed independent directors” to Goodyear’s board in order “to improve governance, bring about a cultural change and help restore con dence among investors;” monetizing “the trapped value of Goodyear’s retail platform,” which Elliott believes is “nearly worth Goodyear’s market capitalization;” and forming an operational review committee “to develop an operational and margin improvement plan.” ■

May 2023 Issue Correction

In the Products section of the May 2023 issue of MTD, we incorrectly listed the Hankook Ventus S1 evo Z AS X as the Ventus SW1 evo Z AS X.

MTD June 2023 14

Industry News

Wendel Burt had a flair for customer service, a founding tenet of the Burt Brothers Tire brand.

Photo: Ben Borchert

THE RUGGED, HIGH-STABILITY YOKOHAMA RT41 THE EARTHMOVER RADIAL YOU AND YOUR CUSTOMERS CAN DEPEND ON.

The Yokohama RT41 sets a new standard for earthmover tires. It’s everything you want at work: tough, hard-working, stable and reliable. Its heat-dissipating construction doesn’t break a sweat, even with long cycles and shifts.

With all-steel construction, rugged cut- and chip-resistant compound and reinforced sidewalls, the RT41 delivers a long initial service life— then it could be ready for re-tread. That adds up to more hours on the job, lower total cost of ownership and lower environmental impact. The Yokohama RT41 is the earthmover tire your customers—and you—can depend on for performance and ROI, hour after hour, load after load.

Contact your Yokohama Off-Highway Tire America representative today for more information on the RT41 and our other great Yokohama OHT tires, call (800) 343-3276 or visit yokohama-oht.com

•All-steel construction

• High traction, high stability

•Cut, chip and puncture resistant

•Tough, retreadable casing

ORDERING TIRES JUST GOT EASIER! Check out our new B2B E-Commerce Portal

www.yokohama-oht.com

800-343-3276 | @yokohamaohta

YOKOHAMA RT41

Relevant statistics from an industry in constant motion Numbers ThatCount 329 Number of new tires and tread designs that have earned SmartWay veri cation Source: U.S. Environmental Protection Agency Photo: Continental Tire the Americas LLC $73.26 Average ticket price for an oil and lube job Source: MTD 2022 Tire Dealer Automotive Service Study

MTD 71% Scrap tires consumed by other markets Source: 2021 Scrap Tire Management Report by U.S. Tire Manufacturers Association

39569256 © Jevtic | Dreamstime.com 13.1% Portion of pickups among all new vehicle registrations in Texas in 2022 Source: Experian Automotive Photo: Ford Motor Co. 56,600 Daily capacity of U.S. tire plants to build medium truck tires Source: MTD Facts Issue Photo: Continental Tire the Americas LLC MTD June 2023 16

Photo:

Photo:

In ation and tax returns

MONTHLY VOLUME DECLINES MATCHED THAT OF APRIL 2020

John Healy By

Retail sellout trends continue to show so ness on a year-over-year basis, marking a h straight month of negative retail sellout. During April, tire dealers saw average unit declines of 4% year-over-year, the largest decline since April 2020, when COVID-19 lockdowns were still in place.

So what’s driving the lackluster performance? We believe the overall in ationary environment continues to weigh on the consumer. Given that volatility, we want to access the health of automobile travel demand, which correlates to tire usage and wear. In April, for the second month in a row, miles driven trends remained positive. It’s the rst time since February and March of 2022 that we recorded back-to-back months of positive trends.

Our miles driven momentum index showed a 1.3% year-over-year increase in March, followed by a 3% year-overyear increase in April. And miles driven through the rst week of May grew 2.7% year-over-year.

Given these recent improvements, we see the potential for sectors related to passenger tires and a ermarket auto parts to improve, as well.

Raw material costs continue to fall in year-over-year comparisons. Combined, the materials needed to build a basic replacement vehicle tire fell 11.2% year-over-year in April 2023, which follows a 8.2% yearover-year decline in the rst quarter.

And with year-over-year drops in the prices of carbon black, crude oil, natural rubber and reinforcement items needed to build a tire, it is becoming abundantly clear that rising raw material costs may be behind us.

There is a growing viewpoint that with this decline in raw material costs, manufacturers may be inclined to reduce price in order to jumpstart sellout trends.

THE SLOWDOWN PERSISTS

Eight out of 10 of our independent dealer contacts reported negative demand for replacement tires during the month of April, which is slightly worse than the 71% of dealers who saw declining demand in March. And for the second straight month, no independent operators saw a year-over-year increase in demand — a phenomenon we have not seen in the 10-plus-year history of our surveys.

While there are always a number of factors that can unexpectedly push and pull tire demand during a month (weather, calendar shi s, etc.), it appears the broader theme of the shaky macro environment has taken hold and created a trend in the tire retailing category.

Outside of these larger macro factors, we note declining year-over-year tax refunds, prior price increases from manufacturers and consumer deferment in automotive service are working against tire sellout trends. While in ation is cool-

Snapshot of Dealer’s PLT Tire Volumes (Year-Over-Year Change)

ing in some sectors of the economy and consumer spending is still elevated in certain premium segments, it appears tire retailing has not seen any signs of positive momentum. Simply put, our latest survey indicates there are a number of headwinds facing the industry, with few tailwinds in sight.

Given fears of a recession during the back half of 2023, we feel it is likely that trends will continue to show so ness.

TOP TIER DEMAND DROPS

For the second straight month, tier-three tires topped the demand charts among dealers in our survey. Tier-two tires moved into second place in April, ipping spots with tier-one tires from the previous month’s survey.

Given that dealers indicated tire demand was at its weakest point in years during April, we are not surprised to see those consumers who did choose to purchase tires traded down to tier-three brands. With in ation hurting the wallets of the low-end consumer the most, we see it as logical and rational that tire buyers would prefer the most inexpensive brands.

Looking forward, we note consumers seem to change their preference for certain tires given the current economic situation and that has played out in the swings in our rankings over the last few months.

Over the long run, we continue to believe consumers will opt for tier-two tires, since they strike a balance between performance and value.

Until then, we think it is likely that consumers will choose the most inexpensive brands, given the fact they are experiencing rising prices in every facet of their lives. ■

MTD June 2023 18

Your Marketplace Feb22 Mar22 Apr22 Feb23 Mar23 Apr23 Average Increase 57% 60% 16% 40% 0% 0% 40% Flat 0% 10% 17% 20% 29% 17% 27% Decline 43% 30% 67% 40% 71% 83% 33% Total 100% 100% 100% 100% 100% 100% 100% SOURCE: NORTHCOAST RESEARCH ESTIMATES

John Healy is a managing director and research analyst with Northcoast Research Holdings LLC, based in Cleveland. Healy covers a variety of subsectors of the automotive industry. If you would like to participate in the monthly dealer discussions, contact him at john.healy@northcoastresearch.com.

WE’RE IN IT FOR THE LONG HAUL.

DRIVING VALUE IN EVERY MILE.

Meet the new standard of quality, performance and reliability. Introducing the All-New Transmax line of truck and bus tires. Transmax bridges the gap between quality and affordability with superior engineering, GXUDEOH��ORQJ�ODVWLQJ�GHVLJQV�DQG�FRQƓGHQFH�EXLOGLQJ� warranties for ultimate peace of mind.

FEATURES

1 2 3

6/50 Free Replacement Coverage (6 Years, 50% of Tread)

6PDUW:D\p�9HULƓFDWLRQ� for Select Patterns

Two Retread Casing Protection Coverage

WWW.AMERICAN-OMNI.COM/TRANSMAX

“If tire prices are going up slightly, that’s not cause for alarm — as long as they are not going up significantly and/or tracking outside the standard rate of inflation,” says JP Brooks, director of business development for Fitment Group.

Tire pricing at mid-year ‘LEVELING OUT’ IS UNDERWAY, SAYS FITMENT GROUP

By

Mike Manges

Tire pricing nally appears to be stabilizing. But long-term normalization of tire prices — at both sell-in and sellout — remains dependent on a wide range of factors, according to JP Brooks, director of business development for Duluth, Minn.-based Fitment Group, which analyzes millions of passenger and light truck tire prices weekly.

“We continue to see prices increase slightly on most consumer goods, as well as tires, but the trajectory has slowed signi cantly,” says Brooks, who provides Fitment Group’s take on consumer tire pricing at mid-year in this MTD exclusive.

MTD: Earlier this year, you mentioned in ation levels were moderating and could work in favor of tire dealers. Has that occurred? What impact has this had on dealers?

BROOKS: Before we dive into retail tire pricing, I think it’s important to rst look at the state of overall in ation in the U.S. On May 10, the U.S. Bureau of Labor Statistics released its latest in ation data through April. A lot of data was dumped upon us, but in short, consumer prices are still rising. However, the rate of increase has slowed substantially. e Consumer Price Index (CPI) rose 4.9% in April from a year

earlier. At its peak, the CPI was just above 9% last summer, so the good news is that in ation seems to be taming and what the Fed is doing as far as raising interest rates seems to be working.

What e ect has that had on tire retailers? With the signi cant price increases we saw in 2022, many tire retailers reported the trend of consumers trading down a tier or two as the prices of tier-one tires were hard to absorb for a lot of consumers, (especially) with the other consumer goods price increases they were experiencing.

Over the last ve months, we’ve seen retail sellout data decline by single digits, with in ation pressure being a key com-

ponent. Consumers are slowing down on some of their spending. I anticipate we will likely see a continued ight to value, where consumers are trading down a tier or two, and a so sellout market while the overall market starts to stabilize.

MTD: Will we see a moderation in in ation during the second half of the year?

BROOKS: We’ve seen tire prices follow relatively the same trend line that’s following inflation, so as long as we continue to see those in ation numbers stabilize and slightly increase, I believe we are going to see the same thing with retail tire prices.

MTD June 2023 20 Tire pricing

AVERAGE ADVERTISED PASSENGER TIRE PRICES (JANUARY 2023 VERSUS JUNE 2023) SIZE MAJOR BRAND (JANUARY 2023) MAJOR BRAND (JUNE 2023) LOW-COST (JANUARY 2023) LOW-COST (JUNE 2023) 225/65R17 $186.06 $196.18 $113.48 $115.80 205/55R16 $152.23 $162.22 $87.22 $86.78 215/55R17 $181.05 $191.96 $99.62 $102.28 215/60R16 $143.50 $151.92 $89.31 $86.75 195/65R15 $129.76 $142.43 $75.05 $74.52

Photo: Butler Tires and Wheels

SOURCE: FITMENT GROUP

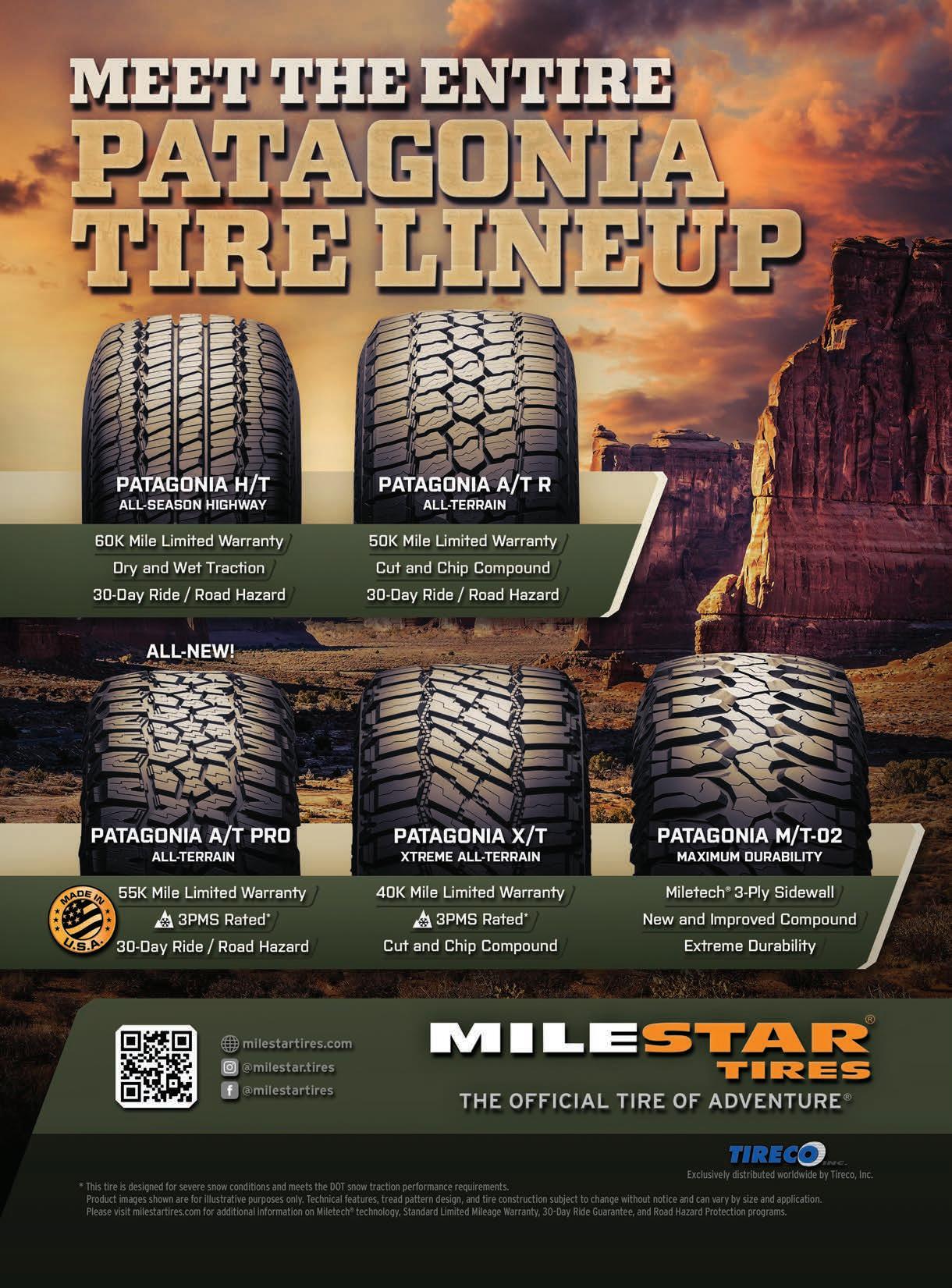

Offer Valid: June 1 - 30, 2023 Rebate form must be submitted online or by mail, postmarked by 7/31/23. CONTINENTALTIRE.COM/PROMOTION Restrictions and limitations apply. Scan code to visit ContinentalTire.com/Promotion for complete details. The Continental Tire Visa Prepaid Card is issued by Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. No cash access or recurring payments. Can be used everywhere Visa debit cards are accepted. Card valid for up to 6 months; unused funds will forfeit after the valid thru date. Card terms and conditions apply. * ** Qualifying Tires ContiPremiumContact™ 2 ContiProContact™ ContiSportContact™ ContiSportContact™ 2 ContiSportContact™ 3 ContiSportContact™ 5 ContiSportContact™ 5P ExtremeContact™ DWS06 ExtremeContact™ DWS06 Plus ExtremeContact™ Sport ExtremeContact™ Sport02 ProContact™ GX ProContact™ RX ProContact™ TX PureContact™ LS SportContact™ 6 SportContact™ 7 TrueContact™ Tour VikingContact™ 7 Purchase a set of 4 qualifying passenger Continental Tires between June 1 - 30, 2023 and get a $110 Visa® Prepaid Card ** by mail. CONSUMER PROMOTION GET A $110 REBATE * Yes, really. THE SMART CHOICE IN TIRES

Tire pricing

MTD: Near the end of 2022, advertised pricing on major brand tires seemed to decline. Will that trend continue?

BROOKS: I would say ‘decline’ wouldn’t be the best word. It’s been more of a stabilization. We continue to see prices increase slightly on most consumer goods, as well as tires, but the trajectory has slowed signi cantly. ere are some outliers, but when we look at advertised tire pricing today, it closely tracks with the CPI and core in ation. e Fed targets a 2% in ation rate, which is an increase, so prices are going to go up. But the target rate of 2% overall is considered low enough for consumers to absorb. We’re not quite there yet with tire prices.

In ation is trending down, but we’re not at the Fed target of 2%, so we’re not considered stabilized. But we could be on our way to stabilization. It’s really kind of how you view it. If consumer prices go up 2% year to year, the Fed is OK with that because that’s a comfortable increase for consumers to absorb. If tire prices are going up slightly, that’s not cause for alarm — as long as they are not going up signi cantly and/or tracking outside the standard rate of in ation. If the CPI is at 4.9% and tires are at an 8% increase, then something is out of whack. Now we have an outlier.

MTD: We’ve seen drastically fewer price hikes announced by tiremakers this year versus the past two years. Why is that

AVERAGE ADVERTISED LIGHT TRUCK TIRE PRICES (JANUARY 2023 VERSUS JUNE 2023)

and has the window for tire manufacturer price increases closed?

BROOKS: We still have a lot of economic uncertainty, but I don’t believe we’ll see anything close to the increases we saw in 2022. Raw material costs are moderating, the supply chain has moderated and consumers, at the end of the day, can’t really absorb more increases across all consumer goods — not just tires. With sellout decreasing, as well, it’s a pretty bad time to raise prices again.

MTD: What can MTD readers expect to see regarding tire pricing during the rest of 2023 and why?

BROOKS: ere’s still a lot of economic uncertainty to wade through. We still have a war in Eastern Europe. We have tensions with China. And we still might have more

interest rate hikes on the horizon. However, we look to be moving in the right direction with in ation. And on top of that, the average age of cars and light trucks in the U.S. has risen again this year, so now the average age of vehicles in the U.S. is 12.5 years. at means more people are keeping their vehicles and repairing them.

I feel that as we continue to see a leveling out of tire prices, we will continue to see a continued ight to value during 2023. As in ation continues to moderate and tire prices moderate along with in ation, we might see an uptick in tier-one tire (sales) at the end of the year as consumers feel not quite as burdened by higher consumer prices. With fewer people buying new vehicles, they may feel less burdened nancially and will want to make an investment in new tires. We’ll have to wait and see what the data looks like in six months. ■

AND TIER FOR SIZE LT265/70R17 (JANUARY 2023 VERSUS JUNE 2023)

MTD June 2023 22

SIZE MAJOR BRAND (JANUARY 2023) MAJOR BRAND (JUNE 2023) LOW-COST (JANUARY 2023) LOW-COST (JUNE 2023) LT265/70R17 $269.46 $283.25 $191.00 $185.86 LT245/75R16 $237.02 $245.65 $149.83 $142.41 LT275/70R18 $296.88 $305.68 $214.43 $212.16 LT225/75R16 $225.65 $231.20 $141.63 $142.41 LT245/75R17 $265.23 $272.70 $176.54 $245.94 SOURCE: FITMENT GROUP

REGION OPENING VALUE BETTER BEST JAN. 2023 JUNE 2023 JAN. 2023 JUNE 2023 JAN. 2023 JUNE 2023 JAN. 2023 JUNE 2023 EAST NORTH CENTRAL $199.50 $201.46 $243.91 $242.97 $268.60 $275.95 $285.67 $292.39 EAST SOUTH CENTRAL $203.23 $207.21 $242.69 $240.62 $267.36 $272.58 $282.62 $290.49 MIDDLE ATLANTIC $170.97 $180.24 $242.17 $242.55 $265.60 $277.90 $284.36 $296.74 MOUNTAIN $205.41 $209.68 $263.44 $253.63 $273.69 $278.61 $283.42 $291.94 NEW ENGLAND $173.55 $189.07 $248.97 $256.05 $277.95 $288.37 $309.31 $311.98 PACIFIC $202.18 $209.04 $254.31 $246.78 $268.64 $274.49 $279.97 $288.61 SOUTH ATLANTIC $191.96 $192.60 $240.04 $239.37 $268.47 $274.98 $283.28 $293.83 WEST NORTH CENTRAL $202.33 $203.95 $239.46 $241.33 $266.12 $274.50 $280.62 $291.41 WEST SOUTH CENTRAL $200.98 $204.92 $242.74 $239.71 $265.05 $271.57 $279.51 $289.08 SOURCE: FITMENT GROUP

PRICING BY U.S. REGION

Dealers take action on tire pricing

MEANWHILE, CONSUMERS LOOK TO LOWER-TIER TIRES

Joy Kopcha By

Navigating the ups and downs of tire pricing has prompted at least one tire dealership to do something it’s never done in its rst 43 years in business.

Nick Fox, president of Fox’s Point S, a four-store Point S Tire & Auto Service operation in Montana, says the company placed its rst container order. e shipment of 700 passenger and light truck Blackhawk tires from Sailun Tire Americas is scheduled to arrive this month.

Fox, the second generation to lead his family’s tire business, called the current state of pricing “bizarre. You’ve got your tier-one and higher tier-twos doing price increases and then the rest of tier-two is leveling out and staying the same. en tier-three and four are going down in pricing. We had to pivot.”

e rst move was to monitor selling prices of his lower-tiered tires more closely. Fox says his company had been selling based on the most recent cost to acquire those tires, but in some cases, that meant they weren’t covering all of their expenses.

He also has streamlined purchasing multiple lower-tiered brands and plans to focus on the Blackhawk line.

“We’ve sold some previously, but it’s never been a major part of our lineup. We’re putting full force behind it. It was a strategic move because they (cost) less money than other brands we were buying.”

Consumers are shocked by the prices they’re facing to replace a set of tires, he says. About 20% of Fox’s customers are deferring service repairs and tire replacement.

He says customers seem more comfortable delaying a purchase than trading down to a lower-priced alternative.

“( e month of) May picked up, but we’re seeing customers holding o on making tire purchases because prices have increased substantially. ey’re coming in expecting to spend $800 on a set of tires and now they’re a $1,000 purchase instead.

“And in Montana, we’ve got a lot of outdoor enthusiasts who are looking for more of a premium tire line and those have been subject to even larger

increases,” says Fox. “It’s gotten to the point where promotions that manufacturers run to save $80 or $100 on a set of tires aren’t all that attractive.”

SHOPPING FOR VALUE

In the Atlanta, Ga., market, Michael Spencer says tire sales are down so far in 2023. In some of the seven TireSouth stores he and his wife Jessica own and operate, volumes are down by anywhere from 7% to 9%.

And while tire demand “is o a little bit,” his cost to replenish inventory is much lower than it was just six months ago.

“ e oodgates have opened, so there’s a lot of inventory out there, which is causing pricing to come down,” he says. “Our replacement cost is signi cantly lower than it was at the end of 2022. Everybody’s calling you with a new deal every other day.” ere’s a downward push on premium brands, but Spencer says, “our entry-level (products) are outselling our premium (products) right now.”

TireSouth markets both levels of tires, as well as a full menu of automotive services. Spencer says “the service side is still humming along.”

He attributes that to drivers holding onto their vehicles longer than normal, which creates the need for regular maintenance.

“People who were used to getting a new car every two or three years are now getting services they’re not used to having to perform. We’re in that sweet spot when it comes to service.

“I think people are more price conscious right now,” says Spencer. “It’s not as bad as it was in 2008 and 2009. I think they’re value shopping a little bit more.”

BALANCING TIRES WITH SERVICE

Small independent tire dealers aren’t the only ones making pricing adjustments.

Mike Broderick, the president and CEO of Monro Inc., told investors in May that consumers had been trading down to lowerpriced tires for three straight quarters.

And in the rst three months of 2023, “as our customers continued to look for more choice and greater value, tire sales of our opening price point tires were a larger proportion of our overall tire sales.” e growing popularity of those lowerpriced tires “was a drag on our overall gross margin” in the quarter. So Monro raised prices on its opening price point tires and Broderick said the company recorded improvement as the period progressed — and maintained market share.

Broderick said he’s focused on Monro balancing its role as both a tire seller and an auto service provider.

“I do not want to be a tire-only provider. I believe Monro’s greatest strength is that we are a full-service provider.” And Broderick said those pricing moves are a step to maintaining that balanced approach. ■

MTD June 2023 24

Tire pricing

In Montana, Fox’s Point S has increased its marketing budget in 2023 to reach more customers.

Photo: Fox’s Point S

TireSouth opened its newest store in Peachtree Corners, Ga., in January. Owner Michael Spencer says consumers have grown more price conscious in recent months.

Photo: TireSouth

YOKOHAMA DRIVE TIRES DRIVE PROFITS

Optimize your long-haul power units with fuel-efficient and highly retreadable Yokohama Ultra Wide Base drive tires. All of our UWB long-haul tires are SmartWay ® Verified and built to last.

Call your Yokohama sales representative today or visit YokohamaTruck.com for more information.

Outstanding mileage for regional and long-haul operations. Exceptional fuel efficiency and unparalleled traction.

YokohamaTruck.com

© 2023 Yokohama Tire Corporation

© 2023 Yokohama Tire Corporation

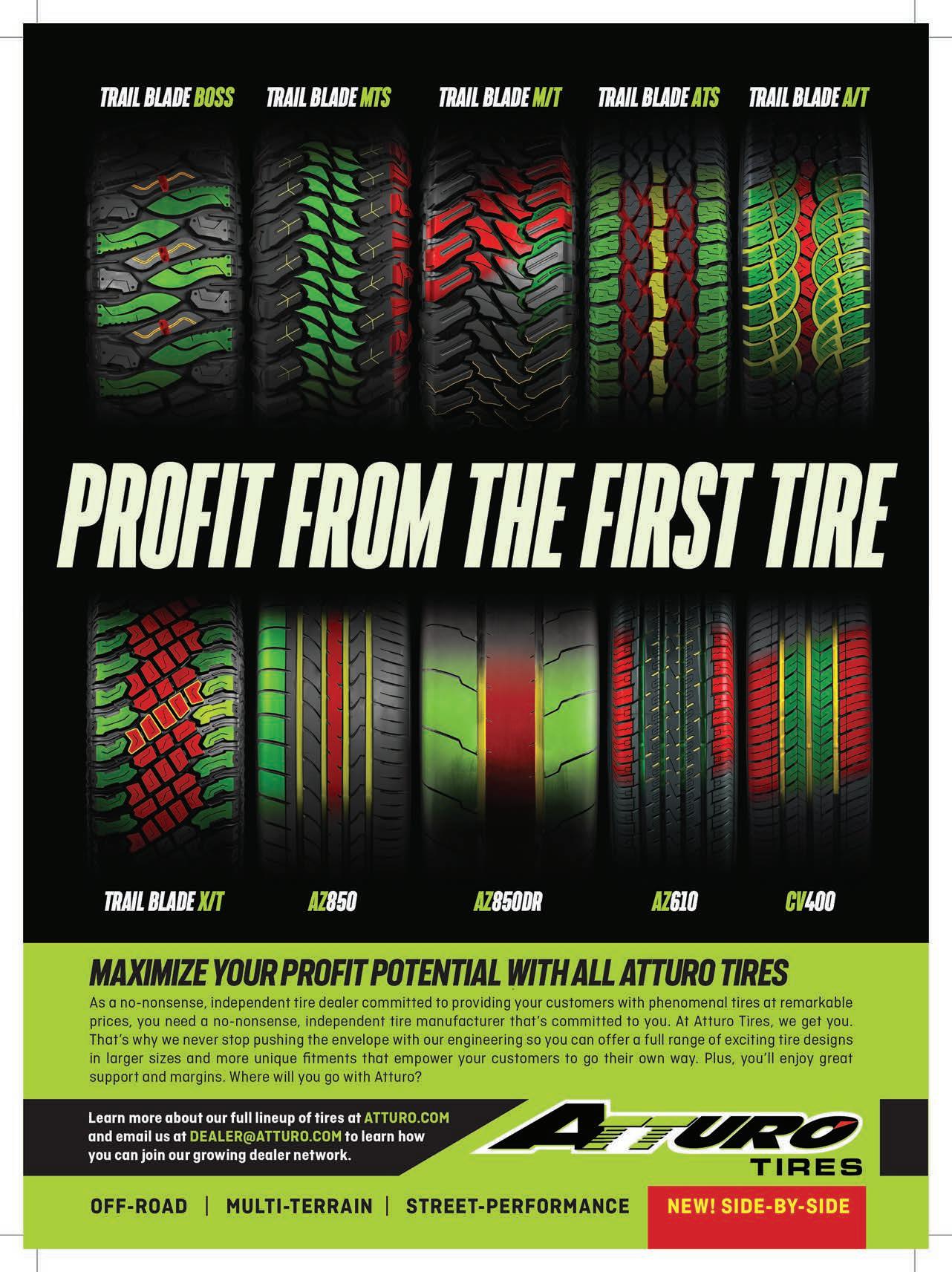

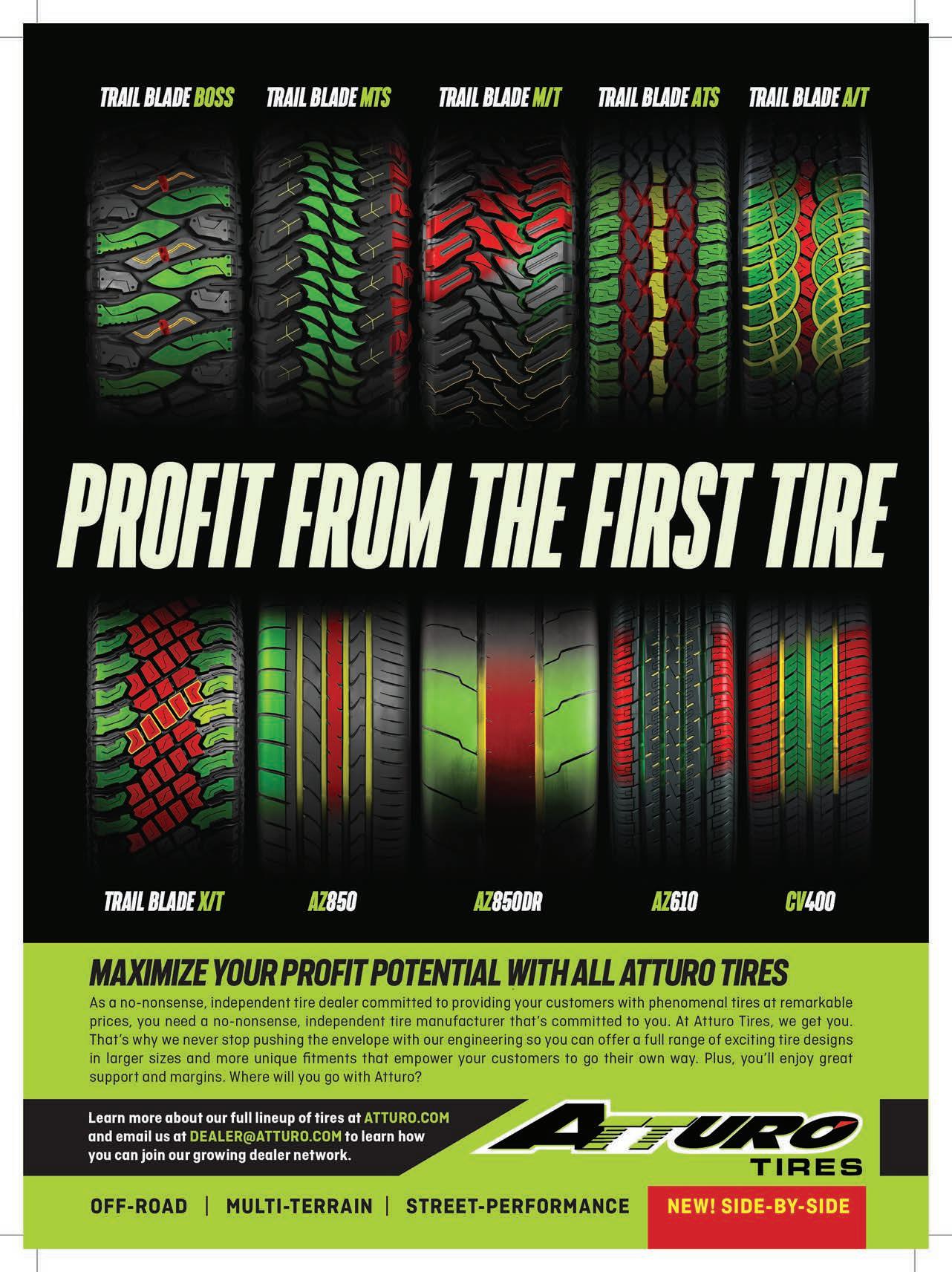

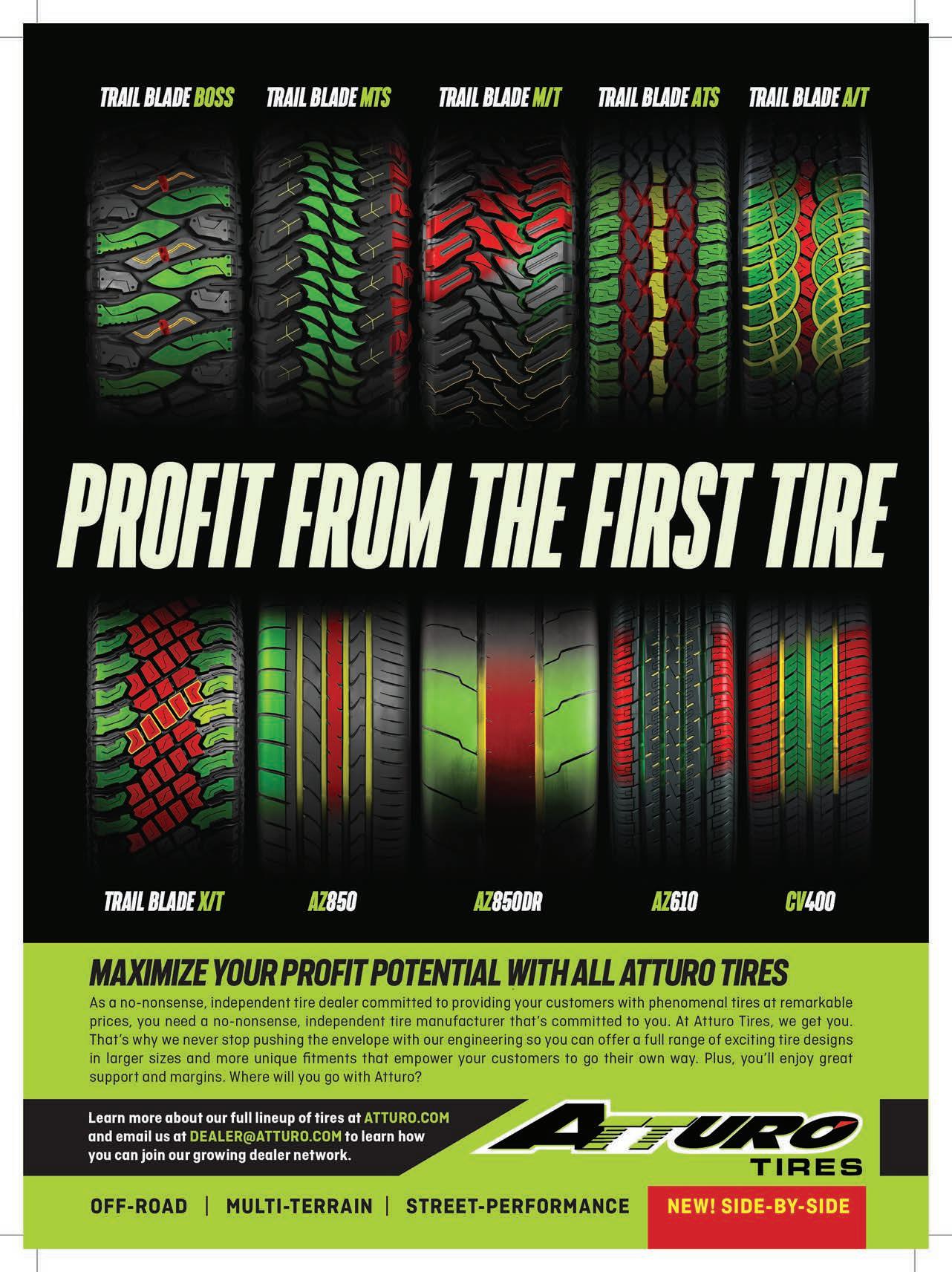

Going wide

ATTURO TIRE FINDS RICHES IN NEW NICHES, WHILE STAYING TRUE TO ITS ROOTS

Mike Manges By

The light truck tire segment, which has been Atturo Tire Corp.’s “home base” for most of the company’s existence, is now serving as a launching pad into other product segments, according to Michael Mathis, Atturo’s president.

Atturo is broadening its product portfolio with the goal of “growing our brand and our business,” he says.

As an example, Atturo entered the muscle car market in late-2021 with the launch of its AZ850 Muscle tire.

One year later, the company entered the powersports segment with the Trail Blade X/T SxS and the Trail Blade Boss SxS — both designed for all-terrain, sideby-side vehicles.

Atturo also continues to expand its specialty trailer tire and light truck tire o erings.

e idea is to capitalize on natural “crossovers” between product lines and customers, says Mathis.

NATURAL SYNERGIES

“As we’ve penetrated the light truck tire market, we’ve run into instances of synergies between that market and other markets,” says Mathis.

“One of the best examples is the crossover between pickup truck owners and muscle car owners.”

Atturo’s research shows that around 50% of muscle car owners also own a light truck, he says.

“Here’s a customer base that already knows Atturo from light truck ownership and is open to the brand for its muscle cars. is is an area where we have found a match between our core product and the other vehicle the customer has in his garage.”

“There are synergies between different product categories that we can capitalize on,” says Michael Mathis, president of Atturo Tire Corp., pictured at the 2022 Specialty Equipment Market Association Show.

Atturo identi ed the same connection between pickup truck owners and specialty trailer owners.

“If you have a trailer, you have a vehicle to tow it that we’re providing tires for,” notes Mathis.

“We did the same thing when we went into the powersports market. If you own a side-by-side, you also own a trailer and light truck to tow that unit around.

“ ere are synergies between di erent product categories that we can capitalize on and that leads down the path of addressing more markets.

“ at also leads to yet other opportunities for broadening the Atturo product range, broadening our customer base and adding more of what I would call strategic, a ermarket SKUs.”

At the same time, Atturo is expanding its menu of “everyday, complementary

MTD June 2023 26 Atturo Tire

Photo: MTD

QUALITY

YOU CAN’T MEASURE DIPSTICK. WITH A

It runs deeper than that. Because Motorcra ® parts are premium replacement parts — designed, engineered and recommended for Ford and Lincoln vehicles. They’re tested to provide performance and long-life reliability. And they’re 20,000 active parts strong, with an inventory that includes fluids, brakes, batteries, wiper blades, spark plugs and much more. Your customers? Full-on satisfi ed. See your Ford Certifi ed Parts Wholesale dealer for more details.

Motorcraft® is a registered trademark of Ford Motor Company.

replacement tires.” An example of this, according to Mathis, “would be to take a popular original equipment (OE) tire and build a di erent tread pattern into it” for a ermarket consumption.

“One of the fastest-growing OE sizes is 275/50R22. e traditional tments on that are 22-inch options for the Chevy Silverado, Cadillac Escalade and Chevy Suburban. I think Dodge also uses that tment.

“Last year, we took that size and instead of building it in a highway tread, we built that with an all-terrain tread. It’s been one of our most successful SKUs.

“ is has created greater pro t potential for our dealers and a more unique o ering that stands out among the myriad of highway tread tires that are available in that size.”

SIMPLICITY WINS

Other factors are driving Atturo’s product expansion strategy, says Mathis.

“ e most obvious one is simply the opportunity to do more business by having more products in more categories to address a larger dealer and consumer base. One of the fastest ways to do that is to build out our product catalog.

“At the same time, we want to stay true to our brand. We’re not trying to be a commodity product.

“ e other part is that as we continue to expand our distributor base — in order to get that shelf space and make sure our distributors have a wide enough variety of Atturo tires to justify inventory — we need to o er” more traditional, products and SKUs, he explains.

“ ere are a lot of brands that only have that a ermarket-type product and don’t have that OE tment tire. Every day, dealers are changing 265/70R17s. We want to make sure dealers have an Atturo (tire) they can sell every day.”

Mathis says that while general tire supply “has been a rollercoaster for the last few years,” Atturo’s inventory is in what he calls “a healthy place.”

However, closely monitoring inventory uctuations has never been more critical for the company.

“As we’ve seen an uptick in business over the last several months, we’re seeing some SKUs go out of stock again. But that’s a re ection of the improved business environment.”

Atturo brand tires are manufactured in four facilities in Asia. “We’re building tires in ailand and Taiwan and a limited number in China,” says Mathis, who adds that the factories “are nimble and can support us when we want to build a SKU that has relatively modest or even infrequent demand.

“We’ve been able to source the capacity and we’ve been able to work with partners that will produce these specialty, targeted tires for us.”

One niche that Atturo will continue to aggressively pursue is last-mile delivery van tires.

“A handful of these SKUs have been among our best-sellers. It’s a segment that continues to grow.”

e segment also o ers plenty of pro t opportunity for dealers who know to service last-mile eets, says Mathis.

“A lot of these eets are not your traditional TBR-type eets that have sophisticated tire management programs. ey’re subcontractors to Amazon or they’re your local plumber who’s converted from an old van to a Ford Transit.”

Atturo has purposely shunned creating an associate dealer network for its customers.

“We’ve put a big effort into raising brand awareness on a scale that’s really bigger than Atturo’s market position,” says Mathis. The company launched two new tires for the powersports market last year.

Michael Mathis, president of Atturo Tire Corp., believes the tire industry has entered a “deflationary period.” And that’s a good thing, he says.

“What we’re hearing and seeing is that there is demand for replacement tires and that’s across the spectrum. The overhang of high-priced inventory from the first half of 2022 has been a challenge for the industry to work through, but we are working through it.

“As that inventory starts to get replaced with lowercost products, retail prices will start to come down. Consumers, quite simply, need the benefit of lower-cost tires. They need to see prices come down.”

As the industry right-sizes, Mathis says “getting back to 2019 volume levels” would be ideal.

“I don’t know if we’re ever going to see 2020 and 2021 volumes again, because I think those were so artificial in so many ways.

“The industry needs a realistic goal of where we should be headed and then looking at where that pent-up demand is for replacement tires.”

Many consumers were “priced out” of the market last year, says Mathis. “But in my view, inflation in the tire industry is dead. That just needs to flow through to the consumer, so they can get the benefit of that. And then the business will carry forward from there.”

Atturo Tire MTD June 2023 28

Photo: MTD

‘We’re in a deflationary period’

Price drops will benefit dealers and consumers, says Mathis

“Atturo doesn’t have a national associated dealer program, but what we can do is support a distributor that has a local program for its dealers,” says Mathis.

“We have a handful of distributors that have their own house programs. is allows Atturo to partner with the distributor in support of their relationship with that local dealer.

“ is is part of our commitment to the independent distributor and dealer channel.”

e decision to not o er its own program under the Atturo umbrella “was born out of our start, when we had a limited catalog and were more of a niche brand than we are today,” he says.

“Our goal is to deliver a tire that will enable the distributor and dealer to make a great margin and allow the consumer to walk away with a tire that outperforms its price point.

“Rather than trying to force distributors and dealers to hit periodic volume targets or a particular product mix or forcing them into inventory situations they didn’t have demand for, we wanted to give them a tire they could make money on.

“ ere are a lot of distributors and dealers who are so conditioned on those programs and that back-end money.”

But, Mathis says, just as many dealers are looking for simplicity.

“If a dealer has to make his month-end number and every customer who comes in through the door is going to be pushed to buy a certain product, it does a disservice to the dealership, as well as the consumer,” he explains.

“My belief is that consistency in margin is what leads to volume.

“We have unique SKUs and our marketing has elevated the Atturo brand from a small-volume private brand into something that’s more nationally recognized.

“We’re focused on those local, independent distributors and dealers and giving them a product that’s not available to every dealer or outlet.

“ at’s what keeps everybody coming back.

“ e marketing we do (also) is a di erentiator for us,” says Mathis. “We’ve taken the approach from the start of presenting our product directly to the consumer, so they go into their local dealer and ask for it.

“Events are a huge part of what we do. On average, we’re at 20-plus consumer events a year with a crew, display vehicles and tires.

“We also do a handful of dealer-focused events. We do a full mix of print, digital and outdoor advertising. And we’ve run a series of TV commercials on cable.

“We’ve put a big e ort into raising brand awareness on a scale that’s really bigger than Atturo’s market position. Customers aren’t just coming in and asking for Atturo. ey’re insisting on Atturo.”

• 3D Mobile Wheel Alignment System

• Fully automatic. Beam can be moved up and down

• Compatible with all car lifts including 2 post lifts and mid-rise scissor lifts

• Shortest distance of rolling run-out compensation in the industry, no need to wait during rolling

• Dual display screens

• Fully Automatic. Super easy to operate

• Leverless Center Post. Rim size up to 30"

• Equipped with Wheel lift cart and a 12" display screen that shows the underside of the wheel when changing the tire

29 www.ModernTireDealer.com

2302MTD_AstonTechnologies.indd 1 1/13/23 3:29 PM

“As we’ve penetrated the light truck tire market, we’ve run into instances of synergies between that market and other markets.”

Michael Mathis, president, Atturo Tire Corp.

Hank’s Tire

$10 million out of one store

HOW HANK’S TIRE GENERATES BIG NUMBERS

By

Madison Gehring

Steve Goldberg, owner of Hank’s Tire, a single-location dealership in Woodland Hills, Calif., says it’s not unusual for up to 10 cars to line up at his store — before it even opens.

e dealership, which was founded 70 years ago by Steve’s father, Hank Goldberg, is busier — and more successful — than ever, turning $10 million in sales last year alone, despite facing some tough competition.

Steve says the majority of independent tire dealerships around his store have been bought out by big chains, making Hank’s Tire one of the last truly independents in the Woodland Hills area.

“I want to stay independent,” he says. “I don’t want to sell out — not only for my dad, but I’m (also) proud of what we do and who our customers are.”

HUMBLE START

Hank’s Tire was started in 1953. Hank Goldberg had returned home from the Marine Corps and was looking for work. His brother-in-law worked in the tire industry and brought him into it.

“My dad just had a little shack he rented and he was open seven days a week,” says Steve.

“He only had one employee and they only did tires. He had his jack and his tire machine and back then, they did all these things by hand.”

Steve says he remembers his father telling him he ran deals selling four tires for $100.

A er two years at his original location, Hank moved to a bigger location in Tarzana, Calif.

He hired a second employee and started doing more mechanical work, like brakes, plus more tire-related services.

“I graduated high school in 1974,” says Steve. “We moved to our current location in Woodland Hills in 1973.”

e store is on the corner of a busy boulevard. ( e facility was a gas station before Hank bought it.)

He remodeled the store and then a couple years later, built a building in the back to accommodate more auto service work.

“We are split, (with) our tire department in the front and our service department in the back,” says Goldberg.

Hank’s Tire has nine bays and is so busy that the company’s biggest problem is nding parking for all its customers, according to Steve.

He adds that Hank’s Tire tries to o er as much as it can.

“We are an AAA-approved repair shop, so we do all mechanical work.

“We do inspections, oil changes, brakes and air conditioning.

“We try to keep it simple and moving because it does get hectic and in the past couple of years, people have gotten more impatient.”

A POSITIVE ENVIRONMENT

Steve says he and his employees try to create a happy shop environment because they want to give people another reason to come — and return to — Hank’s Tire.

“ ey can go anywhere to buy tires or have their vehicles worked on.

“Why should they come here? Because we make them feel comfortable, they can feel the positive atmosphere and everybody

is wearing a smile. It really is the little things that make a di erence.”

Steve says that he compares nding a good tire dealer to nding an electrician or plumber.

“If you have somebody you can trust and comes to your house and just does the job — it makes it so much easier.” at’s the level of trust Steve has achieved with his customers. He says a lot of them don’t ask about price.

“ ey’ve been coming here for years, so they just trust us and that’s a really good feeling.”

Steve says his positive attitude starts at home.

His wife, Cheryl, puts a sign next to his car keys that says, “Choose Happy.”

She does that to remind Steve of his “options,” he says.

“She says, ‘You can go into work grouchy and be like everyone else or you can go in there with a good attitude and make everyone’s day better.’

“She’s right. I’m blessed, I’m healthy, my kids are healthy, the business is doing good and that’s really what we try to pass on to our customers.

MTD June 2023 30

Hank’s Tire, a single-location dealership, achieved $10 million in sales last year — all while competing against bigger operations, says Steve Goldberg, its owner.

Photo: Hank’s Tire

“When a customer comes in all upset over a at tire, I tell them it’s a repairable item and not the end of the world. We can x it!”

Hank’s Tire employs three full-time service writers, nine technicians, six tire salesmen and seven tire installers.

In the early days of the business, Hank’s Tire made the majority of its revenue through tire sales. Steve says it’s now a 50/50 split between tire sales and service.

“We are very proud and I know my dad would be proud, too,” he says.

CHANGING TRENDS

Steve says that his business is the busiest it’s ever been. He credits that, in part, to the fact people aren’t buying new cars as much as they used to and are opting to have them repaired.

Steve says he has been approached by buyers, but doesn’t want to sell because he sees how some other independent tire dealerships that have been bought have lost their personalized service.

“My family probably wouldn’t let me sell it anyways. If I stay home with my wife all day, we might kill each other!”

wears out faster on electric cars — especially the tires because of the weight of the battery. Plus, there is no spare tire in these cars, which a lot of people forget. So when they have a at tire, they must be towed, which just makes it harder.”

e price of tires also has “skyrocketed” in recent years.

Goldberg says he sold his most

Hank’s Tire

expensive set of tires a few months ago for a Lamborghini. e price tag totaled $5,000.

“I learned a long time ago, you make money when you buy and we inventory close to 4,000 tires and sell 80 to 100 a day,” he explains.

“When there’s a deal on tires, we buy them and stock up on them.” ■

“When our sales rep, Kevin, assured us of the FAM211’s uniformity, we were initially skeptical. Wide base steer tires are śşƳƽƉƬşıĔŷŷǤɻķşȁıǃŷƽɻƽƉɻİĔŷĔſıľ ɻ©ƉɻıƉſȃƬžɻĔııǃƬĔıǤʁɻǞľɻƽľƳƽľķɻ ƽśľɻȏȍȐʎȑȐ ȍȍ ȐɻǞşƽśɻĔɻıƉſƳƽƬǃıƽşƉſ œƉıǃƳľķɻıƉžžľƬışĔŷɻȄľľƽɻ ıǃƳƽƉžľƬ ɻ©śľşƬɻİĔŷĔſıľƬɻıƉſȃƬžľķɻşƽƳɻƩƬľışƳşƉſɻşſƳƽĔſƽŷǤ ɻÊľɻ quickly integrated the FAM211 into their program without any issues.

The FAM211’s performance is excellent, and it has an attractive appearance. Working with Fortune’s team has been positive, with top-notch follow-up. We look forward to growing our commercial business with Fortune Tires.”

- Curt Stinnett, VP of Sales – Valley Tire Co

- Curt Stinnett, VP of Sales – Valley Tire Co

FAM211

MIXED SERVICE TIRE

• Special chip/cut compound for longer tire life and resistance to scrape,chips, and cuts

• Unique crown grooving for better heat dissipation

Steve also says it is nice having customers come in and ask about his family. He services second- and third-generation customers.

Like many dealerships, COVID-19 was the biggest challenge Hank’s Tire ever faced. Steve kept everyone employed through the pandemic, but had to make scheduling adjustments, like having employees come in every other week.

“You just have to roll with the punches,” he says.

Technology has become a bigger challenge at Hank’s Tire in recent years.

“I’m in California, so it seems like everyone has a Tesla or some type of electric car,” he explains. “Everything

• Optimized casing for enhanced performance and retreadability

• Five (5) year / two (2) retread warranty

Browse our full TBR line at fortunetireusa.com

Are you ready to DRIVE FORWARD with Fortune?

Prinx Chengshan Tire North America, Inc. info@prinx.us.com

31 www.ModernTireDealer.com

TIRE SPONSOR OF USA PICKLEBALL

OFFICIAL

2306MTD_PrinxChengshanTire.indd 1 5/31/23 8:08 AM

“I learned a long time ago, you make money when you buy and we inventory close to 4,000 tires and sell 80 to 100 a day.”

Steve Goldberg, owner, Hank’s Tire

Coolant system best practices

WHEN IT COMES TO ANTIFREEZE, DEALER SAYS ONE TYPE DOESN’T FIT ALL

By

Madison Gehring

To keep up with ever-changing vehicles, tire dealers may notice they are stocking up on more types and brands of antifreeze than ever before.

Mark Cammy, founder and owner of Camco Tire & Auto LLC, which is headquartered in Milton, Del., is one of those dealers. He says stocking many di erent types of antifreeze is better than using a universal antifreeze.

“Di erent manufacturers use di erent components in their antifreeze, so they are pretty much all speci c,” says Cammy.

He says as an example, General Motors uses what it calls a DEX-cool product, which is an orange antifreeze. Ford uses its own gold and orange color. BMW uses its green color antifreeze.

Camco Tire & Auto keeps around eight di erent brands of antifreeze in stock at all times and carries manufacturerspeci c antifreeze.

“It’s a better service when you use the manufacturer-speci c antifreeze,” he says. “We like to put in the vehicles what came out of them.”

RIGHT RECOMMENDATIONS

Camco Tire & Auto has been doing business at its current location in Delaware for seven years.

Before that, Cammy had two Camco Tire & Auto locations in New Jersey. Having added a third service bay to his store, Cammy says his dealership derives 20% of its revenue from tire sales and 80% from automotive service.

Cammy, who has been in the tire industry for 40 years, sees a di erence in today’s coolant system products.

“Nowadays, manufacturers say it’s a long-life antifreeze,” explains Cammy.

“So you can basically go 100,000 miles based on some manufacturers’ recommendations. Personally, that’s a little too long for me.”

Cammy instead advises his three full-time employees and one-part time employee to service coolant systems whenever they work on a customer’s thermostat, water pump or radiator. “Antifreeze is much better than it used

to be and it’s more speci c to aluminum engines,” he says.

EDUCATING CUSTOMERS

Educating customers about the bene ts of cooling system service is important, according to Cammy. He says customers should know that these services help ensure “optimal health” for their vehicles’ engines.

“It allows for optimal cooling, optimal heating and less damage to the engine due to the wrong antifreeze,” he says.

Sometimes, he adds, customers take a “do-it-yourself” approach when it comes to coolant system service.

Cammy calls them “YouTube-certied” or “Google-certi ed” customers who think they can learn how to perform coolant services from an article or video.

When these customers bring their vehicles back to Camco Tire & Auto, he educates them on the necessity of professional service.

“Everybody is trying to save money these days, which I can appreciate, but I always say, ‘Cheap work is not good work and good work is not cheap.’

“A lot of these guys say, ‘I watched a three-minute video on how to do this,’” laughs Cammy. “And I have to tell them that they watched a condensed video of an hour-long service.”

READY FOR SUMMER

Coolant system service begins to ramp up for Camco Tire & Auto in the summer months. Cammy credits this to warm weather and more customer travel.