ULTRA HIGH PERFORMANCE FOR

SUV, CUV & EV SIZES AVAILABLE

ALL-NEW

FALKEN’S

falkentire.com

EVERY SEASON

SCAN THE QR CODE TO LEARN MORE ADVERTISEMENT

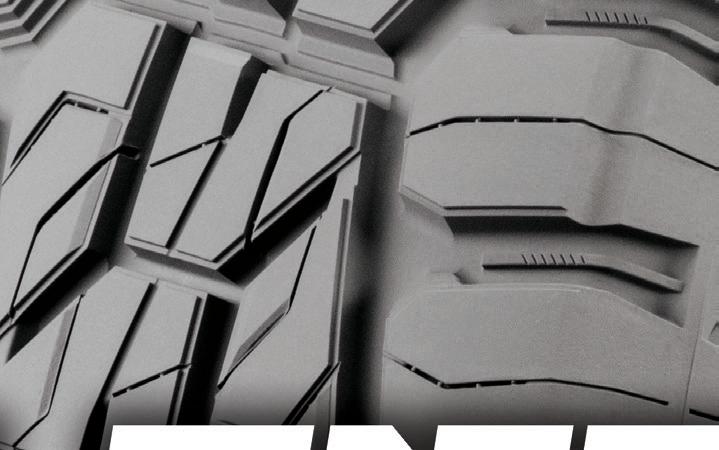

The AZENIS FK460 A/S delivers exceptional year-round handling to modern high-performance vehicles, from sports cars and premium crossovers to performance EVs.

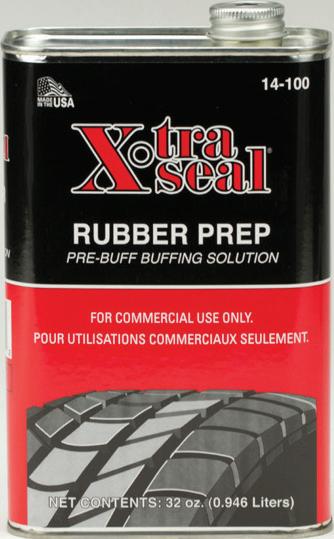

†FREE replacement for up to two years or for the first 3/32nds of tread life. Restrictions apply. Tire will be replaced free of charge. Mounting and balancing not included and you may be charged applicable taxes, the cost of valve stems, and disposal fees. Available in US and Canada only. falkentire.com | 800.723.2553 ULTRA HIGH PERFORMANCE FOR EVERY SEASON FALKEN’S ALL-NEW The AZENIS FK460 A/S, Falken’s all-new Ultra High Performance All-Season tire, blends the versatility you demand of an all-season tire with the excitement you expect from an Azenis. Thanks to award-winning Advanced 4D Nano Technology, Falken developed a rubber compound that achieves the complex balance of high-performance capability, year-round traction, and long tread life. TIRE HIGHLIGHTS • 50K LIMITED TREAD LIFE WARRANTY ON ALL SIZES • HIGH PERFORMANCE DRY HANDLING • CONFIDENCE IN LIGHT SNOW ROAD HAZARD WARRANTY includes FREE replacement for the first 3/32nds of tread life.† POPULAR FITMENTS BMW M4 CHEVROLET CAMARO SS DODGE CHALLENGER SRT HELLCAT FORD MUSTANG GT JEEP GRAND CHEROKEE SRT MERCEDES BENZ AMG GLC63 PORSCHE MACAN GTS SUBARU BRZ TESLA MODEL 3 TESLA MODEL Y 82 FT 78 FT PIRELLI PZERO NERO AS The AZENIS FK460 A/S outperformed leading competitors in 24-12mph snow braking comparision testing. Interlocking traction while maintaining tire rigidity to deliver both dry and wet performance. 113 CONTINENTAL AZENIS FK460 A/S EXTCONTACT DWS06+ GOODYEAR EAGLE EXHILARATE PIRELLI PZERO NERO AS DRY BRAKING STOPPING DISTANCE† The AZENIS FK460 A/S surpassed several leading competitors in dry braking from 60-0mph. High grip chamfer handling capability. UNCOMPROMISING TRACTION IN ANY WEATHER ENGINEERED FOR PERFORMANCE VEHICLES, CUVs AND EVs THANKS TO FALKEN’S AWARD-WINNING ADVANCED 4D NANO TECHNOLOGY, THE AZENIS FK460 A/S OUTPERFORMED LEADING COMPETITORS IN RECENT DRY, WET AND SNOW BRAKING COMPARISON TESTS.* Performance results are based on SRUSA standard testing procedures conducted Q2 2022. Individual results may vary depending on vehicle type, tire maintenance, driving style and road conditions. Test size 275/40R20 on a Dodge Challenger Hellcat. To request complete test results, please write to Falken Tires Attn: Tire Test Results, 8656 Haven Ave., Rancho Cucamonga, CA 91730. Falken is a registered trademark of Sumitomo Rubber Industries, Ltd. All other product names, trademarks and registered trademarks are property of their respective owners. 113 FT 137 FT AZENIS FK460 A/S 115 FT 140 FT EXTREMECONTACT DWS06+ CONTINENTAL 119 FT 136 FT EAGLE EXHILARATE GOODYEAR WET BRAKING FROM 60-0 MPH DRY BRAKING FROM 60-0 MPH 52 FT AZENIS FK460 A/S 62 FT EXTREMECONTACT DWS06+ CONTINENTAL 82 FT EAGLE EXHILARATE GOODYEAR 120 FT 149 FT PZERO NERO AS PIRELLI 78 FT PZERO NERO AS PIRELLI *For illustrative purpose only. Not to scale. UNCOMPROMISING TRACTION IN ANY WEATHER * 113 FT 137 FT AZENIS FK460 A/S 115 FT 140 FT EXTREMECONTACT DWS06+ CONTINENTAL 119 FT 136 FT EAGLE EXHILARATE GOODYEAR WET BRAKING FROM 60-0 MPH DRY BRAKING FROM 60-0 MPH 120 FT 149 FT PZERO NERO AS PIRELLI *For illustrative purpose only. Not to scale. 3 37 DRY BRAKING + WET BRAKING FROM 60-0 MPH SNOW BRAKING FROM 24-12 MPH *Performance results are based on SRUSA standard testing procedures conducted Q2 2022. Individual results may vary depending on vehicle type, tire maintenance, driving style and road conditions. Test size 275/40R20 on a Dodge Challenger Hellcat. To request complete test results, please write to Falken Tires, Attn: Tire Test Results, 8656 Haven Ave., Rancho Cucamonga, CA 91730. Falken is a registered trademark of Sumitomo Rubber Industries, Ltd. All other product names, trademarks and registered trademarks are property of their respective owners.

January 2023 | Vol. 104, No. 1 | $30 | www.moderntiredealer.com U.S. TIRE MARKET IS ‘RIGHT-SIZING’ — BUT CHALLENGES REMAIN Market hangover Factors that will continue to impact your business Are your bonus programs ineffective? New service tools take the spotlight BACK TO NORMAL? MTD’s Facts Issue brings you the numbers behind the story

3 www.ModernTireDealer.com The Industry’s Leading Publication January 2023, Volume 104, Number 1 Modern Tire Dealer is a proud member of: 22 Market hangover Analyst John Healy breaks down factors that will continue to impact your business in 2023 60 New service tools take the spotlight More products from the 2022 SEMA Show/AAPEX MTD’s 57th Facts Issue 30 World sales leaders, sales margins and domestic tire shipments 32 Imports 34 Channel market share 36 Replacement tire market share 38 OE tire market share 40 Where dealerships are located 42 Top tire brands 44 Tire sizes 46 Tire pricing 48 Commercial tire market 50 North American tire plant capacities 52 Automotive service 54 Mergers and acquisitions 4 Editorial Numbers game A look at some key stats reveals major changes in the U.S. tire industry 6 moderntiredealer.com News and navigation tools for MTD’s website 8 Industry News Giti doubles down on commitment to U.S. market ‘Our presence has been rede ned,’ says CEO Phang 18 Numbers That Count Relevant statistics from an industry in constant motion 20 Your Marketplace Positive sellout streak continues Improvement comes even as miles driven lags 64 Business Insight Are your bonus programs ineffective? It may be time for a fresh look — and a fresh start 66 Mergers and Acquisitions How sharing the wealth creates wealth Founders of GCR hit on a winning formula that still works 72 Dealer Development Stop, look and listen Are old habits holding your business back? 74 EV Intelligence Tires are key to optimizing EV performance The wrong tire can reduce a vehicle’s range 76 Focus on Dealers Sullivan Tire eyes more growth in 2023 ‘We have a lot that we’re looking at right now’ 77 Focus on Industry New Continental UHP summer tire targets enthusiasts ‘Trackable street tire’ will be available in nearly 80 sizes 78 Products 79 TPMS Acura MDX – 2023 82 Ad index FEATURES DEPARTMENTS 74 Find out why tires are key to optimizing electric vehicle performance on page 74.

Ford Motor

Photo:

Co.

Mike Manges By

“C

Numbers game

A LOOK AT SOME KEY STATS REVEALS MAJOR CHANGES IN THE U.S. TIRE INDUSTRY

hange is the law of life.” President John F. Kennedy spoke these words nearly 60 years ago, while delivering a speech in Germany. You could argue that change also is the law of the tire industry.

At the moment, you are holding MTD’s 2023 Facts Issue, our comprehensive look at the domestic tire industry — from shipments, imports, margins, manufacturing and pricing to market share, sales, distribution and more.

In light of that, I thought it would be interesting to look at some industry facts and figures that have changed over the last 20 years, using the 2023 MTD Facts Issue and the 2003 MTD Facts Issue as reference guides.

Tire sizing. In 2002, 14- and 15-inch passenger tires dominated, with the number-one size in the U.S. replacement channel, 235/75R15, accounting for nearly 7% of the overall replacement passenger tire market, which totaled 190.5 million units. In 2022, only one 15-inch tire made the top 10 — which also includes one 20-inch size, an 18-inch size, five 17-inch sizes and two 16-inch sizes — with 225/65R17 being the most prevalent replacement passenger tire size. (Slightly more than 216 million replacement passenger tire units shipped in 2022, according to MTD estimates. That’s a 12.5% increase from 2002 totals.) Don’t expect to see a reversal in current tire sizing trends. It’s true that as long as there are 20-year-old Honda Civics on the road, there will be a need for 15- and 16-inch inch tires. But it’s onward and upward from here.

Pricing. Tire diameters aren’t the only things that have gone up. Look at retail tire pricing. In 2002, the average retail price for a major brand 195/75R14 passenger tire was $62.72. Not exactly apples to apples, but in 2022, the average retail price for a major brand 195/65R15 tire was $129.76. Twenty years ago, the average price of a major brand LT235/85R16 tire — the most popular replacement light truck tire size in the U.S. at the time — was $101.08. Last year’s

most popular light truck tire size was LT265/70R17. A major brand light truck tire in that dimension, on average, sold for $269.46.

World leaders in new tire sales. Another intriguing thing I discovered during my research is that the top five world leaders in tire sales, in descending order — Michelin Group, Bridgestone Corp., Goodyear Tire & Rubber Co., Continental AG and Sumitomo Rubber Industries Ltd. — have maintained their relative positions, 2002 through 2022, although, of course, their respective sales have multiplied since. (For example, we estimate that Michelin’s sales will total $27.7 billion in 2022 versus $14 billion some two decades ago. Bridgestone’s sales jumped from $13.9 billion in 2002 to $22.8 billion in 2022.) However, there have been significant changes in this area. The eighth largest tire manufacturer in 2002 — Cooper Tire & Rubber Co. — was delisted from the stock exchange when it was acquired by Goodyear. And three companies that were not on the list in 2002 — Zhongce Rubber Group Co. Ltd., Cheng Shin Rubber Ind. Co. Ltd. and Giti Tire Pte Ltd. — now appear.

Market share and brands. Each year as part of the Facts Issue, MTD examines market share by brand in three key product segments — replacement passenger, replacement light truck and replacement medium truck. Several brands that populated our replacement passenger tire market share rankings two decades ago — Cordovan, Cornell, Delta, Laramie, National and Sears and Sigma — no longer show up on the list. (Sears for good reason as Sears Auto Centers shuttered its doors last year after a long, slow decline. In 2002, however, the Sears brand had 4% passenger tire market share.) How many of today’s market share leaders will be around 20 years from now? Check back in 2043!

Retreading. The number of active retread plants in the U.S. has been shrinking for a long time. In 1982, there were around 3,350 domestic medium truck tire retread plants, according to MTD estimates. By 2002, that number had fallen to 1,065 plants. It’s now believed there are around 640 active truck tire retread shops throughout the country. What hasn’t declined is the efficiency of retreaders. An estimated 15.6 million medium truck tire retreads were produced in 2002 — roughly equal to the same number of truck tire retreads that were manufactured in the U.S. last year. Take a bow, retreaders! All told, you’re achieving the same aggregate output while operating out of 425 fewer plants. (And I’m sure better machinery, tread rubber stock, processes and casings have helped.)

I strongly encourage you to spend some time with MTD’s hotoff-the-press Facts Issue. Our hope is that this will be your reference guide and that you will turn to it throughout the year. Meanwhile, we’ll continue to track those numbers that matter — as well as future changes that will impact your business. ■

If you have any questions or comments, please email me at mmanges@endeavorb2b.com.

MTD January 2023 4

Editorial

MTD’s Facts Issue brings you the numbers that matter.

Photo: Pexels

THE BEST SELLING AFTERMARKET SENSOR IN NORTH AMERICA 1 SKU SENSOR INVENTORY : 314.9MHZ, 315MHZ & 433MHZ ALUMINUM RUBBER > ORIGINAL EQUIPMENT FIT FORM & FUNCTION PROGRAMMABLE UNIVERSAL TPMS MAX SIGNAL STRENGTH 99 % VEHICLE COVERAGE FAST INSTALLATION PRESS RELEASE INTERCHANGEABLE VALVE STEMS TPMS SERVICE TOOL • Perform OBDII Relearns • Four 1-Sensor Programming Methods • FREE Updates for the Life of the Tool TS508WF TPMS DIAGNOSTICS & SERVICE • Print/Email/Text TPMS Health Report • OLS, BMS, SAS, EPB Service Resets • FREE TPMS Updates for the Life of the Tool ITS600 ® WEB: AUTEL.COM | SUPPORT: 1.855.288.3587 EMAIL: USSUPPORT@AUTEL.COM FOLLOW US @AUTELTOOLS UPDATE VIA WI-FI NO PC NEEDED COMPLETE SOLUTION OE QUALITY SENSORS POWERFUL SCAN TOOLS

ModernTireDealer.com

DIGITAL RESOURCES FOR THE INDEPENDENT TIRE DEALER

Stay tuned to MTD’s podcast!

The Modern Tire Dealer Show is available on Stitcher, Spotify, Apple Podcasts, Google Podcasts, iHeart Radio, Amazon Music, Audible and MTD’s website. Download it today!

MTD digital edition

eNewsletters

Sign up now for Modern Tire Dealer’s e-Newsletters. We’ll send you the latest tire news and our most popular articles. Go to www.moderntiredealer. com and scroll down to The Modern Tire Dealer Newsletter is the Definitive Source for Tire Dealer Success.

Check out MTD’s digital edition at the top of our website’s homepage.

Like MTD on Facebook: www.facebook.com/ModernTireDealer

Follow MTD on Twitter: www.twitter.com/MTDMagazine @MTDMagazine

HOME OFFICE

3515 Massillon Rd., Suite 200

Uniontown, OH 44685 (330) 899-2200, fax (330) 899-2209

Website: www.moderntiredealer.com

PUBLISHER

Greg Smith

gsmith@endeavorb2b.com (330) 899-2200, Ext. 2212

EDITORIAL

Editor: Mike Manges, ext. 2213 mmanges@endeavorb2b.com

Managing Editor: Joy Kopcha, ext. 2215 jkopcha@endeavorb2b.com

Associate Editor: Madison Gehring, ext. 2216 mgehring@endeavorb2b.com

PRODUCTION

Creative Services Director: Zach Pate

Art Director: Jonathan Ricketts

Graphic Designer: Audrey Mundstock

Production Manager: Karen Runion, ext. 2210 krunion@endeavorb2b.com

MARKETING STRATEGISTS

Bob Marinez rmarinez@endeavorb2b.com (330) 899-2200, ext. 2217

Marianne Dyal mdyal@endeavorb2b.com (706) 344-1388

Dan Thornton dthornton@endeavorb2b.com (734) 676-9135

As tire dealers continue to monitor their supply, 2023 is starting off with a new wave of tire price increases.

Photo: MTD

Tiremakers’ pricing, strategy moves matter

If you thought 2023 would come without a new wave of tire price increases, the flip of the calendar might have left you slightly disappointed. But the good news is that MTD has plenty of insights into what tire manufacturers are thinking and planning for the year ahead — and readers are noticing. Three of last month’s top stories are exclusive interviews with leaders from various tire manufacturers. And don’t worry, we have more of those exclusive interviews up our sleeve in 2023. 1. Michelin to enact up to a 9% price increase

Sullivan Tire eyes more growth in 2023

Giti doubles down on commitment to U.S. market

Hankook’s Williams discusses company’s growth strategy

SRNA’s Darren Thomas weighs outside forces versus strategy

Why commercial tire dealerships are installing dash cams

Bridgestone plans PLT price increase

USTMA predicts 400,000 fewer tires shipped in 2022

Focus on car count, sales agility in 2023

How Westside Tire & Service thrives during tough times

Sean Thornton sthornton@endeavorb2b.com (269) 499-0257

Kyle Shaw kshaw@endeavorb2b.com (651) 846-9490

Martha Severson mseverson@endeavorb2b.com (651) 846-9452

Chad Hjellming chjellming@endeavorb2b.com (651) 846-9463

MTD READER ADVISORY BOARD

Rick Benton, Black’s Tire Service Inc.

Jessica Palanjian Rankin, Grand Prix Performance John McCarthy Jr., McCarthy Tire Service Co. Inc. Jamie Ward, Tire Discounters Inc.

CUSTOMER/SUBSCRIPTION SERVICE

(800) 260-0562

subscriptions@moderntiredealer.com

EXECUTIVE OFFICE

571 Snelling Ave. N. St. Paul, MN 55104 (651) 224-6207

CORPORATE OFFICER

Vice President: Chris Messer

Modern Tire Dealer (ISSN: 0026-8496) is published monthly by 10 Missions Media, LLC, 571 Snelling Ave N, St. Paul, MN 55104-1804. Copyright © 2023 by 10 Missions Media, LLC. All rights reserved. Modern Tire Dealer content may not be photocopied, reproduced, or redistributed without the consent of the publisher. Periodicals postage paid at St Paul, MN and additional mailing offices. POSTMASTERS Send address changes to: Modern Tire Dealer, 571 Snelling Ave N, St. Paul, MN 55104.

MTD January 2023 6

3.

4.

5.

6.

7.

8.

2.

9.

10.

Giti doubles down on commitment to U.S. market

‘OUR PRESENCE HAS BEEN REDEFINED,’ SAYS CEO PHANG

Giti Tire (USA) Ltd. is doubling down on its commitment to the United States market. “Our presence in America over the last decade has been redefined,” says Wai Yeen-Phang, the company’s CEO.

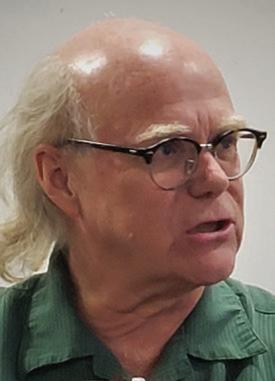

Phang — along with David Poling, Giti Tire’s director of tire development and product marketing — recently sat down with MTD in Las Vegas, Nev., to discuss the company’s performance, production, new product plans, dealer strategy and more.

MTD: Describe Giti Tire’s performance in the U.S. this past year.

Phang: I would say that our challenges are just like anyone in this industry as we have gone through the last few years. We had the pandemic. Then we had global supply chain disruptions. Our challenges were the same as everyone’s challenges. But most importantly for us, we kept focus on our objective.

If you look back, we have been in the market for more than 25 years. At this stage in the lifecycle of our organization, we made the decision to reinvent our global manufacturing footprint. This led to repositioning and realignment and the coming onstream of our plant in Chester County, S.C.

We have built a very substantial (business) in the U.S. and it’s obvious you need to have a manufacturing base where the market is. Over time, this will help alleviate the supply situation. We have stayed focused on this direction and that is the core substance of our business.

MTD: What role has the South Carolina plant played in Giti’s growth?

Phang: The factory came to life in October 2017. Since then, the first phase of

development of manufacturing has been ongoing. To set up a tire factory and for it to reach its first stage of maturity will take about a decade and we are halfway there.

The most important thing (has been) training the first generation of the plant’s workforce and we are happy to say that in terms of the competency of the factory and the competency of our workforce, we are on target.

The (South Carolina) location is integrated from research and development all the way through manufacturing. Out of this facility, we are able to prove to the market that we can make challenging products that require manufacturing and design technology.

MTD: Are most of your tires sold in the U.S. made at that plant?

Phang: Not at this moment. Even 10 years from now, it will still be a combination of imports and (tires) from South Carolina.

MTD: Tire dealers are telling us that domestic and import supply is less of a problem than it was 12 months ago. Many dealers are sitting on a glut of tires. Has this forced you to change production or the number of units you’re bringing in from outside the U.S.?

Phang: All of us know that the American market goes by selling cycles and selling seasons. This year, unfortunately, the selling season has been impacted by inflationary forces. And like anyone else, in the early part of the year, supply disruptions (created) a big backlog. We were not spared from this impact. So right at this moment, everybody is rebalancing supply and demand. We will just have to react accordingly.

MTD: Despite market disruptions,

Giti has maintained a steady cadence of new product introductions. Why is this important?

Poling: It’s important that we continue to refresh our product lines. Even during (the pandemic) when we faced challenges, since we have a R&D facility located at our plant, we were able to keep our development ongoing. We have a full pipeline of products that are available and ready to go.

And it’s important we continue to show our high level of technical expertise in rolling out these products. Dealers are always looking for that next new product that meets market trends.

MTD: Giti introduced two commercial truck tire lines under the GT Radial brand in 2021. How were they received by the marketplace?

Phang: When we designed these tires, we did a lot of field surveys to understand

MTD January 2023 8

Industry News

“We have reinvented ourselves,” says Wai Yeen-Phang, CEO of Giti Tire (USA) Ltd.

Photo: MTD

Charge less and go fur ther.

®

the needs of our customers. We balanced the applications and balanced the performance between running line-haul routes and regional routes. We did a lot of work to define what we put into the design of the tires and we hope to carry on in that direction by adding more size extensions.

MTD: The emergence of electric vehicles (EVs) presents new opportunities for tire manufacturers. Does your company see opportunity in providing tires for EVs?

Phang: On a global basis, this is something we have been (working on) for more than a decade. In the Asian market, we have launched a lot of EV products. We have done some development in Europe. In the U.S., it will come. It’s just a matter of time. We have already started this journey. It’s a necessity for all tire manufacturers as the market changes.

MTD: Can you see bringing a tire that has been specifically designed for EVs to the U.S. market?

Poling: We’re certainly looking at that. We have a global plan for EV tires. We’re working with OEMs on some of their EVs. So we certainly see what’s required and how we can take advantage of that with lines that are similar to our current products, but are specific to the high-load, hightorque requirements of those vehicles. We need to address the needs of those cars and how (their owners) drive and see if we can create a better solution than the OE tire — just like we do today with normal vehicles.

MTD: You mentioned seeking OE fitments on EVs. Can you discuss your general OE strategy in North America ?

Poling: Our OE strategy is to focus on a few key partners and develop lines for them and their premium fitments — being

selective with the GT Radial brand. I think this is going to be very key for us in making our brand stand out.

MTD: Are you satisfied with the coverage you have achieved in the U.S. dealer channel?

Phang: If you look at the channel, the American tire market is already very mature, very saturated and highly fragmented. We are reaching a stage where there are very massive changes in the structure of (tire dealer) ownership. There are very few first generation dealers left. That’s why there’s so much M&A. It’s like musical chairs. I would say that we are watching.

Developing our sales channel is a neverending journey. There will never be enough. We have to look at where we are, our availability of products and what we can provide to the North American market.

MTD: What are some of Giti’s biggest opportunities at the moment?

Phang: I would say participating in emerging markets. There are a lot of emerging segments. All-weather is a growing segment... (and) the growth of the R/T light truck tire segment.

We are committed to the U.S. market. The building of our manufacturing facility in the U.S. is a statement of our commitment to the American market. The factory will not be able to provide substantial volume yet, but it will surely grow.

You can rest assured that the products that are going to come out of the factory will be very relevant to the American market.

This is an integrated facility with a research center inside the factory, where every day, David and his team are listening and reacting to (customers’) needs to make sure our products in America will continue to be relevant to this market.

MTD: Is Giti’s business in the U.S. where you anticipated it would be?

Phang: I would say that we are where we want to be. We have reinvented ourselves. Our presence in America over the last decade has been redefined. We have manufacturing. We have R&D. We are very happy to have laid the foundation. And this will enable us to service our U.S. customers and the North American market.

Poling: We are uniquely positioned to (serve) the North American market. Having been in the industry for 35 years, I can tell you we are very unique. We design everything internally. We do our own tread patterns and our own sidewall designs. And everything we design for this market is designed for manufacturing. It’s seamless and makes us more responsive to market forces, so we can deliver products that meet (the market’s) expectations.

MTD January 2023 10

Industry News

“It’s important that we continue to refresh our product lines,” says David Poling, Giti Tire’s director of tire development and product marketing.

Photo: MTD

A LONG WAY TOGETHER

WHEREVER YOU ARE, BKT IS WITH YOU

No matter how challenging your needs, BKT is with you offering a wide range of OTR tires specifically designed for the toughest operating conditions: from mining to construction sites.

Sturdy and resistant, reliable and safe, able to combine comfort and high performance. BKT is with you, even when work gets tough.

BKT USA Inc.

202 Montrose West Ave. Suite 240 Copley, Ohio 44321 Toll free: (+1) 888-660-0662 - Office: (+1) 330-836-1090 Fax: (+1) 330-836-1091

Bites 2023 opens with price hikes

The next wave of tire price increases has begun, as tiremakers announced new hikes for the start of 2023.

Toyo plant opens

Toyo Tire Corp.’s consumer tire plant in Serbia has opened. The factory will provide tires to the U.S. market, as well as Europe. Announced in 2019, the 150-acre facility is expected to reach its full capacity of five million tires per year during the second half of 2023, according to Toyo officials.

TireHub adds locations

TireHub LLC opened a number of new distribution centers, all in new markets, during the fourth quarter of 2022. The new centers are located in Shreveport, La.; Beltsville, Md.; Greenville, S.C.; Tulsa, Okla., Grand Rapids, Mich. and Spokane, Wash.

VIP Tires grows in Vermont

A fifth VIP Tires & Service store has opened in Vermont. The company renovated a former car dealership in Bennington, Vt., and added four new bay doors, plus a new shop floor, roof, parking lot, restrooms and landscaping. VIP now has 67 locations throughout the Northeast.

Bridgestone promotes Hoeft

Bridgestone Americas Inc. has named Steve Hoeft president of its commercial truck group. He replaces Chris Ripani, who had led the company’s commercial business since 2020. A five-year Bridgestone veteran, Hoeft most recently served as chief operations officer for the firm’s commercial truck group.

Sentury hires Klekamp

Sentury Tire USA has named David Klekamp its technical tire director. A 36year tire industry veteran, Klekamp will be involved in developing Sentury’s product strategy in the United States, among other functions. He’s held senior positions with several tire manufacturers over the years.

Sheehey joins Ralson

Commercial truck tire market veteran Brian Sheehey is the new senior vice president of Ralson Tires North America. He most recently served as vice president of marketing, North America, for Yokohama Off-Highway Tires America Inc. Ralson Tires recently made its North American debut.

Michelin North America Inc. increased prices by as much as 9% on Jan. 1 across its brands on select passenger and light truck tires, plus commercial on-road and mining tires and service offerings. The increase applied to orders in the U.S. and Canada.

Bridgestone Americas Inc. didn’t specify the amount of its latest price increase, which applied to passenger and light truck tires sold in the U.S. and Canada. The increase, effective Jan. 1, applied to Bridgestone, Firestone and Fuzion brand products.

Pirelli Tire North America Inc.’s next price increase goes into effect on Jan. 15. Prices will go up by as much as 10% on passenger and light truck tires and the exact amount will depend on tire line and size. Pirelli officials attributed the increase to “changing market conditions.”

Industry needs more than 600,000 techs

Fewer students completed automotive post-secondary education programs in 2021, thus widening the gap of technicians needed to work in tire dealerships and automotive service businesses across the U.S.

With 11.8% fewer automotive program graduates in 2021 — along with smaller drops of graduates in diesel and collision repair programs- by 2026 the disparity will total nearly 1 million qualified workers, according to The TechForce Foundation.

The numbers come from the foundation’s 2022 Transportation Technician Supply & Demand Report.

The worsening technician supply picture — with combined completions dropping from 48,208 in 2020 to 44,052 in 2021 — overshadows a strong year-over-year rebound in technician employment in the automotive (+4.2%) and diesel (+6.5%) repair segments.

TechForce estimates that demand for new entrant automotive/diesel/collision repair technicians – for new positions, replacements for occupational separations and unfilled positions from prior years — will reach 232,000 in 2022 and total more than 900,000 through 2026.

“This year’s report underscores not only the challenges we face in attracting, training and retaining technicians but also the boundless opportunities for talented young people to build successful, rewarding careers in one of the world’s most dynamic and technology-intensive industries,” said TechForce Foundation CEO Jennifer Maher. “The solution to this crisis lies in industry, non-profit, education and government partners working together to build awareness, curiosity and interest in these careers among our youth.”

MTD January 2023 12

Industry News

Combined with a need for more than 600,000 automotive technicians by 2026, the diesel and collision repair industries are in need of help, too. Combined, the three categories will be short by more than 900,000 technicians by 2026, the TechForce Foundation says.

Photo: TechForce Foundation

When Confidence in the Rain Matters.

A little rain won’t delay your customers’ arrival when they switch to Bridgestone WeatherPeak tires. Help them stay in control with enhanced wet performance for better acceleration and grip on the road. A dependable tire matters. Your customers’ confidence in every turn, every season—that’s what really matters.

© 2022 Bridgestone Americas Tire Operations, LLC

© 2022 Bridgestone Americas Tire Operations, LLC

Bites Hercules had big year in 2022

GRI names Connor director

Global Rubber Industries Pvt. Ltd. (GRI) has named Michael Connor as director of sales for its United States operations. He will oversee GRI’s sales, marketing, operations and customer service efforts in North America, covering its material handling, agriculture and construction tire portfolios.

Atturo offers racing rewards

Atturo Tire Corp. has introduced a motorsports contingency program to expand Atturo’s support to racing teams in the offroading community. The program will feature payouts of up to $2,500 for the premier off-road series such as SCORE, Best in The Desert and Ultra4.

Blackhawk sponsors MMA

The Blackhawk tire brand has been named a sponsor of Bellator MMA, a global mixed martial arts organization. Blackhawk branding will be featured on live event signage and Bellator social media posts.

American Tire Distributors Inc. (ATD) grew its Hercules dealer network by 300 customers in 2022, adding to more than 4,000 retail locations throughout the United States and Canada.

“The addition of these new dealers alone will enable us to potentially add over 100,000 units in 2023,” says Josh Simpson, Hercules’ president.

ATD also significantly expanded its product offerings during 2022. The past 12 months saw ATD’s Hercules and Ironman brands achieve double-digit unit sales gains, with Ironman experiencing “a little higher uptick in sales.”

In addition to adding 300 customers to its Hercules dealer network, American Tire Distributors Inc. rolled out a number of Hercules and Ironman brand tires during 2022. This includes the HerculesTIS TT1 light truck tire.

Photo: MTD

And ATD made several enhancements to its dealer programs during the year. “In 2022, we enhanced our Hercules University — powered by Spark — training program to offer ASE test prep and leadership training for our Diamond and Platinum dealers at no charge, in addition to offering access to ATD’s single supplier auto replenishment tool at no cost” to all Hercules Power Program members.

MTD January 2023 14

Industry News

Bites

CEAT’s production grows

CEAT Specialty Tires increased its production capacity of ag radial tires by 50% in 2022 to meet growing demand in North America and plans to increase its production capacity for radial ag tires to 160 tons per day within two years’ time.

Giti renews with Formula Drift

The GT Radial brand from Giti Tire (USA) Ltd. has renewed its partnership with Formula DRIFT for another three-year term to provide tires to teams in the Pro Championship.

Pirelli is OE at Polestar

Pirelli & Cie SpA’s P Zero has been chosen by Polestar to be the original equipment tire on the new, limited edition Polestar 2 BST 270. The vehicle will be outfitted with size 245/35R21 tires.

Lexus picks Bridgestone

Bridgestone Corp. has earned a new original equipment fitment with Lexus. In North America, the fifth-generation Lexus RX will be outfitted with the Alenza Sport A/S tire.

RNR to open in Houston

RNR Tire Express has signed a franchise agreement to bring a new location to Houston, Texas, in early-2023 that will be owned and operated by local entrepreneurs Taos Ford and Benito Olson.

MaddenCo adds partner

MaddenCo has enhanced its Tire Dealer System software with an integration of a two-way texting and digital vehicle inspection platform from autotext.me.

All Star Auto names CEO

All Star Auto Parts, a specialty distributor of alternative automotive parts that acquired Blackburn OEM Wheel Solutions in 2022, has named Andrew Sexton its CEO. He succeeds Matt Immerfall, who will join the company’s board of directors.

Vic Harisis dies

T.G. “Vic” Harisis, who founded Western Tire Equipment & Supply Co. Inc. in 1974, recently died at the age of 92. He spent his entire career in the tire equipment and supply business and led his company to become an $85 million enterprise.

Tyres International becomes Ascenso Tires North America

Tyres International, a Mahansaria Tyres Private Ltd. (MTPL) subsidiary, will now operate under the trade name Ascenso Tires North America. Since its acquisition by MTPL in 2021, Tyres International has been the exclusive importer of Ascenso brand tires to the United States and Canada.

“Moving to (the) Ascenso Tires North America trade name reflects the company’s growth in the last two years since the tie-up with Mahansaria Tyres Private Ltd. and its strategic plan and investment to become a leading tire manufacturer,” say MTPL officials.

MTPL purchased Tyres International “to efficiently bring Ascenso’s innovative and extensive product range of tires to their customers in North America,” including tires for agricultural, industrial, construction, earthmover, forestry and material handling applications.

The company has added more than 350 sizes to its product portfolio within the last year, “offering a wide range of tires across applications and customizing solutions to suit specific customer requirements.”

Monro waives battery installation fees at stores

Monro Inc. says it is making “sweeping changes” in its battery sales and service business. The company now offers free battery checks “and in a departure from the industry standard,” is waiving battery installation fees at its locations.

“Our customers’ safety is our first concern,” says Michael Broderick, Monro’s CEO.

“It’s not about just replacing the battery. It’s about offering a free, quality 32-point courtesy inspection to ensure that everything is in good working order, especially during the winter season.”

The company is making more than battery service changes. It’s also working with its primary tire supplier, American Tire Distributors Inc. (ATD), to increase in-stock levels of winter tire inventory at its stores.

“This strategic partnership has led to an expanded snow tire offering with Nexen Tires and Nokian Tyres, a more established regional inventory for entry opening price point and all-terrain tires and an upgraded inventory system to allow for daily review and replenishment,” say Monro officials.

ATD acquired Monro’s wholesale business this past summer. As part of the agreement, Monro says it will buy at least 90% of its tires from ATD.

Group buys MTD TEN

Independently owned Dealer to Dealer Development Group LLC (D2D Development Group) has acquired MTD TEN (Training and Education Network) from Endeavor Business Media, MTD’s parent company.

Randy O’Connor, principal and owner of D2D Development Group, says the “transition of MTD TEN — formerly DSP 20 Group — back to independent ownership has been on our members’ minds for years. It makes perfect sense to have an independently owned membership led by an independent.”

O’Connor also writes MTD’s monthly Dealer Development column, formerly titled as TEN Insights. ■

MTD January 2023 16 Industry News

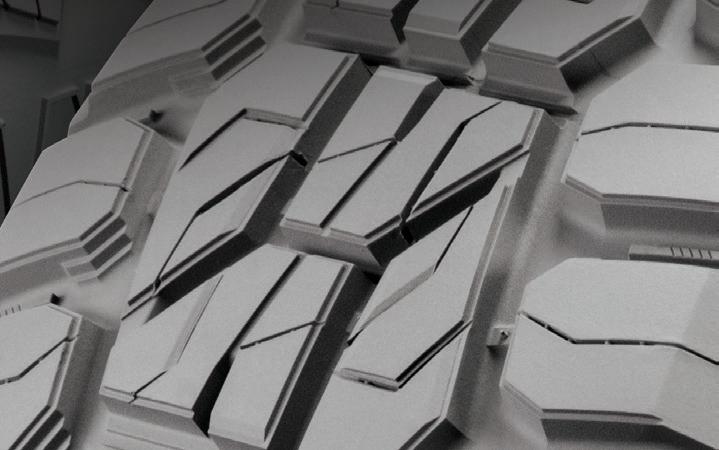

www.yokohama-oht.com THE NEW GALAXY AT GRIP STEEL RADIAL THE SKID STEER TIRE THE MARKET ASKED FOR. Introducing the Galaxy AT Grip Steel, the new skid steer radial designed from the ground up with OTR tire dealers and skid steer operators. This is

the industry asked for, from the long-lasting, high-traction block tread to the sturdy, reinforced sidewalls. The

Steel minimizes bucking and bouncing, and is priced aggressively to make this the best time for customers to switch to radials. Ask your YOHTA REP about the new Galaxy AT Grip Steel skid steer radial, visit yokohama-oht.com or call us at (800) 343-3276. 800-343-3276 | @yokohamaohta Up to 50% longer tire life than bias-ply Nearly 4x more puncture resistance Steel radial belts Reinforced sidewalls AT GRIP STEEL ORDERING TIRES JUST GOT EASIER! Check out our new B2B E-Commerce Portal

exactly what

AT Grip

MTD January 2023 18

12.2 Average vehicle age in years in the U.S.

102 MILLION Number of tires produced in eight Hankook plants around the globe in 2021.

TIRE & TECHNOLOGY CO. LTD.

300,000 Units of 2022 vehicles advertised and available for sale from Ford, Chevrolet, Ram and Jeep in the rst week of December 2022.

S&P

MOBILITY

Ford Motor Co. 6 Independent tire dealerships ranked on the 2021 MTD 100 that were acquired before the 2022 version of the MTD 100 was published.

Relevant statistics from an industry in constant motion

SOURCE: S&P GLOBAL MOBILITY Photo: Pexels

SOURCE: HANKOOK

Photo: Hankook

SOURCE:

GLOBAL

Photo:

26 Number of GCR Tires & Service locations acquired by Southern Tire Mart LLC this past fall.

Numbers ThatCount

SOURCE: MTD Photo: Plaza Tire Service

SOURCE: MTD Photo: MTD

THE BANDIT CUV/SUV IS SPECIFICALLY MADE FOR THESE POPULAR OE FITMENTS: SUBARU OUTBACK TOYOTA RAV4 SUBARU CROSSTREK HONDA CR-V JEEP RENEGADE TRAILHAWK MAZDA CX-5 NISSAN ROGUE FORD ESCAPE JEEP CHEROKEE DELINTETIRES.COM | #DELINTETIRES ^ RELENTLESS 55K MILEAGE WARRANTY ^ ROAD-HAZARD COVERAGE ^ D-TECH SILICA COMPOUND ^ RELENTLESSLY DEEP TREAD ^ DUAL SIDEWALL DESIGN ^ 70+ RELENTLESS SIZES BANDIT CUV/SUV 245/65R17 AS SHOWN NEW

streak continues

John Healy By

Our recent checks with dealers leave us with a view that retail sellout trends continue to show strength and moved higher year-over-year compared to November 2021. Contacts indicate that November saw the greatest year-over-year growth to date in 2022.

Looking closer at volume for the month of November on a regional basis, we note the Midwest region reported the strongest year-over-year growth. Both the Southeast and Southwest regions saw the “weakest” year-over-year performance, with both reporting approximately flat trends.

Dealers indicate pricing actions from manufacturers continue to be a worry. However, slightly easier comparables and winter weather helped drive more traffic into service bays in November.

Looking at miles driven over the last month, which has a significant correlation with the need for a new set of tires, trends again declined on a year-over-year basis in November 2022.

DRIVING REMAINS DOWN

The month of November showed a 7% year-over-year decline in our miles driven momentum index, which compares to a 10.2% decline in October and 5.8% decline in September.

We note the index continues to see volatility during a prolonged period of below-normal miles driven. Every month since March, miles driven have declined. The timing coincides with the Russian invasion

of Ukraine and subsequent increases in fuel prices in the U.S.

The prolonged contraction in our miles driven index mirrors the prolonged declines seen in the aftermath of the COVID-19 lockdowns. But this time, there’s not the same kind of catalyst, like a nationwide lockdown. Simply put, this prolonged decline represents a true reduction in U.S. miles driven.

TIER-THREE COMEBACK?

Tier-two tires remain the leaders in this uncertain market, which matches the longterm trend of 2022, where tier-two tires have either been the most in-demand or tied for most in-demand in the last seven of 10 months.

And while tier-three tires had been at the bottom of the rankings recently, they tied with tier-one tires in November.

Given rising prices for tires and all consumer goods — as well as an influx of lower-tier inventory in the back half of the year — we were not shocked to see this type of result in November. To us, this indicates demand across all three tiers and confirms our survey work, which showed strong demand during the month of November.

RAW MATERIALS MODERATING

Turning to raw material costs, the “basket” of raw materials to make a basic replacement vehicle tire increased roughly 5.6% yearover-year in November 2022, following an 8.1% year-over-year increase in October.

We note the raw material cost increases have begun to moderate as our raw material index in November fell 2.1% sequentially from October, while the month of October fell 2.0% sequentially from September. Based on data through November, this would equate to a 6.5% decline in raw material costs from the third quarter to the fourth quarter.

Looking forward, holding current spot prices flat would equate to a 6.9% yearover-year increase in input costs in the fourth quarter.

Aggregate costs of raw materials have been increasing since May 2020, with peak year-over-year gains — of 37.7% — occurring in March 2022 as the conflict in Ukraine sent oil prices higher.

In assessing raw material price movements, the price of carbon black has increased on a year-over-year basis for 23 months straight, but the rate of increase has begun to moderate.

Crude oil prices have moderated from their spring 2022 peak.

Oil prices grew an average of 9.7% yearover-year in November, though there have been months of sequential declines. Oil prices fell an average of 2.9% in November from October.

Moving to natural rubber prices, our natural rubber index fell by 20.4% in October and 20.9% in November, with month-overmonth declines each month.

At the same time, synthetic rubber costs grew in November by 1.4% year-over-year, though we tracked sequential declines to other raw materials.

Price pressures on reinforcement items continue to show moderation in year-overyear gains as well, with October and November prices up 15.3% and 11.3% respectively, which compares to an average year-over-year gain of 43.3% in the third quarter. ■

MTD January 2023 20 Your Marketplace

sellout

IMPROVEMENT COMES EVEN AS MILES DRIVEN LAGS

John Healy is a managing director and research analyst with Northcoast Research Holdings LLC, based in Cleveland. Healy covers a variety of subsectors of the automotive industry.

Positive

Sept-21 Oct-21 Nov-21 Sept-22 Oct-22 Nov-22 Average Increase 57% 45% 50% 43% 50% 57% 41% Flat 14% 10% 17% 21% 20% 29% 27% Decline 29% 45% 33% 36% 30% 14% 32% Total 100% 100% 100% 100% 100% 100% 100% SOURCE: NORTHCOAST RESEARCH ESTIMATES Snapshot of Dealers’ PLT Tire Volumes (Year-Over-Year Change)

Introducing the all-new Celsius Sport®, designed to deliver superb traction in changing weather conditions for high performance luxury cars, SUVs, and CUVs. It carries the three-peak mountain snowflake symbol designating its capability in snow, slush, and ice for true all-weather performance. Spirited drivers seeking an all-season performance upgrade will appreciate the refined looks, precise handling, and driving comfort. Plus, it comes with up to a 60,000-mile treadwear warranty and a 500-mile / 45-day trial offer.

Mountain Snowflake qualified for severe snow conditions.

ToyoTires.com/CelsiusSport

CELSIUS SPORT® CELSIUS® OPEN COUNTRY® C/T M-55™ OPEN COUNTRY® A/T III CELSIUS® CARGO

©2022 Toyo Tire U.S.A. Corp.

A full range of all-weather tires for cars, CUVs, SUVs, trucks, and cargo vans.

ALL-NEW. ULTRA-HIGH PERFORMANCE. ALL-WEATHER.

Industry analysis

Market hangover

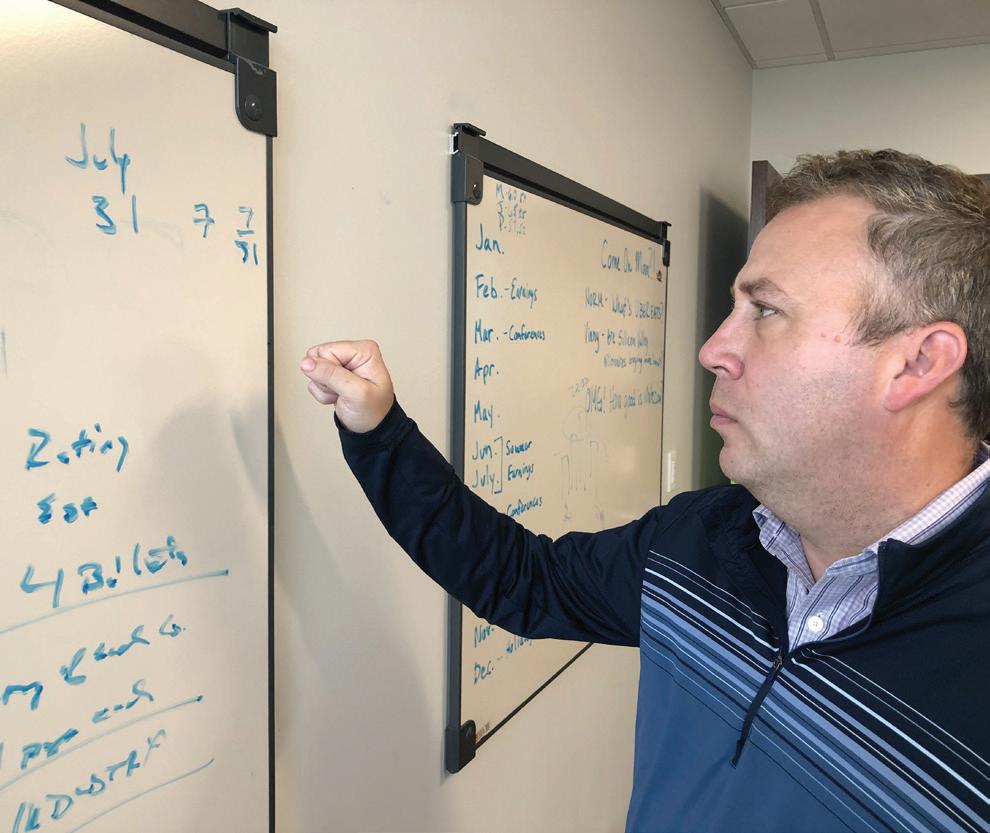

ANALYST JOHN HEALY BREAKS DOWN FACTORS THAT WILL CONTINUE TO IMPACT YOUR BUSINESS IN 2023

Mike Manges By

“To say that supply and demand dynamics over the last 24 to 36 months have been unpredictable would be an understatement,” says Healy.

Photo: MTD

Are challenges like the supply chain crisis and price increases finally in the rear-view mirror? Not necessarily, says John Healy, who tracks the domestic tire industry for Northcoast Research Holdings LLC. (He also writes MTD’s monthly Your Marketplace column.)

The lingering hangover of these factors — along with inflation, rising inventory levels and other dynamics — will impact tire dealers well into the new year. He explains why in this MTD exclusive.

MTD: Last year, there was a significant shortage of products and SKUs. Today, tire dealers are telling us there is almost too much supply, which has created sky-high inventory levels. That’s a major swing that took place in a compressed period of time. What do you attribute this shift to? What happened and how did it happen so quickly? How important will inventory management be for tire dealers?

Healy: To say that supply and demand dynamics over the last 24 to 36 months have been unpredictable would be an understatement. That said, figuring out inventory dynamics and proper alignment has been even more challenging than forecasting demand as tariffs, rising costs, shortages of inputs and delayed and expensive freight costs have all complicated this equation.

Managing tire inventories is always tough and 2022 was a period that was among the toughest. Entering 2022, many dealers we spoke with were seeing accelerating demand as more full re-opening levels were ongoing and industry inventories for product lacked visibility.

Heading into 2022, we heard from many dealers that industry fill rates were suboptimal by a fair margin. Given this, as well as lack of visibility from a timing and expense standpoint on imports, many dealers were scrambling and at times increasing the size of their orders to hopefully get some portion of their target.

MTD January 2023 22

THE SMART CHOICE IN TIRES CONTINENTALTIRE.COM Everything we do is to make you feel confident you’ve made THE SMART CHOICE IN TIRES. DID, LIKE, A BAJILLION ENGINEERS TEST IT? 100 ENGINEERS & CHEMISTS INVOLVED IN DEVELOPMENT, ON AVERAGE. Yes, Really. *Restrictions and limitations apply. See Total Confidence Plan brochure for complete coverage details at www.continentaltire.com/warranty. Up to 80K Mileage Warranty* 60-Day Customer Satisfaction Trial*

Industry analysis

While these dynamics were at play, we believe manufacturers started to catch up from a production standpoint, while simultaneously figuring out ways to get product into markets at an expedited rate. While all of these good things were happening, the demand side of the equation due to inflationary pressures on the consumer started to peak and soften.

In a nutshell, demand softened at the margin, while manufacturers were ramping up production and international product was figuring out more economic ways to get on-shore — thus creating the situation of today, where we feel industry inventories have caught up to demand and are starting in some areas to be uneven.

MTD: Inflation and interest rates have had a major impact on consumers. How has this affected retail tire sellout by tier and what are your projections for 2023?

Healy: While tire buying is not always discretionary, we do believe the categories in which consumers select the tire to purchase is often a function of what the dealer has and recommends, but also the total price point. Given rising pressures in affordability of nearly all goods and services, we are seeing a shift in recent months of the consumer looking for value over brand at the point of sale.

Simply put, consumers are often surprised by the price to replace four tires on their vehicle as a result of inflation, raw materials and even vehicle size. The result for many consumers is sticker shock at the cost to get back on the road.

Given this, we have seen tier-two manufacturers gain share over the last few quarters as part of our survey work with the dealer community. Confirming these trends were recent conversations at the Specialty Equipment Market Association Show with major retailers, which are increasingly modifying their product screen from premium to mid-tier and value lines, so that they can increase consumer conversion and near-term satisfaction.

With inflation being the driving force of this change, we believe the move to value brands will only intensify in 2023. Currently, unemployment still sits at just under 4% — a healthy level. With rising rates and affordability pressures, the likelihood of economic cooling and a recession seems like a prophecy likely to

take place in 2023, under these scenarios. And from the healthy level of employment today, we believe it’s likely that the job situation will deteriorate in the next six months — likely causing the consumer, who is already becoming more valueconscious, to intensify their current path of trading down.

MTD: Nine months to one year ago, shipping was a major problem in our industry. Fewer containers were on the water and freight rates were out of this world. Several tire manufacturers and dealers have told us that freight rates have plummeted in recent months. Why? What’s going on with shipping? Will we see more of the same in 2023?

MTD: M&A activity continued in 2022, including several big acquisitions on the commercial tire dealership side. In the face of rising interest rates and with inflation at a 40-year high, do you expect to see more or fewer deals made next year? Why or why not?

Healy: The broader M&A environment on automotive retailing, service centers and the tire industry surprised me in 2022. Earlier in the year, I would have predicted a cooling of M&A given the intense pressure facing operators related to sourcing, costs and labor — resulting in operators focusing inward rather than on expansion. However, that was not the case.

Looking to 2023, it’s hard for me to not feel a similar way. We feel the combination of rising interest rates and healthy profits in recent years is likely to cause somewhat of an impasse in the expectation of prices to be paid by both buyers and sellers. With high prices in the industry and higher costs of capital, the return math for acquirers is likely to become a bit more difficult.

Healy: If we have learned anything in the last two to three years, it’s to expect the unexpected. When one bottleneck or concern seems to be figured out by our great ingenuity as a country, something else seems to pop up. I fully expect that to be the case in the next 12 months.

That said, will it continue to be the shipping area that compounds logistics and economics for manufacturers and retailers? It’s hard for me to come up with a long list of reasons why it would be.

Generally speaking, I am a bit more cautious on economic output in 2023 as the consumer seems to be a bit more cautious and big-ticket purchases have become more aspirational than in years past due to financing costs. Ultimately, we think these things will all shake out in terms of lower prices due to higher rates and inflation becoming tamed, but we think it takes time and will likely be the story of at least the first half of 2023. Given this, we think shipping pressures and bottlenecks could be alleviated as demand cools.

The one offset we see to this dynamic could be rising energy costs and the uncertainty that this could bring to the shipping/ logistics area. Also labor continues to be uncertain and could be a wild card as we head into 2023.

This dynamic — as well as a consumer outlook that is likely more difficult to get excited about — makes us think that activity levels in the months ahead may abate relative to the speed and size M&A has shown in the last few years. Given this, we look for more sanguine activity in 2023 as buyer and seller expectations align, leaving the door open for a pick-up in activity in 2024 once the parties can find common ground.

MTD: On the wholesale-distribution side, Amercian Tire Distributors Inc. (ATD) made a big move by selling its Canadian subsidiary, National Tire Distributors. And Monro Inc. sold its wholesale division — which operated under the Tires Now banner — to ATD, thereby exiting the wholesale-distribution business. What’s your take on ATD’s strategic direction? Do you expect to see more M&A activity in the wholesale channel?

Healy: We are not surprised by the ATD move or the Monro move this year. We feel wholesaling is a tough business right now. Product availability caused strains in the business in 2021. And 2022 was a year where product costs went up significantly. This dynamic is causing operators to invest more capital to stay the same size — something that is not always enjoyable.

MTD January 2023 24

‘We believe the move to value brands will only intensify in 2023.’

Industry analysis

“Activity levels in the months ahead may abate relative to the speed and size of which that M&A has shown in the last few years,” says Healy, commenting on tire dealership buyouts.

MTD

MTD

Given the capital constraints and consumption of this business, we are not surprised that some entities are reexamining their role in the market and potentially looking to align their capacity and industry position in the niches of where they can add value and earn higher rates of return. That’s what we think happened with ATD and Monro in 2022 and we cannot argue that their decisions seem out of left field to us.

Will more of this happen in 2023? We think so. We look for the big to get bigger and believe the distribution business is a perfect business for this dynamic to continue to unfold. Dealers tell us that they want consistency, price transparency and good fill rates. We think being a bigger distributor allows for these and we look for those with size and commitment to the category to be the winners in 2023.

MTD: In 2021, nearly 45 separate price increases were publicly announced by tire manufacturers. This year, there have been significantly fewer price hikes, but percent increases, as a rule, have been greater. What’s your take on all of this? Has the window for price hikes closed? Are manufacturers in less of a position to enact price increases now versus a year ago and if yes, why?

Healy: We would agree completely that the pace of price increases in 2022 slowed compared to 2021. That said, we have seen the magnitude of those hikes in 2022 steeper than the previous year.

MTD January 2023 26

Photo:

Industry analysis

Our expectation is that as raw materials go, so will price increases.

Broadly speaking, we are hopeful that Fed actions and normalization of production schedules will result in moderating in ation rates, which hopefully keep raw materials manageable for manufacturers. Under this backdrop, we expect fewer price hikes in 2023.

We would not be surprised to see some price hikes in early-2023 with the change of the calendar year and raw material prices that are still above year-ago levels.

at said, as we look to the second half of the year, we think raw material prices for manufacturers might be lower on a yearover-year basis, which theoretically may serve as a pause point for further hikes.

Separately, we believe manufacturers heard from dealers and distribution contacts that fewer and more full price hikes are more reasonable than monthly hikes. We think visibility into prices and ability to manage inventory is key for all retailers and wholesalers and is appreciated.

MTD: Over the past few years, we’ve seen the emergence of several new product categories or sub-categories. e all-weather tire category has grown exponentially. e number of last-mile delivery vans continues to increase, leading to greater demand for C-type tires. And more manufacturers are entering the electric vehicle (EV) tire space with products

that are speci cally designed for these vehicles. What are your thoughts on the above categories and the opportunities they will provide for both tire suppliers and dealers?

Healy: e area I am most excited about is EV. I have come to the conclusion — a er numerous conversations with industry

MTD: Several tire manufacturers that have plants in countries that were slammed with tari s have reported that the impact of countervailing duties on their businesses was signi cantly less than expected. Others have developed e ective work-arounds to mitigate the impact. What will be the ongoing impact of tari s in 2023?

Healy: We believe with a global tire market from a demand standpoint, as well as from a manufacturing standpoint, the impact of tari s has become harder to measure. We believe that global economies continue to look for ways to combat in ation and believe items such as tari s — while protectionary to industries — likely work against the cost dynamic to the end consumer. Given this — and what we believe is a global e ort to curb in ation — tari s might be cast aside as a tool that is not right for the current environment in the short run.

27 www.ModernTireDealer.com

MANUFACTURING HIGH-QUALITY PRECURED TREADS AND RETREADING MATERIALS SINCE 1952 Pre-Q Galgo Corporation 4329 Bronze Way Dallas, TX. 75237 Ph # 214 330 7300 - Fax # 214 331 2222 E- mail: info@pre-q.com www.pre-q.com We provide world-class retread solutions to independent retreaders throughout the United States and Canada that includes over 70 different precured tread designs, commercial & OTR extruder strips, cushion, repair materials, and technical support.

‘Tariffs might be cast aside as a tool that is not right for the current environment.’

operators and dealers — that EVs come back for tire service at a much more frequent and earlier life cycle than internal combustion engine (ICE) vehicles. Given the consumer wealth which is operating EVs, we think the propensity for branded manufacturers that are investing in product specific for these fitments is a big revenue opportunity for at least the next few years.

Simplistically, we believe tire manufacturers have long competed on price and product quality to win share. Product quality has long been marketed to consumers “guaranteed to last X amount of miles.” This investment into how long the tire will last has been a competitive development, but one that has likely worked against the industry’s ultimate revenue and unit size. We see the proliferation of EV fitments as a catalyst for unit demand in years ahead. Our research suggests that EV tires wear out 20% faster than ICE comps. One could argue the growth in EV fitments creates the biggest catalyst for growth in the replacement tire category in decades.

MTD: The Russia/Ukraine war convinced a number of tire manufacturers to withdraw from Russian operations, including manufacturing. What impact, if any, has this had on the North American market and why?

Healy: We have seen some imports into the U.S. replacement tire market increase in 2022, but my sense is that these units are not coming from facilities out of Russia. Frankly, several manufacturers with Russian operators have pulled out of the region, including Michelin, Bridgestone, Pirelli and Yokohoma.

We think the impact of exiting these facilities/operations likely creates capacity in years ahead that will allow for new upstarts to operate or potentially other operators to bring capacity into the region. Ultimately, we see geopolitical factors as deciding how and when these operations will begin to re-contribute to the global tire supply chain and not something we expect to have a meaningful impact in 2023 — especially in the U.S. replacement market.

MTD: Sales of new and used cars are still below historic averages. Meanwhile,

Lightning round

John Healy recently provided quick takes on the largest global tire manufacturers. (He did not comment on Zhongce Rubber Group Co. Ltd. or Cheng Shin Rubber Co. Ltd.):

Michelin Group: We look for Michelin to keep inflating the category. While environmental and sustainability goals are buzz words for many in the financial industry, Michelin is making inroads as it relates to the tire category. We believe Michelin keeps making a great product and (is) serving dealers well, but we are really impressed with some of the traction it’s making with alternative compounds and engineering to make tires more sustainable and potentially work down costs over the long run.

Bridgestone Corp.: Happy dealers and expansion. Of all the brands we hear about, we continue to hear good things about service, partnerships and Bridgestone’s ability and willingness to continue to invest in the business.

Goodyear Tire & Rubber Co.: We think Goodyear is exceptionally positioned to win the EV race. Our checks with dealers suggest EV fitments wear out faster than internal combustion engine vehicle fitments. This, we think, helps the industry and we believe Goodyear is batting well above its normal average in terms of executing wins in this category on the OE side.

Continental AG: Quality and a share gainer. Feedback from the channel has continued to be positive about Continental’s products,

with the only dealer critique being the ability to get product. We think this remains a focus and a light truck tire market share opportunity for the company.

Sumitomo Rubber Industries Ltd: A business in transition. We noted headlines earlier this year of new leadership and planned exits of the company’s truck tire business in Asia, but an overall plan to increase production in other categories that the business feels it has a right to compete in and win.

Pirelli & Cie SpA: Consistency and performance. We believe Pirelli continues to remain the most aspirational brand in the category with solid fitments on “dream vehicles,” but also new traction in areas.

Hankook & Co./Yokohama Rubber Co. Ltd.: Potential winners in 2023. We think that with elevated prices to the consumer — but abatement in terms of logistical and global trade complications — perhaps mid-tierpriced import brands might be in a share gain position in the year ahead.

Toyo Tire & Rubber Co. Ltd.: Expanding. We believe the company is readying to launch some production in Europe, which I believe is their initial foray into production in the region.

Giti Tire Pte. Ltd.: We continue to see the brand show up more in the performance and specialty categories and believe additional capacity increases should allow for this momentum to continue.

the average age of a used car is 12.2 years — an all-time high. What does this mean for tire dealers? And what kind of impact has this had on tire manufacturer shipments into the original equipment (OE) channel? Is having a premium OE tire fitment as important today as it used to be?

Healy: Slumping new car sales relative to previous year levels — 2017 through 2019 — has created natural aging and depletion of the car population in the U.S. market. Given that cars are now

older and have more miles, we see this as helping the maintenance category for all things automotive. From our perspective, this aging car population will in 2023 help contribute to the demand picture.

As it relates to the OE side of the business, with new car production in the mid-teens from the low 17-million level ... we believe some manufacturers have shifted manufacturing capacity from OE to replacement to align with the realities of the current market.

That said, we are believers that the chip shortage is in decline and will

MTD January 2023 28

Industry analysis

Healy sounds off on the world’s biggest tire manufacturers

Industry analysis

likely be a thing of the past by the second quarter of 2023. Given this, we look for tire manufacturers to have to realign production from replacement to OE at the start of the year to meet manufacturer demand.

MTD: What are the three most important things independent tire dealers should monitor and prepare for as 2023 begins?

Healy: Our top three suggestions to monitor would include technician retention, inventory levels and consumer engagement.

A major pain point for dealers over the last year or two has been the ability to find and retain technicians. We do not see the supply of technicians as increasing in a major way of late, so thinking that this area of stress will go away would be naïve. From our perspective, technicians are worth their weight in gold and we believe to provide the type of service that allows for returning customers, good techs are essential.

Managing inventory levels would be an area that we would advise dealers to devote attention to in 2023. We think the consumer is trading down, so having product at a price point that leads to sales conversion is key. Additionally, with raw materials potentially showing some moderation for manufacturers in months ahead, volatility in pricing and availability might become more favorable. As a result, we suggest dealers be smart and nimble with inventory.

Consumer engagement is our final area of recommended emphasis. Having an e-commerce offering, we believe, is essential for the road ahead. The ability to shop, book appointments and provide feedback is all part of a successful “modern tire dealer” game plan. ■

29 www.ModernTireDealer.com

“Managing inventory levels would be an area that we would advise

dealers

to devote attention to in 2023,” says Healy.

Photo: MTD

‘We suggest dealers be smart and nimble with inventory.’

Tires, a Prinx

brand,

DRIVE FORWARD Prinx Chengshan North America, Inc. info@prinx.us.com FORTUNETIREUSA.COM Perfectus Viento Tormenta H/T Tormenta A/T Tormenta R/T Tormenta M/T Tormenta LMD FDH106ET FTH107 FDR601ET FAR602 FAM210 FAM211 FAM212 ST01 FST02 You’ll have confidence in Fortune Tires as each model is backed with leading industry warranties. Designed for those who are focused, those who overcome, those who persist. Are you ready to Drive Forward with Fortune?

Fortune

Chengshan

stands strong in offering a tire that always meets the highest standards. Offering uniformity of quality to meet the precision needs of a wide range of vehicles, from family cars to

high-performance SUVs to commercial vehicles.

BACK TO NORMAL?

After a better-than-expected 2020 and what can only be described as a massive, across-the-board rebound in 2021, the United States tire market appears to be right-sizing.

But challenges — including several hangovers from last year — remain.

Following a solid finish in 2021, retail sellout levels remained elevated during the first quarter. However, demand began to fluctuate around the start of the second quarter, before taking a negative turn mid-year.

Blame it on 40-year-high inflation levels, elevated interest rates, tight household budgets, declining consumer confidence or all of the above — fewer customers bought passenger and light truck tires as the year wound down.

Consumers who remained in-market continued to gravitate toward less-expensive options, as the knock-on effect of tire manufacturer price increases, which continued throughout the year, were felt.

On the original equipment (OE) side, passenger and light truck tire shipments increased during 2022 as auto manufacturers ramped up production

The commercial medium truck tire market continued to show the greatest amount of growth — with replacement shipments eclipsing last year’s totals by 20%-plus. (OE truck tire shipment gains were more modest, but still significant.)

Supply also recalibrated in 2022. Container ship pileups and freight rates are no longer the problem they were 12 months ago. The flipside is that tire dealers and distributors are now faced with high inventory levels.

WHAT’S NEXT?

Will consumer tire demand rebound in 2023? It depends on several macro-economic factors. Last month, the Federal Reserve announced that it seeks to achieve “inflation at the rate of 2%

over the longer run.” (The national inflation rate fell to 7.1% in November, the lowest level since December 2021.)

However, interest rates are expected to remain elevated throughout 2023.

An upswing in vehicle miles driven will work in the tire industry’s favor. And fewer tire manufacturer-driven price increases are expected — a good thing not only for dealers and distributors, but also vehicle owners.

World Leaders in New Tire Sales

(Fiscal year 2022; in billions of U.S. dollars)

TIRE MANUFACTURER

Michelin Group

2022 2021

$27.7 $26.9

Bridgestone Corp. $22.8 $21.9

Goodyear Tire & Rubber Co. $17.6 $14.9

Continental AG $14.4 $13.9

Sumitomo Rubber Industries Ltd. $7.1 $7.2

Pirelli & Cie SpA

$6.8 $6.3

Hankook Tire & Technology Co. Ltd. $6.3 $6.2

Yokohama Rubber Co. Ltd. $5.4 $5.2

Zhongce Rubber Group Co. Ltd. $4.9 $4.5

Toyo Tire & Rubber Co. Ltd. $3.4 $3.2

Cheng Shin Rubber Ind. Co. Ltd. * $3.2 $3.6

Giti Tire Pte. Ltd. $3.1 $3.0

MTD January 2023 30 2023 MTD Facts Issue

ALL ESTIMATES IN THIS SECTION ARE THE RESULT OF MTD RESEARCH, UNLESS OTHERWISE NOTED.

U.S. tire market is ‘right-sizing’ — but challenges remain

*CHENG SHIN DOES BUSINESS AS MAXXIS INTERNATIONAL – USA

Overall U.S. Replacement Tire Sales

Total value of 2022 replacement tire market: $61.4 billion

SEGMENT

2022 2021

Passenger $38.0 $33.4

Light truck $9.0 $8.1

Commercial truck $11.7 $9.5

OTR $2.0 $1.9 Ag $.721 $.714

A LOOK AT MARGINS

Average sales margins fluctuated from 2021 baselines. Passenger tire retail and light truck tire retail margins declined slightly — pushed downward by price hikes and other factors.

Meanwhile, wholesale passenger tire and new medium truck tire margins increased. Commercial medium truck tire retread margins saw the biggest gain.

U.S. AVERAGE Tire SaleS Margins

Segment

2022 2021

Passenger (retail) 28.2% 29.0%

Passenger (wholesale) 12.0% 11.6%

Light truck (retail) 25.0% 26.2%

Medium truck 16.5% 16.0%

Retread (medium truck) 19.0% 17.5%

DOMESTIC SHIPMENT REPORT

Reflecting the general drop in consumer demand that began around the middle of the year, overall U.S. replacement passenger and light truck tire shipments fell in 2022.

Passenger tire shipments at the replacement level declined by slightly less than 2.6%. Replacement light truck tire shipments dropped slightly less than 2.9% year-over-year.

However, OE passenger and light truck tire shipments climbed as automobile production gradually increased.

OE passenger tire shipments rose by 10%. OE light truck tire shipments also grew by around 10%.

Medium truck tire shipments — both replacement and original equipment — reflected the continued strength of the commercial truck tire market.

Replacement truck tire shipments grew by more than 20% versus 2021 levels, while OE truck tire shipments increased by around 9% year-over-year.

U.S. Passenger Tire Shipments

Year

Replacement OE

2022 216.1 41.5 2021 222.0 37.5 2020 202.6 36.2 2019 222.7 45.1 2018 217.0 47.0 2017 209.3 46.0 2016 207.7 49.0 2015 205.9 49.0 2014 206.6 46.3 2013 201.6 44.0 2012 192.0 40.5

U.S. LIGHT TRUCK TIRE SHIPMENTS

(in millions of units, rounded to nearest one-hundred-thousandth)

Year

2022 37.0 6.2 2021 38.1 5.6 2020 30.4 5.0 2019 32.0 5.9 2018 31.1 5.6 2017 30.8 5.4 2016 31.4 4.9 2015 29.0 4.6 2014 28.8 4.4 2013 28.3 4.2 2012 28.3 4.1

U.S. Medium Truck Tire Shipments

(in millions of units, rounded to nearest one-hundred-thousandth)

Year Replacement OE

2022 28.0 6.5

2021 22.7 5.9 2020 18.5 4.5 2019 18.9 6.5 2018 21.0 6.2 2017 19.2 5.7 2016 18.4 5.3 2015 18.0 6.3 2014 17.3 5.8 2013 15.7 5.0 2012 16.0 5.3

31 www.ModernTireDealer.com

(in millions of units, rounded to nearest one-hundred-thousandth)

Replacement OE

THAILAND REMAINS BIGGEST

TO U.S. Overall imports increased in 2022

EXPORTER

Thailand remains the biggest exporter of tires to the U.S. market in three key categories — passenger, light truck and medium truck tires. And even though Thailand’s passenger and consumer tire exports to the domestic market actually slowed slightly in 2022, there’s no sign of the nation giving up its top spot in the near future.

Thailand has a 10-million-unit cushion in passenger tire shipments and a more than 14 million-unit lead when combining passenger and light truck tire units.

Full-year estimates show more than 164 million passenger tires were imported into the U.S. in 2022, up from 151 million in 2021. (That’s an 8% increase.)

A year ago, a country made the top 10 list if it shipped more than 3.9 million passenger tire units to the U.S. In 2022, that threshold was 4.2 million units, which meant Brazil, with 3.1 million imports, and Portugal, with three million, were both short of the top rankings. China imported 2.7 million passenger tires into the U.S. in 2022.

Outside factors influence all of these numbers and the war in Ukraine prompted some tire manufacturers to adjust — or sell off — their business operations in Russia. And while neither country is historically a large provider of tires to the U.S., the downturn still was noticeable. In 2021, 900,000 passenger tires were imported into the U.S. from Russia, compared to less than 650,000 in 2022. The difference was even more stark in Ukraine, with 447,000 passenger tires shipped to the U.S. in 2021, compared to about 153,000 shipped in 2022.

2022 U.S. Passenger Tire Imports

(in millions of units, rounded to nearest one-hundred-thousandth)

Country

Thailand 32.0 33.3 -3.7%

Mexico 21.9 21.1 +3.9%

Indonesia 17.3 14.9 +16.4%

South Korea 14.8 12.6 +17.0%

Vietnam 10.6 9.9 +7.3%

Japan 10.2 8.1 +25.6%

Canada 9.7 10.0 -2.9%

Chile 6.0 5.5 +10.1%

Malaysia 4.2 3.5 +19.6%

Philippines 4.2 2.9 +41.9%

Demand for commercial truck tires in 2022 drove an incredible increase in imported units of nearly seven million tires. An estimated 24 million medium truck tire units were imported into the U.S. in 2022, up from 17.2 million tires in 2021. Eight of the 10 largest exporting countries posted giant double-digit year-over-year increases. Thailand holds a comfortable lead over the others in this category. The next-biggest exporter, Vietnam, increased shipments by more than 70% in 2022. That’s after a 56.8% increase from 2020 to 2021.

2022 U.S. Consumer Tire Imports

(in millions of units, rounded to nearest one-hundred-thousandth)

Country 2022 2021 % CHANGE

Thailand 39.1 40.6 -3.8%

Mexico 24.9 24.3 +2.4%

Indonesia 19.8 17.1 +15.4% South Korea 16.9 14.6 +15.8% Vietnam 16.2 14.0 +16.2% Canada 14.2 14.6 -2.5% Japan 12.8 10.3 +24.3% Chile 6.6 6.3 +4.4% Philippines 6.3 4.3 +44.3% Malaysia 4.4 3.5 +23.4%

2022 U.S. MEDIUM Truck Tire Imports

(in millions of units, rounded to nearest one-hundred-thousandth)

Country 2022 2021 % Change

Thailand 10.4 6.9 +49.1%

Vietnam 3.2 1.8 +69.8%

Japan 2.4 1.7 +39.3%

China 1.7 1.0 +64.1%

Canada 1.4 1.5 -3.8%

South Korea 1.1 0.9 +21.1% India 0.7 0.5 +33.7%

Spain 0.5 0.3 +32.7% Brazil 0.4 0.3 +46.1% Germany 0.3 0.3 -14.5%

MTD January 2023 32

Imports

2022 2021 % Change

THE STREETS ARE CALLING

More value. More performance. More reasons to buy. The Thunderer Mach V is an ultra-high-performance tire designed for exceptional handling in all weather conditions. On the city streets or on the country roads, the Mach V’s asymmetrical tread design and enhanced hydroplaning resistance technology provides superior performance for a quiet, comfortable, and dynamic ride. With 45,000-mile limited treadwear protection and our No Questions Asked, 25/365 Free Replacement Limited Protection Policy, the Mach V delivers power and performance wherever you roam.

thunderertireusa.com sales@americanomni.com

ULTRA-HIGH PERFORMANCE

THE MACH V

LIMITED PROTECTION POLICY

At the retail level, nobody moves more tires than independent tire dealers — and that has only become more pronounced with time. In 2017, independent tire dealerships sold 61.5% of all retail tires in the U.S. Since then, that percentage has increased to 66%.

It was a good year for auto dealership service sales as customers continued to hold onto their vehicles, while new cars remained in short supply.

A source close to Walmart told MTD that the company’s Auto Care Centers, many of which were shuttered during the first year of the COVID-19 pandemic, had a solid year in tire sales.

IN THE CLUB

Warehouse clubs moved 8% of consumer tires at the retail level during 2022, according to MTD estimates.