3 minute read

Is XM Regulated in India? Everything Indian Traders Should Know

Online trading is growing rapidly in India, with more investors turning to global brokers like XM for Forex, commodities, and CFD trading. However, before registering, it’s important to ask: Is XM regulated in India? In this article, we’ll explain XM’s licensing status, what it means for Indian traders, and how you can safely start trading today.

👉 Open an XM trading account now and get access to over 1,000 financial instruments, low spreads, and world-class platforms.

Is XM Regulated by SEBI in India?

No, XM is not currently regulated by the Securities and Exchange Board of India (SEBI) — the official regulatory authority for financial services in India. However, that doesn’t mean you can’t legally trade with XM from India.

XM operates under Trading Point Holdings Ltd, which is regulated by several top-tier international authorities, including:

CySEC – Cyprus Securities and Exchange Commission

ASIC – Australian Securities and Investments Commission

FSC – Financial Services Commission (Belize)

These regulators ensure XM maintains high standards in fund security, transparency, and trading integrity — even for clients outside of their home jurisdictions.

👉 Visit the official XM website to view their licenses and global compliance details.

Can Indian Traders Use XM?

Yes, Indian residents can legally open an account and trade with XM. While not regulated by SEBI, XM accepts clients from India and offers a robust platform tailored to international traders.

Key features for Indian clients include:

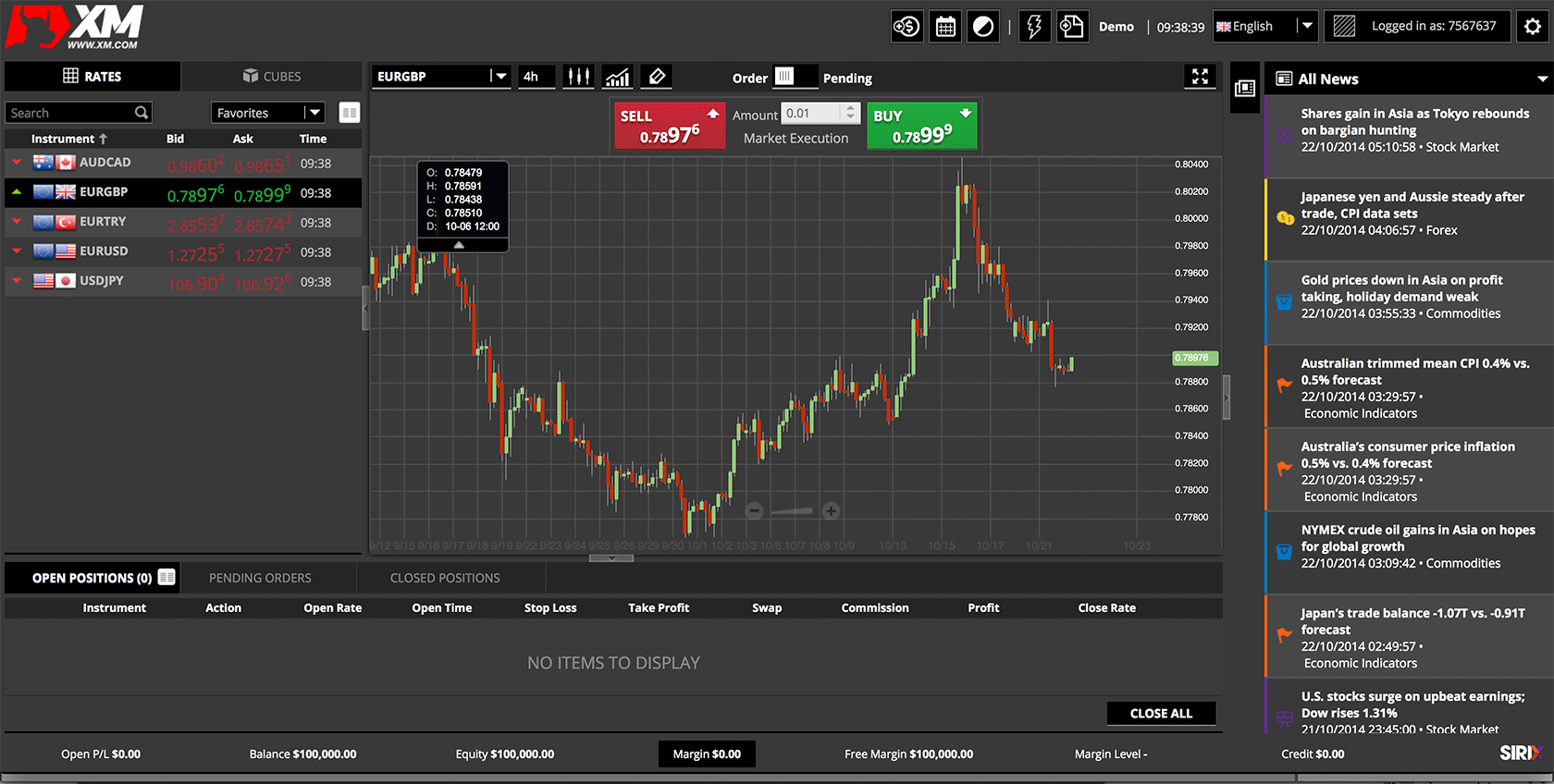

Forex, stocks, indices, and commodities trading

MetaTrader 4 and MetaTrader 5 platforms

Low minimum deposit starting from just $5

No deposit or withdrawal fees

Support for local payment systems and fast transaction processing

👉 Get started with XM today and begin trading global markets from the comfort of your home in India.

Is XM Safe for Indian Traders?

Even without SEBI regulation, XM is widely considered a safe and trustworthy broker due to its:

Strong global regulatory framework

Negative balance protection

Segregated client funds for added security

Transparent fee structure with no hidden costs

Thousands of Indian traders already use XM thanks to its reputation, user-friendly platform, and top-tier support.

👉 For more information about safety and trading conditions, visit the XM official website.

Final Thoughts

So, is XM regulated in India? Not by SEBI — but it is licensed by internationally trusted regulators and legally offers trading services to Indian residents. If you're looking for a broker with powerful tools, low fees, and strong global credibility, XM is an excellent option to consider.

👉 Join XM now and start your trading journey today with one of the world’s most recognized brokers.