2 minute read

JOINT LETTER TO ADDRESS THE CHILDCARE CRISIS

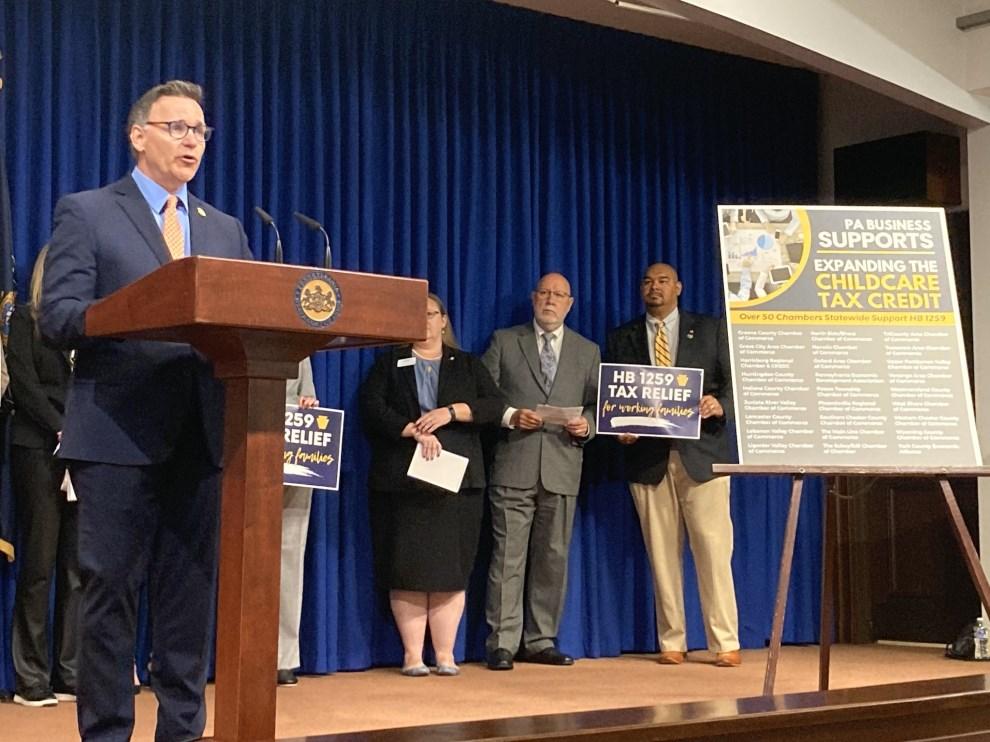

A Great Start House Bill 1259 Passes June 12th – HB 1259 Amends Section 1903-I (credit for child and dependent care employment-related expenses) of the Tax Reform Code of 1971 to add a new subsection. The bill proposes to expand the Child and Dependent Care Enhancement Tax Credit beginning after December 31, 2021 equal to the following for employment-related expenses incurred by the taxpayer who also claimed a federal tax credit during the prior taxable year. The tax credit must be equal or less than the following, whichever is less:

The act would take effect in 60 days.

Advertisement

Background Childcare is necessary for many working families with young children and many families struggle with affording child care. Pennsylvania currently offers a state tax credit, the Child and Dependent Care Enhancement Tax Credit, that eases child and dependent care costs for working families which can be claimed when they file their Pennsylvania Personal Income Tax Return. This credit can range between $180 and $630, depending on income level and the number of dependents and is equal to 30% of the federal credit. Taxpayers must receive the federal credit to be eligible for the state credit. HB 1259 now moves onto the Senate for in hopes of concurrence.

“Special thanks for the positive votes from Representative George Dunbar, Representative Jill Cooper, Representative Eric Nelson and Representative Eric Davanzo for their support as we move towards one of many Childcare initiatives to help get our residents, families and more re-enter the workforce.”

Redstone Presbyterian

This month’s Chamber Champion has been an integral part of Westmoreland County since 1980 and a member of the Westmoreland Chamber of Commerce for almost thirty-three years. Redstone is a leading aging services network partner within the communities they serve. Their vision: “to be difference makers and world changers in one’s life plan.”

Their commitment to the aging population of Westmoreland County is strong. One can feel the pride Redstone Presbyterian Seniorcare has for its residents, the staff, and the community they serve, which is why they were chosen as the July Chamber Champion.

Redstone Presbyterian SeniorCare is a non-profit organization governed by a voluntary Board of Directors, from the local community. The volunteers that serve on the board share a passion for providing high-quality living options and services to adults age 55 and better.

Redstone is a local leader in senior living options, with multiple locations in North Huntingdon, Greensburg, and Murrysville. They pride themselves in having multiple living opportunities that includes the following:

Villa Homes: Experience the benefits of living in a home without the responsibilities.

Veranda Apartments: Have easy access to various amenities outside your door.

Supportive Care: Choose from three styles of personal care Courtyard, Garden or Terrace (memory care) and receive 24-hour assistance with daily activities.

The Rehab Center at Redstone: This center is designed especially for individuals who require stroke rehabilitation, cardiac care and orthopedic rehabilitation. The Terrace at Redstone’s Rehab Center is part of our skilled nursing program and is specially designed for those with memory impairment needing skilled services.

Redstone@Home: This program provides home health, hospice and palliative care from the comfort of your home.

One of the things that sets Redstone apart is their commitment to a strong workforce. It is apparent that staff appreciation is a priority at the facilities. According to their website, they make an effort to attract and retain a strong workforce by increasing their benefits program including offering wage increases to frontline workers, scholarships to clinical team members, insurance benefits for part-time employees, flexible work schedules, and even a voluntary pet insurance program for interested employees!

The Chamber Champion program is brought to our members in conjunction