4 minute read

The Verdict is In: Legal Insurance Continues to Be a Valuable Voluntary Benefit

By Eastbridge Consulting Group, Inc.

We would all agree health insurance is essential to help protect us from both routine and unexpected medical costs but what about legal costs? From wills and real estate transactions to divorces and bankruptcies, professional legal services can cost hundreds to many thousands of dollars, often at an already stressful time. That’s why many voluntary carriers, brokers, employers and employees are showing significant interest in legal insurance. These prepaid legal plans offer advice, drafting and review of legal documents, and consultation or representation in court, typically at a fraction of the cost associated with hiring a lawyer. If this nontraditional benefit isn’t already on your radar, it might be time to consider it.

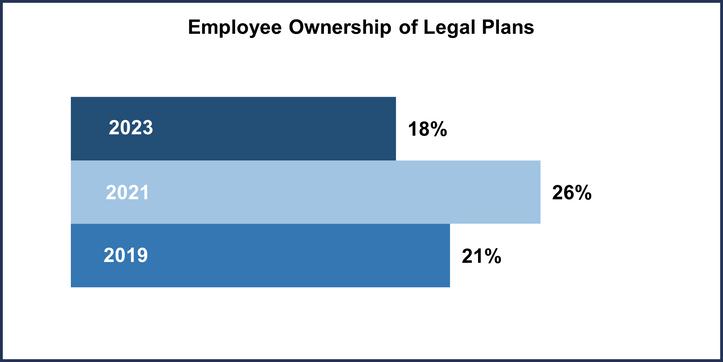

Employee ownership of legal insurance has dropped in recent years, but there’s still strong interest in buying it. Fewer employees own nontraditional products such as legal plans, identity theft protection and pet insurance than before the pandemic, possibly due to inflationary pressures on worker wallet share. But Eastbridge’s 2023 “Market Vision™ The Employee Viewpoint©” report shows that more than a third of employees who don’t own legal insurance are interested in buying this coverage on a voluntary basis.

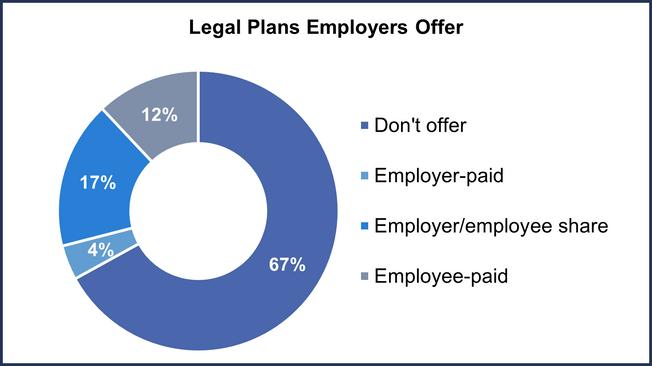

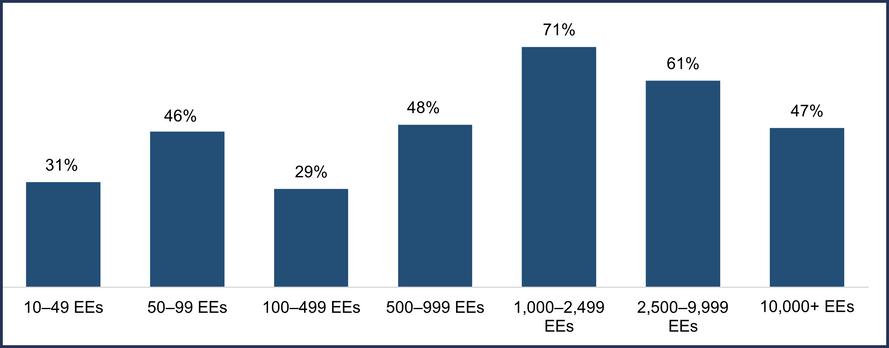

Employers may have a significant opportunity to beef up their benefits packages by adding legal insurance. According to the 2022 “Market Vision™ The Employer Viewpoint©” study, only 33% of employers currently offer this benefit, but another 24% say they’re interested in doing so. And they’re likely to find their employees are willing to share or pay the full cost of this coverage by far the most common funding arrangement for employers already offering legal plans. Larger employers are much more likely to include this coverage in their benefits packages, so smaller groups could represent a market opportunity.

Brokers are increasingly selling nontraditional benefits, including legal insurance. Three-fourths of brokers surveyed for this year’s “Voluntary Benefits: Brokers Back in Business” Spotlight™ report say that they sell nontraditional products on a regular basis, up from 60% just a year ago. Nearly a third of voluntary brokers and one in five benefit brokers say they regularly sell legal plans, ranking this product among the top nontraditional products for both types of brokers.

Carriers are likely to increase their ability to offer legal insurance. Only 25% of carriers include legal insurance in their portfolios, according to the 2022 “Voluntary Product Trends” Frontline™ report. That ranks it below mental health benefits, identity theft protection and financial tools among nontraditional benefits. But legal plans are in the top four products carriers say they plan to offer in the next two years. As demand for legal insurance grows, carriers that want to stay competitive will need to be able to offer it or connect employers to other companies that do.

Legal insurance is a product employees want and are willing to pay for, but access is still limited. Employers who want to create a more comprehensive benefits package, and brokers and carriers who want to reach an underserved market, should consider adding legal plans to their portfolios.

Eastbridge is the source for research, experience, and advice for companies competing in the voluntary space and for those wishing to enter. For over 25 years, they have built the industry’s leading data warehouse and industry specific consulting practice. Today, 20 of the 25 largest voluntary/worksite carriers are both consulting and research clients of Eastbridge.