17 minute read

the fed: inflation may cauSe receSSion

Powell’s stark message: Inflation fight may cause recession

Advertisement

Christopher Rugaber – The Associated Press

WASHINGTON (AP) – The Federal Reserve delivered its bluntest reckoning of what it will take to finally tame painfully high inflation: Slower growth, higher unemployment and potentially a recession. Speaking at a news conference, Chair Jerome Powell acknowledged what many economists have been saying for months: That the Fed’s goal of engineering a “soft landing” – in which it would manage to slow growth enough to curb inflation but not so much as to cause a recession – looks increasingly unlikely.

“The chances of a soft landing,” Powell said, “are likely to diminish” as the Fed steadily raises borrowing costs to slow the worst streak of inflation in four decades. “No one knows whether this process will lead to a recession or, if so, how significant that recession would be.” Before the Fed’s policymakers would consider halting their rate hikes, he said, they would have to see continued slow growth, a “modest” increase in unemployment and “clear evidence” that inflation is moving back down to their 2% target. “We have got to get inflation behind us,” Powell said. “I wish there were a painless way to do that. There isn’t.” Powell’s remarks followed another substantial threequarters of a point rate hike — its third straight — by the Fed’s policymaking committee. Its latest action brought the Fed’s key short-term rate, which affects many consumer and business loans, to 3% to 3.25%. That’s its highest level since early 2008. Falling gas prices have slightly lowered headline inflation, which was a still-painful 8.3% in August compared with a year earlier. Those declining prices at the gas pump might have contributed to a recent rise in President Joe Biden’s public approval ratings, which Democrats hope will boost their prospects in the November midterm elections. On Wednesday, the Fed officials also forecast more jumbo-size hikes to come, raising their benchmark rate to roughly 4.4% by year’s end – a full point higher than they had envisioned as recently as June. And they expect to raise the rate again next year, to about 4.6%. That would be the highest level since 2007. By raising borrowing rates, the Fed makes it costlier to take out a mortgage or an auto or business loan. Consumers and businesses then presumably borrow and spend less, cooling the economy and slowing inflation. In their quarterly economic forecasts Wednesday, the Fed’s policymakers also projected that economic growth will stay weak for the next few years, with unemployment rising to 4.4% by the end of 2023, up from its current level of 3.7%. Historically, economists say, any time unemployment has risen by a half-point over several months, a recession has always followed. Fed officials now foresee the economy expanding just 0.2% this year, sharply lower than their forecast of 1.7% growth just three months ago. And they envision sluggish growth below 2% from 2023 through 2025. Even with the steep rate hikes the Fed foresees, it still expects core inflation – which excludes volatile food and gas costs – to be 3.1% at the end of 2023, well above its 2% target. Powell warned in a speech last month that the

Fed’s moves will “bring some pain” to households and businesses. And he added that the central bank’s commitment to bringing inflation back down to its 2% target was “unconditional.” Short-term rates at a level the Fed is now envisioning will force many Americans to pay much higher interest payments on a variety of loans Federal Reserve Chairman Jerome Powell. than in the recent past. Last week, the average >AP Photo/Manuel Balce Ceneta, File fixed mortgage rate topped 6%, its highest point in 14 years, which helps explain why home sales have tumbled. Credit card rates have reached their highest level since 1996, according to Bankrate.com. Inflation now appears increasingly fueled by higher wages and by consumers’ steady desire to spend and less by the supply shortages that had bedeviled the economy during the pandemic recession. Even so, some economists are beginning to express concern that the Fed’s rapid rate hikes

In fact, – the fastest since the early 1980s – will cause more economic damage than necessary to tame inflation. Mike Konczal, an economist at the Fed officials also forecast more jumbo-size hikes to come, raising their benchmark rate to roughly 4.4% by year’s end – a full point higher than they had envisioned as recently as June. Roosevelt Institute, noted that the economy is already slowing and that wage increases – a key driver of inflation – are levelling off and by some measures even declining a bit. Surveys also show that Americans are expecting inflation to ease significantly over the next five years. That is an important trend because inflation expectations can become self-fulfilling: If people expect inflation to ease, some will feel less pressure to accelerate their purchases. Less spending would then help moderate price increases. The Fed’s rapid rate hikes mirror steps that other major central banks are taking, contributing to concerns about a potential global recession. The European Central Bank raised its benchmark rate by three-quarters of a percentage point last week. The Bank of England, the Reserve Bank of Australia and the Bank of Canada have all carried out hefty rate increases in recent weeks. And in China, the world’s second-largest economy, growth is already suffering from the government’s repeated COVID lockdowns. If recession sweeps through most large economies, that could derail the U.S. economy, too.

Jerome Powell, chairman of the Federal Reserve

Vanessa de Mari,

AIA, president of the Puerto Rico Builder’s Association

A sense of urgency is a requirement for a true reconstruction

It’s been five years. And just when we thought we would start seeing our island rise again, Fiona decided we still have a long way to go. Time is of the essence, and we need to act quickly (or take action). It is time to press on, and stop this endless planning, where no one makes any decisions, be it for fear, lack of understanding, or just because bureaucracy has taken over our system. No other island in the Caribbean has been given the opportunity and the funds to rebuild a new infrastructure and start moving forward. The plans are in place. But instead, we remain stagnant. There is no excuse for having been so ill prepared to deal with the aftermath of Hurricane Fiona with such fragile infrastructure. How can we accept the fact that five years after María, we have not moved forward? Both the executive and legislative branches need to make the tough decisions and execute. In some matters they may fail, but in most, they should succeed. We must stop using legislation that is essential to the island’s reconstruction, as an element of negotiation. These are the issues that continue to stall our economic growth, and most importantly, our people’s well-being. Beyond our fragile infrastructure, there is the issue of lack of affordable housing. There are solutions. We must act on what is truly right and in benefit of the people. Income limits are a huge obstacle to make affordable housing possible. High costs make it impossible to create rental, low income, and senior homes. Right now, we have 4,217 rental units in planning phase since 2020. Twenty-four projects were submitted for the 4% QAP in the

NOFA-2020 round. Of the 17 eligible projects dated September 1, 2021, which represent 2,535 units, only

ONE has closed financing. We also need to create incentives for the construction of affordable and low-income housing. Since 2018, we have been all paying attention to the increasing costs of materials, which make these projects almost impossible. This was further worsened by the pandemic, to a point where the construction of these units is higher than the sales price established by law. Again, decisions must be made. Legislature must approve PC 1470 and PS 1005; reduce the costs that we can control, including permits, municipal taxes, patent, and agency impact fees; and finally, reestablish incentives for buyers under Act 169. It is time to identify and remove all these obstacles for Puerto Rico, to use federal funds assigned to programs that are already in motion, including R3, with the expeditious approval of PC 1063 so more families can benefit from these funds. These decisions will not only start providing relief to people in need of housing but will also create jobs and move our economy. It is time for all politicians, legislative branches, mayors, and government agencies to put aside the differences and work together to make things happen. Courage and will. That’s what it takes. Plus, an unselfish commitment to improve the wellbeing of all Puerto Rican’s.

Vanessa de Mari, AIA

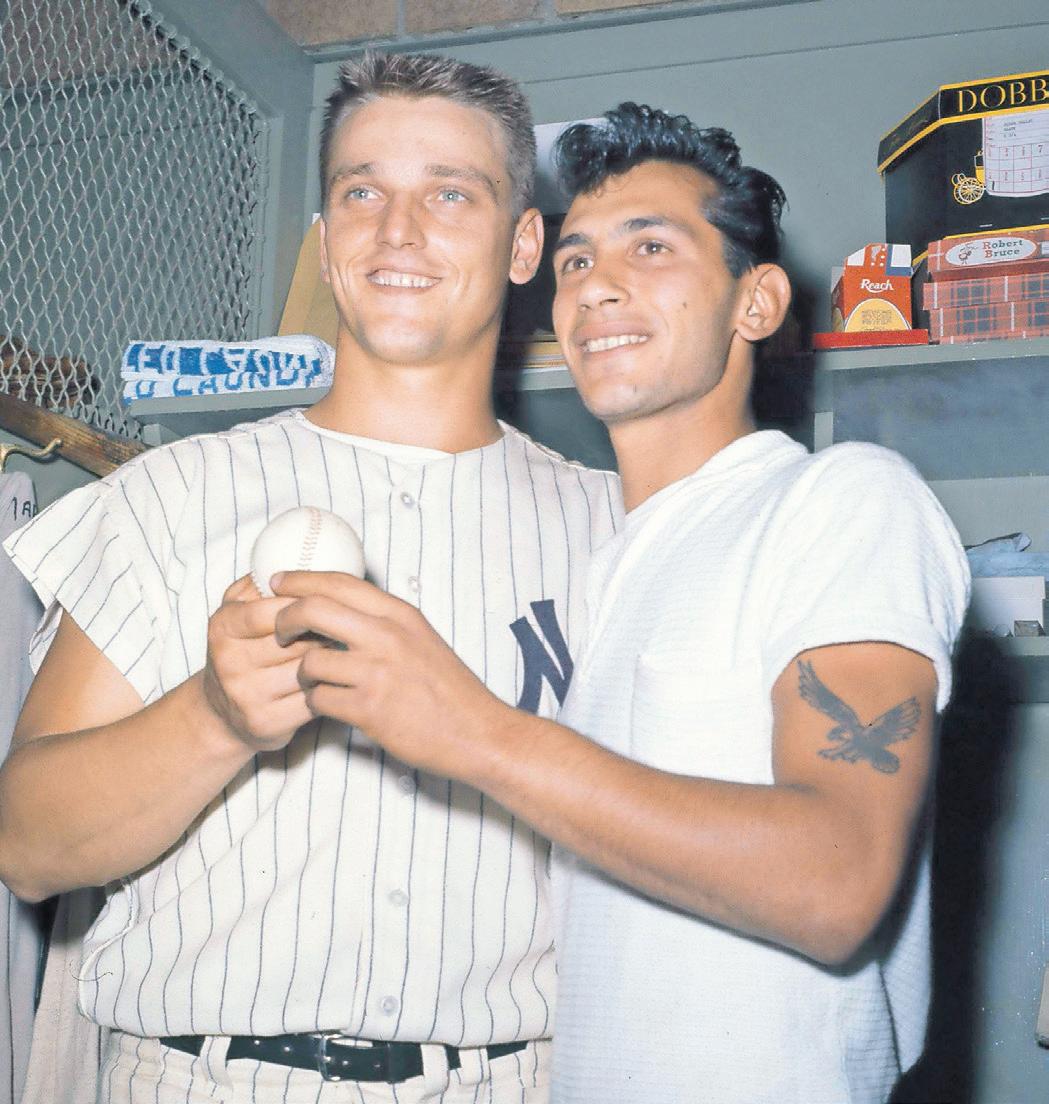

New York Yankees slugger Roger Maris poses with fan Sal Durante in the locker room at Yankee Stadium, Oct. 1, 1961, after hitting his 61st home run of the season. >AP Photo/File

In fact,

Great ball of fire: Return it or sell it?

Baseball fans catching famous souvenirs face a tricky choice

Noah Trister – The Associated Press

If Aaron Judge passes Roger Maris, some lucky fan might become this generation’s Sal Durante.

As a 19-year-old in 1961, Durante caught Maris’ record-breaking 61st home run. The story of what followed — Durante sold the ball for $5,000, and it was returned to Maris as part of the deal — sounds downright quaint by today’s standards. But it’s a reminder that, even six decades ago, fans who caught famous souvenirs faced a tricky choice: keep the ball, sell it, or give it back to the player who hit it?

With Judge now one away from tying Maris’ American League record, anyone who comes up with one of his home run balls could end up with a similar decision to make.

“I’d give it back. Not even a second guess,” said Kevin Heathwood, a 35-year-old teacher from Harlem who was at Wednesday night’s YankeesPirates game in New York. “It belongs to Judge and he earned every single thing that he’s gotten. Just being a part of it, that’s enough for me.”

Many fans share Heathwood’s view, feeling that if Judge wants the ball back, it wouldn’t be right for the fan to keep it. After all, it’s Judge’s moment. Fans are there to enjoy it and share in it — but why should a spectator insist on making a huge profit off a souvenir he or she received simply from being in the right place at the right time?

On the other hand, keeping a record-setting ball and selling it could yield a life-changing amount of money, which could mean far more to the fan than the ball does to the player. And besides, if Judge — or any other famous slugger — really wants the ball that badly, presumably he can afford to pay just about any asking price.

“I’m a big Yankee fan, a big Judge fan and I would certainly work with them, but I would not just give the ball away,” said Danny McDonough, a 32-year-old from Levittown, New York, who attends Seton Hall Law School. “You’re holding a very valuable piece of property and I think you’re foolish if you just give it up without anything substantial for yourself. Not that I wouldn’t like to do that for Judge and the organization. It’s too big of an opportunity to pass up.”

Bob Fay of Watertown is a 63-year-old memorabilia collector who was also at the game. Not surprisingly, his opinion is similar to McDonough’s.

“I’m going to take it home and I’m going to make a million dollars off it,” he said. “If I give it to anybody, I’ll donate it to the Hall of Fame.”

In 1998 — when Mark McGwire and Sammy Sosa were the ones chasing Maris — Durante said he actually did think about giving the 61st home run ball back to Maris. But the slugger told him to keep it and make what he could off it. He eventually sold it to a restaurant owner named Sam Gordon, who then gave it to Maris in a photo op with him and Durante.

Maris gave the ball to the Hall of Fame in 1973.

It’s not always clear who even has the right to the ball. When Barry Bonds hit his 73rd home run in 2001, one man caught it, but it was jarred loose and another man picked it up. They ended up in court, and a judge decided they should sell the ball and split the proceeds.

There’s less controversy when a famous home run is hit to an area fans can’t access. When Hank Aaron hit his 715th homer to pass Babe Ruth, Braves pitcher Tom House caught the ball in the bullpen and immediately went to give it to the Atlanta slugger.

When Mark McGwire passed Maris with his 62nd homer in 1998, St. Louis Cardinals grounds crew member Tim Forneris picked up the ball and gave it back. He got quite a bit of good publicity for that gesture — plus a minivan from Chrysler.

For some fans, there’s a middle ground between selling the ball for as much as possible or giving it back to the player for nothing. At the very least, they’d like the chance to meet him — and perhaps get a few other items of high sentimental value.

“If I caught the ball, honestly I would really want to meet Judge, hand the ball to him myself. Maybe get a signed ball, a signed bat, a signed jersey, talk to him a little bit,” said Rob Casales, a 25-yearold financial analyst from Jersey City, New Jersey, who bought tickets for Wednesday, Thursday, Friday and Saturday after Judge hit his 60th homer Tuesday. “If I’m feeling a little frisky maybe ask for playoff tickets, but I wouldn’t try to extort the Yankees for hundreds of thousands of dollars even though I know a lot of people are going to try and do that,” he added. “It’s not really my move. I love the Yankees too much. I love Aaron Judge too much.”

Rob Siwiec, a 26-year-old from Bayonne, New Jersey, who works at a law firm, said he’d like a photo with Judge, an autograph, some merchandise — and perhaps some playoff tickets.

And he had another idea as well — one that Durante and Maris never had to consider.

“I would request that he follow me on either Twitter or Instagram,” Siwiec said, “and shout me out.”

-Danny McDonough, baseball fan

Book shows personal side of ‘Mockingbird’ author Harper Lee

Jay Reeves - The Associated Press

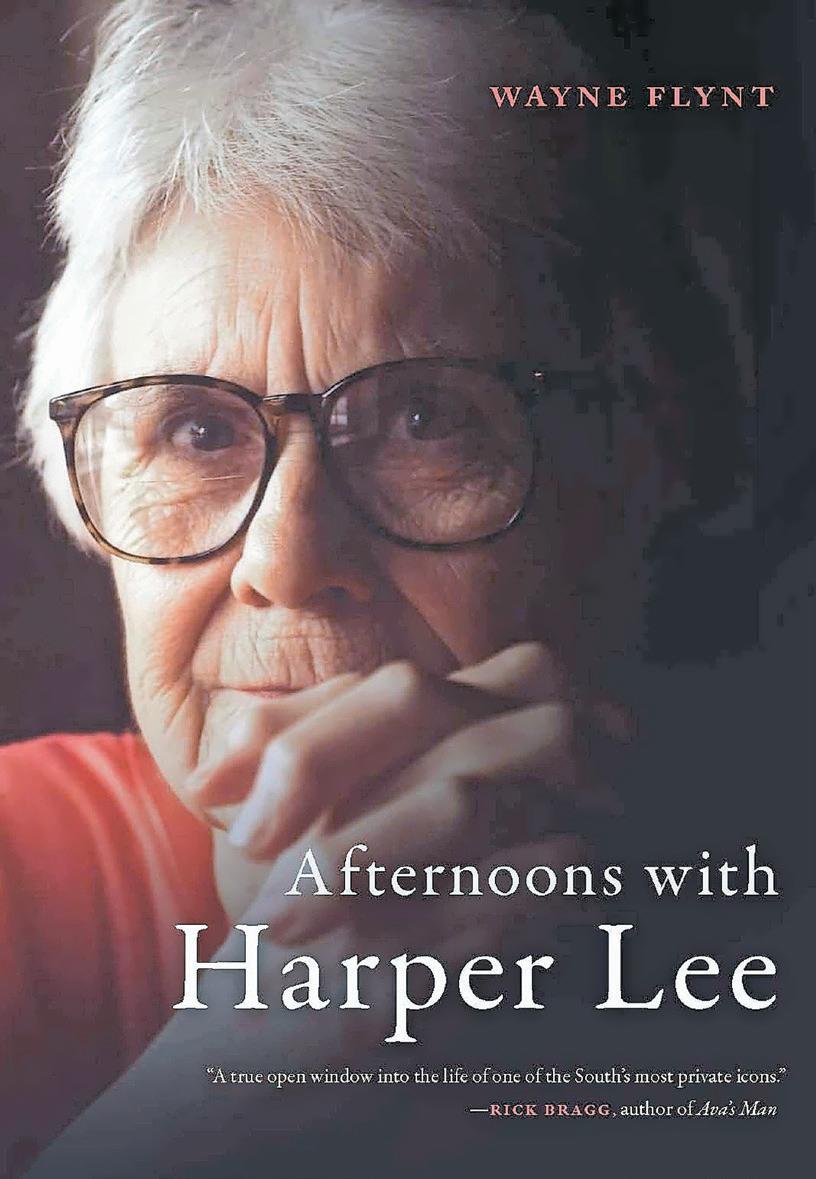

HOMEWOOD, Ala. — To the world, Harper Lee was aloof to the point of being unknowable, an obsessively private person who spent most of her life avoiding the public gaze despite writing one of the best-selling books ever, “To Kill a Mockingbird.” To Wayne Flynt, the Alabama-born author was his friend, Nelle.

Flynt, a longtime Southern historian who became close friends with Nelle Harper Lee late in her life, has written his second book about the author, “Afternoons with Harper Lee,” which was released Thursday with Flynt signing copies at a bookstore in suburban Birmingham.

Based on Flynt’s notes from dozens of visits with Lee over a decade before her death in 2016, the book is like sitting on a porch and hearing tales of Lee’s childhood and family in rural Alabama, her later life in New York and everything in between. That includes the time a grandfather who fought for

the Confederacy survived the Battle of Gettysburg despite heavy losses to his Alabama unit, according to Flynt.

“I told her, ‘You know, half the 15th of Alabama was either killed or wounded or captured, and he got away? Is that just luck or the providence of God? What in the world is that?’” Flynt said in an interview with The Associated Press.

“And she said, ‘No, it’s not the providence of God. He could run fast.’”

The public perception of Lee as a hermit is wrong, Flynt, a former history professor at Auburn University, said. No, she didn’t do media interviews and she guarded her privacy zealously, but she also was warm and kind to friends that included a former first lady, Lady Bird Johnson, Flynt said. And Lee was “deeply religious” in a way many people aren’t, he said.

“It’s an attempt to tell the story of the authentic woman, not the marble lady,” Flynt said.

Wayne Flynt, author

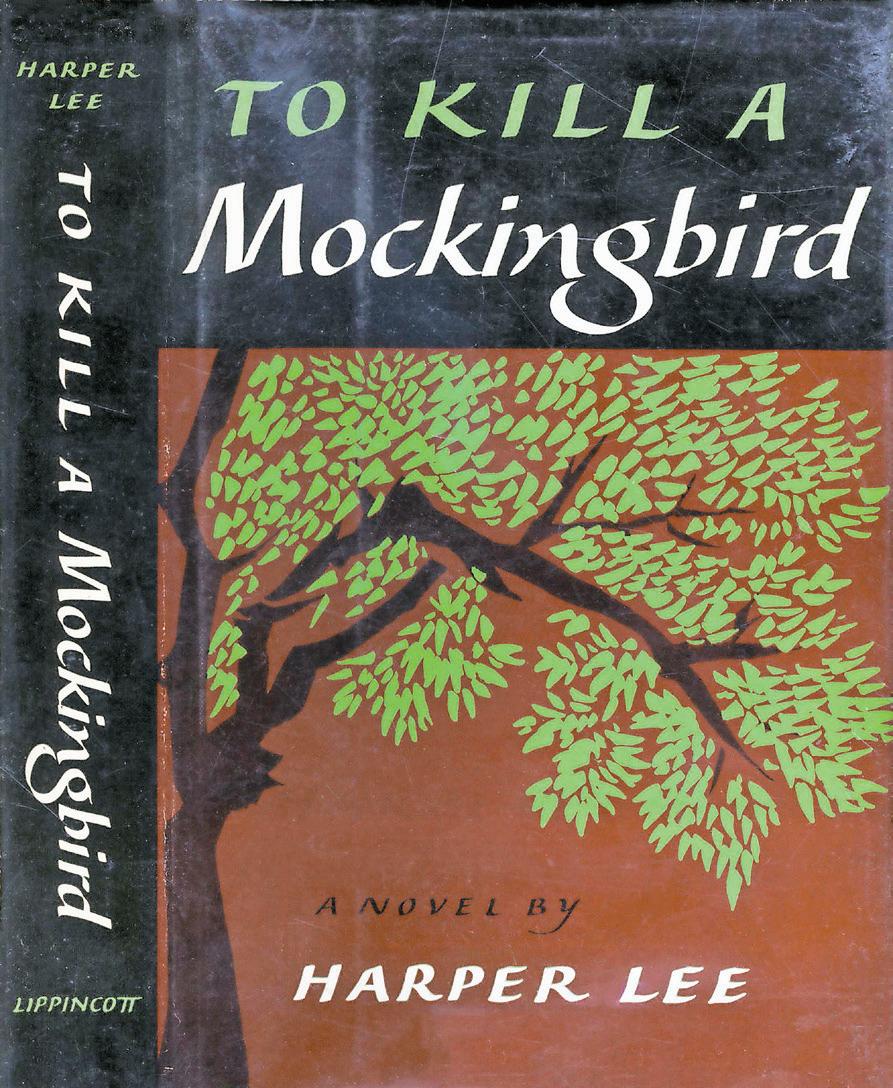

First edition of “To kill a mockingbird,” Harper Lee’s classic novel. This cover image released by NewSouth Books shows “Afternoons with Harper Lee” by Wayne Flynt. >NewSouth Books via AP

The book also is a tribute to Flynt’s late wife Dartie, who died in 2020. Lee, who suffered a stroke in 2007, seemed to identify with the physical travails of Dartie Flynt, who had Parkinson’s disease, Flynt said.

“I think she tolerated me because she loved Dartie,” he said.

Born in 1926 when the South was still racially segregated by law, Lee grew up in the south Alabama town of Monroeville, the daughter of a lawyer who served as a model for attorney Atticus Finch in “To Kill a In fact, Mockingbird,” a story of race, injustice and the law during the Jim Crow era. The town itself became Maycomb, the book’s setting. Preferring football, softball, golf and books to smalltown social affairs or college sororities, Lee’s well-known Lee was the daughter of a lawyer who served as a model for attorney Atticus Finch in “To Kill a Mockingbird.” desire for privacy may have come in part from a feeling of being different from others growing up around her in the South, Flynt said.

“I think she occupied a world where she felt she was not like other girls,” he said.

A childhood friend of fellow author Truman Capote, Lee was rarely heard from in public after her partly autobiographical “Mockingbird” won the Pulitzer Prize in 1961 and was made into a hit movie. She mostly lived in an apartment in Manhattan, where it was easier to blend in than back home until the stroke left her partially paralyzed.

Flynt and his late wife knew Lee’s two sisters, and they became close to the author after she returned to Alabama for good following the stroke. They visited her at a rehabilitation center in Birmingham and then at an assisted living home in Monroeville, where she spent years before her death. Lee died just months after the release of her novel “Go Set a Watchman,” which actually was an early version of “Mockingbird.” The book doesn’t get into the most private aspects of Lee’s life; Flynt said they simply didn’t discuss such things. But it does recount her worsening isolation from deafness and blindness toward the end of her life; her love of gambling; the furor over “Watchman;” and her authorship of a still-unpublished manuscript about a bizarre murder case in central Alabama. Lee was steeped in literature and religion, Flynt said. She preferred the King James Version of the Bible to all others for its lyrical language, he said, and her favorite authors included Jane Austen and C.S. Lewis. “When she died, on her ottoman in her little two rooms, was the complete anthology of all of C.S. Lewis’ books. It must have weighed 50 pounds,” he said. “Afternoons With Harper Lee” is a followup to Flynt’s “Mockingbird Songs: My Friendship with Harper Lee.” While the first book was based on letters between the two, the new book is more meandering and conversational than the first in the tradition of Southern storytelling. “The letters are lifeless compared to the stories,” he said.