UNDERSTANDING THE BACKGROUND & OBJECTIVES OF THE MARKET PLAYBOOKS

In today’s rapidly evolving tourism landscape, Abu Dhabi's bold and ambitious Tourism Strategy 2030 sets the stage for a new chapter in its journey to become a leading, top-of-mind global destination. This ambitious plan serves as a catalyst for strategic initiatives, including comprehensive research projects designed to enhance the emirate's reputation, solidify its unique positioning, and significantly increase visitor numbers

The Market Playbooks are one of the outcomes of these initiatives. They are data-driven guides that provide valuable insights into 25 international markets , enabling Abu Dhabi to better inform and prioritise its offering and marketing strategies

By carefully segmenting target audiences in these 25 markets, the playbooks align their profiles with Abu Dhabi’s diverse product offerings. This is the executive summary of these playbooks. This report is a strategic asset, enabling the Abu Dhabi tourism ecosystem to tailor its marketing efforts with precision, ensuring every campaign resonates deeply and drives significant results. It is one of the cornerstones of Abu Dhabi's data-led approach to achieving its visionary visitation goals.

01 02 03 04 05

Audience Segmentation is more inclusive

Includes travellers who could find Abu Dhabi to be a fit today or in 5 years.

Can be applied and measured in other research conducted by various stakeholders utilising this data.

Has limited overlap between them. Contains depth of actionable segment profiles and insights.

And many more sections are covered in the detailed market reports...

A total of 36,000 interviews were conducted with international travellers from 25 markets, with a 95% statistical confidence level and a 2.6% margin of error

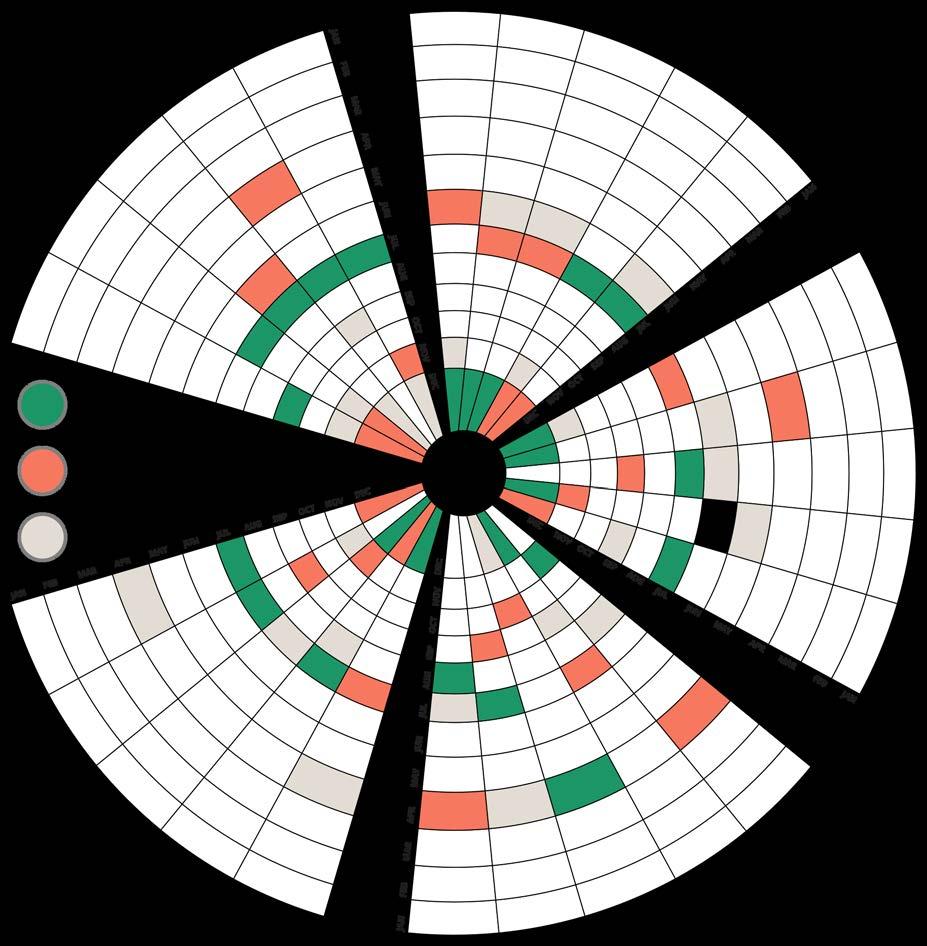

Research confirms that June - July is the most reported travel season due to regular summer holidays across most markets (particularly in the northern hemisphere). December is another peak travel period, due to the holiday and New Year season.

January to March is the period with the lowest preferred travel time across all markets.

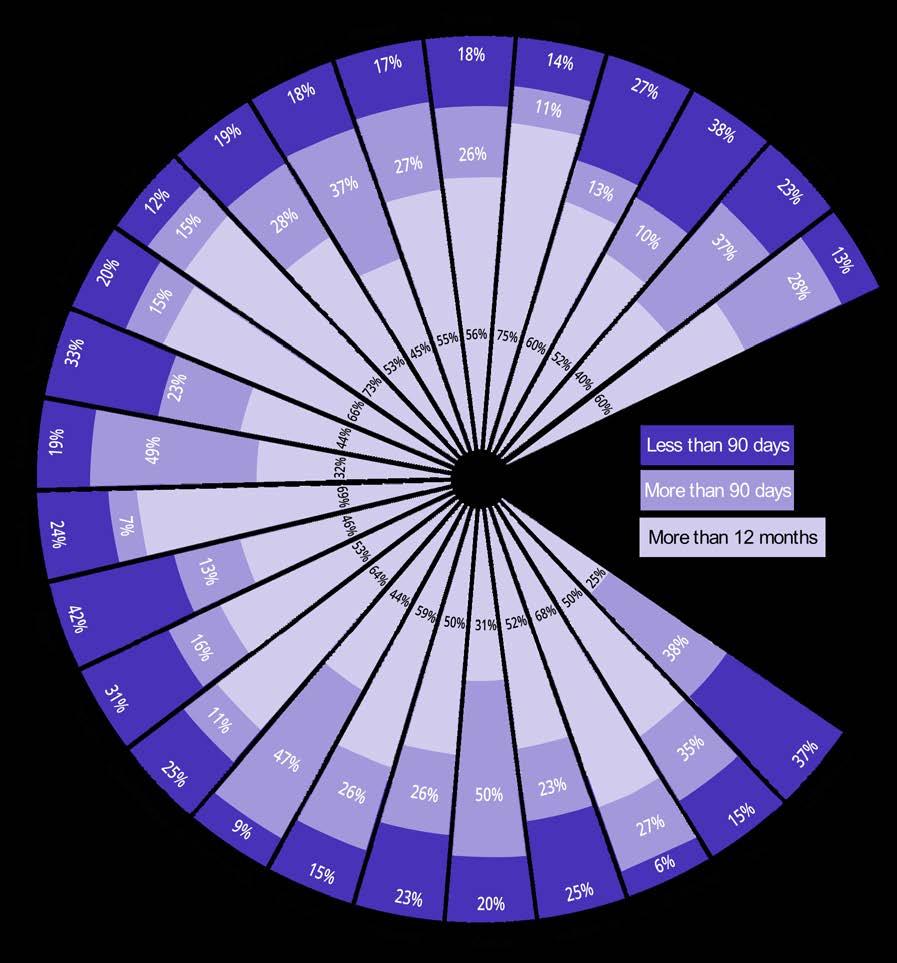

Three Intervals: Irrespective of the destination chosen, three distinct travel planning intervals emerged, spanning from the initial research phase to the travel date. We categorised these into three types of travellers: Early Researchers, Planners, and Spontaneous Travellers. While all markets had a mix of these segments, their prevalence varied significantly.

Early Researchers: These travellers begin their international destination research more than 12 months before their trip. In markets like Italy, USA, Armenia, Canada, China, and India, this segment makes up over 60% of travellers.

Planners: This group begins their international destination research and planning 3 to 12 months prior to their travel date. This segment was most common in Qatar, Belgium, and the Netherlands.

Spontaneous Travellers: These travellers have a short gap between their international destination research and their travel date. Though not the largest segment in most markets, this group was particularly high (30%-45%) in Egypt, Germany, Uzbekistan, Bahrain, and Japan

Understanding traveller behaviour is essential for the tourism industry. By analysing data on party size, party makeup (e.g., families, couples), length of stay, and spending habits, various stakeholders can create more effective strategies. This information enables hotels, attractions, malls, tour operators, and other stakeholders to tailor their offerings, optimise pricing, and develop targeted products that cater to specific customer groups, leading to more personalised experiences for travellers, giving Abu Dhabi’s tourism ecosystem a competitive edge.

Markets with the highest spending per person per day are the USA, Canada, Qatar, Kuwait, Russia, UK, Germany, Saudi Arabia, Japan, Italy, and China.

TRAVELLING INTERNATIONALLY DURING A PUBLIC HOLIDAY

Combining remote work and international travel is a growing trend. In places like Germany, Italy, the UK, Bahrain, Canada, the Netherlands, Qatar, and Romania, nearly half of all travellers work from anywhere and combine international leisure travel while working remotely.

% of those who travel internationally among the people who work from anywhere

WHEN FINALISING THE SELECTION OF A DESTINATION

International travel is driven by a few key motivations

Above all, travellers want to feel safe and have easy access to a destination. They also seek a variety of activities and experiences that cater to their interests. Beyond these essentials, what elevates a trip is cultural immersion. This includes enjoying great food, exploring a location's rich history, and experiencing the local culture firsthand. These motivators collectively shape the decisions travellers make, from the choice of a destination to how they spend their time.

1.Safety & security of the destination

2.Multiple activities in less time

3.Personalised experiences

1.Safety & security of destination

2.Climate & weather at destination

3.Wide range of activities and attractions

2.Direct flights

1.Safety & security of the destination

2.Mix of accommodations

3.Direct flight BAHRAIN

1.Safety & security of the destination

2.Rich in culture, history & tradition

3.Local & international cuisine available

1.Safety & security of destination

2.Well-connected public transportation

3.Budget of the overall trip

1.Safety & security of destination

2.Climate & weather at destination

3.Local and international cuisine available

1.Local & international cuisine available

2.Direct flights

3.Safety of special groups

1.Local & international cuisine available

2.Climate & weather at destination

3.Combine multiple activities in less time

1.Wide range of activities & attractions

3.Ease of reaching destinations – flights, visa, transport etc.

1.Safety & security of destination

2.Climate & weather at destination

3.Proximity to home country

1.Wide range of activities and attractions

2.Local and international cuisine available

3.Ease of reaching destination – flight, visa, transport

1.Safety & security of the destination

2.Wide range of activities and attractions

3.Safety of special groups

1.Safety & security of the destination

2.Experiences offered at the destination

3.Proximity to home country

1.Rich in culture, history & tradition

2.Wide range of activities

3.Proximity to home country

1.Well-connected public transport

2.Mix of accommodation

3.Proximity to home country

1.Direct flights

2.Mix of accommodation

3.Rich in culture, history & tradition

1.Safety & security of destination

2.Local and international cuisine available

3.Rich in culture, history & tradition

1.Safety & security of destination

2.Direct flights

3.Well-connected public transportation

1.Direct flights

2.Wide range of activities & attractions

3.Proximity to home country RUSSIA

1.Direct flights

2.Ease of reaching the destination

3.Rich in culture, history & tradition SAUDI ARABIA

1.Climate and weather at destination

2.Well-connected public transportation

3.Rich in culture, history & tradition

1.Safety and security of the destination

2.Climate and weather at destination

3.Proximity to home country

USA

1.Climate & weather at the destination

2.Wide range of activities & attractions

3.Well-connected public transport

UK

1.Safety & security of destination

2.Rich in culture, history & tradition

3.Experiences offered at the destination

1.Well-connected public transportation

2.Wide range of activities

3.Direct flights UZBEKISTAN

In each market, travellers are inspired by over 20 different sources when choosing a destination. This chart, however, focuses on just the top three sources in each market.

RECOMMENDED BY FRIENDS & FAMILY

AI TOOLS

The data reveals a clear distinction between common and niche sources. While some, like social media, consistently rank among the top three in many markets, others—such as destination websites, word of mouth, and attraction ads—only appear in the top three for specific markets.

TELEVISION PROGRAMMES / MOVIES

TRAVEL BLOGGERS

SOCIAL MEDIA ADS

WEBSITES OFTRAVEL AGENCIES

DESTINATION WEBSITE

WORD OF MOUTH

ATTRACTION ADS

Inspiration for international travel is increasingly digital and personal:

Social Media Leads the Way: Instagram, Facebook, TikTok, YouTube, and Snapchat are the main platforms travellers look for inspiration. Travellers seek visually rich, engaging, and platform-specific content that captures their attention.

Trusted Voices Matter: Recommendations from friends and family continue to influence travel choices. Word-of-mouth remains one of the strongest ways to build trust and interest.

Influencer and Celebrity Endorsements: Collaborating with global celebrities and local influencers can help create excitement and motivate travellers to visit.

The Growing Role of AI: Artificial Intelligence tools are becoming more important for providing travel suggestions. In the future, AI-driven, personalised recommendations will likely play a key role in how travellers decide where to go.

THE

MAPPING THE

1.Travel agencies/tour operators

2.Travel trends

3.User generated content ARMENIA

1.Celebrity endorsements

2.User generated content

3.Travel bloggers/vloggers CANADA

1.Celebrity endorsements

2.Travel agencies/tour operators

3.Social media ads from destination BAHRAIN

1.Travel agencies/tour operators

2.Posts shared by friends & family

3.Celebrity endorsements EGYPT

1.Posts shared by friends & family

2.Influencer collaborations 3.Travel bloggers/vloggers CHINA

1.Travel agencies/tour operators

2.Travel bloggers/vloggers

3.Posts shared by friends & family FRANCE

1.Posts shared by friends & family

2.Travel-focussed social media accounts

3.Influencer collaborations BELGIUM

1.Posts shared by friends & family

2.Travel vloggers/bloggers

3.Celebrity endorsements INDIA

1.Travel-focussed social media accounts

2.User generated content

3.Influencer collaborations GERMANY

1.Travel agencies/tour operators

2.Travel vloggers/bloggers

3.Celebrity endorsements ITALY

1.Posts shared by friends & family

2.Travel photographers

3.Travel magazines/ publications JAPAN

1.Travel agencies/tour operators

2.Travel photographer

3.Live streaming KAZAKHSTAN

1.Travel agencies/tour operators

2.Celebrity endorsements

3.Posts shared by friends & family KUWAIT

1.Travel vloggers/bloggers

2.YouTube travel guides

3.Influencer collaborations

1.Travel agencies/tour operators

2.Travel vloggers/bloggers

3.Influencer collaborations

1.Travel bloggers/vloggers

2.User generated content

3.Travel magazines/ publications POLAND

1.Influencer collaborations

2.Travel agencies/tour operators

3.Travel photographers

1.Travel agencies/tour operators

2.Travel trends

3.YouTube travel guides RUSSIA

1.Posts shared by friends & family

2.Social media ads from destination

3.Travel-focussedsocial media accounts

1.Social media ads from destination

2.Travel vloggers/bloggers

3.Live streaming SPAIN

1.Influencer collaborations

2.Social media ads from destination

3.Celebrity endorsements USA

1.Celebrity endorsements

2.Posts shared by friends & family

3.Travel magazines/ publications ROMANIA

1.Posts shared by friends & family

2.Travel-focussed social media accounts

3.Travel agencies/tour operators

1.Live streaming

2.Travel bloggers/vloggers

3.Celebrity endorsements UK

1.Travel agencies/tour operators

2.Posts shared by friends & family

3.Travel-focussed social media accounts

The study found key perceptions that, if addressed well, can become opportunities to attract more visitors:

Cultural Sensitivities:

Travellers from various markets have reported concerns about the modest dress code expected from women in public places, out of respect for local customs in Abu Dhabi. Additionally, some visitors are mindful of the restrictions on alcohol consumption, which are primarily limited to licensed venues like hotels and restaurants.

Visit Expenses Concern:

Some travellers perceive the costs associated with visiting, staying, or getting around Abu Dhabi as a significant barrier. They may feel that accommodation, dining, and transportation expenses are prohibitively high, making a trip to Abu Dhabi seem out of reach.

Weather Concerns:

The intense heat of the summer months is a significant deterrent for some travellers, as it can make outdoor activities uncomfortable or even unsafe. This extreme climate severely limits a visitor's experience, restricting outdoor engagement to only the cooler hours of the day. Additionally, the high temperatures can complicate movement between various outdoor attractions, as walking or waiting for transportation becomes challenging.

The top barrier reported by the countries when considering Abu Dhabi as a destination to visit was unfavourable weather, except for China, Belgium, Canada, & Kazakhstan.

High costs of travel and accommodation were highly reported as a barrier to visiting Abu Dhabi, except for the UK, USA, Bahrain, Canada, Poland, Romania, Spain, & Uzbekistan. 01 02 03

The majority of the countries reported restrictions on alcohol consumption as a barrier to visiting Abu Dhabi, except for China, Italy, Russia, Belgium, Kazakhstan, Oman, & Romania.

OTHER BARRIERS TO VISITING ABU DHABI

RESTRICTION ON WOMEN’S CLOTHING

Germany | India | Italy | Saudi Arabia | UK | Armenia | China | Bahrain| Belgium | Japan | Kazakhstan | Oman | Poland

HIGH COST OF ACTIVITIES & EXPERIENCES

France | Germany | Italy | Romania | Egypt | Poland | UK | USA | Canada | South Korea | Kazakhstan | Spain

LIMITED TRANSPORT OPTIONS

Italy | Kuwait | Russia | Armenia | Canada | Kazakhstan | Japan | Egypt | Belgium

LANGUAGE BARRIERS

China | France | India | Russia | Japan | Romania | South Korea | UK

CROWDED DESTINATION

China | USA | Armenia | Belgium | Egypt | Netherlands | Romania | Uzbekistan

NEGATIVE REVIEWS

Egypt | Japan | Romania | Uzbekistan | Oman | Netherlands | Spain

LIMITED ENTERTAINMENT OPTIONS

Saudi Arabia | Bahrain | Qatar | USA | Netherlands | Spain

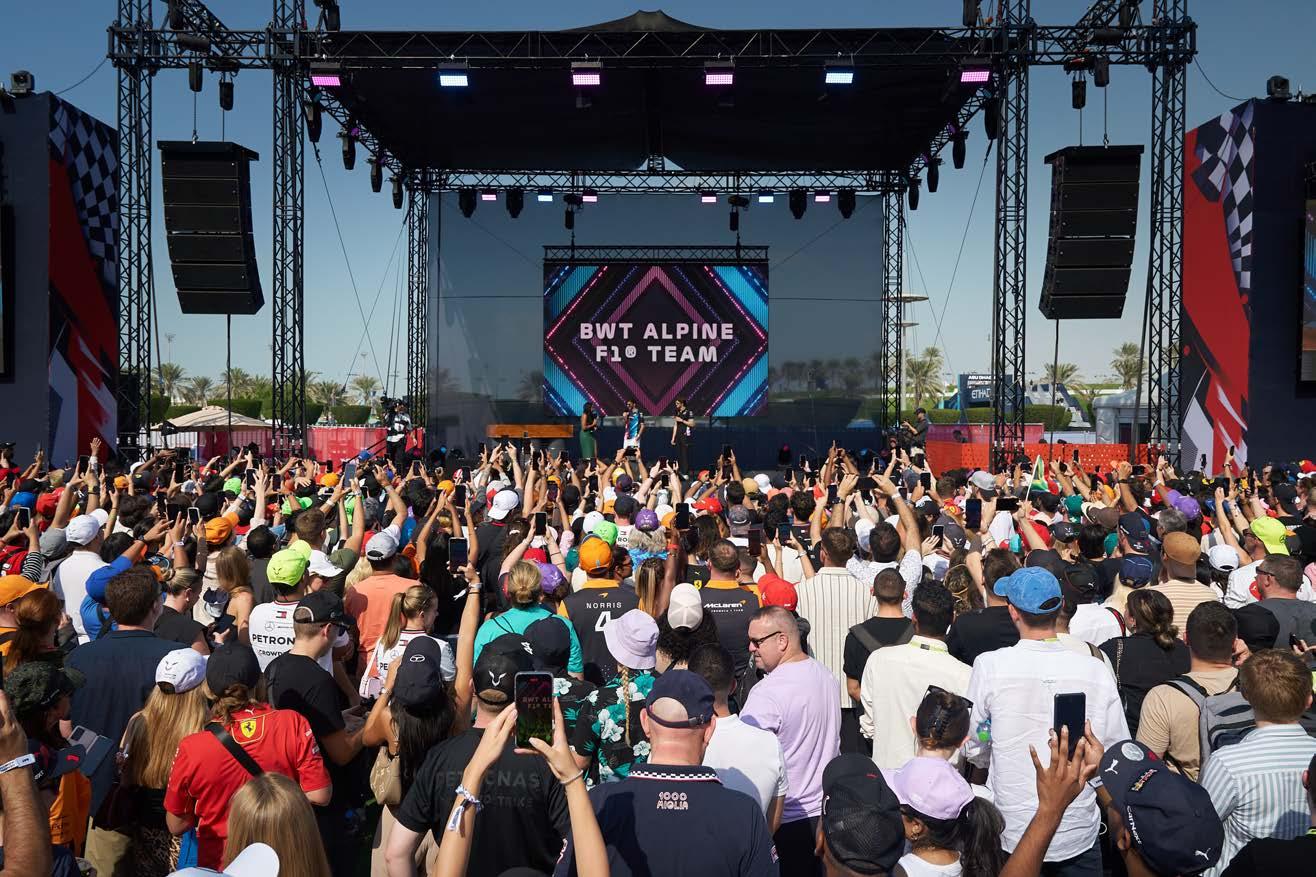

Travellers are willing to travel up to 6.5 hours to attend certain events, making many European, Asian, and Middle Eastern markets reachable

European Travellers:

They are especially interested in cultural events, music festivals, and large-scale mega-events.

Middle Eastern and Asian Travellers:

They show interest in a wider range of events, including culture, art, music, sports, mega-events, and comedy shows

TO ATTEND TYPE OF EVENTS THAT PEOPLE TRAVELLED INTERNATIONALLY

Travellers are open to 8–12-hour stopovers that don’t disrupt their main trip. They often see these stopovers as chances to save money or enjoy special deals.

Key Drivers:

The cost of the stopover and the availability of attractive bundled offers are key considerations for travellers. They are looking for value, with factors like free or discounted hotel stays and bundled tours playing a significant role in their decision-making process. These offers can make a stopover more appealing by providing a comprehensive and economical experience.

Shopping Incentives: Strategic Bundling:

Stopovers can be paired with appealing offers such as food and beverage credits, spa experiences, or unique cultural attractions like teamLab Phenomena to increase their value.

Shopping experiences that blend various retail options, such as modern malls and traditional souks, are a compelling draw for a stopover. This unique mix offers a wide range of products, from luxury brands to local goods, providing a diverse retail experience that can entice travellers to include a stopover destination in their primary holiday plan.

1.Exploring multiple destinations in one trip

2.Relaxing/unwinding in new environment

3.Cost of stopover

1.Saving money on flights (cheap connections)

2.Cost of stopover

3.Take advantage of special deals by airlines/agencies

1.Saving money on flights (cheap connections)

2.Take advantage of special deals by airlines/agencies

3.Cost of stopover

1.Opportunity to combine business & holiday

2.Relaxing/unwinding in new environment

3.Saving money on flights (cheap connections)

1.Take advantage of special deals by airlines/agencies

2.Convenient locations

3.Exploring multiple destinations in one trip

1.Take advantage of special deals by airlines/agencies

2.Cost of stopover

3.Engaging in a specific activity/experience

1.Saving money on flights (cheap connections)

2.Exploring multiple destinations in one trip

3.Cost of stopover

1.Saving money on flights (cheap connections)

2.Cost of stopover

3.Breaking a long journey

1.Saving money on flights (cheap connections)

2.Opportunity to combine business & holiday

3.Cost of stopover

1.Saving money on flights (cheap connections)

2.Exploring multiple destinations in one trip

3.Cost of stopover

1.Cost of stopover

2.Engaging in a specific activity/experience

3.Easy visa and entry requirements

1.Saving money on flights (cheap connections)

2.Cost of stopover

3.Opportunity to combine business & holiday

1.Opportunity to combine business & holiday

2.Convenient locations

3.Saving money on flights (cheap connections)

1.Opportunity to combine business & holiday

2.Saving money on flights (cheap connections)

3.Cost of stopover

1.Take advantage of special deals by airlines/agencies

2.Opportunity to combine business & holiday

3.Engaging in a specific activity/experience

1.Saving money on flights (cheap connections)

2.Cost of stopover

3.Opportunity to combine business & holiday

1.Cost of stopover

1.Saving money on flights (cheap connections)

2.Cost of stopover

3.Opportunity to combine business & holiday

2.Take advantage of special deals by airlines/agencies

3.Convenient locations ROMANIA

1.Saving money on flights (cheap connections)

2.Convenient locations

3.Breaking a long journey RUSSIA

1.Engaging in a specific activity/experience

2.Saving money on flights (cheap connections)

3.Relaxing/unwinding in new environment

1.Opportunity to combine business & holiday

2.Convenient locations

3.Take advantage of special deals by airlines/agencies

1.Saving money on flights (cheap connections)

2.Cost of stopover

3.The chance to earn miles USA

1.Opportunity to combine business & holiday

2.Take advantage of special deals by airlines/agencies

3.Saving money on flights (cheap connections)

1.Take advantage of special deals by airlines/agencies

2.Opportunity to combine business & holiday

3.Engaging in a specific activity/experience

UZBEKISTAN

1.Take advantage of special deals by airlines/agencies

2.Breaking up a long journey

3.Relaxing/unwinding in new environment

DINING & SHOPPING

THE LIST OF FAVOURITE STOPOVER ACTIVITIES

INDULGING IN F&B OUTLETS

Across all 25 countries, travellers agree: indulging in food & beverage is the top stopover activity

SHOPPING

Travellers from 23 out of 25 countries reported shopping as one of their top stopover activities with the exception of Kuwait and Romania

25

COUNTRIES

23

COUNTRIES

OTHER ACTIVITIES INCLUDE RELAXING AND UNWINDING, SIGHTSEEING AND UNIQUE EXPERIENCES

RELAXING & UNWINDING

China | France | Germany | Italy | Kuwait | UK | Armenia | Bahrain | Canada | Qatar | Romania | South Korea | Uzbekistan

13 COUNTRIES

SIGHT SEEING

Saudi Arabia | Egypt | Kazakhstan | Oman | Romania | USA | Japan | Netherlands | Poland | Russia | Armenia

11 COUNTRIES

UNIQUE EXPERIENCES

India | Russia | Kuwait | Spain

04 COUNTRIES

To get a clear picture of what people want when they travel, information was collected about their habits, spending, and reasons for travelling. All this raw information is like a big pile of puzzle pieces. To make sense of it all, it was sorted into smaller, more organised groups. This process is called segmentation, and it helps identify different types of travellers. Each group, or segment, is made up of people who have similar likes and dislikes when it comes to travel. Understanding these groups helps to show what each type of traveller is looking for. The next section will show you these specific groups and what makes each one unique. The goal of segmentation is to be more relevant to the general target audience, hence, increase likelihood to travel to Abu Dhabi and compete better against the many options that people have for vacations.

I travel to experience new cultures and learn about different traditions.

I visit the most popular places, seek out globally hyped attractions or events, and enjoy fun activities.

My travels are often about shopping, luxury trips and, romantic getaways, experiencing new cuisines and restaurants.

I choose my travel destinations based on the experiences they offer.

I travel to visit family and friends, connect with loved ones and the community around me, and seek comfort in familiar and safe places.

I seek adventure to challenge myself, and I value time alone to replenish my energy.

I seek authentic and unique experiences that help me feel more connected to the world.

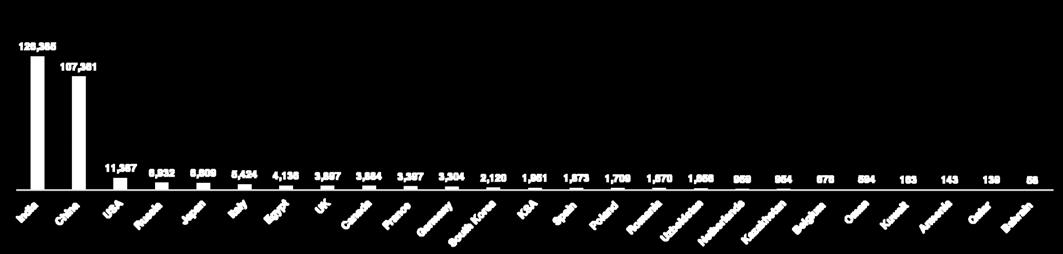

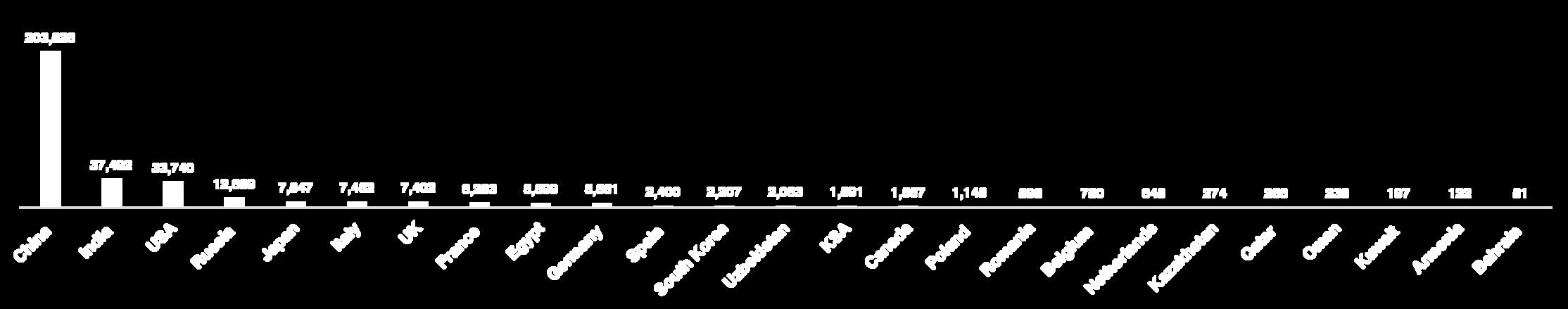

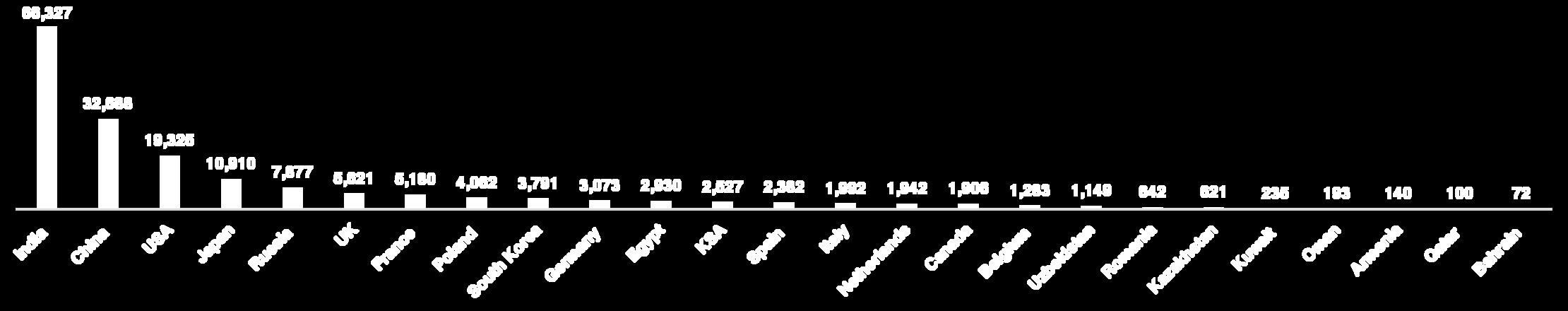

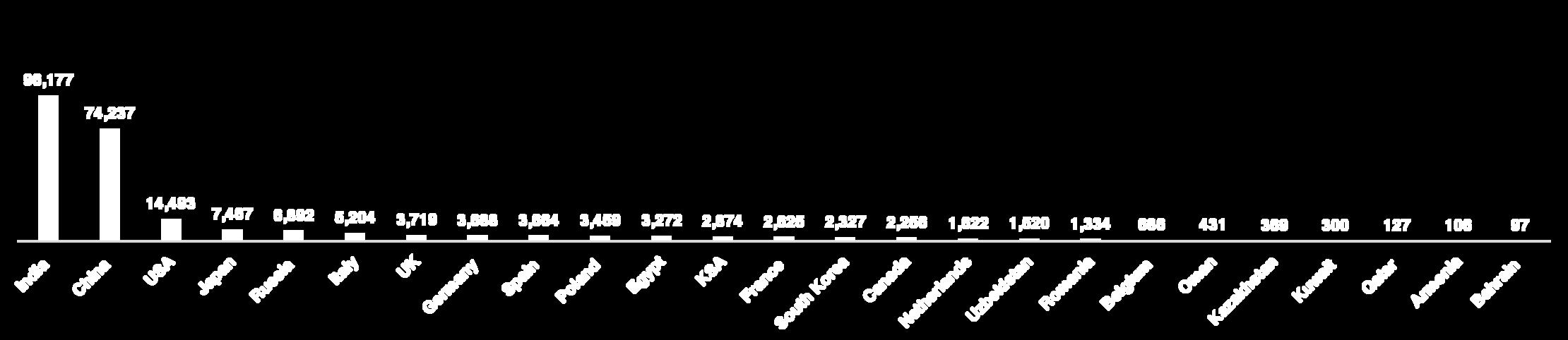

TOP 5 COUNTRIES

TOP 5 COUNTRIES

TRENDY FOMO TRAVELLER

TOP 5 COUNTRIES

CURIOUS EXPERIENCE SEEKER

TOP 5 COUNTRIES

TOP

TOP 5 COUNTRIES

AUTHENTICITY-SEEKING PLANNERS

TOP 5 COUNTRIES

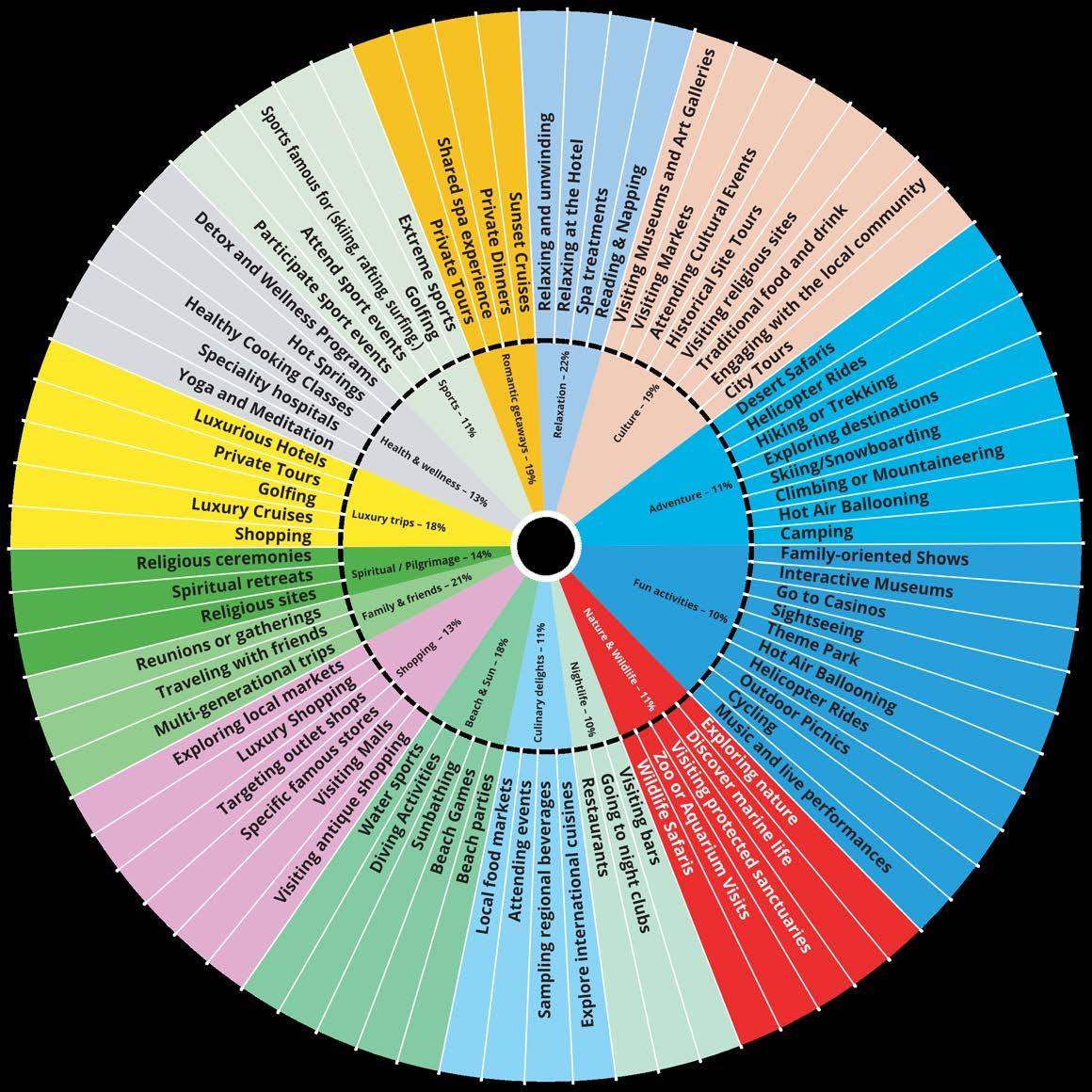

To create a traveller – led view of tourism sector, the 78 tested experiences were clustered based on overlapping traveller demand, ie experiences sharing a high degree of crossover grouped together most closely. The analysis revealed 15 broad clusters of related experiences, which can be used to target travellers, destination and itineraries effectively. Individual experiences are explored in detailed through the following infographics.

The same colour is used for the experience and its related broader cluster of experiences.

BROAD CLUSTERS OF ACTIVITIES TRAVELLERS INTEND TO DO WHILE ON VACATION (overall).

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

*Insights in this section are linked to travel in general, not specific to Abu Dhabi

BROAD CLUSTER OF ACTIVITIES ARMENIAN TOURISTS INTEND TO DO WHILE ON VACATION

ARMENIAN TOURISTS WANT THEIR HOLIDAY TO HAVE “RELAXATION” FOLLOWED BY MEETING “FRIENDS AND FAMILY” AND BEING A “ROMANTIC GETAWAY”

TOP EXPERIENCES ARMENIAN TOURISTS INTEND TO DO WHILE ON VACATION

ARMENIA TOURISTS WANT TO “RELAX AT THE HOTEL” FOLLOWED BY HAVING A “MULTI-GENERATIONAL TRIP” AND BEING ABLE TO “RELAX AND UNWIND”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY ARMENIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

% are not willing to visit Abu Dhabi

High cost of travel/accommodation in Abu Dhabi

The weather is not favourable

Cultural restrictions (women’s clothing)

Crowded destination

Cultural restrictions (alcohol consumption)

BROAD CLUSTER OF ACTIVITIES BAHRAINI TOURISTS INTEND TO DO WHILE ON VACATION

BAHRAINI TOURISTS WANT THEIR HOLIDAY TO HAVE “CULTURAL EXPERIENCE” FOLLOWED BY MEETING “FRIENDS AND FAMILY” AND BEING A “LUXURY TRIP”

TOP EXPERIENCES BAHRAINI TOURISTS INTEND TO DO WHILE ON VACATION

BAHRAINI TOURISTS WANT TO HAVE A “MULTI-GENERATIONAL TRIP” FOLLOWED BY HAVING A “TRIP WITH FRIENDS” AND “ATTENDING EVENTS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY BAHRAINI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

4% OF BAHRAINI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “WEATHER NOT FAVOURABLE” FOLLOWED BY OTHER REASONS.

The weather is not favourable Cultural restrictions (alcohol consumption) Cultural restrictions (women’s clothing) Limited options of entertainment Discrimination or any form of prejudice

BROAD CLUSTER OF ACTIVITIES BELGIAN TOURISTS INTEND TO DO WHILE ON VACATION

BELGIAN TOURISTS WANT THEIR HOLIDAY TO BE ABOUT “RELAXATION” FOLLOWED BY MEETING “FRIENDS AND FAMILY” AND BEING A “ROMANTIC GETAWAY”

TOP EXPERIENCES BELGIAN TOURISTS INTEND TO DO WHILE ON VACATION

BELGIAN TOURISTS WANT TO DO “READING AND NAPPING ” FOLLOWED BY HAVING A “MULTI-GENERATIONAL TRIP” AND HAVING “PRIVATE DINNERS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY BELGIUM TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

16% OF BELGIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “HIGH COST OF TRAVEL AND ACCOMMODATION IN ABU DHABI” FOLLOWED BY OTHER REASONS.

%

High cost of travel/accommodation in Abu Dhabi

Cultural restrictions (women’s clothing)

Limited transportation options

Discrimination or any form of prejudice

Crowded destination

BROAD CLUSTER OF CANADIAN ACTIVITIES TOURISTS INTEND TO DO WHILE ON VACATION

CANADIAN TOURISTS WANT THEIR HOLIDAY TO BE ABOUT HAVING A “CULTURAL EXPERIENCE” FOLLOWED BY “RELAXATION” AND “HEALTH AND WELLNESS”

TOP EXPERIENCES CANADIAN TOURISTS INTEND TO DO WHILE ON VACATION

CANADIAN TOURISTS WANT TO “RELAX AT THE HOTEL” FOLLOWED BY BEING ABLE TO “RELAX AND UNWIND” AND DOING “YOGA AND MEDITATION”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY CANADIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

4% OF CANADIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “DISCRIMINATION OR ANY FORM OF PREJUDICE” FOLLOWED BY OTHER REASONS.

4% are not willing to visit Abu Dhabi

Discrimination or any form of prejudice

Limited transportation options

No direct flight

Cultural restrictions (alcohol consumption)

Environmental concerns

BROAD CLUSTER OF ACTIVITIES CHINESE TOURISTS INTEND TO DO WHILE ON VACATION

CHINESE TOURISTS WANT THEIR HOLIDAY TO BE A “ROMANTIC GETAWAY” FOLLOWED BY BEING A “LUXURY TRIP” AND HAVING A “CULTURAL EXPERIENCE”

TOP EXPERIENCES CHINESE TOURISTS INTEND TO DO WHILE ON VACATION

CHINESE TOURISTS WANT TO HAVE A “SHARED SPA EXPERIENCE” FOLLOWED BY BEING ABLE TO “ATTEND EVENTS” AND TRY “LUXURY CRUISES”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY CHINESE TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

15% OF CHINESE TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “HIGH COST OF TRAVEL AND ACCOMMODATION IN ABU DHABI” FOLLOWED BY OTHER REASONS.

%

High cost of travel/accommodation in Abu Dhabi

Cultural restrictions (women’s clothing)

Language barriers

Environmental concerns

Crowded destination

BROAD CLUSTER OF ACTIVITIES EGYPTIAN TOURISTS INTEND TO DO WHILE ON VACATION

EGYPTIAN TOURISTS WANT THEIR HOLIDAY TO ABOUT “BEACH AND SUN” FOLLOWED BY MEETING “FRIENDS AND FAMILY” AND BEING A “ROMANTIC GETAWAY”

TOP EXPERIENCES EGYPTIAN TOURISTS INTEND TO DO WHILE ON VACATION

EGYPTIAN TOURISTS WANT A “MULTI-GENERATIONAL TRIP” FOLLOWED BY HAVING A “SPIRITUAL RETREAT” AND HAVING “REUNION AND GATHERINGS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY EGYPTIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

5% OF EGYPTIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “HIGH COST OF TRAVEL AND ACCOMMODATION IN ABU DHABI” FOLLOWED BY OTHER REASONS.

High cost of travel/accommodation in Abu Dhabi

Cultural restrictions (alcohol consumption) Negative reviews/not recommended by family

The weather is not favourable

Limited transportation options

BROAD CLUSTER OF ACTIVITIES FRENCH TOURISTS INTEND TO DO WHILE ON VACATION

FRENCH TOURISTS WANT THEIR HOLIDAY TO BE A “LUXURY TRIP” FOLLOWED BY BEING “A CULTURAL EXPERIENCE” AND BEING A “ROMANTIC GETAWAY”

TOP EXPERIENCES FRENCH TOURISTS INTEND TO DO WHILE ON VACATION

FRENCH TOURISTS WANT TO DO “SHOPPING” FOLLOWED BY HAVING A “MULTI-GENERATIONAL TRIP” AND “ATTENDING CULTURAL EVENTS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY FRENCH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

3% OF FRENCH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “HIGH COST OF TRAVEL AND ACCOMMODATION IN ABU DHABI” FOLLOWED BY OTHER REASONS.

High cost of travel/accommodation in Abu Dhabi

The weather is not favourable Cultural restrictions (alcohol consumption)

High cost of visiting Complicated Visa requirements

BROAD CLUSTER OF ACTIVITIES GERMAN TOURISTS INTEND TO DO WHILE ON VACATION

GERMAN TOURISTS WANT THEIR HOLIDAY TO BE A “ROMANTIC GETAWAY” FOLLOWED BY BEING A “LUXURY TRIP” AND MEETING “FRIENDS AND FAMILY”

TOP EXPERIENCES GERMAN TOURISTS INTEND TO DO WHILE ON VACATION

GERMAN TOURISTS WANT TO HAVE A “MULTI-GENERATIONAL TRIP” FOLLOWED BY HAVING “PRIVATE DINNERS” AND GOING ON “LUXURY CRUISES”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY GERMAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

17% OF GERMAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “CULTURAL RESTRICTION (WOMEN’S CLOTHING)” FOLLOWED BY OTHER REASONS.

Cultural restrictions (women’s clothing) Cultural restrictions (alcohol consumption) Discrimination or any form of prejudice

The weather is not favourable

High cost of visiting

BROAD CLUSTER OF ACTIVITIES INDIAN TOURISTS INTEND TO DO WHILE ON VACATION

INDIAN TOURISTS WANT THEIR HOLIDAY TO BE A “CULTURAL EXPERIENCE” FOLLOWED BY MEETING “FRIENDS AND FAMILY” AND ABOUT “HEALTH AND WELLNESS”

TOP EXPERIENCES INDIAN TOURISTS INTEND TO DO WHILE ON VACATION

INDIAN TOURISTS WANT TO “VISIT BARS” FOLLOWED BY “TRAVELLING WITH FRIENDS” AND ENJOYING “SPA TREATMENTS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY INDIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

9% OF INDIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “WEATHER NOT FAVOURABLE” FOLLOWED BY OTHER REASONS.

9% are not willing to visit Abu Dhabi

BROAD CLUSTER OF ACTIVITIES ITALIAN TOURISTS INTEND TO DO WHILE ON VACATION

ITALIAN TOURISTS WANT THEIR HOLIDAY TO BE ABOUT “RELAXATION” FOLLOWED BY BEING A “CULTURAL EXPERIENCE” AND HAVING “BEACH AND SUN” ACTIVITIES

TOP EXPERIENCES ITALIAN TOURISTS INTEND TO DO WHILE ON VACATION

ITALIAN TOURISTS WANT TO “RELAX AT HOTEL” FOLLOWED BY “READING AND NAPPING” AND HAVING A “MULTI-GENERATIONAL TRIP”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY ITALIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

8% OF ITALIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “HIGH COST OF TRAVEL AND ACCOMMODATION IN ABU DHABI” FOLLOWED BY OTHER REASONS.

High cost of travel/accommodation in Abu Dhabi

The weather is not favourable

Cultural restrictions (women’s clothing)

High cost of visiting

Limited transportation options

BROAD CLUSTER OF ACTIVITIES JAPANESE TOURISTS INTEND TO DO WHILE ON VACATION

JAPANESE TOURISTS WANT THEIR HOLIDAYS TO FOCUS ON “RELAXATION”, FOLLOWED BY “CULTURAL EXPERIENCES” AND SPENDING TIME WITH “FRIENDS AND FAMILY”

TOP EXPERIENCES JAPANESE TOURISTS INTEND TO DO WHILE ON VACATION

JAPANESE TOURISTS PRIORITISE “SPA TREATMENTS ” FOLLOWED BY BEING ABLE TO “RELAX AND UNWIND” AND ENJOY “MULTI-GENERATIONAL TRIPS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY JAPANESE TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

12% OF JAPANESE TOURISTS ARE NOT WILLING TO VISIT ABU DHABI MAINLY DUE TO “CULTURAL RESTRICTIONS” AROUND ALCOHOL CONSUMPTION AND WOMEN’S CLOTHING.

Cultural restrictions (alcohol consumption)

Cultural restrictions (women’s clothing)

Limited transportation options

Lack of attractions

High cost of travel/accommodation in Abu Dhabi

BROAD CLUSTER OF ACTIVITIES KAZAKHSTANI TOURISTS INTEND TO DO WHILE ON VACATION

KAZAKHSTANI TOURISTS WANT THEIR HOLIDAYS TO FOCUS ON “CULTURE”, FOLLOWED BY “SPIRITUAL AND PILGRIMAGE” EXPERIENCES.

KAZAKHSTANI TOURISTS PRIORITISE VISITING “RELIGIOUS SITES”, FOLLOWED BY “VISITING BARS” AND “NIGHTCLUBS” TOP EXPERIENCES KAZAKHSTANI TOURISTS INTEND TO DO WHILE ON VACATION

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY KAZAKHSTANI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

10% OF KAZAKHSTANI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI MAINLY DUE TO HIGH TRAVEL AND ACCOMMODATION COSTS AND CULTURAL RESTRICTIONS ON WOMEN’S CLOTHING.

%

High cost of travel/accommodation in Abu Dhabi

Cultural restrictions (women’s clothing)

High cost of visiting Discrimination or any form of prejudice

Limited transportation options

KUWAITI TOURISTS WANT THEIR HOLIDAYS TO FOCUS ON “CULTURE”, FOLLOWED BY “SPIRITUAL AND PILGRIMAGE” EXPERIENCES AND “ROMANTIC GETAWAYS” BROAD CLUSTER OF ACTIVITIES

KUWAITI TOURISTS INTEND TO DO WHILE ON VACATION

KUWAITI TOURISTS PRIORITISE VISITING “MUSEUMS, ART GALLERIES, AND RELIGIOUS SITES”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY KUWAITI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

7% OF KUWAITI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI MAINLY DUE TO “HIGH TRAVEL AND ACCOMMODATION COSTS” AND “CULTURAL RESTRICTIONS ON ALCOHOL CONSUMPTION”.

High cost of travel/accommodation in Abu Dhabi

Cultural restrictions (alcohol consumption)

Discrimination or any form of prejudice

Limited transportation options

High cost of visiting

BROAD CLUSTER OF ACTIVITIES DUTCH TOURISTS INTEND TO DO WHILE ON VACATION

DUTCH TOURISTS WANT THEIR HOLIDAYS TO FOCUS ON “FAMILY AND FRIENDS”, FOLLOWED BY “SPIRITUAL/PILGRIMAGE EXPERIENCES” AND “RELAXATION”

DUTCH TOURISTS PRIORITISE “TRAVELLING WITH FRIENDS”, “MULTI-GENERATIONAL TRIPS”, AS WELL AS “READING AND NAPPING”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

%

HOW MANY DUTCH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

4% OF DUTCH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI MAINLY DUE TO HIGH TRAVEL AND ACCOMMODATION COSTS AND CULTURAL RESTRICTIONS ON ALCOHOL CONSUMPTION.

High cost of travel/accommodation in Abu Dhabi

Cultural restrictions (alcohol consumption) The weather is not favourable

Crowded destination

Negative reviews/not recommended by family

BROAD CLUSTER OF ACTIVITIES OMANI TOURISTS INTEND TO DO WHILE ON VACATION

OMANI TOURISTS WANT THEIR HOLIDAYS TO FOCUS ON "HEALTH AND WELLNESS", FOLLOWED BY "SPORTS" AND "CULTURE"

OMANI TOURISTS PRIORITISE “RESTAURANTS” WITH “DETOX AND WELLNESS PROGRAMMES”, AS WELL AS PARTICIPATING IN “SPORTS EVENTS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY OMANI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

5% OF OMANI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI MAINLY DUE TO WEATHER, HIGH TRAVEL AND ACCOMMODATION COSTS, AND CULTURAL RESTRICTIONS ON WOMEN’S CLOTHING.

The weather is not favourable

High cost of travel/accommodation in Abu Dhabi

Cultural restrictions (women’s clothing)

High cost of visiting Negative reviews/not recommended by family

BROAD CLUSTER OF ACTIVITIES POLISH TOURISTS INTEND TO DO WHILE ON VACATION

POLISH TOURISTS WANT THEIR HOLIDAYS TO FOCUS ON “RELAXATION”, FOLLOWED BY “CULTURE” AND “FRIENDS & FAMILY”

POLISH TOURISTS PRIORITISE “RELAXING AND UNWINDING”, AS WELL AS “READING AND NAPPING”, AND ATTENDING “REUNIONS AND GATHERINGS” TOP EXPERIENCES POLISH TOURISTS INTEND TO DO WHILE ON VACATION

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY POLISH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

9% OF POLISH TOURISTS ARE UNWILLING TO VISIT ABU DHABI, MAINLY DUE TO CULTURAL RESTRICTIONS ON WOMEN’S CLOTHING AND ALCOHOL CONSUMPTION, AS WELL AS CONCERNS ABOUT DISCRIMINATION OR PREJUDICE.

Cultural restrictions (women’s clothing) Cultural restrictions (alcohol consumption) Discrimination or any form of prejudice

The weather is not favourable

High cost of visiting

BROAD CLUSTER OF ACTIVITIES QATARI TOURISTS INTEND TO DO WHILE ON VACATION

QATARI TOURISTS WANT THEIR HOLIDAYS TO BE A “ROMANTIC GETAWAY”, FOLLOWED BY “LUXURY TRIP” AND “RELAXATION”

QATARI TOURISTS PRIORITISE “PRIVATE DINNERS”, AS WELL AS “RELAXING AND UNWINDING”, AND STAYING AT “LUXURY HOTELS” TOP EXPERIENCES QATARI TOURISTS INTEND TO DO WHILE ON VACATION

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY QATARI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY 20% are

20% OF QATARI TOURISTS ARE UNWILLING TO VISIT ABU DHABI, MAINLY DUE TO CULTURAL RESTRICTIONS AROUND ALCOHOL CONSUMPTION, AS WELL AS CONCERNS ABOUT DISCRIMINATION OR PREJUDICE.

Cultural restrictions (alcohol consumption) Discrimination or any form of prejudice

Limited options of entertainment

The weather is not favourable

High cost of travel/accommodation in Abu Dhabi

ROMANIAN TOURISTS WANT THEIR HOLIDAY TO HAVE “RELAXATION” FOLLOWED BY MEETING “FRIENDS AND FAMILY” AND GOING TO A “CULTURAL PLACE” BROAD CLUSTER OF ACTIVITIES

ROMANIAN TOURISTS INTEND TO DO WHILE ON VACATION

TOP EXPERIENCES ROMANIAN TOURISTS INTEND TO DO WHILE ON VACATION

ROMANIAN TOURISTS WANT TO “VISIT BARS” FOLLOWED BY “RELAX AT HOTEL” AND HAVE “MULTIGENERATIONAL TRIPS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY ROMANIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

14% OF ROMANIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “LANGUAGE BARRIERS” FOLLOWED BY OTHER REASONS.

14% are not willing to visit Abu Dhabi

Language barriers

Negative reviews/not recommended by family

Crowded destination

High cost of visiting

Poor infrastructure

BROAD CLUSTER OF ACTIVITIES RUSSIAN TOURISTS INTEND TO DO WHILE ON VACATION

RUSSIAN TOURISTS WANT THEIR HOLIDAY TO HAVE “RELAXATION” FOLLOWED BY GOING TO ON “LUXURY TRIPS” AND GOING TO A “CULTURAL PLACE”

TOP EXPERIENCES RUSSIAN TOURISTS INTEND TO DO WHILE ON VACATION

RUSSIAN TOURISTS WANT TO HAVE A “RELAXING AND UNWINDING” EXPERIENCE FOLLOWED BY “RELAXING AT HOTEL” AND VISITING “RELIGIOUS SITES”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY RUSSIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

8% OF RUSSIAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “HIGH COST OF TRAVEL/ ACCOMMODATION IN ABU DHABI” FOLLOWED BY OTHER REASONS.

High cost of travel/accommodation in Abu Dhabi

The weather is not favourable Discrimination or any form of prejudice

Language barriers

Limited transportation options

BROAD CLUSTER OF ACTIVITIES SAUDI TOURISTS INTEND TO DO WHILE ON VACATION

SAUDI TOURISTS WANT THEIR HOLIDAY TO MEET WITH “FAMILY AND FRIENDS” FOLLOWED BY GOING ON “LUXURY TRIPS” AND GOING ON A “ROMANTIC GETAWAY”

TOP EXPERIENCES SAUDI TOURISTS INTEND TO DO WHILE ON VACATION

SAUDI TOURISTS WANT TO “TRAVEL WITH FRIENDS” FOLLOWED BY “REUNION AND GATHERINGS” AND “MULTIGENERATIONAL TRIPS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

15% OF SAUDI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “THE RESTRICTIONS ON WOMEN’S CLOTHING” FOLLOWED BY OTHER REASONS.

Cultural restrictions (women’s clothing)

Cultural restrictions (alcohol consumption)

HOW MANY SAUDI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY 15%

The weather is not favourable

High cost of travel/accommodation in Abu Dhabi

Limited options of entertainment

BROAD CLUSTER OF ACTIVITIES KOREAN TOURISTS INTEND TO DO WHILE ON VACATION

KOREAN TOURISTS WANT THEIR HOLIDAY TO HAVE “RELAXATION” FOLLOWED BY A PLACE WITH “BEACH AND SUN” AND GOING ON “ROMANTIC GETAWAYS”

TOP EXPERIENCES KOREAN TOURISTS INTEND TO DO WHILE ON VACATION

KOREAN TOURISTS WANT TO HAVE “SPA TREATMENTS” FOLLOWED BY “READING AND NAPPING” AND “REUNION AND GATHERINGS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY KOREAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

16% OF KOREAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “THE WEATHER IS NOT FAVOURABLE IN ABU DHABI” FOLLOWED BY OTHER REASONS.

The weather is not favourable Cultural restrictions (alcohol consumption) High cost of travel/accommodation in Abu Dhabi

Discrimination or any form of prejudice

High cost of visiting

BROAD CLUSTER OF ACTIVITIES SPANISH TOURISTS INTEND TO DO WHILE ON VACATION

SPANISH TOURISTS WANT THEIR HOLIDAY TO HAVE “RELAXATION” FOLLOWED BY GOING TO A PLACE WITH “BEACH AND SUN” AND MEETING “FRIENDS AND FAMILY”

TOP EXPERIENCES SPANISH TOURISTS INTEND TO DO WHILE ON VACATION

SPANISH TOURISTS WANT TO “RELAX AT HOTEL” FOLLOWED BY “SPA TREATMENTS” AND “TRAVELLING WITH FRIENDS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY SPANISH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

11% OF SPANISH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “THE WEATHER IS NOT FAVOURABLE IN ABU DHABI” FOLLOWED BY OTHER REASONS.

The weather is not favourable

High cost of visiting

Limited options of entertainment

Cultural restrictions (alcohol consumption)

Negative reviews/not recommended by family

BROAD CLUSTER OF ACTIVITIES BRITISH TOURISTS INTEND TO DO WHILE ON VACATION

BRITISH TOURISTS WANT THEIR HOLIDAY TO HAVE “ROMANTIC GETAWAYS” FOLLOWED BY “RELAXATION” AND MEETING “FRIENDS AND FAMILY”

TOP EXPERIENCES BRITISH TOURISTS INTEND TO DO WHILE ON VACATION

BRITISH TOURISTS WANT TO ENJOY “RELAXING AND UNWINDING” FOLLOWED BY “TRAVELLING WITH FRIENDS” AND TAKING A “PRIVATE TOUR”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY BRITISH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

16% OF BRITISH TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “THE WEATHER IS NOT FAVOURABLE IN ABU DHABI” FOLLOWED BY OTHER REASONS.

The weather is not favourable Cultural restrictions (alcohol consumption) High cost of visiting Cultural restrictions (women’s clothing) Language barriers

BROAD CLUSTER OF ACTIVITIES AMERICAN TOURISTS INTEND TO DO WHILE ON VACATION

AMERICAN TOURISTS WANT THEIR HOLIDAY TO HAVE “ROMANTIC GETAWAYS” FOLLOWED BY GOING FOR “RELAXATION” AND MEETING “FRIENDS AND FAMILY”

TOP EXPERIENCES AMERICAN TOURISTS INTEND TO DO WHILE ON VACATION

AMERICAN TOURISTS WANT TO HAVE “SPA TREATMENTS ” FOLLOWED BY “RELAXING AND UNWINDING” AND HAVING A “PRIVATE TOUR”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY AMERICAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

12% OF AMERICAN TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “THE WEATHER IS NOT FAVOURABLE IN ABU DHABI” FOLLOWED BY OTHER REASONS.

The weather is not favourable Cultural restrictions (alcohol consumption) High cost of visiting High cost of travel/accommodation in Abu Dhabi Discrimination or any form of prejudice

BROAD CLUSTER OF ACTIVITIES UZBEKISTANI TOURISTS INTEND TO DO WHILE ON VACATION

UZBEKISTANI TOURISTS WANT THEIR HOLIDAY TO BE A “LUXURY TRIP” FOLLOWED BY WANTING TO MEET “FRIENDS AND FAMILY” AND HAVE A “ROMANTIC GETAWAY”

TOP EXPERIENCES UZBEKISTANI TOURISTS INTEND TO DO WHILE ON VACATION

UZBEKISTANI TOURISTS WANT TO “TRAVEL WITH FRIENDS ” HAVE A “MULTI-GENERATIONAL TRIP” AND HAVE “REUNIONS AND GATHERINGS”

EXPERIENCES - RANKED 1 TO 39

EXPERIENCES - RANKED 40 TO 78

HOW MANY UZBEKISTANI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI AND WHY

16% OF UZBEKISTANI TOURISTS ARE NOT WILLING TO VISIT ABU DHABI WITH THE MAIN REASON BEING “THE WEATHER IS NOT FAVOURABLE IN ABU DHABI” FOLLOWED BY OTHER REASONS.

The weather is not favourable Cultural restrictions (alcohol consumption) Discrimination or any form of prejudice

Crowded destination

Negative reviews/not recommended by family

Based on these comprehensive insights, these strategic imperatives are recommended:

Tailor campaigns to highlight outdoor activities during the cooler Nov-Dec peak and emphasise world-class indoor attractions during the Jun-Jul summer. Leverage Jan-Mar for proactive brand building and interest generation. 01

Optimise Seasonal Messaging:

Mitigate Perceptions with Clarity:

Proactively address concerns regarding cultural norms and cost through transparent communication, informative content, and value-driven package promotions 04 02

Capitalise on Holiday Travel:

Develop targeted campaigns around major public and religious holidays in key markets (France, India, Japan, Kazakhstan) to convert holiday travellers into Abu Dhabi visitors.

03

Dominate Digital Channels:

Invest heavily in engaging, visually compelling content across Meta, TikTok, YouTube, and Snapchat. Foster user-generated content and leverage celebrity & influencer partnerships to amplify authentic recommendations

05

Develop Event Tourism:

Strategically bid for and promote events tailored to the preferences of European (cultural, music, mega), Asian, and Middle Eastern (culture, art, music, sports, mega, comedy) audiences, considering the 6.5-hour travel radius.

Utilise the 7 identified global traveller segments to develop highly personalised marketing messages and campaigns that resonate deeply with each group's specific motivations and travel style. 07

Implement Segment-Based Marketing:

Design attractive 8–12-hour stopover packages that bundle unique experiences (F&B, spa, cultural visits), emphasise value, and provide seamless access to key attractions like shopping malls. 06

Enhance Stopover Experience:

This segmentation study provides the Abu Dhabi tourism ecosystem with a robust, data-driven roadmap to accelerate its growth in the global tourism arena. By embracing these insights and strategically tailoring its offerings and communications, Abu Dhabi can unlock new markets, deepen engagement with existing ones, and reinforce its reputation as a truly world-class destination for every type of traveller.

The findings and strategic insights from this research are designed to carry Abu Dhabi's strategic tourism initiatives well into 2030 and beyond

For those interested in a deeper dive, the raw data from this study is available. The Department of Culture and TourismAbu Dhabi (DCT Abu Dhabi) is happy to provide additional support and data as needed.

If you would like advisory from a marketing research perspective or marketing strategy, please reach out to: Brayden Ainzuain - bainzuain@dctabudhabi.ae

Renos Fountoulakis - rfountoulakis@dctabudhabi.ae

Angela Moreno - amoreno@dctabudhabi.ae

Scan the QR code to unlock a curated library of 25 Market Playbooks designed to give you useful insights on a market and segment level.

Whether you are planning, researching, or looking to better understand key markets, these reports are designed to support clear, informed decision-making.

25 expert-designed market reports

Valuable market and segment-specific insights

No sign-up or forms – just scan and access

Scan the QR code now and start exploring

"Comingtogetherisabeginning;keepingtogether isprogress;workingtogetherissuccess”