4 minute read

Lesson 11. Good management of resources

Closing activity:

Ask the group to share some of the benefits they remember of having savings.

Advertisement

Anchor scripture:

• Matt 25:14-18: Again, it will be like a man going on a journey, who called his servants and entrusted his wealth to them. To one he gave five bags of gold, to another two bags, and to another one bag, each according to his ability. Then he went on his journey. The man who had received five bags of gold went at once and put his money to work and gained five bags more. So also, the one with two bags of gold gained two more. But the man who had received one bag went off, dug a hole in the ground and hid his master’s money.

Local proverb:

• Lies and lying to yourself can make us not be accountable to our money in a proper way e.g. kadahwema, kataryama which means :no sleeping and no time to lose

Specific learning objective: As a result of this session, participants will be able to:

• Look ahead and see how money will flow in and out of the business. • Identify some of the pitfalls that cause business failure and how to avoid them

Read aloud: Didier is a rice farmer. He earns a living from farming and selling his produce to the processors. Didier has a book where he writes all his activities on the farm. When he plants, when he applies pesticides, and when he harvests. Last season he harvested and sold his rice for Rwf3 million. He had an input loan to pay and his daughter had just been sent home for school fees. However, instead of seeing to his responsibilities, Didier boarded a coaster headed to Kigali. He booked a room in a motel in Nyabugogo and began enjoying life in the city, drinking and entertaining new friends. Soon after he had nothing left, not even bus fare to take the bus back home. He had to borrow a phone to send his wife a message.

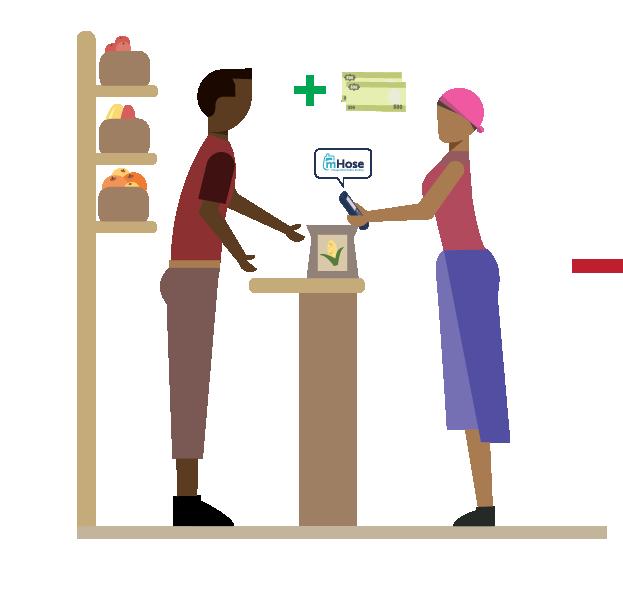

Discuss: What did Didier do wrong? What should his wife do when she receives the message? What should he do differently after the next harvest? Accept all answers, then emphasize the following: • Planning the use of money before you receive it, especially if you receive a lot of your income at one time (like with a harvest or big wholesale order) • The advantage of separating business income from home income. Instead of keeping all the money in one big pot, pay himself his wages so he has that money to use for his family expenses. • Record keeping • Illustrate trader taking inventory in the shop • Illustrate trader’s family having a good meal, while his shop is thriving

Didier may have put himself in the position of a business failure. When a business has run out of money and can’t operate, it has failed. A failure means you don’t have any choices left. For example, if you don’t have any cash or stock left, what can you do? Unless someone owes you money or you can invest more money, the business has failed.

Why do Businesses fail?

Ask participants: what are some of the reasons a business fails? Do they have examples or experiences? Most reasons have to do with running out of money because the expenses are larger than the income.

Too little Income

If you can’t sell enough, your business will end up failing, because too little money is coming in. How can you avoid selling too little? • Choose the right business idea. If nobody needs what you are selling,

you’re in trouble. • Stock the right quality of the product • Set the right price.

Too many Expenses (costs to the business)

This happens if you have too many expenses or take too much out for the household. Your business can fail if your stock is decreasing, and you don’t realize it. (Illustrate using a hand filling a cup with water from a jug, but the cup is leaking from some holes on the sides) Examples of expenses • Taking out too much money for the household • Customers who never pay back credit • Bad prices • Food which goes bad and has to be tossed out • Loans and supplier credit

How can you avoid too many expenses?

• Be careful about how much money you take out of the business. • Keep some records, so you know how your business is doing.

Running dry before becoming Profitable

Another reason your business might fail, is if you don’t have enough money to keep it running until it starts making money. Or, if you take out more money than what you can make back in a short time.

Giving out too much Credit

When you give credit to customers, there’s always a risk that you will never get the money, either because the person can’t pay, or because you forget to whom you gave goods on credit. Only give credit to customers you know and trust.

Keep Expenses smaller than Income

The way to avoid failure is by making sure that expenses are never bigger than the income. Your business will be healthy when the income is big enough to support your expenses. Closing activity: Ask the group to share in small groups some of the things to do and not to do to manage their business resources well.