1 minute read

FINANCE

GRT Rate Reduction

Gross Receipts Tax (GRT) rates vary throughout New Mexico, ranging from 5% to 9.3125%. The total rate for each location combines rates imposed by the State, county, and if applicable, municipality. Every business collects GRT from its customers, then reports and pays what it owes to the State the subsequent month. The State then distributes the municipality portion to the Village the following month. Therefore, when the Village receives the tax, it is from business sales two months prior (e.g., GRT received from a sale in June is received by the Village in August).

Advertisement

Changes to the tax rates may occur twice a year, in January and/ or July. The Taxation and Revenue Department (TRD) posts new tax rate schedules online and in the GRT Filer’s Kit, which can be found online at Tax.NewMexico.gov. As of July 1, 2023, all GRT rates decreased because the State lowered the GRT Rate from 5.00% to 4.875%, a savings of 0.125%. The Village’s new GRT rate is 8.1875% for any sales after June 30, 2023.

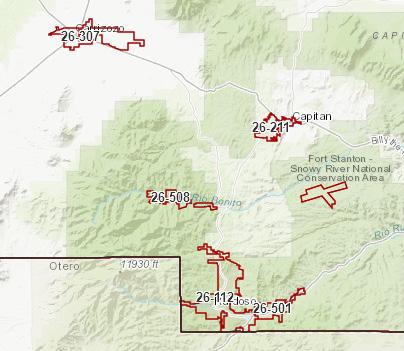

Businesses use the code and tax rate corresponding to the location where their goods, products, or services are sold/ delivered. However, there are some exceptions. For example, if the services performed meet the definition of “professional services”’ according to the statute. Professional services require a license from the State, or a Master’s Degree or better to perform. For more information on choosing the correct location and tax rate for your business receipts, please download TRD’s FYI 200 publication.