10 minute read

Paul Hopkins

The Fact OfThe Matter

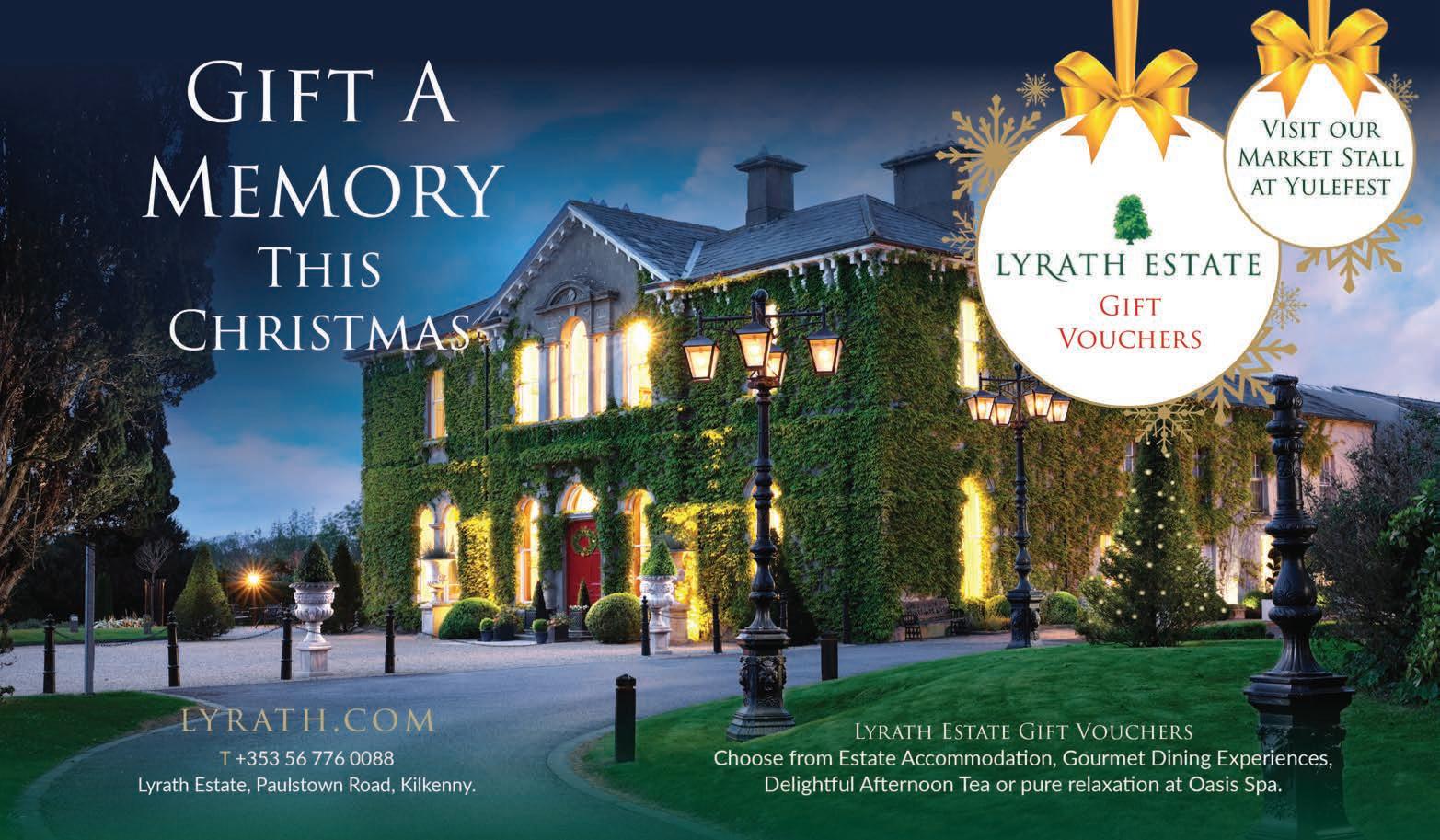

Advertisement

PAUL HOPKINS When every day seems like a bad news day

Back in the late Nineties a new paper began publishing in, I think, Sacramento in California. Its stated mission was to report “only good news”. Happy stories, stories that would bring a smile to your face. Make you laugh. e weekly paper never reached its mandated sales nor advertising quota and, so, after less than a year it folded. Its last edition could not tell its readers it was ceasing publication... as that would have been bad news. ese days, hearing or reading the news, it can seem like the only things reported are terrible, depressing events. Ukraine, Iran, climate chaos, Trump and the AltRight. Deaths in Donegal, the sad passing of Vicky Phelan, sexual abuse in a boys’ boarding school and a plane crash in Tanzania. And so it goes, seemingly endless ‘bad news’. Even our daily weather changes are given red, orange or yellow alerts, telling us all to stay indoors and “don’t go taking unnecessary journeys”, whereas, in my younger days, you just grabbed the umbrella and got on with it. Weathered the storm.

Now, though, with ‘breaking news’ constantly in the palm of our hand there seems little chance of getting a break from it all. And it can all prove quite tiring.

Why does the media concentrate on the bad things in life, rather than the good? And what might this depressing slant say about us, the audience? Or, indeed, about me, coming up to 50 years in this relentless and remorseless trade that is newspapers? My psychologist friend from Magherafelt says sudden disaster is “more compelling than slow improvement”. I retort that reports of corrupt politicians or unfortunate events make for ‘easier’ and, indeed, more responsible stories. ose men in white coats who have studied such matters suggest that humankind has a ‘negativity bias’, the psychologists’ term for our collective hunger to hear, and remember, bad news.

However, it isn’t just schadenfreude — that wonderful German word for pleasure derived by someone from another person’s misfortune — but rather that we’ve evolved to react quickly to potential threats. at our alertness to bad news could be a signal that we need to change what we’re doing to avoid danger. It can be much riskier to ignore negative information (a storm is coming) than good news (a dog rescued a boy from a tree). Paying attention to negative news, the researchers say, is generally an e ective survival strategy. Like not taking a walk along a coastal road during a red alert weather warning.

As you’d expect from this theory, there’s some evidence that people respond quicker to negative words. In lab experiments, ash the word ‘cancer’, ‘bomb’ or ‘war’ up at someone and they can hit a button in response quicker than if that word is ‘baby’, ‘smile’ or ‘fun’ (despite these pleasant words being slightly more common).

So is our vigilance for potential threats — like checking the cabin exits when we board a plane — the only way to explain our predilection for bad news? Perhaps not. ere is another interpretation. On the whole, we think the world is rosier than it actually is. When it comes to our own lives, many of us believe we’re better than average, and that, like the cliché, we expect things to be all right in the end. is rose-tinted view of the world makes bad news all the more surprising and salient. And we think, thank God that’s not me famine-stricken in Somalia or bombed out in Ukraine or not allowed chose what to do with my own body because I live in a deep Red state in America. And, so, we feel good about ourselves and, perhaps too, hold out a little bit of hope for a better day for humanity.

I had an editor once whose motto was, if it bleeds it leads. A recent study involving more than 1,000 people across 17 countries spanning every continent but Antarctica concluded that, on average, people pay more attention to negative news than to positive news. e ndings, published in in the Proceedings of the National Academy of Sciences, suggest that this human bias toward negative news might be a large part of what drives negative news coverage. But the results also revealed that this negative bias was not shared by everyone, and some even had a positive bias — a sign that there may be a market for positive news.

I think I might just start up a new paper...

We're a nation obsessed with checking our mobiles

One in three of us check our mobile phones at least 50 times a day, with almost two-thirds admitting to using their phone as soon as they wake up.

Yet, despite the power our phones have over us, more than half of Irish adults wish they spent less time on their devices.

A survey of digital trends by Deloitte, in which it questioned 1,000 adults aged between 18 and 75, found that 35% of respondents checked their phones at least 50 times a day, with 16% checking the devices at least 100 times a day.

Half of those surveyed said they tend to stay awake later than planned because they are using devices into the night.

Even with over half wishing they spent less time on their devices, six in 10 continue to use a smartphone as soon as they wake up.

John Kehoe, audit partner at Deloitte, said: "Over the last two years through the Covid19 pandemic, technology connected us while we had to stay apart. Technology continues to keep us connected, with smartphone access remaining at 94%, with access to the old reliables such as tablets and laptops, continuing their downward trend, having peaked in 2017.”

Referring to the frequency with which people check their phones, he said: "While these are great and useful devices, we need to be aware they can have a negative impact on our social interactions and sleep patterns.”

Accessing social media platforms (64%) and instant-messaging (62%) apps remains the top activity for people who have smartphone.

Other devices are playing a huge role in our lives, with smart TVs growing to 66%, up from 44% ve years ago.

Access to video streaming services subscription is stable at 75% with Net ix the most popular, followed by Disney+.

How to lessen the impact of inflation on your pension

Ifac, Ireland’s leading farming, food and agribusiness professional services firm, is advising Kilkenny pension holders to make sure they know how much risk is being taken with their pension money and how well is it diversified.

Martin Glennon, Head of Financial Planning at ifac said: “This year has been a very turbulent one for pension funds, with falls averaging -10%. But you can take proactive steps to lessen the impact on your pension.”

How is inflation impacting my pension?

The two main components of most pension funds are stock market investments and government bonds. Stock market investments are seen as growth assets, and government bonds are seen as more secure assets. How much of your money is in each will depend on your risk profile, but as a guide, a medium-risk fund could have 40% invested in each asset. The fund manager can increase and reduce the amount held in each.

Stock Markets

The economic world is concerned that we are sliding into a recession. The war in Ukraine and subsequent increases in commodity prices such as wheat and oil have contributed to this turmoil. Add to this recent job cut announcements, and it’s clear to see why the profitability of companies is under scrutiny. This has led to an increase in the volatility of the large stock markets, with the Euro Stoxx index down 15% and the S&P500 down 17%, year to date. With this type of volatility, most pension investors would prefer their fund manager to reduce the holding in the stock markets and increase the investment in more secure assets. And that’s what fund managers would typically do. But here is the real problem.

Government Bonds are not so secure!

Inflationary fears have forced central banks to increase interest rates very quickly. And at recordbreaking levels. The ECB rate has gone from 0% to 2% in three months. In the last few years, governments have been borrowing money at next to zero interest rates. The increase in interest rates has reduced the market value of these existing government bonds. Subsequently, the bonds held in pension funds are seeing reductions in value of up to 20%! Remember, these are supposed to be the more secure assets.

Diversification Works

The inclusion of other asset classes, such as property, infrastructure, and commodities, has helped lessen the impact. The average medium-risk pension fund return is about -10%. The best-performing funds have suffered losses of circa -4% to -6%. So clear evidence that diversification works.

“The important takeaways from all this uncertainty are to make sure you know how much risk is being taken with your pension money and how well is it diversified," said Martin Glennon. e Just Eat Awards are back, and they’re set to be bigger than ever! TV presenter and podcast host Muireann O’Connell recently launched the ninth annual awards which celebrate the very best of Irish takeaway restaurants across the country.

Making greatness is the theme of this year's awards in recognition that for restaurants, creating and preparing delicious food is more than just a job – it's an art. eir passion, and dedication to excellence shines through in every dish that’s brought to our doorstep. is year, more than 150 restaurants have been shortlisted across 16 different award categories, including the ‘Best Chinese’, ‘Best Pizzeria’, ‘Best Newcomer’ along with the new ‘Sustainability Award’ recognises restaurants using eco-friendly packaging, reducing food waste and nding innovative ways to promote sustainability in their restaurant.

Food lovers across the country can now vote for one or more of their favourite local restaurants, whether that’s their number one local independent takeaway or a well-loved chain that always hits the spot.

Voting closes December 31 and everyone who casts a vote will be in with a chance to win FREE takeaway for a year!

More than 68,000 public votes were cast in 2021, making it the highest year to date, and Just Eat is hoping to surpass these gures this year. e Just Eat Awards winners will be announced at a gala ceremony in Dublin hosted by Muireann O’Connell in February 2023.

Muireann launches Just Eat Awards

Leaving Cert pupils invited to online event

An online information event aimed at Kilkenny parents and guardians of school leavers will be run by South East Technological University (SETU) on Tuesday, November 29 from 6.30 to 7.30pm. e one-hour online ‘Parents’ Event’ is designed to support parents and guardians of anyone interested in starting on a full-time college course in autumn 2023.

Kilkenny continues to be one of the most important feeder counties for SETU, with 249 students from Kilkenny choosing to join the south east’s rst university this September.

SETU’s dedicated outreach team has designed the information evening, which will take place via Zoom, based on common queries and concerns to help put parents’ minds at ease. Parents will learn about SETU's wide range of courses, the CAO process, links with further education colleges, student supports, grants, sports scholarships and much more.

Claire Holden, Schools' Liaison & Outreach O cer at SETU, says, that while the student is best placed to list courses in order of genuine preference, in many cases it is parents who get in touch by phone or online chat with queries.

“Choosing the next steps after school is both exciting and challenging. Applicants can choose 10 courses at Level 8, and another 10 at Levels 7 and 6 so it is vital they get their order of preference right." *Details and registration can be found at www.setu.ie/parents