4 minute read

John Ellis

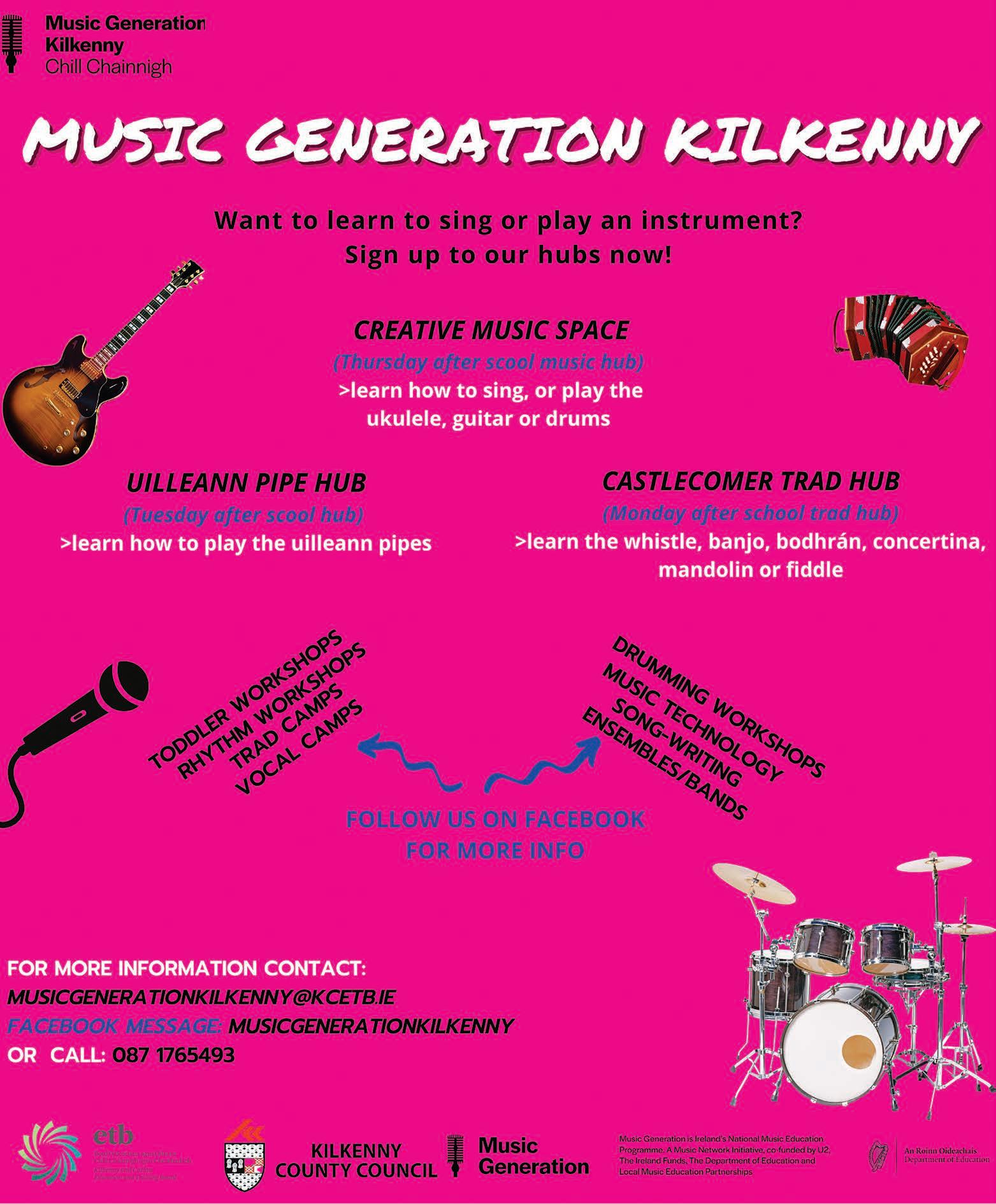

Time to be a pension detective

BY JOHN ELLIS

Advertisement

FINANCIAL ADVISOR

IT’S pension time again. Advertising is being ramped up across all media streams encouraging us all to either start a pension or increase our contribution to existing plans.

As we discussed before, a pension is a long-term investment. Its value can go down as well as up and could be worth less than was paid in.

Laws and tax rules may change in the future. Your own circumstances and where you may have lived will also have an impact on the tax treatment of the plans.

If you’ve worked multiple jobs over the years, you may have been added to several pension plans by your past employers. You might also have a few personal pension plans that you opened yourself.

As a current advertising bill board states, “We believe small actions can have great impacts,” so decide this is the year you will track down your old pensions.

With a pension transfer, you can combine all your pension plans into a new, single plan. is will help you see the total amount you have saved for later life much more clearly and it could even result in lower annual charges.

You can also factor your combined pension plan total with the old age state pension thereby having a clearer picture of how much pension savings you might have to live on in later life, giving you the option of whether you choose to retire fully or simply reduce the amount of hours you work.

Here are some other reasons to consider combining pension plans:

Better planning - once you can see your savings in a combined pension pot, it should be easier to know how much you have to live on in later life.

More value - you could have a better range of investment choices and lower management charges.

Better management - with all your pension savings in one place, you can cut back on paperwork by focusing on a single plan

Better retirement options - knowing exactly how much you have in pension can make it clearer when deciding how to take your money when you retire.

But transferring pensions isn’t for everyone. There are a few things you should think about that can help you decide if it’s the right choice for you:

There’s no guarantee that your retirement income will be better after transferring your pension plans into one place. That’s why it’s best to contact your Financial Advisor to carefully make an informed choice.

Your existing pension plan may give you benefits or guarantees that the new plan might not offer and/or you might also find that the new plan doesn’t offer the same investment choices that you’re currently invested in.

Remember, speak to your Financial Adviser if you’re unsure about pension transfers.

How long does it take?

From start to finish, pension transfers can take a matter of weeks or months. The more information you have, provider’s name, policy numbers etc. the faster the process will be. Typically, you will be asked for the following information about each plan you’re thinking about transferring:

Your latest pension statement for each provider and /or a recent valuation statement if you have one.

If you don’t have that information not to worry, information can be gleaned using previous address, dates of birth and names of previous employer. Once you know who your pension plans are with, you can contact them to get the relevant information we need before we start your transfer.

This can be time consuming, and you may not know where to start, but with a letter of authority from you to your Financial Advisor the process will begin.

John@ellisfinancial.ie 0868362633.

LANGUAGE or lack off is one of the greatest barriers to inclusion. A great way to understand a language is to possibly speak it bilingual. Who can forget the great Broadcaster Liam Ó Murchú of RTÉ Television’s Irish language chat show ‘Trom agus Éadrom’. We may not have been fluent Gaelic goers but with his format of b lingual interviews we knew enough to enjoy the shows

Sometimes we can highlight the beauty of language especially when we read the prose of some of the great authors of this and past generations.

On the 30th of September this year we celebrate European Day of Languages. This year we have an incredible event where part of the day’s itinerary is the chance to meet Ireland’s leading writer Colm Tóibín in conversation with selected translators of his prose into European language

Joining Colm Tóibín and his French, Greek and Polish translators, Anna Gibson, Athina Dimitriadou and Jerzy Kozłowski, to celebrate the European day of Languages from a Polish perspective renowned Polish translator Jerzy Kozłowski being one of them.

This year’s event will take place in the Trinity Centre for Literary and Cultural Translation.

On a lighter note but still one of importance our great friend JOXER GOES TO PL POLAND!

To discover new, this groundbreaking video go to www.joxergoestopoland.ie

Join Joxer on his trip around Poland and help him get the best possible score!

There is no download needed, just type www.joxergoestopoland.ie and enjoy the experience on any device!

At the end of the game, register your score in and see if you get on the Top 10 Scoreboard. The highest scorer each week receives a prize!

As we said at the beginning, these weeks, two events are Ciężki i lekki or Trom agus éadrom