4 minute read

The rising popularity of the PRSA pension Your Money & You John Ellis

e increasing popularity of a Personal Retirement Savings Account (PRSA) for pension provision in over the last decade is re ected in the recent Pensions Authority data. Currently there are 355,706 PRSA contracts in place with an asset value of €9.986 billion whereas in 2010 there were 181,711 such contracts with an asset value of €2.4 billion.

Why so? e PRSA is a long-term investment option that o ers a exible, tax-e cient way to retirement. It was introduced in 2002 as a ‘modern option’ for retirement savers giving a “portable, transparent, and wholly client-owned pension product” with the principal purpose of being a solution for the modern workforce where a ‘job for life’ is no longer.

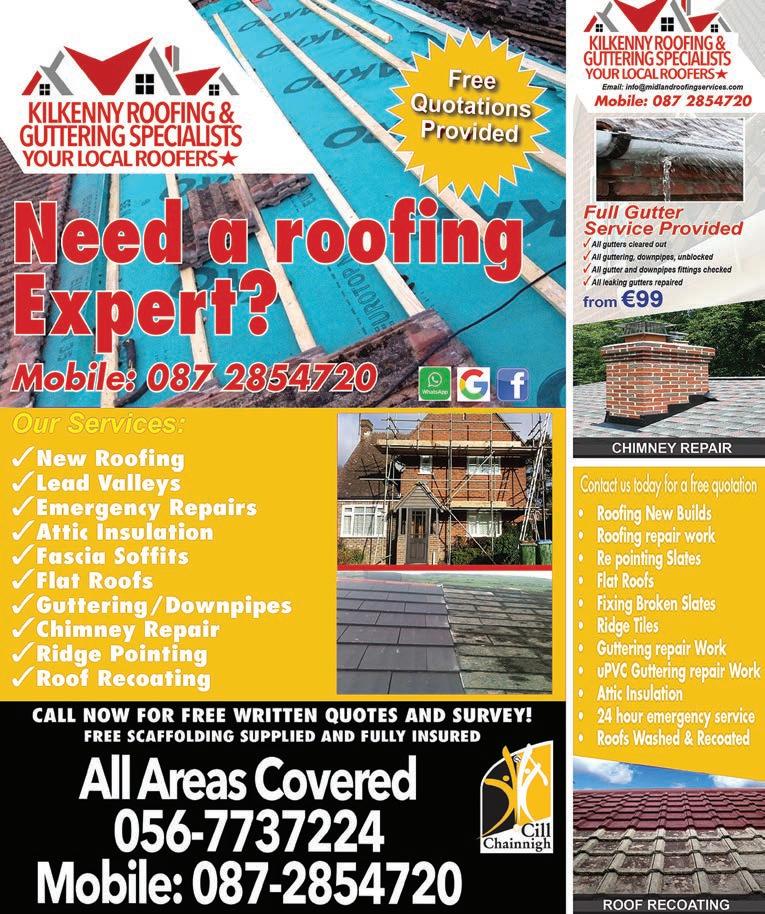

Advertisement

Initially, the PRSA was seen as the poor man’s pension and had limitations due to the way they were treated over and against existing pension plans. e treatment of employer contributions especially to a PRSA vs. an occupational scheme was the main drawback for employers and the reason for the establishment of so many single members’ pension schemes. e pension roadmap, published in 2018, outlined the Government’s intention to transform the pension landscape from 2018 to 2023. A key part of this plan was to reduce the number of one-man schemes. e plan was that future pension provision by smaller employers would be by means of the PRSA, or a Master Trust solution which was launched earlier this year. e PRSA was made more attractive especially for the single member pension. Up until the Finance Act 2022, that came into e ect in January 2023, employer contributions to a PRSA attract- ed Bene t In Kind and, with the introduction of IORP II, onerous requirements for occupational schemes the PRSA was a good alternative. is now means that moving schemes of 10 members of less into a master trust is not the only viable solution – the PRSA is a comparable product. By assessing, with your nancial advisor, your occupational pension scheme vs a PRSA options you may see the PRSA solution to be a more suitable. For instance, the occupational pension is owned by the scheme trustees and not you, whereas the PRSA is in your name and in your control from outset

Your employer is restricted under an occupational scheme as to how much they can contribute to your pension, based on a calculation using your salary and years’ service as outlined in the Revenue’ manual, whereas the PRSA allows unlimited employer contributions for employees and all contributions receive tax relief in the year they are paid. e standard fund threshold still applies, €2M.

Occupational schemes require prior Revenue approval but the PRSA is preapproved by Revenue and the Pensions Authority and requires no further approv- als. Most importantly, in the case where an employee dies in service, the full PRSA fund is paid to their estate, currently tax-free whereas occupational schemes can only pay at 4 x nal salary tax free and the balance must be transferred to an ARF or annuity for spouse/ dependants. john@ellis nancial.ie 086 8362622

In retirement and in conjunction with good tax planning PRSA holders can drawdown their retirement bene ts in stages using multiple PRSAs up to age 75, whereas with an occupational scheme all bene ts must be taken together. Of course, there are many other considerations to make when looking at the various options, but this is where your nancial advisor comes in. Advice is paramount.

Successful people are empowered, con dent and comfortable in their own skin. ey walk the world with authenticity and conviction, and do what is meaningful to them.

As a Harvard-trained psychologist, Dr Cortney Warren found that this sense of self-assuredness makes them better able to navigate con ict and be vulnerable with others, mostly because they aren’t looking for external validation. But takes a lot of work to get there. If you use any of these nine phrases, you’re more emotionally secure than most people:

1. “Let me think about that before I respond.” One of the most noticeable characteristics of emotionally secure people is that they articulate themselves well. ey choose their responses carefully and aren’t impulsive in their reactions.

Similar phrases:

• “I’m really frustrated and need some time to myself. I don’t want to say something I might regret later.”

• “I don’t have an answer right now. Can we revisit this conversation tomorrow?”

2. “No.”

Emotionally secure people feel comfortable setting boundaries. ey are clear about what they will and will not do based on their own moral principles, needs and desires.

Similar phrases:

• “I’m sorry, but I can’t help with that because I have too many other commitments.”

• “ ank you for the o er, but that’s not something I enjoy doing.”

Although cigarette smoking is the main cause of lung cancer, not all smokers develop this disease. In a recent study published in Nature Genetics, researchers from Albert Einstein College of Medicine propose that certain smokers may have resilient protective mechanisms that limit mutations and, thus, safeguard them against lung cancer. is discovery could aid in the identi cation of smokers who are more susceptible to lung cancer and require close surveillance.

“ is may prove to be an important step toward the prevention and early detection of lung cancer risk and away from the current herculean e orts needed to battle late-stage disease, where the majority of health expenditures and misery occur,” said Simon Spivack, MD, MPH, a co-senior author of the study, professor of medicine, of epidemiology and population health, and of genetics at Einstein, and a pulmonologist at Monte ore Health System. For a long time, it has been widely believed that smoking causes lung cancer by inducing DNA mutations in healthy lung cells. e lack of an accurate method to quantify mutations in normal cells has prevented the veri cation