13 minute read

Marianne Heron

As I See It

Advertisement

Marianne Heron Inheritance: a tax worth knowing about

Any close encounters with the taxman reduce me to an apprehensive state akin to skating on thin ice. Not knowing what is lurking underneath the ice increases the fear. Ridiculous I know, taxation is an instrument of monetary policy that’s meant to be fair, nevertheless I am not alone in finding taxation ….well taxing.

What happens to that nest egg or the accumulated wealth from a lifetime’s work is a particularly emotional issue. A recent report suggesting a hike in inheritance tax stirred up a hornets’ nest of reactions from political derision when Leo Varadkar dubbed the Report of the Commission on Taxation and Welfare as something that “was straight out of the Sinn Fein manifesto” to howls of protest from senior citizens who see their efforts to benefit the next generation under threat.

“I’ve worked hard and struggled to own my home/ business/farm out of taxed income, so why should I pay double tax” is a typical comment.

It doesn’t seem fair put that way. But in fact, it’s not the now deceased who will pay the tax but their beneficiaries. Inheritance tax is not on the actual estate of the dearly departed but part of the value of the transaction that occurs when money or wealth in some form is transferred to another party.

There hasn’t been an increase yet… and at 33% on taxable elements of inheritance that seems high enough and it doesn’t raise much anyway — about 1% of tax revenue in 2020.

The other point is that there are ways to reduce inheritance tax AKA Capital Acquisitions Tax (CAT). Once you know the rules, there is wiggle room. Surprisingly though, a majority in Ireland don’t even make a will, perhaps to avoid thinking about the Grim Reaper. So I took a look at what is under that revenue ice.

Some of the inheritance tax regulations are straightforward, others merit the advice of a creative accountant and need to be considered long before the thought of succession planning has entered most people’s heads. Also cases vary, depending on circumstances.

Firstly, there are tax-free thresholds which depend on the relationship to the disponer — that is the person who provided the gift or inheritance — and the beneficiary, anything beyond those thresholds is taxed at 33%. Gifts and inheritances between spouses/civil partners are exempt from CAT.

The first threshold (currently €335,000) applies to children (including adopted child, stepchild and certain foster children) The second (currently €32,500) applies to a brother, sister, nephew, niece or lineal relation and the third (currently €16,250) applies in all other cases. There is also a taxfree allowance of €13,000 annually per individual gifted as a way of reducing future inheritance tax.

There’s a balancing act involved here, give too much away and you risk running short of funds for later years and we are all living much longer now. Planning early is key. “It’s important to sit down and to plan what you want to achieve,” says Adrian McManus of McManus McCabe accountants. Inheritance where businesses and farms are involved are a particular concern when it comes to succession

Tax regulations are designed so that farms, or part of them, and businesses don’t have to be sold off in order to meet inheritance tax but there are strict rules to be met to qualify for business and farming relief of 90%.“In relation to business it’s important to review what has happened each year to reduce tax liability,” says Adrian Mc Manus. “Where a business is growing and where you have built up wealth what is the point in having it all in your name rather than passing ownership early?”

Farm inheritance can be particularly sensitive and knowing the rules for agricultural relief can make a big difference. One of the important ones is that the recipient of an agricultural must have been an active farmer for six years or where the land is leased it must be farmed as a commercial venture for six years.

There are instances where inheritance tax regulations could be used creatively to help resolve issues like the housing crisis or the need for renewable energy. If part of a family home is divided to create a granny flat and the part given to a son or daughter that gift would be liable to CAT, this surely merits changing to get people started on the housing ladder. Allowing marginal farms full relief when leasing to a wind farm would promote renewable energy.

There is a simple solution, though: go skiing, spending the kids’ inheritance...

UPMC Nowlan Park Saturday 8th October 2022 JJ Kavanagh & Sons Jnr Hurling Semi Finals

12.00 Dicksboro v Windgap 13.45pm Piltown v Black & Whites St Canice’s Credit Union Snr Hurling Semi Final 3.30pm Tullaroan v Shamrock’s Ballyhale. NOTE: Entry is at the DeGras Stand side only. (Breathnach Stand side entrance will remain closed.) General Admission €15. These tickets can be purchased online or in Supervalu or Centra Supermarkets Student & Pensioners discounted tickets for €10 can only be purchased online.

UPMC Nowlan Park Sunday 9th October 2022 Michael Lyng Motors Hyundai Intermediate Hurling Semi Finals

2.00pm Danesfort v Rower Inistioge 3.45pm Thomastown v Carrickshock NOTE: Entry is at the DeGras Stand side only. (Breathnach Stand side entry will remain closed.) General Admission €15. These tickets can be purchased online or in Centra or Supervalu Supermarkets. Students & Pensioners discounted ticket for €10 can only be purchased online.

ere’s nothing worse than listening to your child coughing and sneezing, it makes you feel so helpless. ankfully, there are natural remedies that can help relieve their symptoms. It can be that when you collect them from creche or school they are coughing or sneezing, especially at the start of the school year. It’s a good idea to have a couple of things in the cupboard for these times.

ForTuss Otosan is ideal to help relieve coughs and is suitable for a dry or productive cough. It tastes good too which is important for kids. I love that it’s suitable from one year of age as there is very little for this age group. It’s suitable for the oldest member of the family too! It contains Manuka Honey, renowned for its anti-microbial properties.

Elderberries are traditionally used to help with respiratory problems there’s lot of supplements. Biocare Children’s Elderberry Complex is one option, it’s formulated for children aged three and above. It has a fruity avour and can be taken straight from the spoon, or mixed in food or drinks. Elderberries are a natural source of vitamin C and zinc.

To help support immunity, top up on vitamin D, as it’s antiviral and supports immunity. BetterYou Vitamin D Oral Spray is a great option for kids as there is no struggle swallowing large tablets or chewing unpleasant tasting pills. It is easy to administer, a simple spray onto the inside of their cheek. Most parents love this product as there is seldom any argument. Choose between the infant or the junior depending on the age. And of course, don’t forget yourself, you need to stay on top of your game. You can choose between the 1,000iu or the 3,000iu BetterYou Vitamin D Oral Spray.

A healthy diet is important, and not always easy to achieve with young kids. However,

Winter remedies for kids with coughs and colds CLAIR WHITTY keep an eye on the number of dairy products and sugar they eat as they can contribute to excess mucous production and aggravate the problem. You might like to top up their nutrient level with a multivitamin, you could consider BetterYou Junior MultiVit Oral Daily Spray, like the vitamin D it’s sprayed onto the inside of the cheek. Let us help you keep you and your family healthy this winter.

Shop online at www.naturalhealthstore.ie where you’ll be able to take a look at these brands. Natural Health Store, Market Cross Shopping Centre Phone: 056 7764538 Email: info@naturalhealthstore.ie

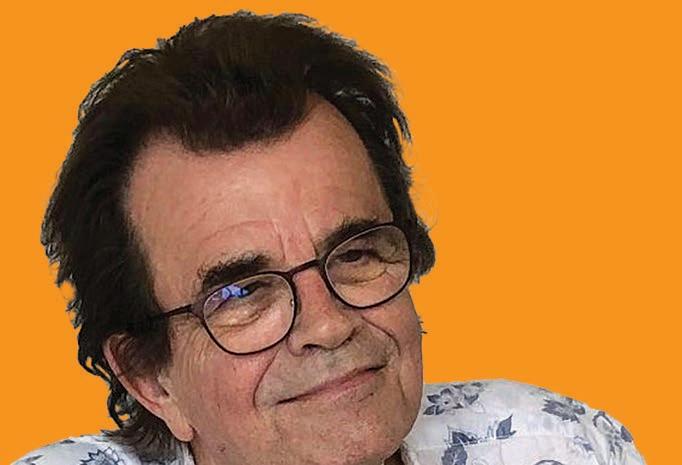

“People don’t understand what adopted people go through. You’re always wondering, ‘Will I get a phone call today, or tomorrow.’ You’re always waiting. You need patience because it’s very frustrating.” at’s how Meath woman Marguerite Penrose [pictured] describes her journey from the rst three years of her life in a Mother & Baby Home on Dublin, from where she was adopted by loving parents, to where she is now – a woman who traced her mother and who nally reconnected with the birth siblings she never knew.

Marguerite has had more than her fair share of battles over the years – from facing fundamental questions about her own origin, to battling racism due to her skin colour, and as an active woman who lives with a disability.

She has chronicled all this in her memoir, Yeah, But Where Are You Really From? at’s a question which Marguerite, the daughter of an Irish mother and a Zambian father, has often been asked and one which, no doubt, she posed herself when she embarked on the search for her birth parents.

To nd those answers, she turned to Tusla Child and Family Agency, who assigned social worker Margaret Comaskey as her case worker and gave her the task of taking on the search.

It was an undertaking hampered by the arrival of the Covid pandemic and then by the cyber-attack on the HSE website, which led to a shutdown of the computer network.

“ e cyber-attack was very hard, ere were months of not being able to do anything,” says Marguerite.

Covid added to the di culties. “We never got to meet one-on-one, but we had good Zoom calls,” she says. “Margaret had a good sense of my expectations… but it’s a Pandora’s Box… something you can’t prepare for.”

What Margaret found was that Marguerite’s father had been a cadet in the Zambian Army Medical Corps and had been based in the Curragh army camp for a period of time before returning to his homeland. It was during this stay that Marguerite was conceived and subsequently put up for adoption in St Patrick’s. e introduction of GDPR in 2018 made tracing searches more di cult. Prior to this, Margaret and her colleagues could search medical records, client IDs, contact post o ces and parish registers, and nd people through PPS numbers. Now, all of that was o the table and only births, deaths and marriage certi cates could be used.

“Case workers are under strict instructions about what they can tell you,” says Marguerite. “It can be a long, slow process. “I’m 47 – but there are people who are quite old who don’t have five or six years to do this. I hope the system gets easier.”

That wish could well be granted with the arrival of the Birth Information and Tracing Act, begun on October 3, and which provides full and clear right of access to birth certificates, birth and early life information for anyone who was adopted, boarded out or the subject of an illegal birth registration.

The law sees the establishment of a tracing service and contact a preference register, as well as a making available a broad spectrum of counselling and support services.

The birth information and tracing journey can be traumatic. And although Tusla aims to make the search for information as smooth as possible, the agency says it can never guarantee that what you hope to find will be available in its files or in the files of other agencies. Sometimes people’s experiences don’t live up to expectations… mistakes are made, and delays occur.

It was only last year that Marguerite finally got hold of her birth certificate. Prior to that, what scant information she had about her origins was on an ‘adopted birth certificate’ and she had no access to her medical history – a vital aspect of her life considering Marguerite was born with the spinal condition scoliosis.

“The whole process could be made a lot quicker,” she says. “How the Bill will work once it properly kicks off remains to be seen. I’ll be keeping an eye on it as I have friends who are adopted and are going through the process.”

Using information sourced by Tusla, it emerged that her birth mother was now dead, and using the MyHeritage. com genealogy platform, led to Marguerite discovering that she had birth siblings - two brothers and a sister.

Through Dublin company AlphaBioLabs, she also got a breakdown of her DNA… something that is vital in the search for her African family, and Margaret will be there to support her when that time comes to that journey, too.

Says Marguerite: “She has been 100% there for me. I knew from Day One that we would get on. It’s very important to have a connection with the person. She is very understanding and deserves great credit. She always says I can call her anytime, which is great.”

The search has already brought three families together – those of her birth siblings and Marguerite’s own adopted family of parents Mick, Noeline, and her sister Ciara.

“I didn’t tell them about the trace until I heard about my [birth] mum, [but] my family always wanted me to find out,” she says.

So, what’s it like having so many new people in her life?

“Sometimes I do feel torn. I’m trying to get to know my new family but I’m also very aware of the time I spend with people; that I make time for everyone. It’s emotionally trying, dividing yourself up, and soon I’ll be even more so with the African side of my family.”

She adds: “I will do a DNA test, but it’s quite expensive and you have to pay yourself. I think it’s something the State should pay for.”

For Marguerite and others like her, the new legislation will hopefully help in what is a traumatic and emotionally draining detective hunt.

“It’s great to hear the news about Tracing,” she says. ‘We need to educate people… they need to hear the human side to the [adoption] story. I had a positive experience – it’s important to tell people that it’s not all negative.”

The good news for Marguerite, though, is that thanks to her case worker Margaret’s efforts, she has been reunited with her birth brothers, and it was a reunion that went perfectly.

“I couldn’t ask for a better [one]. We met in December, before Christmas. It was like we were never apart… it was full-on,” she says.

“The similarities are uncanny.” I feel like I have known them my whole life. It worked out for me, which isn’t always the case.”

Taking on a search for one’s origins is no easy; task, but with Tusla’s help and with the new legislation, things might become a bit easier for all concerned.

SPECIAL REPORT ‘I didn’t tell them until I heard about my [birth] mum, but my family always wanted me to find out...’