8 minute read

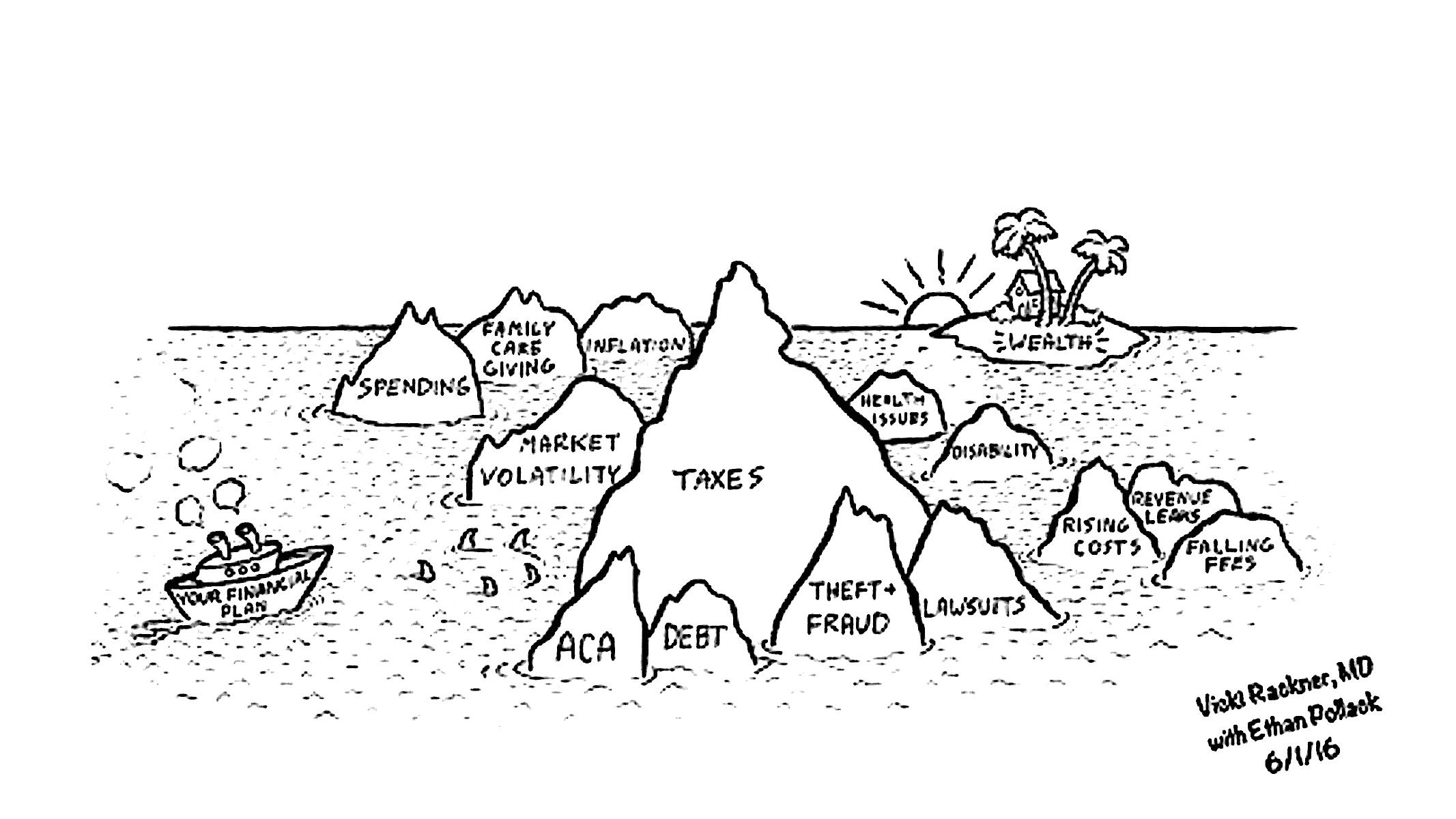

Harnessing The Power Of Media To Build A Lasting Legacy Imagine If You Could Legally And Ethically Reduce Your Taxes By 30% Or More?

As you look to create and cultivate your legacy, remember that the influence of media cannot be underestimated because it possesses the extraordinary ability to mold perceptions, ignite transformative change, and forge enduring legacies.

Effectively harnessing the potential of various media channels, individuals and organizations can construct narratives that resonate authentically with their audiences, fostering connections that transcend temporal boundaries.

Advertisement

When you consistently engage your viewers, listeners, or readers, you can cultivate legacies that leave an indelible imprint on the world. Embrace the remarkable opportunity to share your story, connect with others, and leverage the transformative power of media to make an everlasting impact that transcends generations.

BY STERLING LOUVIERE

Sophisticated investors understand that proactively managing taxes is one of the most effective strategies for building wealth. Why?

Because taxes represent your most significant lifetime expense.

The way you manage your lifetime tax burdens will impact the rate at which you build wealth. Let’s say, for example, you want to move up your retirement date by five to ten years. You have three basic choices:

1. Increase your income.

2. Get better returns on your investments.

3. Cut your costs.

Every dollar you keep instead of paying

Uncle Sam is something you can put to work growing your wealth. Conversely, without proactive management, taxes erode your wealth and the legacy you pass on to the next generations. Following are some essential things to understand about taxes

Taxes Are A Form Of Social Engineering

The tax law is a form of social engineering designed to reward specific behaviors that benefit society. Saving for retirement, making long-term investments, creating jobs, building houses, and giving to worthy causes are all rewarded with reduced tax burdens. Thus, you build wealth more effectively when you align your investing choices with the rewarded behaviors.

How The Tax Law And Jobs Act Impacts You

In 2017, a new tax code became law, and it is the most sweeping tax reform in over thirty years. This new tax law aims to strengthen the US economy by making us more competitive in a global market.

Prior to this, the old corporate tax rate of up to 35% was one of the highest in the world, and logic suggests that lowering the corporate tax rate could attract more business and investments here. This idea has bipartisan support because in reality, tax breaks only for the wealthy would be politically untenable. So, for it to pass, the new tax law also included tax benefits for the employees of these corporations. Additionally, reducing corporate tax rates without reducing small business owners’ taxes would make passage of the new law difficult. How would the government make up the revenue lost through these tax cuts to these three groups? High-earning professionals like you will now shoulder a larger share of taxes. How? Many deductions you have used to lower your tax bill in the past have been tightened or eliminated, including personal exemptions, state and local taxes, mortgage interest, and many others. Some business owners ask, “How does the new tax law work?” But the better question is, “How can I make the tax law work for me? How can I harness the power of the corporate changes and put them to work for me?”

Getting Help From Your CPA You might be thinking, “I’ve got my taxes under control. work with a CPA who works with lots of doctors.”

You may be right, but the reality is that most CPAs are tax historians.

They summarize the calendar year’s financial activities and calculate the taxes you owe. Further, your CPA is only as good as their knowledge of tax law, which is complex.

Unfortunately, the unplanned capital gains taxes derailed his retirement dreams because he needed to structure the sale correctly.

How Do Tax Strategists Find Tax Savings?

Tax strategists have four essential tools to reduce your tax bills:

1. Code-based strategies

The new tax code brings wideranging changes, and at this moment, sharp minds are working hard to make the codes work in favor of their tax-paying clients. Your tax strategists can find ways of making the new tax code work for you.

For example, changing your corporate structure or shifting from a W2 employee to a 1099 independent consultant could make a significant difference.

Can your current CPA help you with code-based strategies? Maybe or maybe not.

If your CPA is a true tax strategist, they would have called you and said, “The new tax law is a huge opportunity for you. Let’s get together and consider some changes we can make to reduce your tax bill.”

If your CPA did NOT make this call to you, invite you to get a second opinion from a true tax strategist. There is too much money on the line, so please don’t leave tax savings on the table. Is reducing your taxes legally and ethically by going with the momentum of the tax code unpatriotic?

Will you be subject to increased scrutiny?

Will you increase your risk for an audit? Judge

About the author: Sterling Louviere is a training students, engaging in conflict resolution through peace-building efforts with community partners and developing student leaders through Model United Nations programming. These individuals are now pivotal in making peace-building and kindness contagious, promoting the ideal of resolving conflicts in their respective communities, and utilizing their acquired knowledge and skills to promote positive opportunities and support to those in need. iSERVE has also collaborated with AlphaGamma Founders Arthur and Eric Gopak to support initiatives around content marketing, education about how to get the most out of accessible opportunities, and sharing information about how to search the AlphaGamma Business portal for young professionals to get selected for some of the worldwide opportunities.

We also held a scholarship and fellowship workshop, and iSERVE assisted a student in earning a Fulbright Fellowship. Additionally, we collaborated with the Founder of Pundutso Financial Education Trust and a Mandela Washington Fellowship Alumnus, Leslie Makwembere, along with the U.S. Embassy of Zimbabwe’s Education USA Team to help Zimbabwean students to unlock their hero’s journey storytelling skills so they can apply to international universities and fellowships.

We’re not merely offering solutions, but encouraging people to tackle their challenges head-on, fostering resilience and hope through practical opportunities. In this regard, Servant Leadership

About the author: resonates strongly. It’s not just about empathy and humility; it’s about creating actionable outcomes that enrich lives, and we echo the need for those we train or assist to keep the cycle of serving going.

Lori is an International Media, Marketing, and Branding Expert specializing in helping entrepreneurs and business leaders understand the power of developing one cohesive plan. She was selected as an official speaker for the Think & Grow Rich World Legacy Tour and was invited as a Featured Speaker for Turning Point 20/20, with 2.25 million people attending live.

Helping raise over three million dollars for literacy, Lori’s global work earned her the Lifetime Presidential Service Award. Most recently, she also received the Global Visionary Leader Award and Outstanding Leadership Recognition by the LA Tribune. She has authored / coauthored several books and works globally to support literacy, cancer research, young entrepreneurship, and military programs.

Some of my mentors showed me that understanding team well-being isn’t just about empathy and offering practical resources that nurture resiliency and wellness. This roadmap promotes healthier environments championing empathy, compassion, kindness, and opportunity awareness.

Remember, kindness isn’t passive; it’s about adding value. It’s about attentive listening, helping neighbors, and offering support, making every act a catalyst for significant positive change. As we ‘Conquer with Kindness,’ we inspire others to do the same, cultivating hope in our communities.

If you want to learn more about integrating kindness and servant leadership into your lives, check out the book, “Conquering with Kindness How to Pursue a Successful and Meaningful Life Serving Others while Discovering and Living Your Purpose to Be Your Best Self” that’s set to be released soon. Let’s continue our shared responsibility and privilege to serve others and conquer with kindness!

No matter your industry or role, it’s in serving others that we truly lead. It’s through kindness that we truly conquer.

It’s in transforming ourselves that we can actually begin to transform the world one person at a time. The journey is demanding, the challenges are many, but the rewards are fulfilling.

About the Author:

Bogdan Matuszynski, a firstgeneration Polish-Mexican-American, has used his experiences and skills to make education and opportunities more accessible to others globally, propelling his mission of service in his founding of iSERVE. In his role through iSERVE, Bogdan acts as a Scholarships & International Opportunities Advisor, teaching leaders diplomacy skills, international project development, and the art of designing award-winning essays for scholarships, fellowships, university admissions, and grants to help people access life-changing opportunities.

His commitment to service earned him prestigious international fellowships and grants, such as the Ambassador Charles Hostler Fellowship, the Hansen Summer Institute on Leadership and International Cooperation, the U.S. Department of State’s Fulbright Spain Teaching Grant, and the Rotary Peace Fellowship. He has also earned the RISE San Diego Urban Leadership Fellowship, the San Diego State University’s “Quest for the Best” Vice Presidential Student Service Award, and Congressional Recognition for his activity related to Model United Nations. Bogdan holds a Bachelor’s degree in International Security and Conflict Resolution, with minors in Islamic & Arabic Studies and Latin American Studies, and is set to complete a Master’s Degree in Defense & Strategic Studies from the U.S. Naval War College. Additionally, he enjoys serving by volunteering at community events, helping social organizations as a brand ambassador, and has organized educational activities worldwide to use education as a tool to promote peace.

A tax strategist –who may be a CPA—can help you proactively make choices that could significantly reduce your tax bill. Basic and advanced tax strategies can help you significantly reduce your tax bill, but we have observed that most doctors must be aware that options exist.

Picture this: a surgeon reduced his 2018 tax bill by $940,000 by seeking a second opinion from a tax strategist who works with many doctors. Contrast that with the story of a surgeon who planned to fund his retirement by selling his stake in a surgical center.

Learned Hand said, “There is no patriotic duty to increase one’s taxes. Over and over again, the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.”

2.

Timing strategies

Each source of income can be assigned to one of three buckets:

• Taxable income - The more you make, the more you’re taxed

• Tax-deferred income When you put money in your retirement plan like your 401(k) or IRA, you enjoy a lower taxable income for that year; however, you will pay taxes when you withdraw the money at the tax rate in that year.

• Tax-free income - Specific sources of income are not taxed. For example, it makes sense that orphans and widows would not pay taxes on life insurance benefits after the breadwinner’s death.

Paying taxes later instead of paying now is generally a good idea. However, this strategy comes with the uncertainty. What will the future tax rates be? Most economists agree that the tax rate you will pay when you withdraw money from your retirement plan will almost certainly be higher than the historically low tax rate you pay today. Further, chances are good that your expenses in retirement will go up—not down. 3. Income-shifting strategies

You do not have to put all your income in one bucket. You can potentially create different business entities. This is an approach tax strategists call “cracking and packing.” Have you considered shifting income to people like your children in lower tax brackets?

4. Product-based strategies

Just as you have access to new diagnostic and therapeutic tools, many financial tools can also be used to lower your tax burdens, including Employee Stock Ownership Plans (ESOP), Cash Balance Plans (CBP), Charitable Remainder Unit Trusts (CRUT), captive insurance companies and many more. Finally, you can do well by doing good. You can structure your charitable donations to make your contributions go further, allow you to enjoy tax benefits during your life, and preserve your legacy after your death.