7 minute read

Agricultural Industries Coping with Increased Costs

by TPIturfnews

By Scott Brown, PhD

Today’s headlines are dominated by the increased costs facing all parts of the world economy. The sod industry is no exception, with significantly higher and sometimes record prices for many of the inputs used in the industry. In these times of skyrocketing input prices, it is imperative for all farmers to better know and manage their costs, and the sod production industry is no different. Although the last few years have been a period of growth, increased demand, and better returns for the industry, bottom lines have become increasingly squeezed in recent months. One well-documented, but rather un-widely publicized tool for tracking selling prices is the Producer Price Index (PPI) reported by the U.S. Bureau of Labor Statistics (https://www.bls.gov/ppi/). The Producer Price Index (PPI) is a family of indexes that measures the average change over time in selling prices received by domestic producers of goods and services. PPIs measure price change from the perspective of the seller. This contrasts with other measures, such as the Consumer Price Index (CPI), that measure price change from the purchaser's perspective.

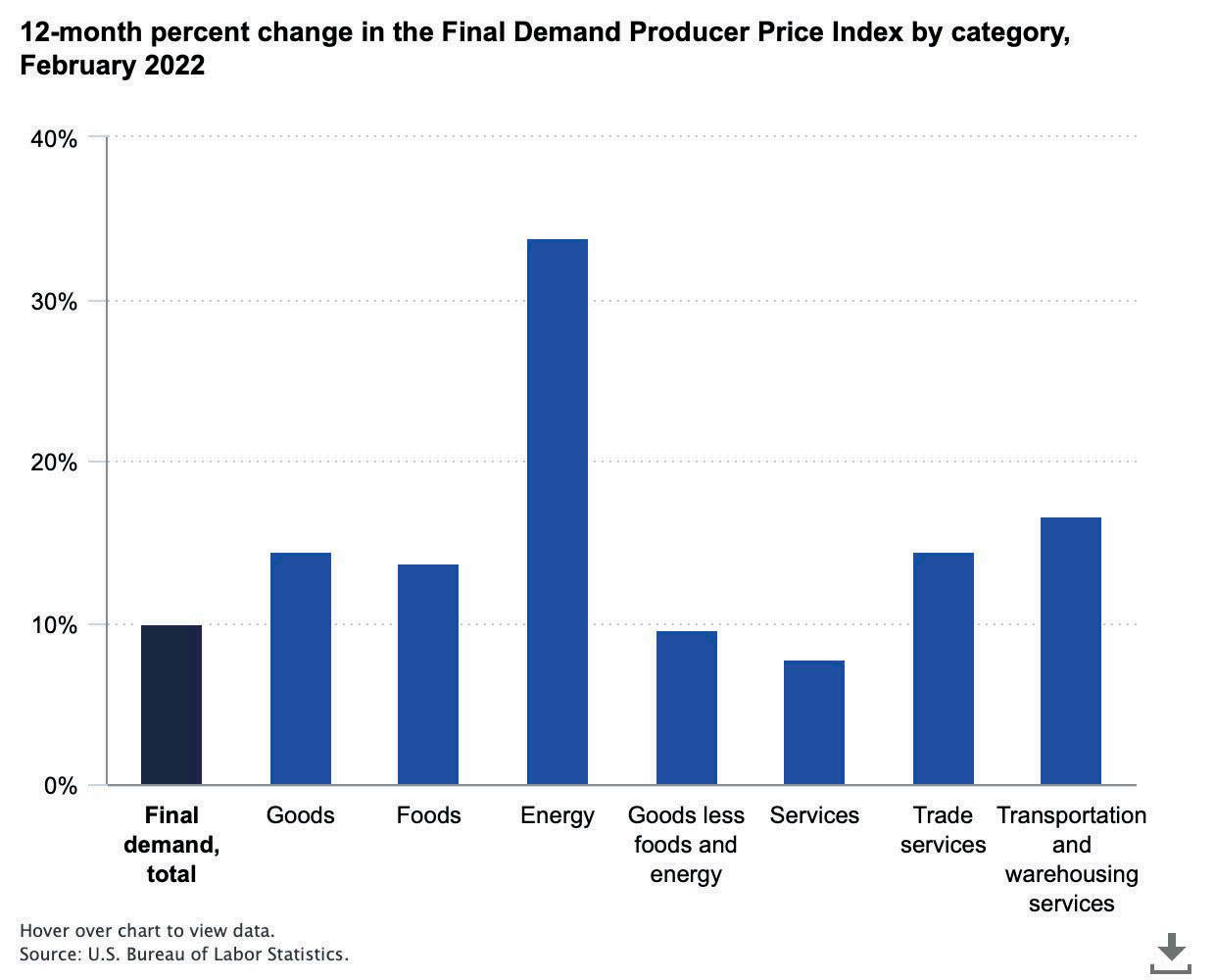

Chart 1: Final Demand Producer Price Index

As reported in Chart 1, producer prices for final demand increased 10.0 percent during the 12 months ending February 2022. Prices for final demand goods increased 14.4 percent over the year ending February 2022. Final demand energy prices increased 33.8 percent, while final demand food prices were up 13.7 percent. Final demand prices for goods less foods and energy increased 9.6 percent. Over the year, prices for final demand services increased 7.8 percent in February. Within the final demand services category, prices for final demand transportation and warehousing services increased 16.6 percent, while final demand trade services were up 14.4 precent. What’s the common trend? They’ve all gone up.

Another benchmark is the U.S. Department of Agriculture’s National Agriculture Statistics Service (USDA-NASS). USDA-NASS conducts five surveys every year in midMarch to collect information from agribusinesses on the prices producers paid for recent sales of approximately 450 key agricultural inputs. The prices paid surveys collect information on agricultural chemicals (including fertilizer), farm machinery, feeds, fuels, and retail seed.

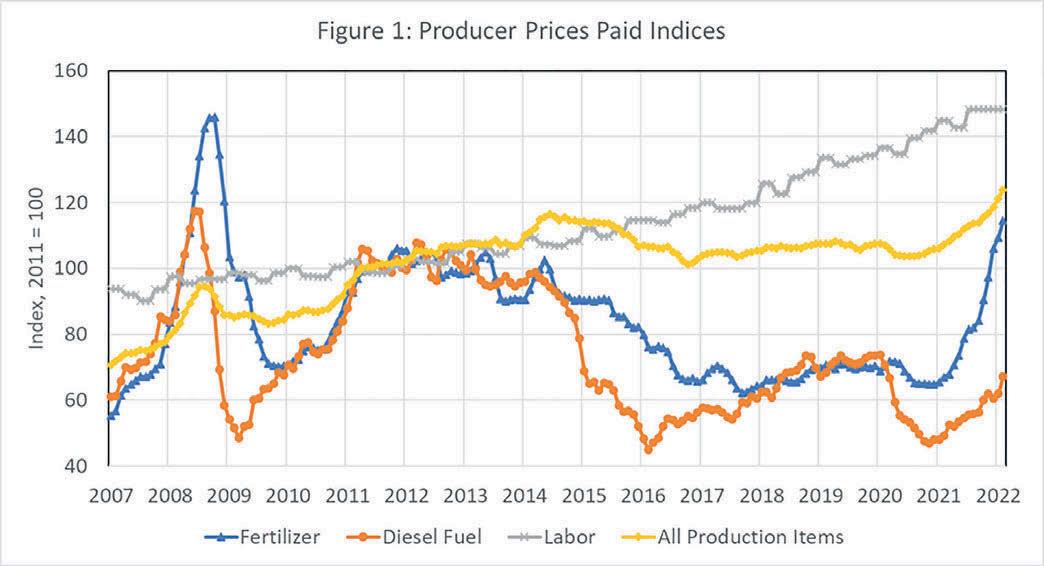

USDA data shows the marked increase in costs facing agriculture in 2022 (Figure 1). The total fertilizer index is nearly 40 percent above a year ago, and components of the overall fertilizer index, like nitrogen, have more than doubled. Labor costs continue their upward march, with labor availability being an additional issue. Diesel fuel has increased from $3.15 per gallon in April 2021 to $5.20 per gallon in April 2022, with the war in Ukraine responsible for about $1.00 per gallon of the increase.

Of course, most producers don’t have to look at a survey to know their costs have increased when they can just look at their bottom line. TPI has heard from members all over the world who have shared their experiences locally. One sod producer states “We have a lot of line items on our spreadsheet, but only six of them make up 90 percent of our expenses: Payroll, Fertilizer, Fuel, Chemicals, Rent, and Supplies (such as pallets and netting). Keep in mind that capitol items like depreciation, taxes, and some others are not in this variable list. The big changers for us are fertilizer up 96 percent, fuel up 78 percent, and pallets and netting up 60 percent. When I calculate the cost changes, (or the expected changes) and compare them with a three-year average of those same expenses I estimate an 18 percent increase in my expenses for 2022.”

The uncertainty of when inputs will arrive and the extreme volatility in input prices have also made planning much more difficult. Supply bottlenecks that appeared with the Covid-19 outbreak have been persistent, with relief not expected soon for inputs shipped from overseas. Input cost and availability issues have provided multiple reasons to keep a sharp pencil at hand when examing your production costs.

Source: U.S. Department of Agriculture: National Agricultural Statistics Service

For many agricultural products, producers find themselves unable to influence the price they receive for the product they produce. For instance, farmers who sell agricultural products into commodity markets. In that case, it is virtually impossible to pass along cost increases to a buyer. In some cases, the only path that returns profitability to the industry as a whole is one where the highest-cost producers are forced to exit from the industry, an excruciating process for all involved.

The sod industry may be better situated to pass along increased costs than many other segments of U.S. agriculture, particularly in a hot housing market. The number of sod producers is lower than is the case in many other agricultural enterprises, which can also help with passing increased costs to end-users. Are customers going to complain? Of course they are. Are they going to leave for another producer? Perhaps. Are they going to return if and when that other producer’s price has also increased? Probably so. One sod producer states “Overall, for 2021, my cost of goods sold (COGS - refers to the direct costs of producing goods sold) rose by 16 percent. We raised our price three times and need to do it again. Our COGS are increasing at such a rapid pace that our price is still lagging behind. I have been telling customers to not get too comfortable with the price because it is likely going to change again.”

There are various ways producers share that they have been able to successfully pass along some of their costs increases. They range from increases in their price of sod, as stated above, to implementing drop fees, higher pallet charges, adding fuel surcharges, and so on.

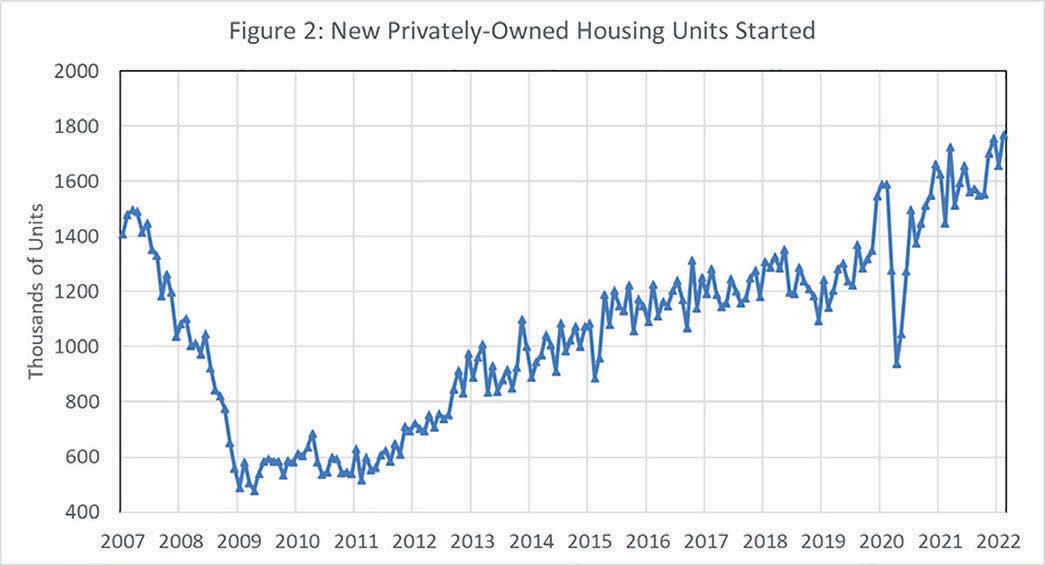

There are more factors at play than just the number of producers. Another factor at play right now is strong demand for housing. Figure 2 shows that in February 2022, new housing starts reached 1.769 million. The housing start data continues a trend of strong demand for housing, leading to large increases in new home prices. The cost of labor and materials for home building has gone up significantly as is the case with most all inputs. This strong demand in housing starts may provide the needed opportunity for sod producers to increase sod prices to help offset the increased costs they face today. Given the current boom in housing starts, the demand for sod may remain rather strong even if sod prices move higher.

Looking longer-term, there are risks that strong demand could wane in the coming months if economic growth slows, making it more difficult to pass along higher sod prices. This of course makes it even more important to capture the market now. “We as sod producers are a little like gas stations,” says one TPI member. “They’ve got tanks in the ground that cost them x to fill up today but likely much more than that to re-fill them tomorrow (as fuel prices increase). So, they need to sell it for more than x today to be able to buy the same fuel at a higher price when they fill up next time. Similarly, I am selling sod today that I put in the ground a year ago when things were cheaper. I am going to be re-planting at much higher costs today than I was a year ago, so I need to capture that revenue now. If next year’s market dips, then I’ll be doubly hurt because not only am I selling sod cheaper then, but it cost me more to plant that sod now than what it might next time if the market is down.” Remember the game of musical chairs? No one wants to be left standing if the market dips 12-18 months from now with high-cost inputs invested in sod on the ground at a time of low demand.

Figure 2:

Source: U.S. Census Bureau

The most important information for sod producers today is to be aware of your cost of production and understand how it has changed in today’s cost environment. One sod producer goes on to say that “Right now, with the market being strong and sod supply being short, many of us have healthy bottom lines due to the increase in sales volume. I think though it is important that no matter what your net income is showing, you must make sure not to let COGS grow faster than our pricing.” Or, as one producer puts it more simply at their farm “I’ve got to go up or go out!”

Dr. Scott Brown is director of Strategic Partnerships for the University of Missouri College of Agriculture, Food, and Natural Resources (CAFNR) and associate extension professor of Agriculture and Applied Economics.