3 minute read

Professional Services

Scott

Chartered Accountants

Advertisement

With the Federal election looming, the Labor Party has proposed a number of changes. If elected, proposed amendments include:

HOW WILL LABOR’S CHANGES IMPACT YOU?

n Reduce the general CGT discount to 25% from 50%, with exceptions for grandfathered investments. n Limit negative gearing to investments in new housing, with grandfathering for pre-existing investments. n Remove the ability for share investors to claim

excess franking credits as cash tax refunds.

n Reinstate the 10% test and repeal the recently introduced tax deduction for concessional superannuation contributions by an individual, including employees. Contact our office now to review your position in light of proposed changes and for the 2019 year end.

LOCATED UPSTAIRS: Village Shopping Centre, Suite 8, 43-45 Burns Bay Road. P: 9418 6669 EMAIL office@scottca.com.au

MORTGAGE CHOICES

To fix or not to fix – that is the question!

There has been much in the media about home loan interest rates, and whether the next move will be up or down. You may be surprised to know many lenders are offering fixed rates below even the most competitive variable rate loans. Stephanie Cook, of Mortgage Choice Lane Cove, says “many lenders are offering great fixed rates for both home and investment loans, over two, three or five-year terms. So, even with the variable rates at historical lows, there may still be merit in looking at fixing some, or all, of your home loan. Fixing an interest rate has the advantage of surety. You will know exactly what your repayments will be for the fixed term of your loan. This is helpful in budgeting and gives peace of mind, knowing you will not be affected by further interest rate increases during the fixed term. However, fixed rate loans generally only allow minimal extra repayments and can have high early discharge or ‘break’ costs. Many of our clients take out a combination of fixed and variable rates with their home loan as they see this as the best of both worlds. Some lenders also offer competitive fixed rates that build in many of the flexible features traditionally only associated with variable loans.” The team at Mortgage Choice Lane Cove is always ready to assist. Give us a call today! Please feel free to contact us on 9420 3052, visit 15/43-45 Burns Bay Road, Lane Cove or email stephanie.cook@ mortgagechoice.com.au

Mortgage Choice Limited ACN 009 161 979. Australian Credit Licence 382869.

Lane Cove locals proudly working with the Lane Cove community.

Michael and Renee Stevens each have over 20 years’ legal experience gained in national and international law firms. We provide affordable, straightforward legal services for both your business and individual needs. • Conveyancing and property-related issues (eg. transfers between related parties, caveats, easements, consolidation of by-laws) • Drafting and updating of wills, powers of attorney and appointment of enduring guardian documents • Estate administration (obtaining grants of Probate and assisting executors to administer a deceased estate) • Commercial and retail leasing • Business sales and purchases • Drafting and updating of business documents such as terms and conditions of trade, guarantees, contractor and employment agreements • Debt recovery and dispute resolution • Notary Public services

PLEASE CALL US FOR AN OBLIGATION FREE CHAT Level 1, 102 Longueville Road, Lane Cove (with lift access) 9188 9631 I renees@srmlawyers.com.au

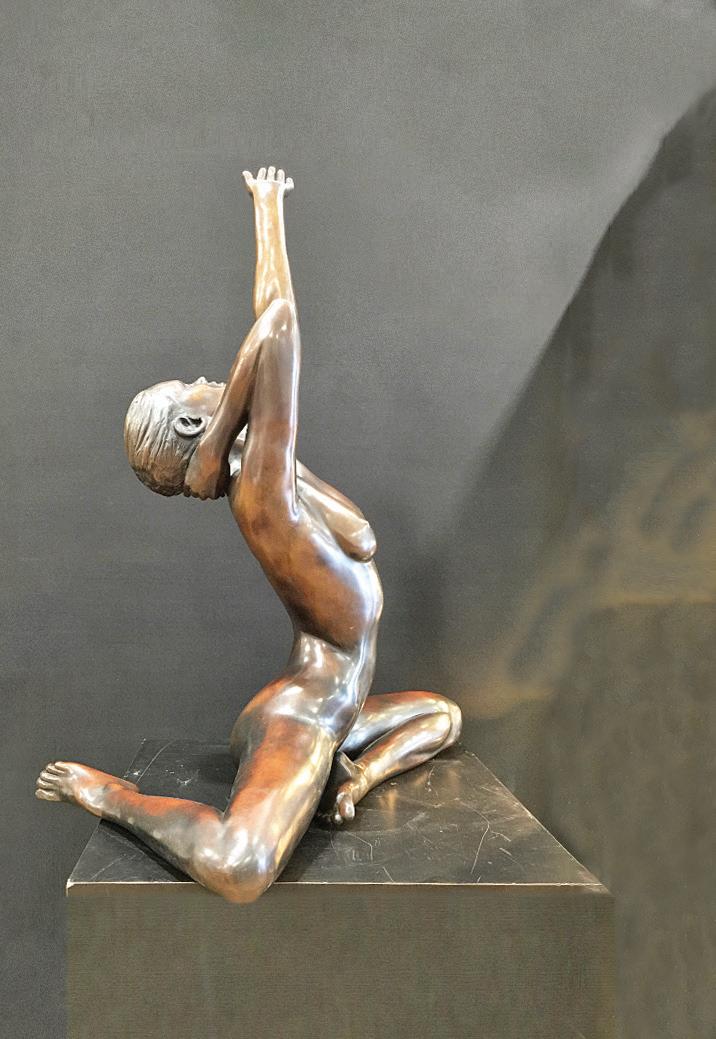

FEATURING OVER 100 SCULPTURES. SOME OF AUSTRALIA’S LEADING SCULPTORS. BRONZE, COPPER, ALUMINIUM, STAINLESS STEEL AND GLASS AND AN EXTENSIVE RANGE OF PAINTINGS AND DRAWINGS

Release the major work

COMMENCES 1ST OF APRIL

UNIVERSAL ITEC, 40 BURNS BAY ROAD, LANE COVE OPEN SEVEN DAYS. 9AM TO 5PM. 0419 400 980