2 minute read

FOCOL raise could have beaten $16m

from 05112023 BUSINESS

by tribune242

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

FOCOL Holdings could have raised “far more” than the $16m received in Monday’s preference share offering, its chairman said yesterday, as it moves into an accelerated “growth mode”.

Advertisement

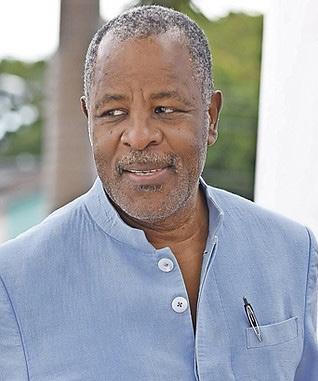

Sir Franklyn Wilson told Tribune Business that the BISX-listed petroleum products supplier, which is now diversifying and expanding into utilities and renewable energy, decided to “cap” its Series E preference share raise at $16m and return to the Bahamian capital markets at a later date when further financing may be needed.

Acknowledging that the $16m was itself a 60 percent oversubscription, compared to the original $10m target, he added that FOCOL has

SEE PAGE B4

Bahamas trade deficit up $325m at five-year high

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

THE BAHAMAS’ trade deficit expanded by $314.6m or 10.7 percent during 2022 to hit a fiveyear high of $3.254bn, it was reveled yesterday, as inflation and higher global oil prices caused import costs to soar.

The Bahamas National Statistical Institute, unveiling the annual 2022 foreign trade statistics review, said:

“The balance of trade (total exports minus total imports) continued to result in a deficit. The trade deficit increased by 10.7 percent between 2021 and 2022, resulting in a negative bal- ance of $3.3bn.”

While Bahamian exports increased year-over-year by $42.6m or 7.8 percent, growing to $586m from $543.4m in 2021, these figures were not surprisingly dwarfed by imports given that The Bahamas brings in virtually everything it consumes. As a result, imports leapt by $357.1m or 10.3 percent to a new five-year high of $3.84bn as opposed to $3.483bn the year before.

The $3.84bn represents foreign exchange that The Bahamas has to generate through a surplus on its capital account,

• He, Bahamian JPLs ‘not playing nicely in sandbox’

• Call for ‘crossborder protocol’ with Supreme Court

By NEIL HARTNELL Tribune Business Editor nhartnell@tribunemedia.net

AN FTX creditor/investor group yesterday leapt to The Bahamas defence by branding claims that the Government was “in cahoots” with Sam Bankman-Fried as “shockingly inappropriate”.

This nation, and the Bahamian provisional liquidators for FTX Digital Markets, appeared to gain some friends in the battle for jurisdictional control of the collapsed crypto currency exchange’s fate as the group called for the creation of a “cross-border protocol” with the Delaware Bankruptcy Court to address all further legal and other disputes.

Conceding that Brian Simms KC, the Lennox Paton senior partner, and the PricewaterhouseCoopers (PwC) accounting duo of Kevin Cambridge and Peter Greaves, “do not seem to be ‘playing nicely in the sandbox’” with FTX US chief, John Ray, the group said the crypto exchange’s creditors were “paying the price” for the two sides’ battles through legal fees and wasted time that is reducing potential asset recoveries for themselves.

Asserting that the fight between the Bahamian joint provisional liquidators and Mr Ray, who controls 134 FTX entities, is “no longer productive or cost efficient”, the