10 minute read

Market declines on fears of more interest rate hikes

STOCKS retreated Wednesday following hefty losses on Wall Street as still-strong economic data fanned expectations that US interest rates will go higher and stay there longer than expected.

The PSE index, the 30-company benchmark, lost 101 points, or 1.50 percent, to close at 6,699.23, as all six subsectors went down.

The broader all-share index also tumbled 42 points, or 1.17 percent, to settle at 3,579.36, on a value turnover of P4.93 billion. Losers outnumbered gainers, 134 to 45, while 43 issues were unchanged.

Nine of the 10 most active stocks ended in the green, with BDO Unibank Inc. rising 0.08 percent to P124.

Meanwhile, the peso shed 0.17 percent of its value to close at 55.18 against the dollar Wednesday from 55.08 Tuesday.

Asian markets traded lower as traders await the release of minutes from the Federal Reserve’s latest policy meeting hoping for an idea about officials’ views on how much and how far to lift borrowing costs.

All three main indexes in New York plunged at least two percent Tuesday, with forecast-beating purchasing managers index data showing the US economy remained in rude health despite almost a year of rate hikes and elevated inflation.

The readings followed a massive surge in new jobs in January and a slower-than-hoped drop in inflation, piling pressure on the Fed to continue tightening policy, which many fear could spark a recession.

Adding to the dark mood were downbeat 2023 projections from retail titans Walmart and Home Depot, who noted the impact of inflation and higher interest rates on consumer health.

They also essentially put to bed any talk of the Fed pausing its rate hikes and even cutting rates by the end of the year.

“A tight labor market and resilient consumer demand could goad the Federal Reserve to maintain its rate hiking campaign into the summertime,” said Jeffrey Roach, chief economist for LPL Financial.

“Investors should expect volatility until markets and central bankers come to agreement on the expected path for interest rates.”

Tokyo, Seoul and Jakarta were down more than one percent, while there were also losses in Hong Kong, Shanghai, Sydney, Singapore, Wellington, Mumbai, Bangkok and Taipei.

London, Paris and Frankfurt all fell at the open.

The Fed minutes, which are due to be released later Wednesday, are a key focal point for traders.

They come after a number of policymakers have lined up to warn of more tightening to come as they try to bring inflation back down to their two percent target from the current levels above six percent. With AFP

Hong Kong unveils $97-b budget for post- COVID recovery

HONG KONG, China--Hong Kong’s finance chief unveiled a HK$761 billion ($97 billion) budget on Wednesday, plunging into the coffers to pay for the recession-hit city’s post-COVID recovery. Hoping to kickstart the finance center’s economy, Finance Secretary Paul Chan announced tax cuts and more consumer spending vouchers.

Hong Kong’s leaders are keen to resuscitate its fortunes after posting recessions in three of the past four years—a tumultuous period that saw the economy battered by protests, virus controls and Beijing’s authoritarian crackdown. While rival financial hubs reopened to the world long ago, Hong Kong only fully emerged from pandemic

McKinsey plans to slash 2,000 jobs on cost savings

SAN FRANCISCO, United States

—Global consulting giant McKinsey plans to let go 2,000 of its employees, Bloomberg News reported Tuesday. The round of layoffs would be one of the company’s biggest ever, according to Bloomberg, which said the firm had increased its headcount from 28,000 to 45,000 over the past five years.

Citing anonymous sources, Bloomberg said the number of employees affected could still change, and is expected to primarily target administrative staff who do not in- teract directly with clients.

McKinsey is seeking to centralize its support services for its consultants in a bid to save money after having recruited heavily in recent years.

Founded almost 100 years ago in Chicago and now operating in more than 130 countries, the consultancy had a record revenue of $15 billion in 2021, and exceeded that figure in 2022, according to a Bloomberg source.

Many large US companies, especially in the tech sector, have rolled out layoffs in recent months, fol-

PHILIPPINE Offshore Gaming Operators, or POGOs, are hard put these days to win the publicity war against them because of the so-called moral crusaders who see nothing good in the industry. But a hardnosed rationalization of the sector and swift response from authorities will easily allay the fears of its many detractors.

A few POGOs were linked to illegal activities like prostitution, illegal recruitment and employment of minors in the past, while some unscrupulous players were taking advantage of the lax enforcement of the law. A strict implementation of the law, however, has neutralized the notoriety of the few.

Recent actions of the Philippine National Police (PNP) have put a stop to crimes supposedly involving POGO employees. The social costs of POGOs, as their critics claim, can be contained with political will, effective enforcement and proper regulation.

The PNP simply improved police visibility and were more vigilant in guarding against POGOrelated crimes. The moves instantly produced the desired results. By the Senate’s second hearing, the PNP reported that there were zero crimes involving POGOs.

Like any industry, POGOs will have their bad eggs, as Sen. Sherwin Gatchalian pointed out in the Senate’s POGO inquiries. There will be POGOs who do not fully comply with government requirements and there will be those that do not remit the proper revenues.

But just because 10 percent or less of the industry are non-compliant doesn’t mean we should shut down the over 90 percent legitimate POGOs, who employ thousands of Filipinos and pump billions of pesos into the economy.

There are Filipino businesses that do not remit the proper taxes and take steps to avoid paying the Bureau of Internal Revenue. What the government does in these cases is go after the erring parties. That is what’s needed with regard to POGOs―go after the guilty (assuming there are ones) and leave the innocent, lawabiding POGOs alone. Why condemn the majority for the sins of a very small minority? One bad apple does not necessarily spoil the rest of the bunch. Blaming the entire industry would be an overreaction on the part of government. It is overacting, or OA in the Filipino vernacular. Banning them would be an extreme measure. The Senate’s POGO hearings, in fact, reveal they are job-generating enterprises that compensate their lowing years of rapid growth fueled by the accelerated digital transition during the pandemic.

The layoffs come two years after McKinsey’s approximately 650 senior partners chose Bob Sternfels to replace Kevin Sneader at the helm of the company.

Sneader’s short tenure atop McKinsey was marked by US lawsuits accusing the company of having contributed to the nation’s deadly opioid crisis through work with pharmaceutical companies, such as OxyContinmaker Purdue Pharma. AFP isolation earlier this month when it restored its border with mainland China, its main economic pipeline.

“Our economy is at the early recovery stage, and members of the public as well as a large number of enterprises are still weighed down by tremendous pressure and require support,” Chan

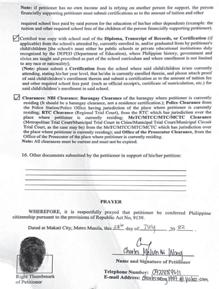

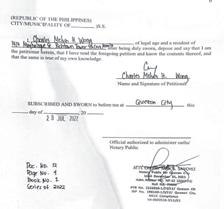

HUI WONG to be naturalized as Filipino citizen pursuant to Republic Act No. 9139. SCN CASE NO. 0000815

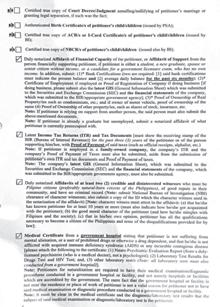

Pursuant to the provisions of Republic Act No. 9139, petitioner hereby submits a petition for naturalization to become a citizen of the Republic of the Philippines and respectfully declares:

1. My full name is Charles Melvin Hui Wong but I have also been known since childhood as Bin or I have been judicially authorized to use the alias name(s) N/A workers over and beyond what other industries are capable of paying.

POGO critics have simply gone overboard in attacking the industry. One of their exaggerated claims is that allowing POGOs in the country will hurt the country’s attempts to lure Chinese tourists to the Philippines. They contend the Chinese government will “blacklist” the country and discourage their citizens from visiting our shores if we allow POGOs to operate, an assertion made by our very own Senate President––but debunked by the Chinese Embassy itself.

Recent developments have shown that the Chinese government on the contrary are encouraging their citizens to visit the Philippines. When President Ferdinand Marcos Jr. visited Beijing last month, he returned from his State Visit with 14 bilateral agreements, one of which is the implementation of the MOU (Memorandum of Understanding) on tourism between the Philippines’ Department of Tourism (DOT) and the Ministry of Culture and Tourism of China.

The agreements immediately bore fruits. Chinese Ambassador to Manila Huang Xilian and Tourism Secretary Christina Garcia Frasco in the last week of January welcomed over 200 travelers from China at the Ninoy Aquino International Airport. Huang says the Philippines is one of the first 20 countries that the Chinese government included in a pilot program to resume outbound group travel for Chinese citizens––one of the “deliverables” of President Marcos’ visit to China.

Adds Huang: “We hope and believe that the Philippine government will continue to provide convenience and facilitation to Chinese tourists and ensure a pleasant, convenient and safe journey.” That does not sound like a foreign government that plans to blacklist the Philippines.

POGO employees are fortunate that Mr. Marcos has shown more empathy than those in the Senate or in his Finance team who want POGOs out. He knows jobs are at stake, and the Chief Executive has approached the issue with an open and mind, one that recognizes that the benefits of POGOs cannot be denied.

The President acknowledges that banning them comes with costs––thousands of unemployed Filipinos, billions in foregone revenues––that will outweigh whatever purported problems the prohibition of POGOs seek to cure.

E-mail: rayenano@yahoo.com or extrastory2000@gmail.com and she was born on 23 February 1971 in Hong Kong. She is a citizen or subject of Hong Kong.

5. My trade, business, profession or lawful occupation is Asst. Store Operations Manager and from which I told legislators while announcing his 2023/24 budget.

The latest blueprint for reversing the downturn allocates HK$5,000 (US$637) handouts for more than six million people, half last year’s amount as Chan is under pressure to rein in fiscal spending. AFP the Philippines from the date of the filing of this petition up to the time of my admission to Philippine citizenship.

14. My character witnesses are Rochelle L. Ongchap and Alan L. Tan both Filipino citizens, of legal age, and residing at Quezon City and Quezon City respectively, who have executed sworn statements attached hereto in support of my instant petition, together with: (a) brief biographical data about themselves; (b) detailed statements on the dates they first came to know me, the circumstances of our initial acquaintance and the reasons and extent of our continuing familiarity; and (c) the number of times they have acted as character witnesses in other petitions for naturalization.

6. My civil status is SINGLE. I was married on N/A_ in N/A my wife’s husband’s name is N/A and she/he was born on N/A in. N/A She/he is a citizen or subject of N/A and presently resides N/A

7. I am legally separated from my spouse; my marriage was annulled, per decree of legal separation/annulment dated N/A granted by N/A (please indicate the particular court which granted the same). I am a widower/widow and my spouse died on N/A in N/A

8. I have N/A child/children, whose names, dates and places of birth and residences are as follows:

9. I received my primary and secondary education from the following public schools or private educational institutions duly recognized by the Department of Education, Culture and Sports (DECS), where Philippine history, government and civics are taught and prescribed as part of the school curriculum and where enrollment is not limited to any race or

10. I am able to read, write and speak Filipino and/or any of the following dialects of the Philippines: .

11. I have enrolled my minor children of school age in the following public schools or private educational institutions duly recognized by the Department of Education, Culture and Sports (DECS), where Philipine History, government and civics are taught and prescribed as part of the school curriculum and where enrollment is not limited to any race or nationality:

Name of ChildName and Place of SchoolDate of Enrollment N/A N/A N/A

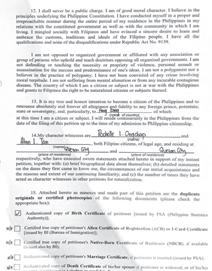

12. I shall never be a public charge. I am of good moral character. I believe in the principles underlying the Philippine Constitution. I have conducted myself in a proper and irreproachable manner during the entire period of my residence in the Philippines in my relations with the constituted government as well as with the community in which I am living. I mingled socially with Filipinos and have evinced a sincere desire to learn and embrace the customs, traditions and ideals of the Filipino people. I have all the qualifications and none of the disqualifications under Republic Act No. 9139.

I am not opposed to organized government or affiliated with any association or group of persons who uphold and teach doctrines opposing all organized governments. I am not defending or teaching the necessity or propriety of violence, personal assault or assassination for the success and predominance of one's ideas. I am not a polygamist nor a believer in the practice of polygamy. I have not been convicted of any crime involving moral turpitude. I am not suffering from mental alienation or from any incurable contagious disease. The country of which I am a citizen or subject is not at war with the Philippines and grants to Filipinos the right to be naturalized citizens or subjects thereof.

13. It is my true and honest intention to become a citizen of the Philippines and to renounce absolutely and forever all allegiance and fidelity to any foreign prince, potentate, state or sovereignty, and, particularly, to Hong Kong of which at this time I am a citizen or subject. I will reside continuously in

GDP expected to expand at slower rate amid global headwinds this year

THE Philippine economy is expected to continue growing in 2023, but at a slower rate in the face of global headwinds, government and private sector economists said.

Department of Finance assistant chief economic counselor director Marites

Oliva, Bank of the Philippine Islands economist Rafael Alfonso Manalili and Philippine Chamber of Commerce and Industry secretary-general Ruben Pascual shared a positive outlook on the economy at a webinar organized by the Philippine Institute for Development Studies.

The webinar featured the study “Macroeconomic Prospects of the Philippines in 2022-2023: Steering through Global Headwinds” by PIDS senior research fellow Margarita Debuque-Gonzales, supervising research specialist John Paul Corpus and research analyst Ramona Maria Miral.

Oliva said the economy’s 7.6-percent growth in 2022 surpassed the Develop- ment Budget Coordination Committee’s assumption and market analysts’ and multilateral agencies’ projections. She said all major production sectors grew last year, suggesting broad-based expansion despite increasing global and domestic commodity prices. The services sector registered the highest growth at 9.2 percent, followed by the industry and agriculture sectors, which grew at 6.7 and 0.5 percent, respectively.

“As we expect a gloomy world outlook this year, we will remain vigilant to ensure that the country will be resilient and on its path toward economic growth. The Bangko Sentral ng Pilipinas will take further tightening measures in early 2023 to curb elevated inflationary pressures,” she said.

Risks to inflation include high international food prices due to supply chain constraints and high fertilizer prices, trade restrictions, the impact of weather disturbances on agricultural stocks and potential wage hikes.