23 minute read

Shaping the future we

Manufacturing is central to REALISING THE FUTURE WE WANT

Digital technologies are reshaping our economy, manufacturing ecosystem and workplace. Though painful, these changes will enable us to meet our net-zero ambitions, while being resilient and productive. Jonny Williamson reports

Advertisement

Three things dominate current discourse: economic growth, wealth equality and the race to net zero. Reasons for why this is the case are starkly evident. How these goals can be successfully delivered, however, is a source of intense debate, one which cost Liz Truss her premiership and in record time, no less. The task is made harder by the trio being intrinsically linked; they cannot and should not be tackled in isolation.

As countries strive to create fairer, greener and yet more productive societies and economies, relatively few acknowledge the vital role manufacturing plays. The UK government is especially guilty, with no industrial strategy and seemingly no desire to implement one. Indeed, the Minster for Industry, Jackie Doyle-Price (at time of printing), has said she doesn’t even like the term ‘industrial strategy’.

Yet, manufacturing – specifically, digitally-enabled manufacturing – will be a core enabler of the future we want. One in which everyone has the things they need at a price they can afford without causing harm to the environment or society. That was the message to delegates who attended the inaugural InterAct Network conference in October.

A diverse roster of speakers drawn from across industry, policy, think-tanks and academia shared their unique insights and perspectives on what it will take to create a future digital manufacturing ecosystem that delivers for everyone.

The future is not the past In his opening keynote, Tamim Bayoumi, Deputy Director at the International Monetary Fund, described how technology has historically widened many forms of inequality, particularly during the IT revolution which took hold around 1980.

Tamim explained that new technologies require new skills. This raises demand for such skills at a time when supply is limited. The resulting wage premium skilled workers can command increases inequality, albeit only initially. Over time, demand for new skills slows and the supply increases which leads to less of a wage premium and lower inequality.

This notion, introduced by American economist Simon Kuznets in the 1950s, broadly holds true for all three Industrial Revolutions to date. Steam, electricity and computers have each provided a myriad of uses that have transformed our lives and the economy. Their impact on inequality has also been similar – an initial rise followed by a plateau.

Does this mean the current Fourth Industrial Revolution will follow the same path? Not necessarily, but we have to accept that IT has created greater inequality than any other technology. This is due to the profound effect IT has had on the economic geography of prosperity.

“Historically, manufacturing required low-skilled labour and land. Factories were therefore located in relatively small towns or on the fringes of larger cities. In 1985, for example, Toyota built its largest US plant in Georgetown, Kentucky; population 30,000.

“By contrast, the main input to IT is skilled workers. Hence, why most IT companies base themselves in cities and large towns,” Tamin noted.

The relocation of cutting-edge industry from small, less prosperous towns to large, wealthy cities over the past 50 years has deepened inequality along three dimensions:

1. Higher demand for skilled labour has benefitted the educated versus the unskilled 2. Rapid urban growth has raised land prices which has benefitted (generally) old and well-off land-owners versus the young and poor 3. Urban prosperity has come at the expense of towns, even as the high cost of housing has made it more difficult for people to move to these prosperous cities IT’s transformation of multiple sectors, not least manufacturing, has seen the zone of prosperity widening out from major cities to other places. However, this can’t be allowed to result in a corresponding expansion, or indeed continuation, of inequality.

Avoiding such a scenario means providing places that have been left behind with the tools to win in the IT age. Most obviously, education that is focused on the skills needed in the future digital age.

“We also need to do more to help those with talent but limited means to move to where opportunities are through housing support,” Tamin suggested. “We need to pay for both these initiatives. Those who benefited most from the IT revolution, the skilled and landowners, should contribute most via an increase in the marginal tax rate.”

The skillset of industry is adapting The theme of skills was picked up by Bhavina Bharkhada, Head of Policy and Campaigns at Make UK, who noted that labour is the primary challenge facing manufacturing businesses. The sector is battling to fill 95,000 vacancies which Make UK estimates equates to around £7bn in lost output for the wider UK economy or £21m a day in lost GDP per worker.

Manufacturing is being disproportionately affected by the recruitment woes facing numerous sectors, with around four vacancies for 100 manufacturing jobs in the country. This is more than double the usual level of vacancies which typically stands at 1.9 per 100 jobs, and even surpasses the hard-hit hospitality sector, which is running at 3.6 per 100.

Industry’s long-standing recruitment challenges are being compounded by the very nature of manufacturing undergoing a transformation. This can be seen on four fronts, said Bhavina: “Automation, digitalisation, greenification [sustainability] and flexible work.”

Skills are at the heart of each of these areas, with the digital skills gap considered the biggest barrier to wider technology adoption. On-site working practices are changing rapidly thanks to digital developments such as virtual reality, artificial intelligence, 5G, robotics and additive manufacturing. This has led to a rise in demand for skills such as cyber security, programming and software development, among others.

Additionally, almost two-thirds of manufacturers are changing their skills strategy in order to manufacture products more sustainably, with 40% believing greenification is a key factor driving changes to how they operate and the skills and jobs which their businesses need.

As a result, Make UK has seen rising demand for skillsets relating to:

• Resource efficiency (carbon accounting, lean manufacturing) • Low carbon economy (nuclear and renewable energy generation, carbon emission minimisation) • The development of new or amended products (circular design)

Something often overlooked is the importance of strong management and leadership during times of change, Bhavina noted. Most manufacturers agree that these skills are key to increasing the adoption of new technologies, yet less than ten percent of training budgets is spent on leadership. This is something being acutely felt by SMEs, many of which identify a lack of access to management skills as a barrier to their future growth.

Bhavina concluded by outlining how government policy could help smooth the transition toward the future of work:

The fight for talent means manufacturers need to FIGHT for talent

Automation is scarier for SMEs because the solution will touch a higher percentage of staff

• Create an Employer Training Fund by reforming the Apprenticeship Levy: a portion of unspent levy funds should be ringfenced to support the upskilling and retraining of existing employers • Introduce a Training Investment

Allowance: expand the current tax exemption for work-related training, providing a tax rebate on investment in training for existing employees • Expand the government’s Help to Grow Management scheme; the current eligibility of ten to 250 employees is restrictive Reframing the automation discussion The UK is the ninth largest manufacturing nation in the world; France is eighth and Italy is seventh. All three countries have a similar manufacturing output but France and Italy have twice the UK’s level of automation. Moving up the rankings requires the UK to invest in automation and upskilling. Yet, automation frequently carries a negative connotation.

Troy Barratt, Managing Director of Kent-based Contracts Engineering Limited (CEL), passionately advocated a quick and effective change leaders can make when discussing the arrival of new technology, especially automation.

“Deskilling is a horrible word used to describe the process where skilled people are replaced by machines, but in most instances, this is not what actually happens,” Troy noted. “Usually, when companies invest in software or plant to drive productivity, it leads to workforce upskilling.

“Not only is deskilling the wrong word but it also drives a wedge of distrust creating an ‘us and them’ attitude between teams that should be working together.”

Automation will be crucial to successfully reindustrialising the UK, it will provide much-needed capacity and enable the country to manufacture cost-competitively on the world stage. Troy encouraged reframing the discussion to change people’s views of automation from a job-killing negative to a careercreating positive.

“What sounds better?” he asked. “Let’s deskill manufacturing jobs and add automation to reindustrialise the UK, or let’s upskill our manufacturing workforce using automation to reindustrialise the UK; which will add more well-paid jobs?

“It’s a trick question because we’re talking about the same thing. An automated factory will need skilled operators, engineers, computer scientists, programmers and technicians.”

Troy is speaking from experience having invested in both factory and back-office automation. CEL currently has one cobot and one robotic welding cell, with plans to be at five-plus by the end of 2023.

“We spend a lot of time and effort on training and upskilling the team in the factory and the offices. This helps to create buy-in for investments,” Troy concluded. “Additionally, because we’re coming from a small base, investments are a win-win for the company and the team. And yes, since investing in automation, our workforce has grown.”

Tapping into the power of purpose Aimee Doole’s keynote expanded on the points made by Tamim earlier in the day. Aimee, Strategy Head for integrated engineering company Booth Welsh, noted how previous industrial revolutions have largely prioritised maximising profit, whereas the Fourth Industrial Revolution prioritises:

• Profit: using digital technologies to improve and grow manufacturing • Planet: using digital technologies to reduce the sector’s environmental impact • People: using digital technologies to better enable and empower teams

Booth Welsh has coined the term ‘Environment 4.0’ to reflect how smart technologies are helping businesses to deliver tangible results in efficiency, performance, resilience and waste

Emerging digital technologies provide a world of possibilities to fully align both your business and your environmental goals

Aimee Doole, Strategy Head, Booth Welsh

reduction, while also delivering a positive impact on profitability.

“The workforce of the future will be much more purpose-driven. Purpose drives a human-centric approach with greater resilience and societal value,” Aimee explained. “Environment 4.0 taps into the power of purpose using technology and will help businesses cross the bridge to the next phase of industry, from Industry 4.0 to Industry 5.0.”

Environment 4.0 has four defined technology pillars, according to Booth Welsh, all of which have become increasingly commonplace in industry:

1. Collaborative robots (cobots) 2. Digital twin technology 3. Industrial Internet of Things (IIoT) sensors 4. Remote support and testing with virtual tools • Realising the future we want will require knowledge, skills and technology • Businesses require much greater support to embrace innovation and increase technology adoption • We need a radical redesign of our education and skills system to ensure future skills needs will be met • Collaboration and adopting a systems approach are crucial • The lack of an industrial strategy needs to be addressed

“We believe that Environment 4.0 comes with an in-built sense of paying it forward. When you follow these principles as you adopt new business solutions, doing the right thing balances people, planet and profit — with no need to worry about a trade-off.

“As we’re all aware, adopting a change in your way of working isn’t easy. It requires a collective effort. Joining meaningful networks has been key for us.” concluded Aimee.

It was a fitting conclusion as the theme of collaboration ran through the entire agenda. Indeed, it is InterAct’s raison d'etre.

The questions facing business leaders, policymakers and wider society are multifaceted with no easy answer. Equally, the scale of change needed and the timeframe in which to achieve it is intimidating, to say the least. The key will be adapting a systems approach and working together in order to combine expertise from the broadest range of perspectives around common goals.

As Made Smarter Challenge Director, Chris Courtney, commented: “Yes, the future looks daunting but consider what we have already achieved in our lifetimes. Twenty years ago, Tesla hadn’t built anything, Apple hadn’t introduced the iPhone, no one was on Facebook and the term ‘cloud computing’ hadn’t been coined.”

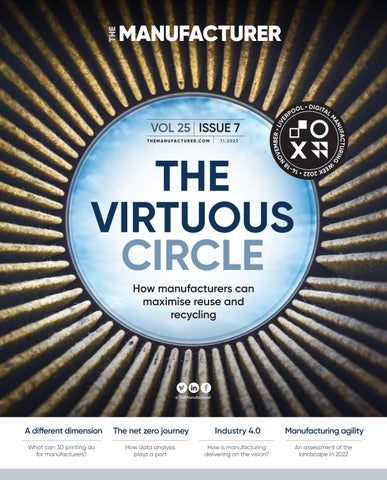

The day closed with an in-depth panel discussion featuring some of the day’s speakers and several new voices. The takeaways from this discussion will be summarised in an upcoming article, look out for it on TheManufacturer.com. ABOVE: The inaugural InterAct Network conference was held at the historic Institution of Engineering and Technology (IET), London IMAGE: COURTESY OF INTERACT

KEY TAKEAWAYS

InterAct Network

InterAct is a £4.4m Made Smarter Innovation funded network that aims to bring together economic and social scientists, UK manufacturers and digital technology providers to address the human issues resulting from the adoption of new technologies in industry. Its long-term vision is to build an engaged interdisciplinary community to support UK industry in the adoption and development of digital technologies that will result in a stronger, more resilient, manufacturing base. www.interact-hub.org

STRONG POUND = STRONG ECONOMY DISCUSS

The end of September saw the pound fall to a record low against the dollar. Despite the wellreported negative consequences in the mainstream media, John Mills, economist and Founder of The John Mills Institute for Prosperity, claims that such an event could result in a silver lining, and growth opportunities for UK manufacturing

MAIN PIC: John Mills, economist and Founder of The John Mills Institute for Prosperity

Speaking in the days following the pound’s devaluation, John highlighted the UK’s historic national obsession with policies that lead to an overvalued pound which have contributed to driving down manufacturing productivity, creating an unproductive and lowgrowth economy.

He also identified that a lower value pound represents an opportunity to boost manufacturing and for the government to make UK exports more competitive and increase the profitability of our domestic manufacturing sector. This would encourage investors to site new manufacturing plants and operations in the UK rather than elsewhere. The Manufacturer Editor, Joe Bush, caught up with John to find out more. Why has the UK traditionally had an obsession with a strong pound?

JM: We’ve had this ethos for a few hundred years, going back to before the days of the gold standard. There’s always been a general perception that the stronger the pound, the better off the economy. In fact, when you analyse it, the reverse is true. A higher pound actually makes us less competitive, which means there is lower growth in exports and less investment. That results in lower living standards and lower productivity gains.

This perception was reinforced by the inflationary problems we had in the 1970s. Between 1977 and 1982 the exchange rate for the pound rose by about 70%. No wonder manufacturing (mostly operating in highly price sensitive international markets) as a percentage of UK GDP,

A lower pound will make UK exports more competitive and increase the profitability of our domestic manufacturing sector

went into a steep decline. At this higher exchange rate, swathes of manufacturing investments became unprofitable.

Despite all the efforts to increase UK productivity, this is the reason why we’ve slipped down the international rankings. Something like 30 countries now have higher living standards than the UK, whereas 150 years ago, we were the preeminent country.

Policies introduced to stabilise the economy in response to the inflation of the 1970s, resulted in a rising exchange rate. This was not replicated in the east; countries in that part of the world got exchange rates down. The imbalance we've seen ever since has meant that economies in the east have grown significantly faster than those in the west. Our growth rate has steadily fallen and, if we're not careful, we’ll have no growth at all for the next five to ten years.

What have been the consequences of an overvalued pound on UK manufacturing?

It’s been disastrous; manufacturing as a percentage of GDP has fallen from around 30% in 1970 to less than ten now. We’ve lost share of world trade and for a highly competitive market, like the one for manufactured goods, we've suffered as a result.

In addition, there is a cultural problem, as well as one based around competitiveness and economics.

Other countries enjoy much stronger manufacturing lobbies than we do in the UK. A look at the history of Germany, for example, will show that they’ve always had a very competitive exchange rate; the Bundesbank and big export companies have always insisted on that remaining the case, which was the basis on which the Euro was set up.

In the UK there’s never been that drive from industry to make sure that we have a competitive pound. Rather, industry has been prepared to accept the services view of the world, which is very strong in the UK and represents approximately five percent of GDP export surplus.

We’re good at services, helped by all manner of natural advantages such as our language, geography, legal system, universities and training. But because services is so dominant, it tends to set the economic climate. Services can live quite happily with $1.50 to the pound, but unfortunately, that exchange rate is completely lethal for manufacturing.

A further problem is that it’s more difficult to increase productivity and sell abroad in the services sector than it is in manufacturing. Therefore, if there is an over reliance on services, a large balance of payments deficit can result, which then leads to the levels of inflation like we currently have and a weak economy.

How could a more competitive pound impact UK manufacturing and how could businesses take advantage?

All the evidence is that the lower the pound, the more competitive, relatively speaking, exports become and the better the balance of payments. I think the recent strengthening of the pound (following the recent dramatic fall) won’t be reflected in an improvement in the balance of payments; far from it.

If the pound had stayed down, it would have made a lot of competitive difference. Generally speaking, the lower the pound, the faster the growth of the economy. Therefore, what we have right now is a policy choice on the level at which we try and get the pound to settle. In terms of what our economic targets should be, currently it’s to try and keep inflation at two percent. A better target, in my view, would be for the Bank of England to maintain an exchange rate to produce enough investment to get our growth rate to two and a half or three percent per annum. Unfortunately, that’s a very long way from where the present government or opposition are. Right across the political spectrum, it’s not something that’s being considered.

However, it’s crucial that we get the rate of business investment up. Currently, the total amount of investment in the UK, including R&D, is approximately 17% of GDP. The global average is about 25%, and in places like China, it's over 40%. It’s that investment that can really make the difference. Further to that, however, there are particular types of investment, particularly around mechanisation, power and technology, which produce very high rates of return. It’s these that really drove the first Industrial Revolution.

These elements are all part of manufacturing, but the weaker manufacturing is, the less benefit there is from this sort of investment, and the slower the growth rate. So, by driving manufacturing forward it will increase regular investment.

Will the benefits of a lower pound on manufacturing mean negative trade-offs elsewhere?

Of course, no economic policy is without its downsides, and certainly any policy of a lower exchange rate means higher import prices. Whether that actually adds to inflation is a moot point. I was always brought up to believe that it would, but when you look at the international figures, the evidence would suggest something different.

A striking example was when the UK came out of the Exchange Rate Mechanism (ERM) in 1992. A year previous the inflation rate was around six percent, and despite some politicians claiming it would be a disaster to come out of the ERM, inflation actually went down, dropping to around one percent in 1993/94.

Following that we had 15 years of growth through to 2008 at a reasonable rate. That shows, first of all, that inflation doesn't necessarily follow from devaluation. But also, if we’re trying to get the percentage of GDP from investment to something like 25% (from 17% currently) to keep pace with the rest of the world, then we need to shift eight percent of consumption into investment.

That means we need to find the resources to do that i.e., via savings from government, borrowing from abroad, the corporate or household sector. It's not easy, but it's possible, and there are plenty of other countries that have achieved it.

Maintaining a competitive pound will require a combination of two things; first of all, everything on the supply side needs to be in place - better education and training, infrastructure, longer-term capital, etc. Second, we also need to make sure that’s balanced by having enough competitiveness on the demand side, to make sure that we've got a reasonable amount of exports and investment flowing from that. An iron rule of economics is that if you’re losing your share of trade, then the economy will grow more slowly than the world average; that’s been the UK’s problem for a long time.

Would a more competitive pound benefit all manufacturers, both large and small?

A more competitive exchange rate would benefit manufacturing businesses of all sizes. Economies of scale mean that larger manufacturing businesses are able to bring down their unit cost for manufactured goods. However, that’s much more difficult for smaller manufacturing businesses. For that reason, a more competitive exchange rate could actually be more impactful for smaller manufacturers – it will boost their margin on goods that they sell internationally.

Plus, many smaller manufacturers have also historically put off international expansion because of the costs of exporting. A lower exchange rate would

33

Our political leaders must shift away from our national obsession with policies that lead to an overvalued pound

give many such companies the nudge they need to start selling abroad, and the fact that it will be more profitable to sell abroad will help offset the upfront costs of setting up all the administration that is needed in order to do so.

Are these goals achievable with such a negative perception of a lower valued pound?

It’s going to be a hard sell for sure. Devaluation has got a very bad name, partly because when we have devalued in the past, it has tended to be at times of crisis (sometimes of our own making when the exchange rate has been too high). If you ask the average person in the UK whether they would like a strong or a weak pound, their reply will inevitably be for the former.

That creates a tricky starting point for politicians who have been persuaded by the arguments addressed here. The problem is that if we go with public opinion and get the pound as strong as possible, then we’re going to end up going down the path that we’ve trodden before, where we continue to lose our share of world trade. We will have lower and less profitable investment in manufacturing, productivity will decrease and income will stagnate, in turn leading to political instability, and I’m concerned that’s where we're heading.

This situation is even more serious now because of the heavy costs that are coming down the track around climate change, health and social care, pensions, increased military expenditure and further interest charges as a result of increased debts. With all these headwinds against us, we need to drive as much economic growth as we can to offset this.

Most of the costs heading our way will hit the public sector; that means taxes will go up and living standards will go down. That’s not where the government, of any hue, wants to be.

What needs to be done?

First and foremost we need a debate where the academic and practical policy world engage about the pros and cons of this sort of policy. Currently, that isn’t happening. If you talk to anyone about the exchange rate, the response will be that it’s fixed by the market and there’s nothing we can do. It’s like the weather, you just have to put up with it.

I don’t believe that’s the case, particularly if you look around the world at policies that have been pursued by other countries. A very striking example is China which devalued its currency by about 75% between 1980 and the mid-1990s. The result was that they could produce more or less any goods at around half the price of that in the west. Unsurprisingly, their economy grew very rapidly, whereas ours languished. Manufacturing declined in the west, whereas it advanced at huge speed in the east.

So, a lower exchange rate would undoubtedly make the pound more competitive. There would also need to be settled government policy; we’re not going to attract investors if they believe that the pound will go back up, so we need consistency.

We will also need all the complementary policies on the supply side in place; education, training etc, because it’s the two together that really make the difference. We also need to raise the prestige of manufacturing and get it from where it is at the moment (about ten percent of GDP) to around 15%. At the current level the economy will never get rid of the very serious imbalance it has

KEY TAKEAWAYS

• A strong pound doesn’t necessarily mean a strong economy • A more competitive pound will encourage investors to site new manufacturing plants and operations in the UK • The exchange rate isn’t like the weather – you don’t just have to put up with it • A debate needs to be generated around a more competitive currency • We need to raise the prestige of manufacturing

The John Mills Institute of Prosperity is a cross-party research initiative that seeks to provide new, innovative and fresh ideas to increase levels of prosperity and growth. By working with policy stakeholders, legislators, business and industry leaders, trade union representatives, economists, commentators, regional leaders and the public, the Institute for Prosperity aims to bring policymakers together to affect change and find new solutions to Britain’s economic problems.

currently; we’ll never get the traditional, industrial red wall areas of the country back to a reasonable level, where they have enough to sell to the rest of the world. And we’ll never close the gap between London and the South East, and the rest of the country, so there’s a huge amount at stake, and it’s not an exaggeration to say that a more competitive pound would help to steer us out of the economic crisis.