6 minute read

Supply chains and China:A never ending game of difersification

Supply chains and China: A never ending game of diversification

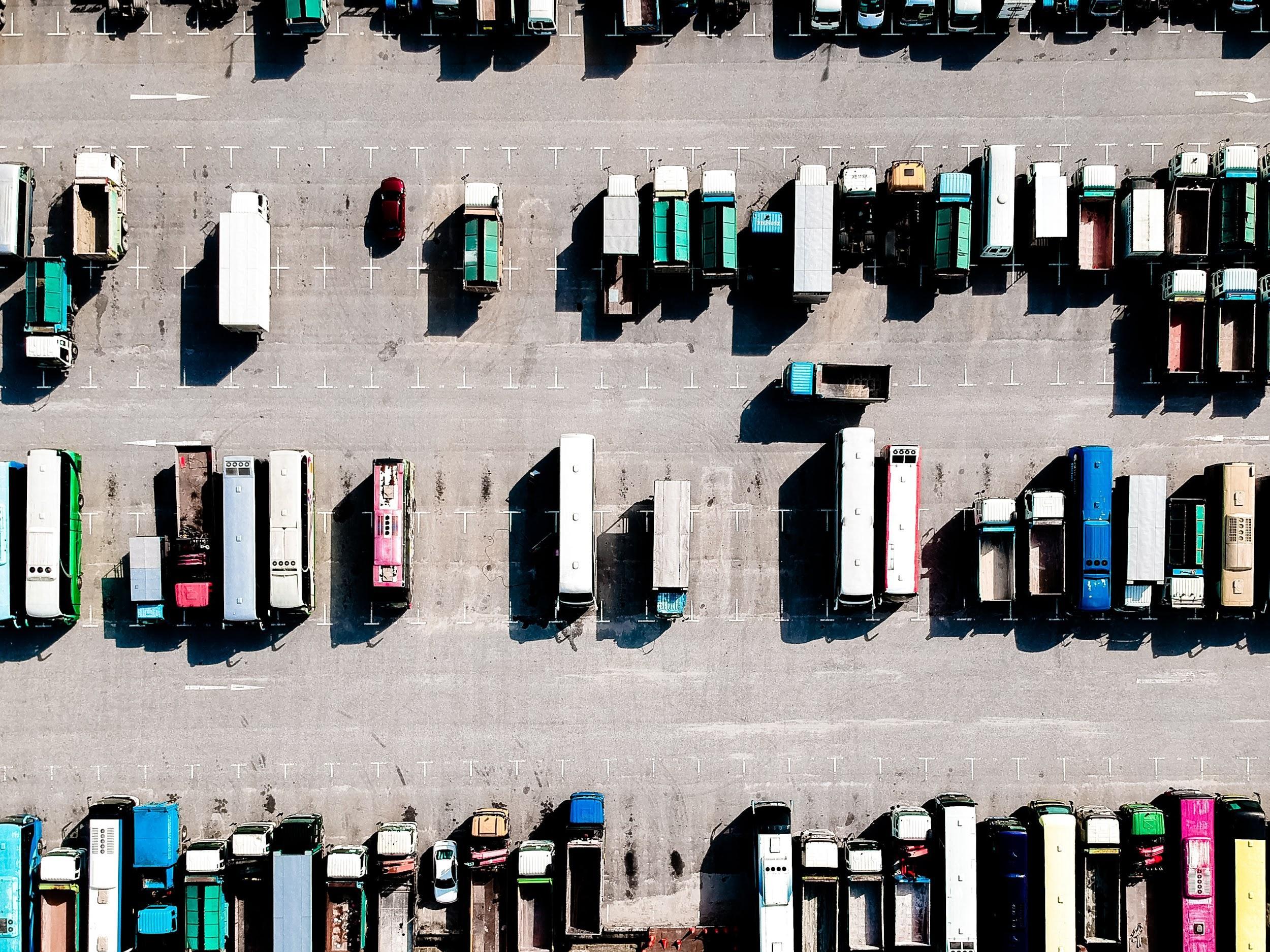

Kamala Raman, Sr Director Analyst at Gartner Inc. explains why China is slowly losing some supply chain players. One of the reasons is Covid-19 but firms are looking for diversification. The labour cost is another major factor for this shift. What locations are being considered and how will this impact global manufacturing?

Advertisement

What types of manufacturing and sourcing activities are being moved away from China?

Manufacturing of all sorts has been diversifying away from China. On the low cost end, industries that are relatively easier to move (apparel, footwear, home goods, furniture) have been moving for several years as labor costs have been more Cambodia, Bangladesh, India. This is mostly an extension of the reason such industries went to China in the first place, the labor cost arbitrage play. For high tech, the supply chain ecosystem has become heavily concentrated in China and here the diversification away from China is more for resilience and some buffer from

advantageous in places like Vietnam, the growing negativities between the US and China. Some of this has moved within Asia -some sophisticated manufacturing has gone to high cost countries like Taiwan, Japan or South Korea. Malaysia, India, Taiwan are among the lower cost winners.

Life sciences has a lot of active ingredient sourcing happening in China with the drug formulations happening largely in India and Israel. Due to the more regulated nature of

pharma, moves, if any, will be very slow in this industry. Easier to move parts of the life sciences like PPE can move easier than drugs or medical devices.

How have events like Covid, Brexit, trade wars, transformed the idea of supply chain resilience?

Global supply chains were being disrupted before COVID-19 came along. The U.S.-China trade war and Brexit symbolized resentment at three decades of globalization — a trend that supply chains have been at the forefront of driving.

For Western multinational companies, the offshoring of sourcing and manufacturing activities to lower-wage economies allowed them to mass-produce an ever increasing array of consumer and industrial goods at prices customers were willing to pay, while also improving their bottom lines. This operating model was facilitated by inexpensive labor, efficient and cost optimized logistics, and relatively stable and

benign international trading conditions. Low-cost locations now play some role in almost every supply chain, even if they are far upstream at the sub tier supplier level. However, globalized supply chains also have some notable weaknesses. These include those complex, multi tier supply bases, poor upstream visibility and longer supply lead times.

In recent years, some companies have begun shifting away from global supply chain models to regionalized ones. Key drivers for this include being closer to customers to serve them in a more agile way and improve their experience, demand for customized products and services, ……….

stretching sustainability targets, and opportunities presented by digital technologies. This typically means attaching more weight to speed and service, relative to cost, in terms of how supply chain organizations define “network efficiency.”

Although agility and responsiveness are becoming more important considerations, the primary objective for most supply chain organizations remains one of maximizing efficiency. Until now, relatively few — and typically those that are more mature — have accepted that ensuring resilience in the face of major disruptions like COVID-19 and the U.S.-China trade war might actually mean dialing back on efficiency.

Resilience is “the ability of an organization to absorb and adapt in a changing environment to enable it to deliver its objectives and to survive and prosper.” In practice, resilience comes with costs attached. Although the cost of doing nothing may be significant, not every firm can afford to pay this bill.

Even for those that do have the financial resources, the menu of options (e.g., dual sourcing, alternative factories, spare capacity and more generous safety stocks) is often unpalatable. Such measures appear to go against the well-versed philosophy of lean supply chains founded on just-in-time principles.

Nevertheless, new Gartner research reveals that increasing resilience will be a priority for many supply chain leaders as they emerge from the current crisis and reset strategies to anticipate disruptions as the “new normal” going forward.

Will just-in-time change to respond to the move of manufacturing facilities to be more local than global?

Just-in-time inventory has really worked in global networks to keep inventory costs down even as goods are made far from the end consumers. But in today's’ world where every company has more products on offer, the customers are more fickle with demand

patterns and at the same time want what they order rapidly, conventional models are giving way (at least in consumer facing industries) to small or customizable batch sizes made close to the demand centers and delivered very quickly after the order has been placed. In this sense, the move to regional or local manufacturing or final assembly is more to meet this customer demand for agility using technology (digitalization, visibility, 3D printing, automation) to make these small batch sizes economical. So the just-in-time is not just about finished goods inventory, but can be for the manufacturing process to improve the customer experience.

Could we expect a manufacturing boom in the US and Europe?

The cost differences between manufacturing in low cost regions of the world and the US or Western Europe are still significant. Further, the extended ‘ecosystem’ (the nuts and bolts and such components that go into

every product) is still anchored in Asia (especially China). So unless there are huge government or trading bloc incentives to move manufacturing closer to ‘home’, private companies may only be diversifying some parts of their supply chain and not moving lock stock and barrel. So we will see some local manufacturing in these countries (like Jabil now making masks in the US in a heavily automated, sophisticated plant) we likely won’t see a manufacturing boom.

How will companies try to control the

Companies are expecting costs to go up when they make such moves, no doubt. As our report argues, they are using technology to keep the costs down with digitalization, supply chain visibility, investments in analytics, flexible automation that reduces cost and time associated with changeovers. Large brand owners are also likely to require resilience of their smaller suppliers so in some sense it becomes a cost of doing business rather than a ‘nice to have’.

What would the move mean for the Chinese market and the global economy?

China will continue to be a huge and sophisticated manufacturer and also a large market for the world’s producing companies. Diversification efforts from companies had already been underway for rising labor costs,

costs related to the move?

the tariffs and other reasons.

Companies that do move some production outside of China are likely to utilize a multi-hub strategy rather than have all their manufacturing concentrated in one country. However, in the near future, China will continue its position as a global mfg leader due to the concentration of raw materials and components in the country and the beneficial efforts of this ‘network effect’ on global supply chains.✷

Kamala Raman

Kamala Raman advises companies on designing their supply chain networks to optimize performance and capacity for total network cost, service, agility and resilience. In this role, Ms. Raman leverages her broad and deep operational experience in manufacturing, supply chain and technology.