5 minute read

MEAT’S MATCH

Has reducetarianism taken hold in New Zealand? The latest data indicates Kiwi attitudes towards meat are changing.

New Zealand might be known for its livestock industry, but many Kiwis are increasingly turning their backs on meat. In a growing trend, plant-based foods are taking centre stage, as consumers see these as key to enjoying a healthier, more sustainable, eco-friendly and ethical lifestyle. An IRI survey revealed health is the number one reason Kiwis avoid or restrict meat, followed by environmental, sustainability and animal welfare concerns(1) .

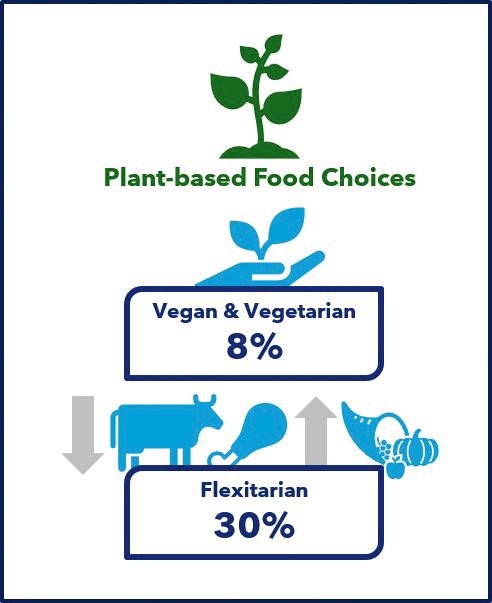

Eight percent of New Zealanders identify as vegetarian or vegan1 and according to Google Trends, New Zealand is the fifth most popular country for veganism in the world(2) .

So, what’s the difference between a vegan and a vegetarian? The Vegan Society of Aotearoa New Zealand defines a vegan as, ‘a person who knowingly chooses not to consume, use or wear any products produced from animals or containing animal byproducts and avoids products tested on animals(3).’ The NZ Vegetarian Society describes vegetarians as those who, ‘for whatever reason (e.g. moral, health, religious), do not eat meat (red meat, poultry, fish, shellfish or crustacea) or by-products of slaughter(4).’

However, for many of us, it’s not about cutting out meat completely, but reducing consumption. The concepts of flexitarianism and reducetarianism are undoubtedly gaining momentum, as almost one in three Kiwis identify as flexitarian.1

Growing trend

The increasing popularity of plant-based options is clear when considering that sales of pickled vegetables are up 6.6%, vegetable juices and drinks have risen 5.7%, fresh vegetarian snacks and meals have grown by 12.8%, and frozen vegetarian snacks and meals have jumped a whopping 16%. All are outperforming total pre-packaged goods growth, which has risen 1.9%(5) .

Dairy alternatives have also seen phenomenal growth, largely due to the fact more than one in five Kiwis exclude or limit dairy in their diets(1). Dairyfree shelf-stable milk, which makes up 45% of the category, has grown by 13.1%, outpacing category growth of 1%. Dairy-free ice cream and dairy-free yoghurt have both seen growth this year, up 25.4% and 4.8% respectively. And while non-dairy specialty cheese remains niche, it has still experienced almost double the rate of category growth(5) .

From alternative to mainstream

As plant-based eating gains momentum, it’s clear everyone wants a ‘leaf’ of the action. The hospitality industry is fully embracing it; not least because plant-based has become a micro-trend of health and wellness. A 2020 nationwide survey by The Restaurant Association of New Zealand identified veggie-centric and plant-based proteins among the top chef-driven trends for the year. Almost a quarter of Restaurant Association members anticipated menus would increasingly be driven by reduced meat consumption(6) .

Meal kit providers are also biting into the trend. My Food Bag and HelloFresh have extended their offerings to include vegetarian and plant-based packages, and The Kai Box and Green Dinner Table solely produce plant-based kits. Prep Plant Based Meals provide ready-to-eat dishes free of meat and dairy, while V on Wheels is a vegan meal delivery service.

There is a stream of innovative vegan, vegetarian and flexitarian products hitting our grocery shelves. Star launches from the past year include Tip Top’s vegan Trumpet ice creams, Let’s Eat’s plant-based frozen meals and The Collective plant-based yoghurts and milk; all of which can boast in excess of $1 million in annual sales. Also making a splash, with sales of more than $100,000 this year, are The Natural Confectionery Co. vegan fruit flavoured jellies, The Baker’s Son vegan mince and cheddar pies and Milo’s Plant Based Energy dairy-free drink(5) .

The choices for those looking for vegan and plant-based options have never been more abundant, from Wattie’s Plant Proteinz soups to Mrs. Green’s frozen vegan pizzas; Naturli’ plant-based spreads to Plantasy Foods’ baking supplies. Even wine is on the bandwagon, with new launches including The Vegan Wine Project and Hello! V.F.

The trend isn’t restricted to food categories; Glad’s 50% plant-based range of plastic bags and wraps have enjoyed a sales lift of $1.4 million on last year, while Anchor’s 2-litre plant-based milk bottle has had almost half a million dollars in sales since launching in October 2020(5) .

Meat in the middle

Of course, the Kiwi love-affair with meat isn’t over just yet. Just as in the US three quarters of shoppers are adamant meat belongs in the diet(7) , here meat remains the meal anchor, and we still eat twice as much of it as the global average(8). This year Kiwi shoppers purchased an extra $32.9 million of frozen meat and $33.1 million of continental meats such as pre-packaged bacon, ham, salami and sausages(5) .

Countdown’s Paul Ahern, Merchandise Manager – Meat commented: “New Zealand has a proud agricultural history and meat remains a key part of our customers’ shopping needs. In our stores, sales of meat have continued to grow in both value and volume but what we’re seeing – both here in New Zealand and overseas of course – is a desire for Kiwis to include more plants in their diet, and plant-based protein is a critical part of us being able to respond to this.”

Consumers are very much open to products which maintain the taste and texture of meat – without being derived from animals. More than six in ten Kiwis have tried, or are interested in trying, meat alternatives(8) . Beyond Meat, pioneers in the new generation of plant-based products that mimic meat, continue to see year-on-year growth, with sales up 89.2% compared to 12 months ago(5) .

A helping hand

IRI believes the plant-based movement has reached mainstream status and will only continue to evolve and strengthen. IRI are currently exploring the trend and will be working closely with suppliers on a syndicated market research project aimed at understanding consumer attitudes and behaviours around it. If you want to stay ahead of your competitors, get involved.

Source:

1 IRI State of the Industry Survey 2020

2 www.chefspencil.com

3 www.vegansociety.org.nz

4 www.vegetarian.org.nz

5 IRI MarketEdge New Zealand, Grocery, MAT to 18/04/2021

6 www.restaurantnz.co.nz

7 IRI US – The Power of Meat© 2021

8 www.foodfrontier.org

By Pravina Patel - Insights Consultant Solutions & Innovation at IRI