16 minute read

COVER STORY: OLYMPICO VISION A Woman With a Noble Vision And a Message for World Peace

ADAPTING TO CHANGE AND CONSENSUS

Written by Dr. Graham Bright JP, Euro Exim Bank

Advertisement

If the recent UN COP26 “Conference of the Parties” has taught us anything, it is that nations can come together, appreciate the enormity of the task of tackling climate change, agree to closer political and economic ties and above all leave a planet cleaner and more sustainable for generations to come, with consensus.

And consensus is not just confined to politics. Banking and insurance are sectors actively in not only exploring but implementing practical solutions which will protect and promote future collaborative trade.

From standardised Basle III compliant policy wording in insurance markets to interoperability in open banking platforms, the challenge is on. Above all there seems to be more global acceptance to take on the investment and navigation through new technology projects with blockchain and Ai elements, with a vision to improve systems, supply and services.

With a raft of new ideas in the digital space, advanced technologies, emerging players in fintech challenging traditional delivery methods, the key drivers to competitive, sustainable international trade will be standardisation, rationalisation and re-usability of processes.

And this drive for smarter, faster, more efficiency and trusted process is not from the industry, but from savvy tech-enabled consumers. Customers are reverting to pre-pandemic demand for goods, not only defined as what they need, but what they want and can easily get, as consumerism through the power of advertising re-emerges.

As the world gets to be a riskier place through cyberattacks, ongoing shortages and trade disputes, and active conflicts in over 40 countries, consumers are unphased by the underlying problems surrounding current issues with global supply chains. A possible lack of Christmas turkey and toys seems to be the biggest issue for many. But let us get back to consensus, a general agreement.

Consensus can certainly be seen in the proliferation of free trade agreements. In Africa, putting aside nationalism, protectionism and isolationism, long debated differences between nations have finally resulted in 54 participants able to collectively exploit the new demand for raw materials and services.

From vaccines to technology, the political will, means and finance have been made available to build manufacturing centers, reduce dependency on expensive imports and export more competitively through supply of finished goods to new markets.

More importantly, the example of the African AfCFTA gaining wide consensus, with a number of countries agreeing process, taxonomies, customs duties, acceptable documents, payment methods, infrastructure routes, all in the name of building resilience, creation of wealth in like-minded countries, is one where the continent may greatly benefit.

Nations are able to bypass latent technologies and take advantage of latest cost-effective advanced communications networks, supporting smart mobile technology for payments, and use of sophisticated applications (for example created and maintained by new technology centres in Ethiopia).

These new apps are for example, helping farmers and remote communities improving crop yield, and entrepreneurs to realise new projects providing payment and loan gateways to connect, enfranchise and lift some 30 million people living in extreme poverty, offering the unbanked financial security and bank accounts.

The consensus model for Africa will change perception, allowing it finally to be seen as a global collective powerhouse. No longer the continent to be feared or exploited but a major player in supply of the worlds limited precious resources. Africa has the potential to create more goods locally and become more self-sufficient as opposed to remaining a victim to large external economic forces, excessive cost of loans and dependency on both international and charity. It is sobering to think that without investment and further industrial development, it is forecast by The World Bank that 90 percent of the world’s poor will reside in Africa by 2030.

Ultimately, by standardising and harmonising both international and domestic regulatory practice, reducing and uncomplicating tariff barriers and minimising punitive tit-for-tat tariff measures, technology will be a critical factor in assisting with economic efficiency, digitising documents and digitalising process for faster, trusted, cost-effective outcomes for all.

Today, multilateral and bilateral agreements between nations number in the hundreds, covering geography, farming, IT, intellectual property, and all manner of collaboration, where the goal is not always profit but fair, sustainable, ongoing trade.

The importance of these agreements and their action cannot be underestimated, and whilst we are in the later stages of the pandemic, with signs that trade is edging back to pre-covid levels, there is cautious optimism of normality on high streets and improved global trade albeit with higher prices and threat of rising inflation.

But consensus in not confined to international politics. A different type of consensus, in blockchain, is a major element driving the power consumption required for validation of computational transactions.

Consensus protocols form the backbone of blockchain by helping all the nodes in the network verify transactions, making sure one hacker cannot access more than 51% of the nodes and therefore gain control, vast arrays of computers are now required to be the first to validate and then earn from the process.

There is a growing price to pay, with major environmental concerns and consequences especially in carbon footprint and air pollution, where the only way to satisfy the insatiable demand for power is to prolong use of inefficient fossil fuels. In the early days, consensus was simple, where a lone home computer could validate a transaction, consuming a negligible amount of electricity. But with multiple coins and enormous demand to earn (rewards equate to approximately 6.25 new bitcoins for guessing the hash key correctly) it is no surprise that mining remains lucrative.

Due to the scale and size of the bitcoin public ledger, distributed across many multiple network nodes, today it is estimated that 12 years of household electricity is consumed per coin mined. This staggering operational cost has fuelled demand for faster devices, more efficient processors, better cooling systems and higher pressure on electricity supplies, costs which are out of reach for individuals but only sustainable by nation state funded or large corporation budgets.

According to the New York Times, the process of creating Bitcoin to spend or trade consumes around 91 terawatt-hours of electricity annually, more than is used by Finland, a nation of about 5.5 million. To put computational requirements into perspective, Digiconomist estimated that one bitcoin transaction generates a million times more in carbon emissions than a single credit card transaction, and that Bitcoin energy requirements could equal that of all datacentres globally.

It will be fascinating to see how mainstream crypto becomes, how consensus protocols which favour large server arrays will flourish and to what extend the world can satisfy its unquenching thirst for energy.

In conclusion, adapting to change in financial markets is a must as global companies cannot rely on past performance, budget or organisational structures.

As the businesses of the world embrace digital processes, we see change in working practice, more cross-border agreements, new international entrants to support supply chains, new economic centres and mobilisation of people, and witness the continuing shift from agricultural to industrial economies.

Companies are at a critical stage as they must all purposefully prepare themselves for change, by standardising, rationalising and re-using systems and process immediately if they are to compete, work with consensus, collaborate and continue to exist in our new world. The time is now.

INNOVATE WHILE REMAINING CONNECTED TO YOUR VALUES AND KNOW-HOW

The rapid development of multi-family services has competed with the traditional wealth management services provided by private banks. Herculis Partners SA offers his HNWI clients with easy access to unique sets of investment specialized vehicles, including hedge funds, private equity and special situations in its dedicated geographical areas, aimed at steady and regular performances. By offering a tailormade management including non-financial services with high added value for the family, these structures have succeeded in attracting a demanding clientele.

How can Herculis Partners continue to innovate as a multi-family office? By listening to their clients and to the market and by remaining consistent with their know-how and values, as shown by Herculis Partners. We profile the firm as we look to explore the secrets behind its success. 2020 A Key Milestone 2020 is not just another year. It marks an historical year for Herculis Partners SA. The company is celebrating its 10th year since its launch in December 2009. This is definitely a key milestone! Launching a company following a major financial crisis needs a strong will, conviction and the right skill set. Since 2009 the company has grown to 14 professionals and has transformed the small, old-fashioned office into a completely renovated building, as the Headquarter of Herculis Partners SA, in the center of Porrentruy, Canton du Jura, Switzerland.

Today, the Herculis Group consists of four companies : Herculis Trustees in Zurich, Herculis Partners and Herculis Guardians located at the Porrentruy’s headquarters, as well as the Herculis Partners branch in Geneva and Lugano and soon to be opened a fourth company in Liechtenstein : Herculis Advisors. The Clients’ Satisfaction our Core Objective Herculis Partners initial business model as a single-family office in 2009, no longer resembles the current one. Diversification, private equity deals and acting as facilitator for some of the main players in the covered regions, the company has been evolving over the years.

But the Herculis Partners key investment principles and the way of approaching asset management focuses on growing value in a risk controlled environment for its clients at its core, which has always been the primary theme. It’s not just a concept; it’s the cornerstone to protect and to grow our clients’ assets. Always looking to produce the best results, Herculis aims to inform and to advise clients in the financial fields, and to act as facilitators in business negotiations through a vast network of relationships in its geographic areas and greater industrial expertise such as biotech medical industry and fintech.

Subsequently, the company has quickly expanded to become a key intermediary to their customers, opening doors of Swiss institutions and offering relocation services to their clientele. This triggered the launch of the multi-family offices, which has remained a stalwart for the firm over the years. Sticking to what Herculis Partners knows best, while believing in a hard-won and sustainable investment skillset as well as openmindedness in looking at market developments, has worked out well for Herculis Partners for the past ten years. It remains a key guideline for the future.

Continuity, a rare but cherished feature in the financial world, is definitely a key to the companies’ successes. Herculis Trustees AG Ever expanding, Herculis Trustees AG was then created, in Zürich, to assist clients with solutions to various issues, including taxes and other legal structures. As a result, Herculis Trustees AG developed a circle of competences and services such as creating, and subsequently managing, a suitable corporate structure, such as a family holding company and foundations. It also allows them to acquire real estate, and to assist them in setting up education plans for the youngest members of the family.

Note also that the company proposed escrow accounts for real estate or trading deals. Both Herculis Partners SA and Herculis Trustees AG are regulated financial companies subject to the direct supervision of the self-regulated organization : Swiss Association of Self Managers SAAN under FINMA control. A New Relevant Offer to Meet New Needs Herculis Guardians SA In the new completely restored and highly secure building Herculis Guardians SA offers an individual safe box rental service. One ID only, along with signing a normal lease contract, is required, warranting a safe box renting in total discretion.

Herculis Guardians also proposes dedicated vaults with a domestic area and a “Freeport” area. Larger or greater number of goods can therefore be stored in custody such as paintings (specially designed space), precious metals, precious stones and wine over a long-term period in a controlled environment to ensure that items are kept in perfect condition. The Freeport activities are under the Swiss Custom Administration supervision as the stored items under this regime are VAT exempted during their storage. Last but not least, in a Global Risk Assessment Report Herculis Guardians SA has been granted a ‘Superior’ rating by PROTEKTA Conseils-Risques SA – a Major Insurance Supervisory company - as offering the highest guarantees and security for its safe box rental services, Freeport storage facility and art warehouse.

“The global risk evaluation assessment is a true accomplishment that speaks to our commitment to offer only the highest level of security, service, and experience every day, to every client,” said Nikolay Karpenko of Herculis Guardians SA. “Our clients expect nothing less than perfection and know they can count on us for unequaled security and privacy to protect their most precious assets.” In addition, the company has the Swiss authorities’ license to edit Negotiable Warehouse Warrants allowing the client to obtain credit/loans or to transfer the ownership of the goods deposited in Herculis Guardians vaults.

Ultimately, Herculis Guardians’ customers benefit from a discreet, inviolable, highly accessible place to store their treasure coupled with a unique high-end service defined by luxury, security and availability. Among the future developments, Herculis partners are planning the launch of a fund management activity based in Liechtenstein and the launch in the fourth quarter of a wallet corner (digital wallet) allowing customers to manage their crypto-currencies based on blockchain technology with a private public key, in partnership with a producer in Switzerland. A success story does not write by itself.

It is built on years of hard work and endless support from the families, business partners and loyal investors. The company is celebrating 10 years since its inception in December 2009 and every single person involved has contributed to this achievement. All among the Herculis Group are very excited for the years to come and happy to welcome new prospects.

CARBON CAPTURE KEY TO DECARBONIZATION BY OFFSHORE ENERGY AND MARITIME SECTORS

By David Ramirez

Today’s offshore energy and maritime news highlight how the maritime companies are working to minimize carbon emissions with sights set to net-zero by 2050 globally. Oslo-based Energy analyst, Rystad, has today focused on how offshore contractors are using carbon capture and storage (CCS) to reduce carbon emissions.

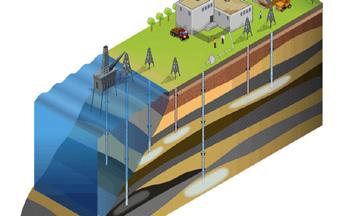

Firstly, maritime carbon capture and storage (CCS) involves the capture of waste carbon dioxide (CO2), transporting it to offshore storage sites, and depositing it in a way that it doesn’t reenter the atmosphere.

The deposition of carbon deep underground as a means of decarbonization is a relatively new concept, but companies that deal in subsea, offshore wind, shipbuilding, and oil & gas sectors have had tremendous pressure to use projects that minimize carbon emissions. And through carbon capture and storage, CO2 (the biggest contributor to global warming) is captured from industrial processes to prevent it from reentering the atmosphere.

Rystad has further added that since governments and industries across the globe introduced CCS in offshore installations to reduce carbon emissions in 2011, the clean energy sector continues to experience a boom, with multinational agencies expected to use as much as $35 billion in capital spending on CCS projects in Europe alone between now 2021 and 2035. Moreover, a significant slice of this investment is expected to go to offshore contractors directly involved in decarbonization efforts. The analyst further identified similar CCS projects around Europe, with the majority of those in the UK, Denmark, and the Netherlands, and further projects underway in Italy. The biggest huddle faced so far, however, has been the installation of transport facilities, pipelines, construction, and storage facilities. But Rystad said the next couple of years, probably a timeline of five years, would see the completion and operation of these projects.

Call to Action

The main challenge with the already existing CCS projects has been the huge investment required for the maintenance of shipping infrastructure such as truck lines. But the analyst has called on the World’s most industrialized states to step up their funding efforts so as to speed up the realization of the net-zero carbon emissions globally by 2050.

Health and Safety Concerns

While mitigation of fossil fuel use is in line with the global climate conservation accord, lawmakers in scores of Europe (especially in the UK, Italy, and Norway) have had to amend safety laws that govern offshore energy industries. These laws are however particular to the installation that’s dedicated to CCS. In the UK, for instance, the Offshore Installation safety case regulation requires that contractors submit structured and systematic approaches that can manage major hazards.

Existing CCS Projects

In his report, Rystad said that several offshore companies such as Subsea 7, Technip FMC, Shell, Total, and Saipem are involved in the capture and storage of carbon dioxide in Norway’s heavy industry. And since transportation of CO2 in its form is hazardous, it is compressed into liquid form and shipped from West Norway to the North Sea for storage.

ELEANOR ROOSEVELT, LNG POWERED VESSEL, HAS BEEN OFFICIALLY UNVEILED

By David Ramirez

Balearia, one of the largest ferry operators in Spain, has officially unveiled its pioneering, fast, Liquified Natural Gas (LNG)-powered vessel Eleanor Roosevelt. The maiden presentation was done today in the ports of Ibiza, Denia, and Palma. This comes a fortnight after the vessel’s official unveiling was put on hold May 1 due to logistical concerns.

The event officially threw down with voyages to three ports and included jubilant group visits to the new ferry. According to executive reports, the shipping company used $106.2 million in capital spending towards the construction of this vessel – said to be the longest, fastest, and fast-LNG powered ferry in the world. The ferry measures 124 meters long, 29 meters wide, has 500 meters of car and truck lines and can carry over 1100 passengers on board.

Eleanor Roosevelt isn’t the first LNG-powered vessel to be constructed by the shipping company. It is the seventh in line, but the project began in 2018 and was co-financed by the European Commission to create the world’s largest LNG-powered ferry.

LNG-New Dawn for Clean Maritime Energy

It is not long ago that LNG was termed as fuel for the future. Fast forward to today, it has outgrown expectations and has grown popular as a marine fuel. Research shows that Liquified Natural Gas reduces emissions of Nitrogen Oxides by 89%. Additionally, LNG reduces carbon dioxide emissions by 30% compared to diesel-powered vessels. And in recognition of the viability of LNG as a marine fuel, most shipping companies have projects underway to construct LNGpowered maritime vessels.

Curbing Emissions

As already stated, LNG reduces emissions of nitrogenous components to the atmosphere to a larger extent. A recent research note has underlined its viability as a maritime fuel. And each year, Eleanor Roosevelt is estimated to minimize carbon dioxide emissions that’s equivalent to planting 30,000 trees or emissions from 9000 mid-size cars.

Considering its viability, LNG is also an attractive proposition and could be offered competitively with regards to the prices of other heavy fuels. What is more compelling though is its commercial viability especially in Europe and the United States. And compared to other low Sulphur fuels, its Sulphur oxide (OX) emissions are almost negligible.

What’s Next for Balearia?

The shipping company further reports that Eleanor Roosevelt will boast speed, minimal emissions, a particularly flexible cargo-carrying capacity, cars, and other hazardous cargo that is otherwise not permitted on conventional ferries. Moreover, the ferry’s cargo system consists of fully automated loading and unloading systems that are also powered by LNG.

Beyond Balearia, major shipping companies have also taken up the construction of LNG-powered vessels, while others are still in planning and development stages. It is further anticipated that with the commercial viability of LNG as a maritime fuel, its competitive prices, and the huge environmental offset, maritime regulations will be amended to speed up the achievement of net-zero emissions. And LNG is favored as an efficient maritime fuel to power vessels towards the achievement of this goal come 2050.