4 minute read

Smart payments mean smart business

While carrier billing is going from strength to strength, many merchants are looking at adding other forms of payments too – but it can he hard work. Paul Skeldon meets the people lightening that load

Direct carrier billing (DCB) continues to be one of the best ways to monetise telemedia content.

Indeed, it has gone from strength to strength in recent years, driven by the growth of the digital economy and the exploding mVAS market (see page 1). But it comes with challenges. Regulations, transaction caps and an inability to support crossborder payments are all factors that make DCB somewhat selflimiting. It’s a great way to pay, but many merchants – especially those looking to grow revenues, expand in new markets or offer subscriptions services – it needs a little help.

“There are three kinds of merchants out there,” says Nick Dobson, chief revenue officer at Celeris, a company that manages and orchestrates payments for merchants and acquirers.

“There are those that are DCB only, but want to expand what they can sell and where; there are those that already augment DCB with credit card, Apple Pay and Google Pay, but want to do more; and there are those that have tried to add these alt. payments, but have struggled to make it work. Our aim is to help these players better manage credit card and alt.payments as an addition to their DCB payments,” he adds.

CHANGING TIMES

The number of consumers using digital services and payments is rapidly increasing, with the latest white paper from Celeris suggesting that where it stood

at 51% of consumers in 2021, it grew in just one year to 62%, as global average. In developed markets it is even higher, with some 90% of US consumers using some form of online payments.

However, at the same time cross border payments are also growing – raking in some $150trn in 2022. Together, these face many merchants with a dilemma? How to grow their digital sales against a backdrop of DCB that is limited, especially when it comes to looking to sell services and content cross-border.

MANAGING ALT.PAYMENTS

For many merchants, the answer lies in adding other payment channels – typically credit card, Apple Pay and Google Pay. But managing these other payment channels can be hard work.

“Integrating new payment channels means managing relationships with acquirers, currency exchange – for cross border – security and working

within the rules of any given region or jurisdiction,” says Dobson. “Managing flows, chargebacks dn the tech needed is a challenge for many.”

And this is what Celeris aims to offer: a one-stop-shop for merchants looking to add in all these other payment channels – as well as managing subscriptions – as seamlessly as possible.

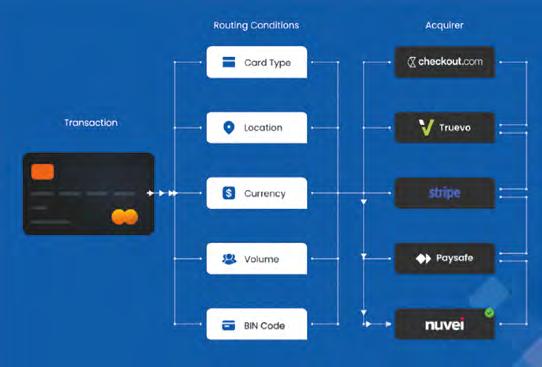

The company offers intelligent routing and optimisation that increases success rates and reduces costs, enhanced security and fraud prevention using tokenisation and, perhaps more importantly, managing the complexity of subscriptions.

Many merchants using DCB are particularly interested in enhancing their recurring revenue streams with subscription solutions. Celeris offers tailored subscription management tools to effectively meet this need.

“Our recurring payments feature streamlines the process, providing a seamless experience for customers,” explains Dobson. “We also offer zero authorisation solutions, enabling more customers to sign up for free trials without any initial charges. This reduces barriers to entry and increases the likelihood of customers accepting subscriptions, as they don’t need to pay anything upfront.”

A case in point

A well-known mobile games company using DCB for all transactions hit a wall at $100,000, facing issues such as payment delays, high carrier fees and transaction caps, limiting growth.

The company wanted to explore other payment options, but lacked guidance and connections for moving to credit cards and digital wallets and were unsure if the cost and effort would be worth it. So, it decided to test new payment options on a new product it was about to launch.

Celeris played a key role in helping the company transition. Using its extensive network, it introduced the firm to essential industry partners, ensuring smooth onboarding with acquirers. They also connected it with top-notch chargeback and fraud prevention solutions, addressing security concerns. Celeris provided its award-winning Orchestration platform, packed with features to improve transaction success rates and streamline payment processing.

With Celeris’ help, the company expanded its payment options to include credit cards and digital wallets. This boosted its confidence in payment processes, leading to an increased marketing budget. It soon rolled out the new payment options across all its products, seeing a significant revenue increase in just one month.

Find out more at celerispay.com

Download the latest white paper at celerispay.com