6 minute read

State of the industry: global compliance falls to 88% as banner ad rules change and X removes moderation

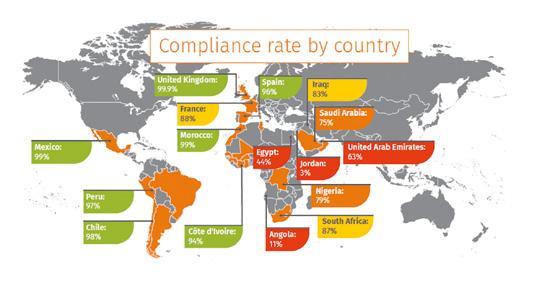

Compliance across carrier billing-based ads fell from 93% in 2022 to 88% in 2023, with analysis of some 5 million digital journeys and 500,000 VAS tests worldwide finding around 65,000 issues.

According to Empello’s Annual Review 2023, the primary reason for the decrease in compliance has been a raft of changes to banner requirements in the Middle East and LATAM, which have resulted in significant fluctuations in the compliance rates in some countries or carriers. The removal of moderation from X –formerly Twitter – has also had an impact. At one extreme over the course of this year, Empello has seen an example of one carrier’s compliance falling from 83% compliance to 8% purely due to changes in banner guidelines.

PERFORMANCE ASSESSED

As has become usual, performance varied from market to market and region to region, with LATAM being the most compliant region and the Middle East being least compliant, lagging far behind the other regions.

The level of compliance in Europe has fallen in 2023 and that is mainly driven by the results in France and Spain which drove half of all issues we found in Europe.

Drilling down to specific countries, Em

pello’s data shows a dramatic improvement in South Africa this year, rising from 63% to 87% compliance. Conversely there has been a fall in France from 98% compliant to 88%.

Fresh markets researched, including Angola and Jordan, showed what Empello says are “extraordinarily high levels of non-compliance”.

In Nigeria, however, compliance was found to sit at a rate of 79%, high for a market with no formal compliance programme, says Empello’s report, adding: “Key to achieving and maintaining high compliance rates is participation by all parties in any compliance programme, but specifically active engagement by the carriers involved”.

COMPLIANCE ISSUES

With that in mind, the study shows that the main sources of non-compliance was content locking and misleading flows, which accounted for 56% of all issues found globally. This is exactly the same as in 2022. Content Locking remains the highest category in 2023 and continues the resurgence seen from the last quarter of 2021 and throughout 2022.

“It goes to prove that when it comes to advertising fraud, the old tricks are still working on consumers and fraudsters continue to deploy them in various guises,” says the report.

Brand passing, however, has declined further in 2023, with 2415 instances found compared with 3451 in 2022 and 8672 in 2021. However, this year Empello has introduced a sub-category called Impersonation of a Public Figure, in order to better capture misuse of personal identities, particularly in the Middle East compared to misuse of brand identities. This added an additional 473 instances.

Auto subscriptions have decreased from 941 in 2022 to 582 in 2023, but Saudi Arabia leads the pack with 219 auto-subscriptions showing the presence of widespread and systemic payment fraud. Attempted auto subscriptions have also declined by around 30% from 940 to 668.

Take down times in the Google Playstore have reached a record high, with take down of rogue apps happening in as little as 24 hours.

“However,” says the report, “it does beg the question of why these apps make it through to the Playstore in the 1st place when it’s so easy to take them down? Surely it would be better to prevent them going live at all than suffer the damage they can cause in even 24 hours live on the Playstore?”

SERVICE TYPES IN 2023

There has been little change in the types of services advertised and their relative compliance rates. Games services remain the most advertised services in 2023, followed by Video Streaming and Mixed Content. More specialised services remain in the minority, but typically have much higher compliance rates.

The most common form of payment flow found by Empello is a header enrichment two click flow, although this is heavily influenced by the LATAM markets. MSISDN PIN flow is the second most common flow and predominantly found in the Middle East.

Web advertising still accounts for 90% of campaigns Empello discovered in-market. The compliance of Facebook advertising is particularly problematic with 98% non-compliance on this channel (up from 84% in 2022), with Instagram and Tik Tok following a similar pattern at 96% each (up from 43% and 53% in 2022).

This year’s new entrant is X, previously known as Twitter, which due to a lack of content moderation and controls over publishers has shown a 100% rise in discoveries from 4712 to 9921 in 2023, with a non-compliance rate of 96% also.

“This means that, if merchants are advertising on social media, 96 times out of 100 it will be non-compliant.,” says Empello’s report. “Of course, that is not to say that direct buy media from Social Media channels is all bad, but affiliate networks typically use social media channels for misleading and content locking campaigns. The social media companies do have a responsibility to ensure that there are proper policies in place to prevent these practices.”

The company also identified new threats to the compliance of web advertising in 2023, including so-called Banner Farm websites on Google Display, as well the increase in Shell Apps via the Google Play Store. These continue in 2023, leading to the

introduction of a new compliance category of Misleading Placement of a Google Banner. This has been separated from the general Misleading Flow category as the merchant may have little or no control over how and where Google places its banners.

LOOKING ON THE BRIGHT SIDE

Overall, it is disappointing to see the average level of compliance fall in the global market in 2023. However, there are a number of markets and carriers that continue to maintain consistently high standards, such as Vodafone UK, and many that have improved from 2022, such as the South African market. Other markets such as Qatar and Oman have suffered from changes to banner guidelines dramatically impacting their compliance rates.

Stand out countries that are still ripe for compliance improvement are Saudi Arabia, the UAE and Egypt – just as they were in 2022.

“Maintaining compliance is very much like weeding a garden,” says Empello. “It has to be done diligently and regularly because if you let weeds get a hold whilst you are not looking, a garden can be quickly overrun which then requires a major clean-up effort. As ever, our global mission is to create compliant and fraud free environments where VAS services can thrive in the long term, so if you have some weeding to be done, or you want your VAS garden to be weed free from the get-go, then please get in touch.”

Download the full report at https://www.empello.com/ empello-releases-its-annualreview-for-2023/