2 minute read

Stock picking based on social media seemed crazy – until it wasn’t

Tej Kohli reviews how the Robin Hood and Reddit Rebellion have led to a rebirth in stock picking based on social media sentiment which is measured using artificial intelligence.

Tej Kohli | 9 FEBRUARY 2021

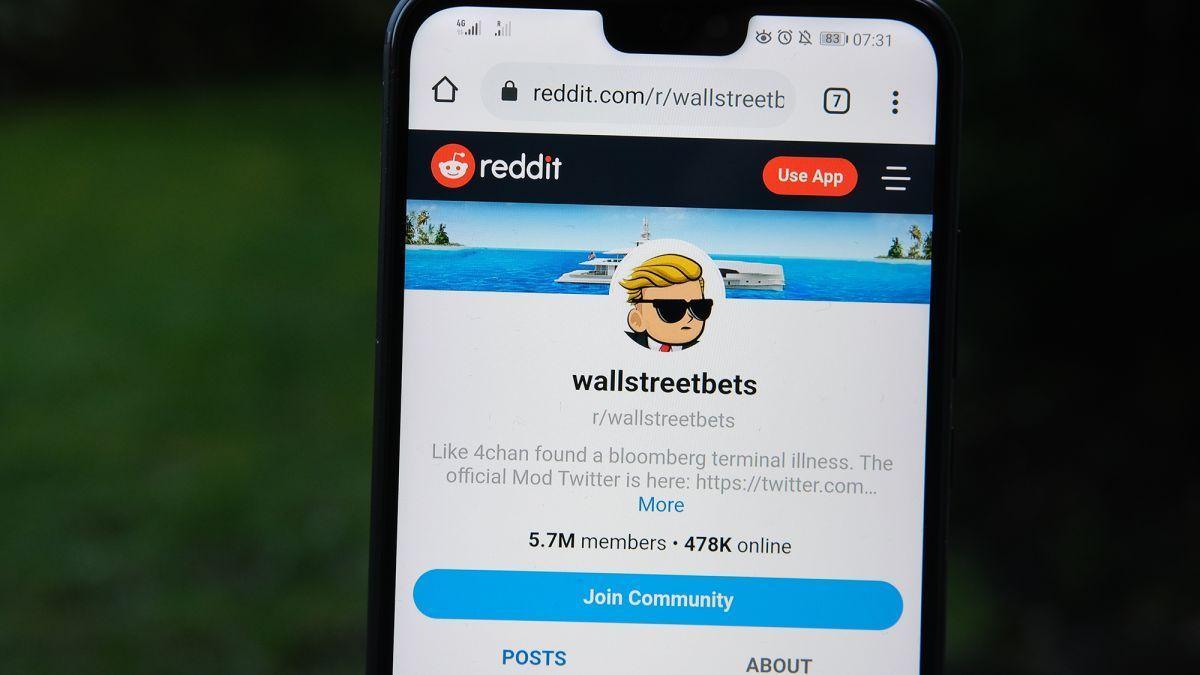

The Robin Hood and Reddit Rebellion have led to the rebirth of stock picking based on an investment index that uses artificial intelligence and machine learning to measure sentiment on social media channels such as Twitter, blogs and news articles.

The AI identifies patterns, trends and changing sentiment which can affect market outcomes. Then the 75 US large-cap stocks that have the highest degree of positive investor sentiment are used to form the portfolio, which is rebalanced each month.

This is nothing new. In 2016 the Sprott Buzz Social Media Insights ETF was launched but disappeared again during 2019. Its disappearance was no surprise, since during the lifetime of Sprout, the underlying index that it was based on the Buzz NextGen AI US Sentiment Leaders Index - outperformed the S&P 500 by only 10%.

However, since April 2020 the underlying Buzz index has taken off, surging by 130%, which is well ahead of the 55% gain of the broader S&P 500. The performance marks a new era in which social media has given smaller investors the power to collaborate to move markets.

Given the show of strength of Robin Hood in driving the Tesla stock price to new heights, and the impact that thousands of ‘Reddit Rebellion’ investors have been able to have on moving other stock prices by coordinating their actions through the social network, even the most seasoned of investors will now have to start paying more attention to social media.

Using artificial intelligence to choose stocks has already been emerging for some time. In 2019 one of the best stock pickers on Wall Street wasn’t a human, but AIEQ, an artificial intelligence powered equity exchange-traded fund (ETF),

which nearly doubled the gain of the S&P 500 by analysing 6,000 stocks every single day and cross-referencing information.

What is more interesting is the underlying implication that, as humans, we are converting our sentiment about stocks into modalities of data which machines can understand, simply by expressing them on social media. It is machines who are then making investment decisions whilst also having a moderating effect by also taking other data into account.

Who then is really driving the markets? The humans postulating on a prospective investment, or the machines measuring their sentiment and checking if it is right?

The combination of social media listening with machine learning into the kind of artificial intelligence that can move markets has to be one of the most exciting AI applications of our times.

#TejTalks