4 minute read

more than 10% (Not Applicable to eligible startups upto

Community Stock Options Pool

Advantages

Efficient standard agreement Access to Growth Stage Startups Financial Protection Direct Investment Information rights Disadvantages

No entry on the Cap Table Mandatory Call Option No Voting rights No GST Credit

CSOP v/s SAR

Features CSOP(Community SOP) SAR

Subscription to this Options

Exit

To be paid in cash Options are allotted for services rendered

Valuation Formula is applied as per contractual terms on the investment amount Difference of Shares prices for a period

Relationship with the Company

Investor Investee 1. Employer -Employee 2. Contractor-Contractee

Liability in Balance Sheet

Valuation Cap

As per Contractual Terms As perAS/ Ind-AS

As per contractual Terms the valuation cap can be froze As per the scheme terms

Cash out flow It can be capped if the contract mentions It can be capped if the scheme mentions Regulations Contract Act SEBI , Co.sAct Cash inflow To be considered as Revenue No cash inflow

SWEAT EQUITY v/s PHANTOM SHARES

FEATURES SWEAT EQUITY PHANTOM SHARES

On Allotment Direct Allotment after lock in period

On Exercise

Cash-Flow

Shares issued to employees at discounted price which is allwed as Compamies Act

Shares can be sold by employees after completion of lock in period for selling. No initial cash outflow as shared from wealth created

No equity dilution as only cash is paid after the lock in period expires

Issued to Whom?

To acquire IPR from Employee and Directors Can be used to pay vendors and consultants also

Impct on Financials ? Taxation ? Valuation ?

Taxed on Allotment Taxed on FMV Taxed on receipt of cash Taxed on differential value – business income

FEATURES SHARE PAYMENTS

NON-SHARE PAYMENTS ESOP SWEAT EQUITY SAR PHANTOM SHARES CSOP

On Allotment Conditional allotment Direct Allotment No equity dilution No equity dilution What happens at initial stage of allotment

On Exercise

Option get converted to equity share on future date

Shares issued to employees at discounted price Compensation given to employees for appreciation of company share price over a period of time It is form of SAR Are shares issued here ?

Cash-Flow No cash outflow at all

Issued to Whom?

Impct on Financials ?

To employees and directors to retain them

To acquire IPR from Employee and Directors

Can be used to pay vendors and consultants

Can be used to pay vendors and consultants Used at which level and how ?

Impact to P&L during vesting period : Grant value – exercise value Share can be sold by employees after completion of lock in period.

Mostly Issued by listed company since FMV is readily available

No initial cash outflow as shared from wealth created Whether there is any cash outflow for subscribers ?

Impact to P&L in the year of allotment. : FMV value Impact to P&L each reporting year until liability is Discharged Impact to P&L each reporting year until liability is Discharged

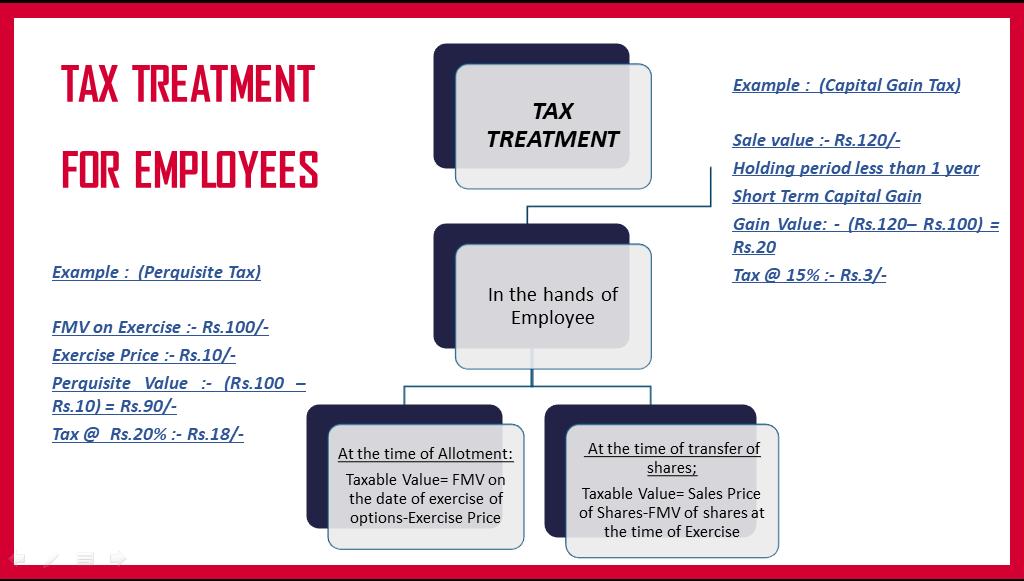

Taxation ? Tax on Exercise Taxed on Allotment Taxed on receipt Taxed on receipt What can be the impact on financials ?

How will it be taxed in the hands of subcriber and the Company ?

Valuation ? FMV – Exercise price Taxed on FMV Taxed on differential value Taxed on differential value – business income

What will be the valuation at redemption ?

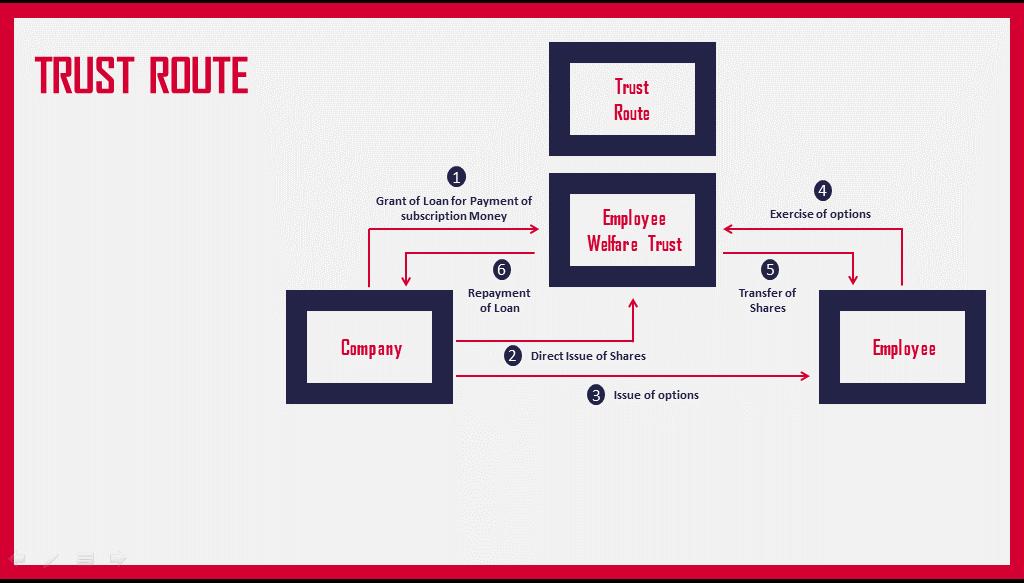

Trust Route of issuing ESOP

Tax Implications

FAQ w.r.t ESOP & SAR

Tax implications on preferential allotment to consultants

Whether TDS is required to be deducted on equity issued to consultant “u/s 194R” perquisite ?

Can method of valuation be Questioned by AO – even in case of preferential allotment?

Whether ESOP discount is allowable in vesting period?

Whether SAR is taxable as perquisite or Capital gain?

Whether SAR is allowable every year of appreciation?

Taxation in case of valuation capping or discount capping

Whether investment in CSOP allowed as deduction on redemption ?

Whether Gift tax may be applied CSOP holder on allotment of shares ?

Taxation Aspects of the ESOP

The Finance Act 2022 amendment – From the FY 2020-21, an employee receiving ESOPs from an eligible start-up need not pay tax in the year of exercising the option. The TDS on the ‘perquisite’

stands deferred to earlier of the following events

Particulars : Total Income before including perquisite value of ESOPs (A) Add: Perquisite Value of ESOPs (B) Total Income after including perquisite value of ESOPs © Tax on Rs. 1.30 crores as per slab rates applicable for Assessment Year 2021-22 as per old taxation regime (D) Add: Surcharge [E = D * 15%] Add: Education Cess [F = (D + E) * 4%] Total tax liability forAssessment Year 2021-22 after considering perquisite value of ESOPs [G = D + E + F] Tax liability attributable to salary income (excluding the perquisite of ESOPs) [G *A/ C] Particulars Total tax liability forAssessment Year 2021-22 after considering perquisite value of ESOPs Less: Tax already paid at the time of filing of return for the Assessment Year 2021-22 Differential amount to be deducted or paid by the employer or employee in theAssessment Year 2025-26 Amount Rs.

44,40,150

13,66,200 Amount Rs. 40,00,000 90,00,000

1,30,00,000

37,12,500

5,56,875 1,70,775

44,40,150

13,66,200