3 minute read

Crucial & sustained role for LNG in Asia’s energy supply

CRUCIAL & SUSTAINED ROLE FOR LNG IN ASIA’S SUPPLY

DNV analyses how the demand for LNG in Asia is expected to change

Advertisement

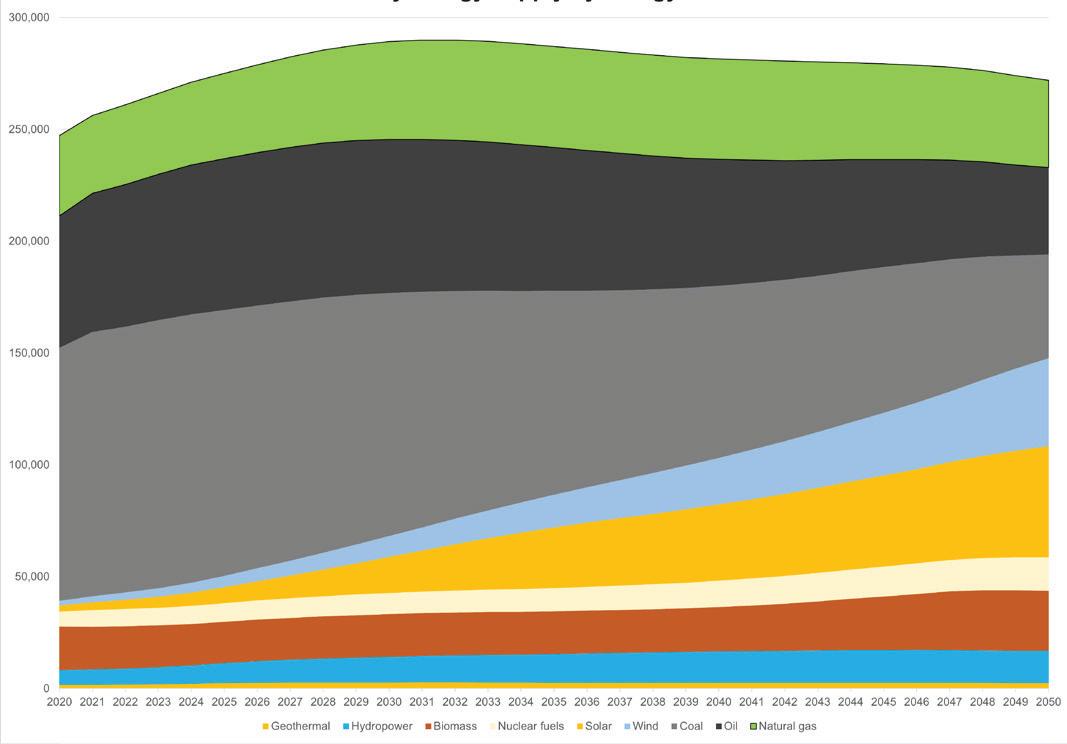

ENERGY DEMAND is expected to continue rising across Asia, with a predicted peak in the early 2030s; approximately 20% higher than 2020 levels, according to DNV’s Energy Transition Outlook. Renewable sources are expected to meet a majority of the growth forecast. However, the medium-term growth potential of greener options in Asian markets is limited by challenges in integrating them with existing electrical infrastructure, all while ensuring reliable, secure, and dispatchable power. This means that the requirement for natural gas, the lowest carbon fossil fuel, will also grow in the future, alongside the development of increased renewable capacity. Given the limited availability of domestic natural gas, and the lack of local pipeline infrastructure, LNG imports will have a larger part to play.

RENEWABLES FORECAST

‘We expect that growth in renewables will be the primary support for rising energy demands across Asia over the coming decade, increasing from 13% of primary energy supply in 2020 to over 20% by 2030,’ says James Laybourn, regional sales director for DNV Energy Systems in Singapore. ‘We are actively supporting the rapid development of new renewables sources across Asia, as well as the associated power infrastructure to support them,’ Laybourn continues. ‘However, the growth in overall energy demand combined with challenges scaling renewable infrastructure means that we expect natural gas to play a particularly important and sustained role in Asia’s energy supply through to 2050.’ Asia is expected to maintain a continued dependence on natural gas to fulfil around 15% of its total primary energy supply until mid-century. Much of this supply will be in the form of increased LNG imports to Asia.

CURRENT LNG IMPORTS IN ASIA

Imports of LNG into the region are currently curtailed as Europe scrambles to secure supply ahead of winter. This has been fuelled by Russian supply being largely cut off and the inability of Norway to scale up its own. This is leading to supplies being diverted from Asia which, in combination with high spot prices, is reducing imports. In some countries, a return to coal has also been precipitated by the urgent need for a readily available, reliable and less costly energy supply. Sustained high LNG prices have therefore eroded the present economic case for imports of gas into Asia. Two of the largest forecast growth markets in the region – China and India – have reduced their LNG imports by 20% and 10% year-over-year, respectively. Sales in Asia through July 2022 have fallen more than 6%, compared to the same period in 2021.

ASIA’S LNG RESOURCES

For the long term, continued investment is necessary if LNG supply, alongside the development of renewable energy capacity, is to meet Asia’s increased demand. There will need to be a particular focus on LNG import facilities and supporting downstream infrastructure in new markets – and investment needs to be accelerated soon. The maintenance and integrity management of existing infrastructure will also be necessary to retain the system’s efficiency and functionality. Domestic supplies of natural gas are limited and cannot ramp up to meet the growing demand. Geopolitical fears also lead to a need to diversify supply sources to ensure security in an uncertain world. Singapore is one example where LNG is now favoured over regionally sourced (and increasingly scarce) pipeline gas. LNG imports present the most logical candidate for most Asian countries due to limitations on pipeline infrastructure, and an increased focus on energy security. In the medium term, DNV expects a returned focus on LNG imports into Asia, particularly among developing economies looking to reduce their dependency on highly carbon intensive coal-fired power generation. Hence, LNG is expected to bounce back after gas prices have normalised. It will enhance its role as the most flexible and secure natural gas source and will see a diversification in its role in downstream markets in the transition to a lower carbon future. Preparations for infrastructure development will have to be made to accommodate this increased market activity.

01

For more information:

www.dnv.com https://eto.dnv.com/2021

01 Fig 1, Primary energy supply by energy carrier. Source: DNV Energy Transition Outlook 2021