8 minute read

THE STORY IN THEIR OWN WORDS

“NC Agency will freeze hiring, lay off consultants and limit purchases to ‘mission critical’ items.”

“…permanently close due to the pandemic…”

Advertisement

“NC Jobless Rate Rises” https://des.nc.gov/apply-unemployment

“…back to school with students at home…”

“Guilford County unveils sparse budget”

“Food prices see historic rise and are likely to stay high”

“We will be changed.”

We continue to read about the financial shortfall for our State and local community, and so many hardships for our citizens due to the coronavirus in 2020.

Scoop recommended in May that the town let you the citizens keep your town property tax money for this fiscal year, for a tax holiday. A zero town property tax levy for $500,000 would be better in YOUR pocket during this unprecedented pandemic and an the Reserves amount would go from $6 to

Rather than take time to study costs and options they chose to put $500,000 in the budget for the Architect and planning for the $5 million town hall. Take a look at the “Summerfield Annual

Budget was approved for $2.2 million, ($400,000 higher than fiscal year ending 6/30/2020). Operating costs to run the town are budgeted at $1,284,400, and capital costs of $879,300 are from the $6 to $7 million Reserves. Budget is recommended by Scott Whitaker, manager, Dee Hall, finance officer, and approved by council members recognized as “needy.”

Tim Sessoms, Lynne Williams Devaney, John O’Day, and Reece Walker who is town council member and Summerfield FIRE fireman. Council Member Teresa Pegram voted no.

Mayor said the town has desperate need to taxes. For what?

pay for water for FIRE District. Research from FIRE reports show that only one structural fire in five years needed water to extinguish the fire in our town. Or is the town water authority needed to prepare for higher density housing and commercial development that is in the U.D.O.?

dollar projects. The budget could easily be reduced; but they decided now is the time to spend the Reserve Fund that the town has had for almost 20 years. Through the years $9 million, and provided needed interest income each year, and aided capital projects like the ball fields.

Income” chart in this issue of Scoop. Income varies slightly and no way for the town to increase income, except to raise property taxes. Note property taxes and sales tax that is received averages $560,000 a year. If your Town property tax is tripled the town will only receive $1 million more.

The Reserves could be quickly gone. Mayor BJ Barnes said if the Reserves are gone it would be easier to just get “grant money.” Scoop believes that is a risky plan for taxpayer money, and Summerfield is not

Take a look at your property tax bill, and if you add another ZERO “0” to your Summerfield Town property tax that will increase your town tax ten-fold, and after paying expenses to run the town there may be $4.8 million, not enough to replenish the Reserves -- and our taxes would be closer to Greensboro Now is not the time to start multi-million

Scoop believes the record high spending they approved is not wise during such uncertain times.

Town Budget July 1, 2020 – June 30, 2021. From Scott Whitaker, manager, and Dee Hall, finance officer. Approved by a majority of council.

“.. battling an unseen virus is requiring new expenses for safety and prevention measures – more physical space to social distance, plexiglass separators, additional cleaning efforts and supplies, signage, equipment, and tele-learning and tele-working IT expenses.”

“Is tightening the grip on the fund balance (Reserves) the best sign of solid financial stewardship? Or is undertaking a major capital project when financially able a welcomed part of area economic recovery efforts?” It appears the town had none of those expenses, not even Zoom. Town was open full time for business as usual. Town had one less part time employee with parks closed, no Founders Day expense, and other economies.

Spending all the Reserves is “no grip on taxpayer money,” and not “solid financial stewardship.” Does he think spending the Reserves and building a $5 million town hall will help local economic recovery? No. Town tax for one year might help the taxpayers’ recovery. Manager is confused about “deficit financing,” “when government spends more money than it receives as revenue, and makes up the deficit with spending reserves or borrowing to stimulate the economy.” That is what the federal government does because they print the money. Is investing locally important? Then why is the main town attorney from Chapel Hill, NC, Brough Law Firm? Why are the bills to the second law firm paid to Columbia SC, a firm with 758 lawyers? ($350 - $400/hour) Manager and finance officer Dee Hall recently recommended, and majority of council approved, a new Auditor, Wade Greene from Carolina Beach NC, someone the finance officer worked with in the past.

The budget claims to: “balances growth with the preservation and utilization of our natural, cultural, fiscal and citizen resources, and enhances our quality of life and our small-town identity.”

“Summerfield citizens elect representative officials responsible for policy-making and they in turn hire a professional manager to oversee daily operation.” If true – why does the draft UDO, Unified Development Ordinance, more than double the density, with no requirement for open space, for hundreds to thousands of acres? The PD (Planned Development) has a new name – “OSMOpen Space Mixed Use”, to integrate a variety of residential and commercial zoning uses, specifics defined by the developer and town administrator after it is rezoned. There is more to learn and IF future development will be compatible with the budget claims.

Council is only responsible for policy-making decisions? They need to do more to oversee financial decisions, and do it at public meetings.

Comments from Mayor BJ Barnes

“…together building a town responsive to the needs of the citizens.”

“This council will be completely transparent in all its dealings and using the town server for quick response on any information request.” As a candidate BJ Barnes said he was opposed to a new town hall. After elected he said,” We need a meeting space. Currently, most of the meetings are held at the Community Center and staff must set up folding chairs and tables every time there’s a meeting. I’d like something akin to what Oak Ridge and Stokesdale have.” This was a candidate multi-million dollar lie with your money. Campaign promise from the BJ Barnes team “Low taxes.” Then put a referendum on the ballot for $5 million to see if citizens truly need and want your $5 million town hall. The jail that you built as Sheriff is often half empty – so please do not overbuild in our town at our expense!

Then why spend taxpayer money on town attorney as town business emails are difficult for the public to access?

Why didn’t BJ Barnes tell you the truth when he was a candidate? How much will it cost for a dedicated meeting room with permanent chairs for 100 people, and a dais, raised platform for mayor and council for 12 or less meetings a year? Community Center holds 80 people and an investment could improve that space and enhance the meeting place for many organizations and events. To replicate Oak Ridge or Stokesdale will be much more than $5 million.

Low taxes? For how long? In the midst of a pandemic these are the big spenders.

BJ Barnes “You could build a town hall and do it on the interest that we’ve earned, using Finance Officer Dee Hall’s calculation that reserve funds have generated almost $3.9 million in interest for the town since 2003.” That $3.9 million has been SPENT through the years as much needed INTEREST INCOME. How much higher would the property tax rate have been without that interest income? If the Reserves are gone, and if the town wants to approve a budget with a deficit how much will it cost to borrow money?

“Forever Home” Presented by Lynne Williams-Devaney & supported by the manager, mayor, and majority of Town Council.

Why a very expensive new Town Hall? Summerfield’s Forever Home

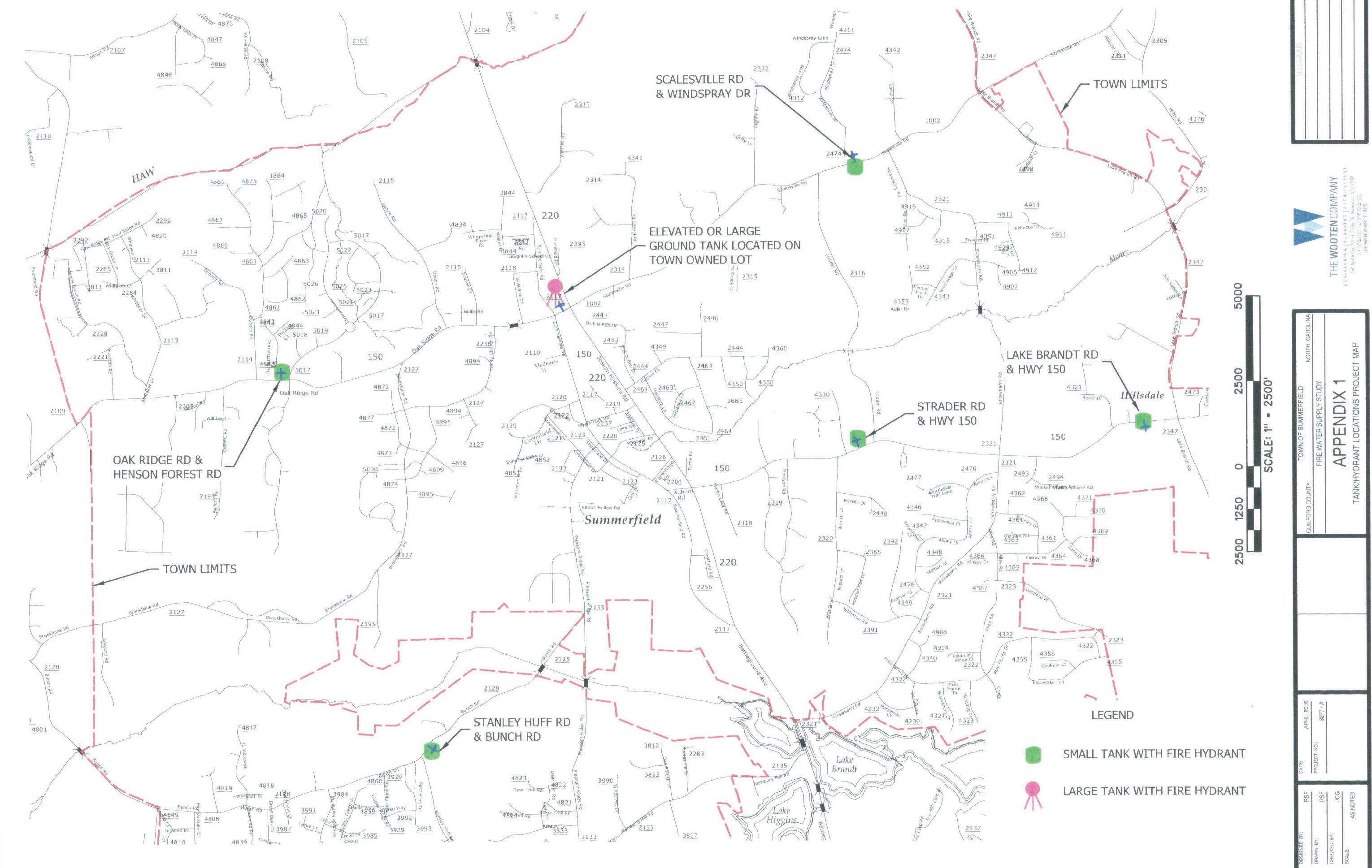

“Benefits In conjunction with this ‘Forever Home’, a town owned water storage tank for the FIRE District for fire protection for all citizens.” “We need to invest taxpayer dollars into assets for the town.”

“Sell off parcels of land the town does not need”

“Benefits: Grants from the feds, grants from the State, private donations, silent auction, benefit functions.”

“Due to operating expenses being the same as operating revenue + having a high FB Fund Balance there will be NO tax increase.” Town Manager Scott Whitaker has said he is “ashamed of Summerfield meeting space and doesn’t want to invite others to our town for a meeting.” (January 2019 on video)

Now $10.7 million and more! The $5 million town hall, and town estimate of $5.7 million for water tower is $10.7, millions more than the Reserves.

An asset is a benefit. Fiscal conservative and small government might be a better asset.

Suggest council get land sold before you spend the money as manager in the past would not sell any land. Will you donate money for the $5 million new town hall? It can be expensive time and money to host fundraisers.

This is most ridiculous and the 3 points are false. “Operating expense same as operating revenue?” What kind of business will make money? Is the town going into real estate investment for operating revenue? This plan for the $5 million town hall is based on SPENDING the FB/Reserves— there will be no high Fund Balance left. This adds up to a property tax increase.