6 minute read

Fintech Market Size, Share, Trends, Demand, and Forecast 2025-2033

Market Overview:

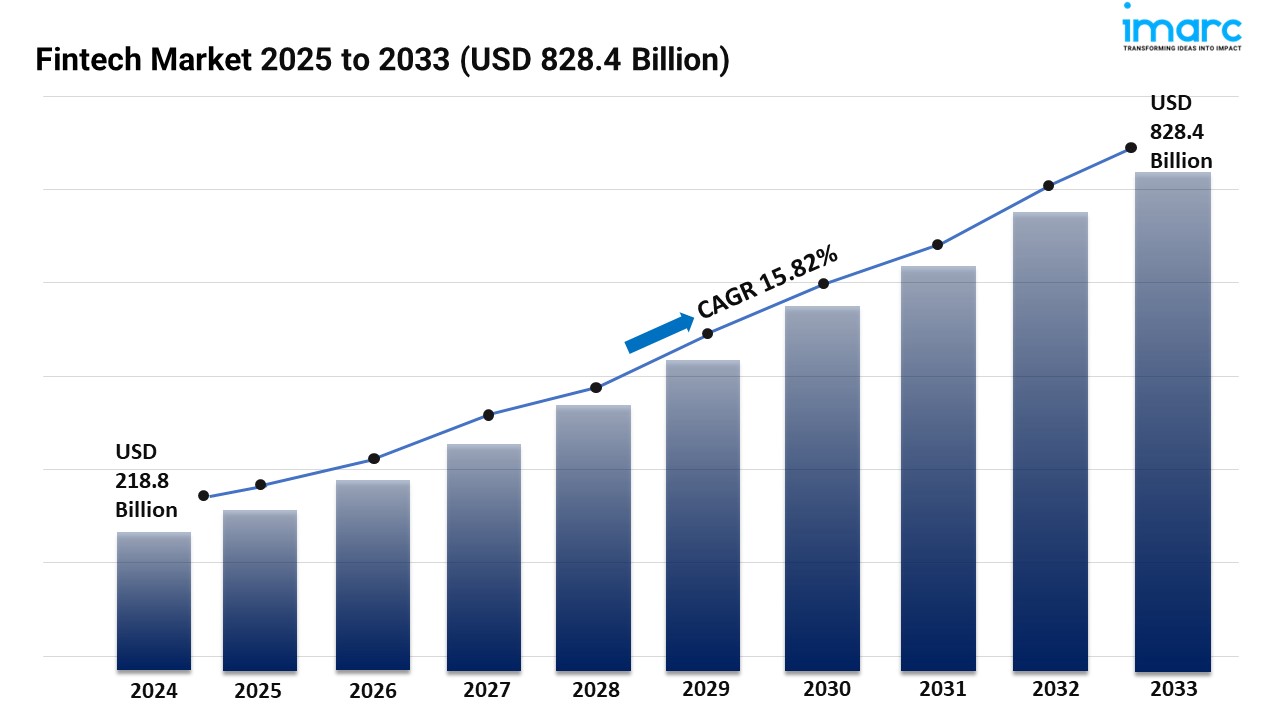

The fintech market is experiencing rapid growth, driven by embedded finance & seamless integration, ai-driven personalization & automation, and decentralized finance & blockchain adoption. According to IMARC Group's latest research publication, "Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033", The global fintech market size was valued at USD 218.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 828.4 Billion by 2033, exhibiting a CAGR of 15.82% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/fintech-market/requestsample

Our report includes:

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Factors Affecting the Growth of the Fintech Industry:

Embedded Finance & Seamless Integration:

Current changes in the Fintech Market stem from built -in funding together with user requirements for seamless financial service integration in daily experiences. The drive among customers exists to boost their financial interaction expectations for easy no-friction financial operations across various non-economic platforms which include e-commerce websites and ride-sharing applications together with social media platforms. Payment processing and lending services among others can conveniently integrate into these platforms because of API and SDK focus. Real-time users access AI-controlled private financial services through behavioral data stimulated by their actions and data patterns. The creation of white marked fintech solutions aims to enhance non-economic businesses so they can deliver brand-financial products and services. The expansion of open bank initiatives ensures data security together with enabling new financial product development. Micro-loans together with PEK-off-cell financial products grow the availability of credit for managing consumer expenses. Users gain better control of general financing operations through their increased interest in financial dashboard integration and personal financial management systems. This facility specializes in providing financial inclusion services and digital wallets combined with cross-border payment solutions for focused global trade. The built-in financial development permits more than payment buttons but weds financial services to everyday life to form an accessible and practical economic system.

AI-Driven Personalization & Automation:

The fintech market operates under substantial forces that drive privatization then automation because customer experience enhancement and operational efficiency are key drivers. The dynamic system offers financial products and services through its fueling capabilities of learning technologies along with natural language processing and advanced analytical methods. When dedicated to A-powered chatbot development the Robo-Furler obtains better virtual advising services while improving its ability to personalize financial consultations for multiple clients. A-controlled safety systems continue to be used because of increasing business demand for automatic fraud detection along with risk management and compliance solutions. Loan approval together with investment management and automatic customer onboarding optimization enhance operational efficiency and minimize costs. Increased automated credit scoring processes along with enhanced lending platforms enable unqualified populations to access credit. Users can effectively handle their financial matters because budget stations and individual financial planning equipment have been developed. Both Voice -Active Financial Services and escalating demands for converted banks boost accessibility alongside convenience levels. The advancement of positive economic habits through behavioral change leads to financial welfare that enables individuals to leverage the economy while using AI-controlled chopping tools. The AI revolution serves to develop adaptable financial solutions with integrated user need estimation and dynamic financial output adaptation.

Decentralized Finance & Blockchain Adoption:

Customers demand better security and accessibility together with greater transparency so the Fintech market transforms using decentralized finance (DEFI) and blockchain technology. The market expanded because of growing interest in stackerCoin and peer-to-peer cryptocurrency like dynamic cryptocurrency along with decentralized applications (DAPP) that provide business operation lending services. Business operations need blockchain technology to create cost-efficient economic leaders whereas transparency and immutability must be maintained through reduced middlemen use. The rising importance of automated financial agreements through smart contracts leads organizations to seek them because these systems lower costs and simplify transaction operations. Liquidity pool systems connected to decentralized exchange technology allows users to manage their assets without requiring permission from anyone. The growing demand for property and art symbols together with fractional ownership schemes extends ownership access to unorganized assets for broader segments of potential investors. Blockchain identification methods alongside KYC (Kjenn customer) procedures boost the security level and compliance standards simultaneously. Area-specific blockchain technology adoption has resulted in major benefits including shorter transaction times and reduced fees for payment and transfer services. Decentralized insurance solutions and better risk management through decentralization permit more individuals to find financial security opportunities. The cryptocurrency industry represents only one part of blockchain technology since the system builds a completely open financial framework which includes all participants.

Leading Companies Operating in the Global Fintech Industry:

Adyen N.V.

Afterpay Limited (Block Inc.)

Avant LLC

Cisco Systems Inc.

Google Payment Corp.

International Business Machines Corporation

Klarna Bank AB

Microsoft Corporation

Nvidia Corporation

Oracle Corporation

Paypal Holdings, Inc.

Robinhood Markets Inc.

SoFi Technologies Inc

Tata Consultancy Services

Fintech Market Report Segmentation:

By Deployment Mode:

On-premises

Cloud-based

On-premises represented the largest segment as some financial institutions and businesses prefer to maintain control over their data and infrastructure, especially for sensitive financial transactions.

By Technology:

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

On the basis of technology, the market has been segmented into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

By Application:

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

Payments and fund transfer exhibit a clear dominance in the market on account of the growing consumer demand for convenient and efficient payment solutions.

By End User:

Banking

Insurance

Securities

Others

Banking holds the largest market share as traditional banks increasingly collaborate with fintech companies to offer digital services.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position in the fintech market due to the growing number of fintech startups and financial institutions.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145