4 minute read

Used Cooking Oil Market Size, Share and Growth Analysis 2025-2033

Global Used Cooking Oil Industry: Key Statistics and Insights in 2025-2033

Summary:

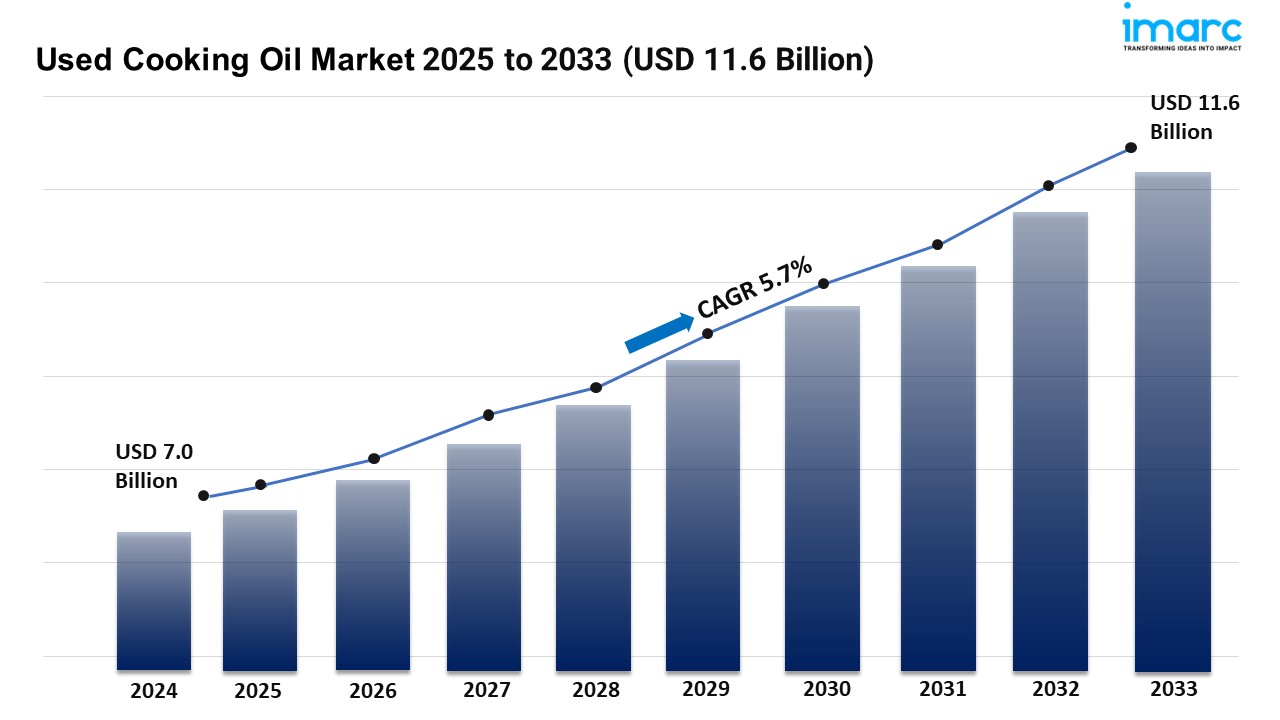

The global used cooking oil market size reached USD 7.0 Billion in 2024.

The market is expected to reach USD 11.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033.

Europe leads the market, accounting for the largest used cooking oil market share.

Commercial sector holds the majority of the market share in the source segment due to the increasing emphasis on sustainability and waste reduction in this sector.

Biodiesel dominates the used cooking oil industry.

The rising need for biodiesel production is a primary driver of the used cooking oil market.

Technological advancements and sustainability trends are reshaping the used cooking oil market.

Industry Trends and Drivers:

Sustainability trends:

Today, an increasing number of consumers and companies are looking for green products and services. This discourages littering as one would collect the waste, for example, used cooking oil for recycling such as biodiesel. For a circular economy, recycling and reuse are important points. Below is the analysis and discussion of what kind of oil is ideal for this purpose, used cooking oil (UCO). It can also be converted into biodiesel, hence the need to prevent it from being dumped in landfills. Today there are many sustainable strategies implemented by various companies to fulfill their responsibilities. This includes DVC appling for energy and the UCO stream being recycled for production.

Biodiesel production:

From this perspective, biodiesel is cost-effective as the feedstock, used oil, costs less than virgin material. This increases profits. As established, biodiesel obtained from UCO is renewable hence sustainable. This meets the growing demand of customers for such environmentally friendly products. Authorities often manipulate the market by providing subsidies, tax credits, and/or mandates to stakeholders in the biodiesel industry. They particularly promote the use of renewable sources such as poultry oil. These incentives further increase biodiesel production; as a result, the use of UCO increases. The high cost of reaching environmental standards for fossil fuels makes switching to biodiesel an attractive proposition. These regulations are well addressed by easy-to-use and readily available platforms such as UCO.

Technological advancements:

Technological advancements are helping to make it easier to convert used cooking oil or UCO into biodiesel. Technologies such as supercritical fluid extraction and enzymatic transesterification now produce biodiesel with greater purity. These innovations also reduce the cost of collecting, transporting, and processing UCO. For example, through automated systems and improved supply chains, costs can be reduced. Better methods of analysis enable UCO to meet the biodiesel standard. This also gives the final product greater reliability and performance. In addition, these advancements enable the use of more types of UCO. This enhances supply services in the luxury market.

Request for a sample copy of this report: https://www.imarcgroup.com/used-cooking-oil-market/requestsample

Used Cooking Oil Market Report Segmentation:

Breakup By Source:

Household Sector

Commercial Sector

Commercial Sector represents the largest segment as the commercial sector, including restaurants and food processing companies, generates substantial volumes of used cooking oil due to high-frequency frying and cooking.

Breakup By Application:

Biodiesel

Oleo Chemicals

Animal feed

Others

Biodiesel accounts for the majority of the market share because it provides a sustainable and cost-effective alternative to fossil fuels, driving significant demand for UCO as a feedstock.

Breakup By Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Europe enjoys the leading position in the used cooking oil market owing to stringent regulations promoting renewable energy, a strong biodiesel industry, and widespread consumer awareness of sustainability practices.

Top Used Cooking Oil Market Leaders:

The used cooking oil market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

ABP Food Group

Arrow Oils Ltd

Baker Commodities Inc.

Brocklesby Limited

Grand Natural Inc.

Greasecycle LLC

MBP Solutions Ltd.

Oz Oils Pty Ltd

Valley Proteins Inc.

Veolia Environment S.A.

Note: If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–631–791–1145