4 minute read

Fintech Market Size, Share, Trends, Growth Report 2025-2033

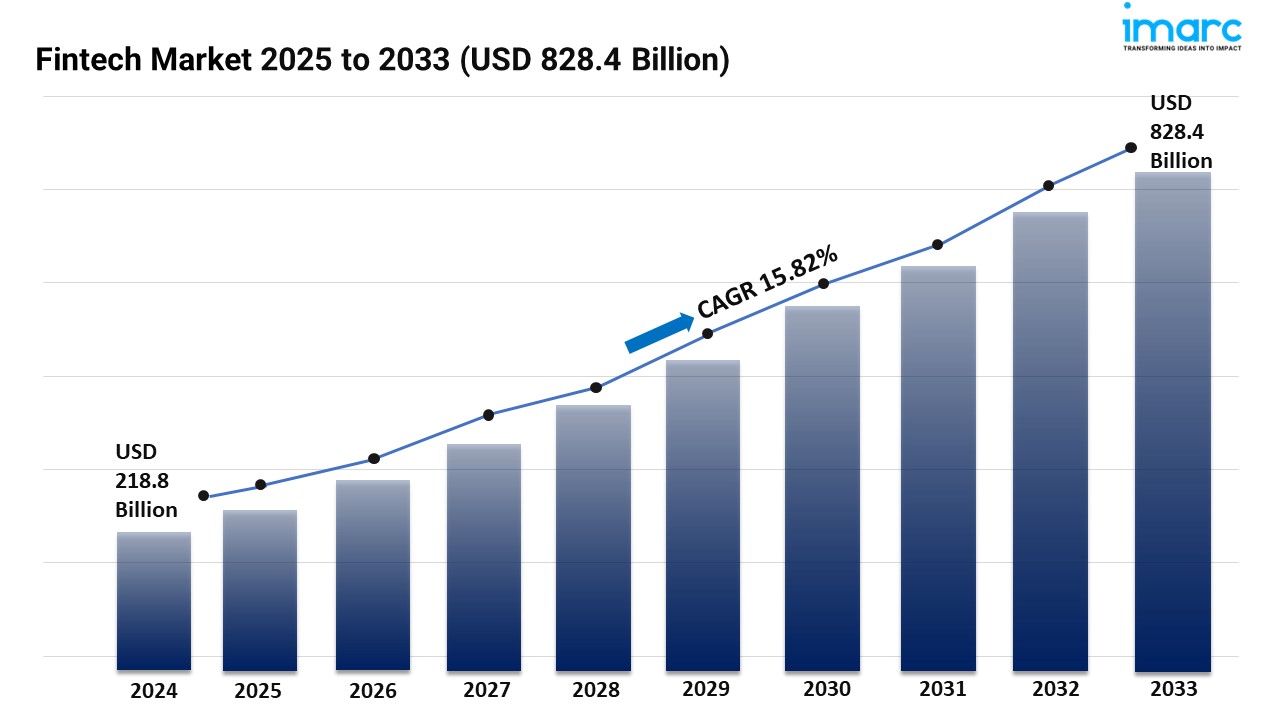

IMARC Group’s report titled “Fintech Market Report by Deployment Mode (On-Premises, Cloud-Based), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), End User (Banking, Insurance, Securities, and Others), and Region 2025-2033”. The global fintech market size reached USD 218.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 828.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.82% during 2025-2033.

Factors Affecting the Growth of the Fintech Industry:

Increasing Consumer Demand:

Today consumers are choosing to use online financial services in view of their ease. To pose an answer to this demand, fintech organisations employ mobile apps and online platforms. These service include payment, financial, investments and P2P services. Further, they make use of the information to provide solutions in line with their clients’ needs hence suitable for those who are in need of special services. In many cases, fintech is less expensive than a regular bank. It also gives more control to the staff and cost less than the above mentioned systems. Fintech providers provide better interest rates and transparent pricing far more than the traditional banks.

Enhanced Tech Infrastructure:

Modern technology has made ease in accessibility of high-speed internet possible. This has, in turn, have enhanced the provision of services by fintech firms. It also enables the easy and efficient Get full research paper for only $13.99 USD Order Now Effective communication between the consumers and providers is made easy by the internet. Tablets and smart phones, 4G and the future 5G networks are helping create a culture of mobility. As such, more and more firms in the financial technology sector are leveraging on this innovation. It also stated that they are creating apps and platforms for those customers who like to perform mobile transactions.

Cybersecurity Awareness:

People are turning towards fintech due to fear of cybersecurity and related crimes facing both the consumers and businesses. Now, customers are much more aware of data consumption and gathering. To this end, newly emerging FinTech firms have started applying safer methods of authentication and encrypted data. In addition to this, there has been some fear about cybersecurity hence leading to authorization of the fintech sector. Consequently, the firms specializing in the provision of financial services have been forced to follow strict cybersecurity measures, to sustain secure transactions and information.

Grab a sample PDF of this report: https://www.imarcgroup.com/fintech-market/requestsample

Leading Companies Operating in the Global Fintech Industry:

Adyen N.V.

Afterpay Limited (Block Inc.)

Avant LLC

Cisco Systems Inc.

Google Payment Corp.

International Business Machines Corporation

Klarna Bank AB

Microsoft Corporation

Nvidia Corporation

Oracle Corporation

Paypal Holdings, Inc.

Robinhood Markets Inc.

SoFi Technologies Inc

Tata Consultancy Services

Fintech Market Report Segmentation:

By Deployment Mode:

On-premises

Cloud-based

On-premises represented the largest segment as some financial institutions and businesses prefer to maintain control over their data and infrastructure, especially for sensitive financial transactions.

By Technology:

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

On the basis of technology, the market has been segmented into application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

By Application:

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

Payments and fund transfer exhibit a clear dominance in the market on account of the growing consumer demand for convenient and efficient payment solutions.

By End User:

Banking

Insurance

Securities

Others

Banking holds the largest market share as traditional banks increasingly collaborate with fintech companies to offer digital services.

Regional Insights:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America enjoys the leading position in the fintech market due to the growing number of fintech startups and financial institutions.

Global Fintech Market Trends:

Many countries are adopting open banking regulations. These allow people to securely share financial data with fintech companies. Meanwhile, demand for digital payments and mobile wallets is growing. Consumers are leaning towards convenient, contactless methods. Additionally, robo-advisors and wealthtech platforms are becoming popular. They offer automated investment advice and manage portfolios. This trend attracts people who want simple, affordable investment options.

Interest in cryptocurrencies and blockchain technology is also growing. Fintech companies are exploring uses beyond traditional finance. This includes supply chain management and digital identity verification.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145