2 minute read

When Should You Draw Social Security?

Recently, I posted a one-minute video on Facebook encouraging people not to make the decision about when to draw Social Security based on fear — the fear that Social Security will be discontinued by the government or the fear that you won’t live long enough to wait until a later age. To my surprise, this video created a firestorm! It has almost 500,000 views, 500 comments, 200 shares and 2,000 likes. Most of the comments that people made are not only emotionally charged but also grossly inaccurate. Not that Facebook should be the source of information for anything of great importance, but the level of misunderstanding about Social Security was mind numbing to me.

SOCIAL SECURIT Y ISN’T GOING AWAY

Obviously, Social Security and Medicare have financial problems that the government has to address. According to the Social Security Administration (SSA), unless legislative changes are made by Congress before 2034, the government will only be able to pay 78 percent of the monthly benefits. There have been several potential solutions proposed that would make Social Security solvent and these could include raising the Social Security tax on earnings, raising the wage cap for Social Security taxes, delaying the full retirement age, delaying the early retirement age or perhaps reducing benefits for higher wage earners. The politicians have kicked this issue down the road for as long as they can, and we now only have a decade left to fix the problem. But I believe that the problems will get fixed. After all, Social Security benefits are the sole source of income for nearly 40 percent of Social Security recipients today. Doing away with Social Security would impoverish an entire nation.

Longevity Matt Ers

How long you are going to live definitely affects the age at which you should begin drawing your Social Security benefit. The only problem is, we don’t know how long we are going to live. Your lifestyle habits, medical issues and family history can all affect your life expectancy. One helpful tool is to use a longevity calculator to help estimate your lifespan by taking into account these external factors. You can either Google life expectancy calculators or use the one on our website at yeisleyfinancial.com/longevity-calculator to estimate your life expectancy based on your particular lifestyle habits and your family medical history.

Do The Math

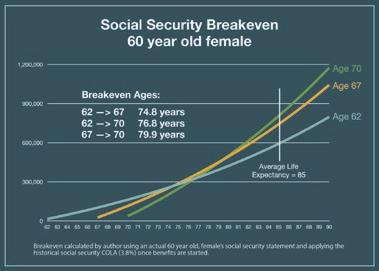

If you draw your Social Security at age 62 instead of age 67, you give up 30 percent of your Full Retirement Age (FRA) benefit … for life! Yes, you will get a benefit for longer, but you could end up robbing yourself of more money toward the end of your life when you need it even more. The graph shows the breakeven analysis for an actual 60-year-old female client for various filing ages. You can see that if she lives to at least age 75, she gets more lifetime income from Social Security by waiting until FRA (age 67) than if she drew it at age 62 — and she gets even more lifetime income if she waits until age 70. According to Social Security, the average life expectancy for a 60-year-old female today is about 85.

Bottom Line

Making any long-term decision based on fear will almost always be the wrong decision. Don’t let emotion or fear cause you to start your Social Security benefit too early. Instead, do the analysis for your particular situation and compare all the pros and cons for various filing ages. A comprehensive financial plan will evaluate and optimize when you should start your Social Security benefit. Choose a fiduciary advisor that will put your best interests first, and then make the Social Security decision with confidence.

Randy Yeisley is a local, independent investment advisor and is the founder and president of Yeisley Financial Group, Inc., located in northeast Wichita. He can be reached by emailing advisor@yeisleyfinancial.com or by calling 316.719.2900.