22 minute read

Irrevocable Trust medical

Go from Workhorse to Powerhouse.

EC Medicaid Asset Protection Trust® Documents

Advertisement

• Spouse One Irrevocable Trust • Certificate of Trust • Will and Testament of Spouse One • Assignment of Personal Property • Trust Summary and Funding Letter • Information for Trustees • Information for Tax Professionals

ElderCounsel’s drafting system, ElderDocx®, puts a smart, efficient document creation and assembly process right at your fingertips. ElderDocx helps you generate a wide array of elder law (including general estate planning), special needs planning and Veterans pension planning documents.

This package contains seven different documents generated from the ElderDocx document set for Medicaid asset protection. Each section includes a table of contents and the first two pages of each document as a preview.

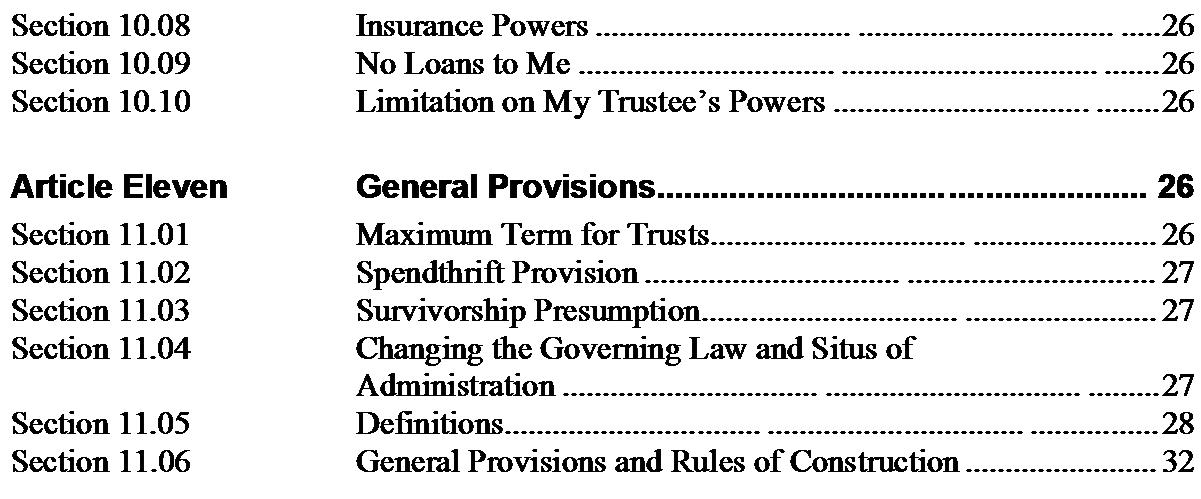

EC Medicaid Asset Protection Trust Preview Table of Contents

Spouse One Irrevocable Trust.......................................................................... 1 Table of Contents .................................................................................................................1 Preview ................................................................................................................................4 Certificate of Trust............................................................................................. 6 Preview ................................................................................................................................6 Will and Testament of Spouse One .................................................................. 8 Table of Contents .................................................................................................................8 Preview ................................................................................................................................9 Assignment of Personal Property .................................................................. 11 Preview ..............................................................................................................................11 Trust Summary and Funding Letter ............................................................... 12 Preview ..............................................................................................................................12 Information for Trustees ................................................................................. 14 Preview ..............................................................................................................................14 Information for Tax Professionals.................................................................. 16 Preview ..............................................................................................................................16

Spouse One Irrevocable Trust Page 1

Spouse One Irrevocable Trust Page 2

Spouse One Irrevocable Trust Page 3

Spouse One Irrevocable Trust

Establishing My Trust

The date of this Irrevocable Trust Agreement is _________________, 20___. The parties to the agreement are Spouse One (the “Grantor”) and Son Ofoneandtwo (my “Trustee”). By this agreement I intend to create a valid trust under the laws of Ohio and under the laws of any state in which any trust created under this agreement is administered.

Identifying My Trust

My trust is called the “Spouse One Irrevocable Trust.” However, the following format should be used for taking title to assets: “Son Ofoneandtwo, Trustee of the Spouse One Irrevocable Trust dated ____________________, 20___.”

Third-Party Reliance on Affidavit or Certification of Trust

My Trustee may provide an affidavit or certification of trust to third parties in lieu of providing a copy of this agreement. Third parties are exonerated from any liability for acts or omissions in reliance on the affidavit or certification of trust, and for the application that my Trustee makes of funds or other property delivered to my Trustee.

An Irrevocable Trust

This trust is irrevocable, and I may not alter, amend, revoke, or terminate it in any way.

Transfers to the Trust

I transfer to my Trustee the property listed in Schedule A, attached to this agreement, to be held on the terms and conditions set forth in this instrument. I retain no right, title or interest in the income or principal of this trust or any other incident of ownership in any trust property.

Trustee Acceptance

By execution of this agreement, my Trustee accepts and agrees to hold the trust property described on Schedule A. All property, including life insurance policies, transferred to my trust after the date of this agreement must be acceptable to my Trustee. My Trustee may refuse to accept any property. My Trustee shall hold, administer and dispose of all trust property accepted by my Trustee for the benefit of my beneficiaries in accordance with the terms of this agreement.

Spouse One Irrevocable Trust Page 4

No Distributions of Income or Principal

My Trustee shall have no right, power, privilege, or authority to invade or distribute income or principal of the trust to or for my benefit, under any circumstances.

Statement of My Intent

I am creating this trust as part of my estate plan to ensure efficient management, administration, and protection of the trust assets for my beneficiaries. It is my express intent that the principal and income of this trust will not be available to me for any purpose, including Medicaid.

Family Information My Wife

I am married to Spouse Two. Any reference in this agreement to “my wife” is to Spouse Two.

My Children and Descendants

I have one child, Son Ofoneandtwo. All references in this agreement to “my children” are references to Son Ofoneandtwo. References to “my descendants” are to Son Ofoneandtwo and his descendants.

My Lifetime Beneficiary

While I am living, Son Ofoneandtwo is the only beneficiary of trust income and principal (my “Lifetime Beneficiary”). In this agreement, “Lifetime Beneficiary” refers only to Son Ofoneandtwo, and does not include me. As specified in 0 above, under no circumstances may my Trustee invade or distribute trust income or principal to or for my benefit. The distribution provisions for income and principal are specified Article Three.

Trustee Succession and Trust Protector Provisions

Resignation of a Trustee

A Trustee may resign by giving written notice to me. If I am deceased, a resigning Trustee will give written notice to the income beneficiaries of the trust and to any other Trustee then serving.

Trustee Succession

This Section governs the succession of my Trustees. Spouse One Irrevocable Trust Page 5

Certificate of Trust Spouse One Irrevocable Trust

I, the undersigned Trustee, being duly sworn, depose and say: 1. The name of the trust is: Spouse One Irrevocable Trust. 2. The trust currently exists. 3. The trust was executed on ____________________, 20___. 4. The Grantor of the trust is Spouse One. 5. The trust is irrevocable. 6. The trust is amendable by the Trust Protector. 7. The trust has not been revoked, modified, or amended in any manner that would cause the representations contained in this Certificate of Trust to be incorrect. 8. The currently acting Trustee of the trust is: Son Ofoneandtwo 9. The Trustee may conduct business on behalf of the trust without the consent of any other person or entity. 10. The tax identification number of the trust is Spouse One’s Social Security number.

As a matter of convenience for financial records, this number may be formatted as xx-xxxxxxx. 11. Assets held in the trust may be titled in any manner that identifies the Trustee and the name and date of the trust, for example: Son Ofoneandtwo, Trustee of the Spouse One Irrevocable Trust dated ____________________, 20___. 12. The powers of the Trustee include the power to acquire, sell, assign, convey, pledge, encumber, lease, borrow, manage, and deal with real and personal property interests of all kinds, including accounts at financial institutions. 13. Excerpts from the trust agreement that establish the trust, designate the Trustee, and set forth the powers of the Trustee will be provided upon request. 14. The trust agreement provides that a third party may rely on this Certification of

Trust in lieu of a copy of the trust agreement. It further exonerates third parties from any liability for acts or omissions in reliance on this Certification of Trust, and for the application that the Trustee makes of funds or other property delivered to the

Trustee. The statements made above are accurate and the trust has not been revoked or amended in any way that would cause the representations in this Certification of Trust to be

Spouse One Irrevocable Trust – Certificate of Trust Page 6

incorrect. All of the currently acting Trustees of the trust are identified above and are signatories to this Certification of Trust.

Dated: ____________________, 20___

Son Ofoneandtwo, Trustee

Notary state _____________________________

Spouse One Irrevocable Trust – Certificate of Trust Page 7

Will and Testament of Spouse One

Declaration of Will

I, Spouse One, a resident of Anywhere, Florida, on this day, ____________________, 20___, revoke any prior wills and codicils made by me and declare this to be my Will and Testament (hereafter, my Will).

Family Information

My Wife

I am married to Spouse Two. Any reference in my Will and Testament to “my wife” is to Spouse Two.

My Children and Descendants

I have one child, Son Ofoneandtwo. All references in my Will and Testament to “my children” are references to Son Ofoneandtwo. References to “my descendants” are to Son Ofoneandtwo and his descendants.

Executor and Disposition of Estate

Executor

I appoint the following, in the order named, to serve as my Executor: First: Matthew Hines Second: Mavis Jones

No Bond

My Executor is not required to furnish any bond for the faithful performance of my Executor’s duties, unless required by a court of competent jurisdiction and only if the court finds that a bond is needed to protect the interests of the beneficiaries. No surety

Spouse One Irrevocable Trust – Will and Testament of Spouse One Page 9

will be required on any bond required by any law or rule of court, unless the court specifies that a surety is necessary.

Ancillary Administration

If any ancillary administration is required or desired and my domiciliary Executor is unable or unwilling to act as an ancillary fiduciary, my domiciliary Executor may designate, compensate, direct, and remove an ancillary fiduciary. The ancillary fiduciary may either be a natural person or a corporation. My domiciliary Executor may delegate to the ancillary fiduciary any powers granted to my domiciliary Executor as my domiciliary Executor deems to be proper, including the right to serve without bond or without surety on bond. The net proceeds of the ancillary estate will be paid over to the domiciliary Executor.

Disposition of My Probate Estate

My Executor will distribute my entire probate estate to the Trustee of the Spouse One Irrevocable Trust dated ____________________, 20___, to hold and administer according to the provisions of that trust.

Estate Administration and Executor Powers

The terms of my Will and Testament supplement the provisions of Ohio law, and to the extent they conflict, the terms of my Will and Testament prevail, unless the conflicting provisions of Ohio law are mandatory and may not be waived.

Apportionment of Death Taxes

Except as otherwise specified in my Will and Testament, my Executor will apportion death taxes as provided under the law of Ohio in effect at the date of my death.

Executor Compensation

My Executor will be entitled to fair and reasonable compensation for the services rendered as a fiduciary. My Executor may charge additional fees for services that are not within its duties as Executor, such as fees for legal services, tax return preparation, and corporate finance or investment banking services. In addition to receiving compensation, my Executor may be reimbursed for reasonable costs and expenses incurred in carrying out its duties under my Will and Testament.

My Executor’s Powers

My Executor may exercise, without prior approval from any court, all the powers conferred by my Will and Testament and any powers conferred by law, including, without limitation, those powers set forth under the common law or statutory law of Ohio or any other jurisdiction whose law applies to my Will and Testament. The powers

Spouse One Irrevocable Trust – Will and Testament of Spouse One Page 10

Assignment of Personal Property

For value received, I, Spouse One of Anywhere, Florida, hereby assign, transfer, and convey all of my right, title, and interest in all of my tangible personal property to: Son Ofoneandtwo, Trustee of the Spouse One Irrevocable Trust dated ____________________, 20___, and any amendments thereto. My tangible personal property includes, without limitation, all of my jewelry, clothing, household furniture, furnishings and fixtures, chinaware, silver, photographs, works of art, books, boats, automobiles, sporting goods, electronic equipment, musical instruments, artifacts relating to my hobbies, and all other tangible articles of personal property that I now own or hereafter acquire, regardless of how they are acquired or the record title in which they are held.

Dated:

Spouse One, Assignor

Spouse One Irrevocable Trust – Trust Summary and Funding Letter Page 11

Trust Summary and Funding Letter

May 12, 2015

Mr. Spouse One 121 Main St Anywhere, FL 11121

Re: Summary and Funding of Your Medicaid Asset Protection Trust

Dear Mr. One:

This letter will describe how your Irrevocable Trust will operate. It sets forth the various steps necessary to “fund” your Trust and to carry out the use of the Trust for Medicaid planning purposes. It is critical that the procedures discussed in this letter are followed precisely so that the planning objectives desired in establishing your Trust will be accomplished. Failure to follow these instructions may result in adverse Medicaid and tax consequences.

Among other things, we will (1) describe what actions you must take to transfer assets into the Trust, and (2) discuss some of the things you need to know and be thinking about in the future, to ensure the proper administration of the Trust in a manner that will ensure the protection of the Trust assets in the event you require long term care.

As you are aware, none of the income generated from the assets that you transfer to

the Trust is payable to you during your lifetime. During this time, it is anticipated that the Trust will run smoothly and that your Trustee will have few legal problems in the administration of the Trust. In order to help accomplish the long-range objectives for which the Trust was created, however, it is necessary that administration of the Trust be consistent with the rules set forth in the Trust instrument and the tax laws related to trusts.

The first step in implementing the Trust is for you to transfer your assets into the Trust.

YOUR TRUST IS EFFECTIVE ONLY TO THE EXTENT THAT IT IS FUNDED.

The Trustee collects the income and, in the Trustee’s discretion, pays it to the income beneficiaries. Under no circumstances may trust principal be paid to you, as Grantor. This is necessary to ensure that the assets in your Trust remain protected in the event you require long term care and wish to qualify for government benefits to assist you in paying for such care.

As you can see, while you are living, the assets that you fund into the Trust will be administered for the Trust beneficiaries according to your instructions in the Trust. Then, upon your death, the remaining assets will be distributed to the remainder beneficiaries by means of the provisions of the Trust.

Spouse One Irrevocable Trust – Trust Summary and Funding Letter Page 12

I. WHAT IS A “MEDICAID ASSET PROTECTION TRUST”?

Although we discussed your Trust in detail and you now understand the basics of how an irrevocable trust operates, this summary explanation will likely be helpful when you review the Trust in the future.

By signing the Trust instrument (that is, the Trust Agreement), you created a new legal entity, or legal being. This is the Trust itself. Within it, you established a number of rights and responsibilities for persons named in the Trust. These persons serve four roles.

The first is the role of “Grantor.” The Grantor of a trust is the creator of the trust. For your Trust, you are the creator of the Trust, and therefore the Grantor of the Trust, and you will transfer assets into it. The second is the role of “Trustee.” The Trustee of a trust manages the trust, makes decisions regarding the use of trust assets, and makes distributions pursuant to the terms of the trust. You have appointed Son Ofoneandtwo to serve as Trustee of your Trust.

The third is the role of “beneficiary.” A trust exists for the benefit of the beneficiaries. A trust has two types of beneficiaries: the income beneficiaries, who are the recipients of distributions of trust income, and the principal beneficiaries, who are the recipients of distributions of trust principal. While you are alive, both the income and principal beneficiary of your Trust is your son, Son Ofoneandtwo, who may receive distributions for any purpose, at the Trustee’s discretion, if the Trustee is independent, and if not, may receive distributions for health, education, maintenance, and support, at the Trustee’s discretion.

CAUTION: If a principal beneficiary is a “Supplemental Needs Person,” we recommend that you consult with our office prior to making any outright distributions of principal to the beneficiary to determine how this might affect the beneficiary’s government benefits.

After your death, the income and principal beneficiaries of your Trust are your descendants, per stirpes, who will receive their shares outright.

The fourth is the role of “Trust Protector.” A Trust Protector is responsible for protecting the purpose and intent of the trust. In your Trust, the Trust Protector will have the limited ability to make certain amendments to the Trust, remove a Trustee, and fill Trustee vacancies. The Trust Protector cannot, however, change the beneficiaries of the Trust. The responsibilities and the powers of the Trustee are described in Article Nine of the Trust Agreement. Not all trust instruments contain the same powers, so the Trustee must pay attention to the language in your Trust to be certain of the authority and options available. Some of the Trust provisions reflect existing trust law, while others are included because they suit your situation and may supersede such existing laws for irrevocable trusts.

Spouse One Irrevocable Trust – Trust Summary and Funding Letter Page 13

Dear Trustee:

You have been appointed as Trustee of the Spouse One Irrevocable Trust, serving alone. You may make decisions about trust business without the approval or consent of any other party.

The Spouse One Irrevocable Trust is an irrevocable trust, which means that the trust may not be amended by the Grantor. However, the Grantor has reserved the power to change the distribution of the trust assets after death. This power is called a power of appointment and is found in Section 3.02 of the trust document.

In addition, the trust allows a Trust Protector to amend the trust in certain circumstances, as specified in Section 4 of the trust document.

Inasmuch as we have been retained to render advice to you as Trustee regarding the proper administration of the trust, we encourage you to contact us in the event you have any questions or experience any challenges during your service as Trustee. Generally, the trust document itself will control decisions that must be made during the course of your term as Trustee.

Administration During Lifetime of the Grantor

Trust Accounting and Bank Accounts As Trustee, you are authorized to use trust funds to hire an accountant to help with trust accounting and tax issues, including tax returns. The Information for Tax Professionals document will help tax professionals with trust accounting.

As for setting up bank accounts in the name of the trust, the financial institution will want to know how to report income to the IRS and will request a taxpayer ID number from you. DO NOT GIVE THEM YOUR PERSONAL SOCIAL SECURITY NUMBER.

Because the Spouse One Irrevocable Trust is a so-called “grantor trust,” it doesn’t need to file a separate tax return. Instead, trust income is reported on the Grantor income tax return, so the trust can use the Grantor’s social security number for income tax reporting by financial institutions.

Unfortunately, many financial institutions insist on a separate taxpayer ID number for the trust (frequently referred to as an Employer Identification Number, or EIN). If you need assistance dealing with any particular financial institution, please let us know.

For additional information, please contact our office or see the Information for Tax Professionals document.

Spouse One Irrevocable Trust – Information for Trustees Page 14

Distributions to Lifetime Beneficiaries You must review the trust document to determine who the Lifetime Beneficiaries are. The trust document will also tell you whether distributions to the Lifetime Beneficiaries are discretionary or mandatory, and whether they must be made in equal shares, but in general, your authority is as follows.

The trust authorizes you to make distributions to the Lifetime Beneficiaries for their health, education, maintenance, or support. “Maintenance” and “support” refer to distributions to maintain a person’s standard of living. Your authority to make these distributions is discretionary. Even a beneficiary with a legitimate need cannot demand a distribution from the trust. But when you make a distribution from the trust, it must be for the beneficiary’s health, education, maintenance, or support.

However, if you are an “Independent Trustee” (that is, a disinterested party to the Grantor and all beneficiaries), then you can make distributions to the Lifetime Beneficiaries for any purpose. This means that distributions are not limited to those needed for specific purposes, like health or education. It also means that distributions are not limited in amount—you can distribute all of the trust property out to the Lifetime Beneficiaries.

Distributions to the Lifetime Beneficiaries may only be made during the lifetime of the Grantor. But don’t confuse distributions with other disbursements from the trust, like payment for services and other trust expenses, which may only be made in accordance with your duties and responsibilities as Trustee (more on that below).

Administration After Death of the Grantor

The Spouse One Irrevocable Trust might provide for a change in Trustees after the Grantor’s death. If you were serving as Trustee during the lifetime of the Grantor, review the trust document to determine if you are still the Trustee after the Grantor’s death.

Trust administration upon death of the Grantor depends on the terms of the trust, which should be reviewed carefully with a trust attorney before taking any action. For example, you need to determine if the retained limited power of appointment was exercised— which can alter the distribution terms in the trust agreement—and if so, over what portion of the trust assets.

You need to comply with whatever the trust requires, including paying trust expenses and coordinating with the deceased Grantor’s estate representative to deal with federal and state estate tax returns, if applicable, as well as the decedent’s final federal and state income tax returns.

Because the Grantor reserved a testamentary limited power of appointment, all the trust assets are included in the decedent’s estate, which also means that all trust assets get a new tax basis as of the date of death. Therefore, it’s important to document the

Spouse One Irrevocable Trust – Information for Trustees Page 15

General Information

The trustee of the Spouse One Irrevocable Trust may not distribute any income or principal to the grantor. However, there are other trust beneficiaries during the grantor’s lifetime (the “lifetime beneficiaries”) to whom the trustee may distribute income or principal.

The grantor has retained a testamentary limited power of appointment, so has the power to change the remainder beneficiaries of the trust.

Gift Taxes

In general, with limited exceptions, a gift tax return needs to be filed in years in which a donor makes any transfer by gift.1 However, gifts can be either complete or incomplete, and the gift tax only applies to completed gifts.2

Until the IRS released CCM 201208026 in 2012, it was generally thought that a limited testamentary power of appointment caused the transfers to an irrevocable trust to be incomplete gifts for gift tax purposes. 3

The CCM seems to conflict with PLR 200247013, which reached the conclusion that a retained testamentary limited power of appointment meant that the grantor continued to possess dominion and control over the property transferred to the trust and that the transfers to the trust would not be treated as completed gifts.

Therefore, if the objective is to report the gifts accurately as either complete or incomplete, a careful analysis of the CCM should be made in conjunction with the terms of the trust.

On the other hand, there does not appear to be anything in the tax code or regulations that would prevent reporting the transfers to the trust as completed gifts on a gift tax return, even if they are incomplete gifts. Put differently, nothing in the code or regulations seems to require a donor to contend that a gift is incomplete, it merely requires the donor to provide evidence showing all relevant facts if the donor makes the contention:

1 IRC 6019. IRC=Internal Revenue Code (Title 26 of the United States Code). 2 See, e.g., IRC 2702(a)(3)(B); TR 25.2511-1(c)(1), 25.2511-2(f). TR=Treasury Regulations (Title 26 of the Code of Federal Regulations). 3 See, e.g., PLR 200247013.

Disclaimer: This tax information relates only to the identified trust and may not be applicable to other trusts. Further, it merely reflects the opinion of the author as of May 26, 2016. You should do your own research and reach your own conclusions.

Spouse One Irrevocable Trust – Information for Tax Professionals Page 16

“If a donor contends that his retained power over property renders the gift incomplete . . . , the transaction should be disclosed in the return . . . and evidence showing all relevant facts . . . shall be submitted with the return.” 4 Arguably, this language is permissive—it doesn’t require the donor to make the contention that the gift is incomplete.

It could be advantageous to report the transfers to the trust as completed gifts, especially if the trustee anticipates making distributions in subsequent years that exceed the annual gift tax exclusion amount, as those distributions would otherwise complete the gift, giving rise to the requirement to file a return in each of those years.5 Note that the trust is not making the gift—the gift tax does not apply to trusts—rather the distribution from the trust completes the gift from the grantor to the beneficiary.6

And even if the trustee anticipates that distributions in subsequent years will be limited to the annual exclusion amount, ongoing administration of the trust is complicated by the requirement to analyze distributions from the trust each year to determine if they qualify for the annual exclusion.

Therefore, filing a gift tax return for the initial transfers and claiming them as completed gifts (or, more accurately, not contending that they are incomplete gifts) eliminates the need for annual analysis of the trust distributions for gift tax purposes. Note that reporting transfers as completed gifts on a gift tax return does not foreclose inclusion of the assets in the transferor’s estate and claiming an adjusted basis at death. See Basis Adjustment at Death, below.

Finally, it’s worth noting that the transfers to the trust don’t qualify for the annual gift tax exclusion because they are gifts of a future interest in property.7

Income Taxes, Generally

In general, the grantor trust rules determine whether the grantor is treated as the owner of the trust (or portion of the trust) for income tax purposes.8 And if so, then the grantor is taxed on the income, regardless of who receives it or whether it stays in the trust.9

4 TR 25.6019-3(a); see also TR 301.6501(c)-1(f)(5), which seems to permit reporting incomplete gifts as completed gifts: “For example, if an incomplete gift is reported as a completed gift on the gift tax return and is adequately disclosed, the period for assessment of the gift tax will begin to run when the return is filed, as determined under section 6501(b).” 5 TR 25.2511-1(g)(1). 6 TR 25.6019-1(e), 25.2511-1(g)(1). 7 IRC 2503(b)(1). 8 IRC 671–679. 9 IRC 671.

Disclaimer: This tax information relates only to the identified trust and may not be applicable to other trusts. Further, it merely reflects the opinion of the author as of May 26, 2016. You should do your own research and reach your own conclusions.

Spouse One Irrevocable Trust – Information for Tax Professionals Page 17