1 minute read

OPPORTUNITY ZONE TAX ADVANTAGES

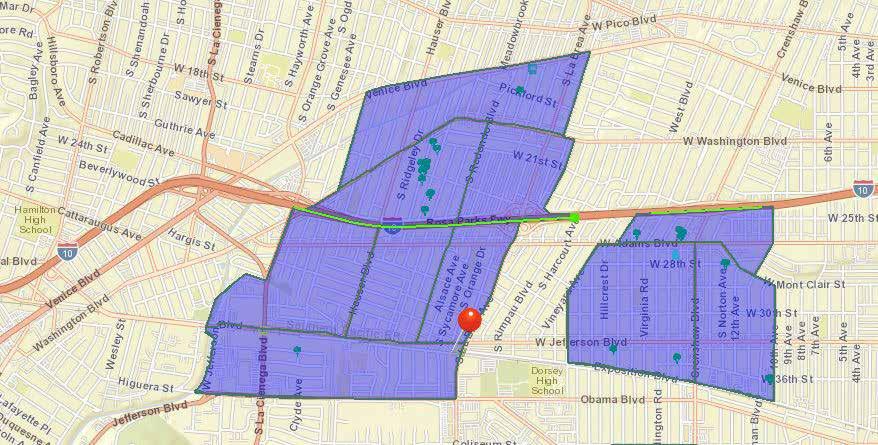

3043 S La Brea is strategically located on the easternmost border if a Qualified Opportunity Zone, allowing an investor to capitalize on the economic incentives that this program provide. This location provides tax advantages for an investor, reducing capital gains by as much as 15% over a seven year hold period and fully exempt from capital gains tax if the investment is held for at least 10 years. Because the biggest tax breaks are available to investors who retain their investment in these zones for at least 10 years, the Opportunity Zone program encourages new construction.

3043 S La Brea is strategically located on the easternmost border if a Qualified Opportunity Zone, allowing an investor to capitalize on the economic incentives that this program provide. This location provides tax advantages for an investor, reducing capital gains by as much as 15% over a seven year hold period and fully exempt from capital gains tax if the investment is held for at least 10 years. Because the biggest tax breaks are available to investors who retain their investment in these zones for at least 10 years, the Opportunity Zone program encourages new construction.

Advertisement

3043 S La Brea is strategically located on the easternmost border if a Qualified Opportunity Zone, allowing an investor to capitalize on the economic incentives that this program provide. This location provides tax advantages for an investor, reducing capital gains by as much as 15% over a seven-year hold period and fully exempt from capital gains tax if the investment is held for at least 10 years. Because the biggest tax breaks are available to investors who retain their investment in these zones for at least 10 years, the Opportunity Zone program encourages new construction.

Year 5 2023

Year 5 2023

Tax on original capital gain is reduced by 10%

Tax on original capital gain is reduced by 10%

Year 7 2025

Year 7 2025

Tax on original capital gain is reduced by another 5% (15% total reduction)

Tax on original capital gain is reduced by another 5% (15% total reduction)

Year 9

Year 9

April 15, 2027

April 15, 2027

Pay taxes on original deferred capital gains (minus 15% reduction)

Pay taxes on original deferred capital gains (minus 15% reduction)

Year 10

*Details about the Opportunity Zone program and the site’s eligibility should be confirmed by buyer or tenant’s CPA or tax attorney.

*Details about the Opportunity Zone program and the site’s eligibility should be confirmed by buyer or tenant’s CPA or tax attorney.

Year 10 2028

2028

All capital gains taxes now eliminated on any Opportunity Fund profifits

All capital gains taxes now eliminated on any Opportunity Fund profifits

METRO E LINE (EXPO) / SIGHT LINE

PRE-APPROVED ENVIABLE ADVERTISING SIGHT-LINE FROM THE METRO E LINE (EXPO) LA BREA PLATFORM STATION