1 minute read

A HISTORIC TIME To Buy

from Home Buying Guide from Keith Curran

by HomeServices KOI Companies: Semonin | Rector Hayden | HUFF

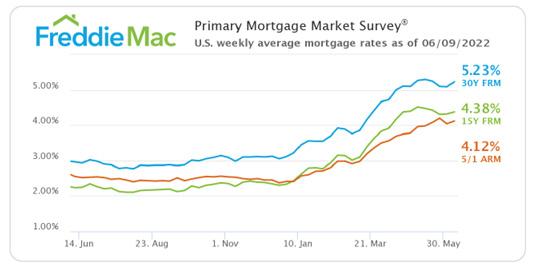

According to Freddie Mac's Chief Economist, Sam Khater, "mortgage rates rose again on the back of increased economic activity and incoming inflationdata. The housing market is incredibly rate-sensitive, so as mortgage rates increase suddenly, demand again is pulling back. The material decline in purchase activity, combined with the rising supply of homes for sale, will cause a deceleration in price growth to more normal levels, providing some relief for buyers still interested in purchasing a home."

We must keep in mind that while rates aren't at their all time lowest, they're still very far from historic highs. Just take a look at the last 30 years!

In the 1980s, rates averaged at 12.7%, and at 8.12% in the 1990s

So even if you may have missed the lowest mortgage rates ever offered, you can still get a much better rate than 10, 20, and 30 years ago.