2 minute read

What’s in store for the hotel sector in 2020

In their latest report, Skift Research looks forward into 2020 and what the new year could hold for the global economy and the travel industry. Their overall stance is cautiously optimistic. Risks are present, and the global economy is slowing. But importantly, it is still growing.

Skift forecasts another good year for international tourism flows in 2020, expecting about 40 million new trips in 2020, growing the total by 3 percent to 1.34 billion. Their overall advice is for travel leaders to be prepared but not to panic.

Advertisement

Below is an excerpt from Skift’s Research Report that shares their high-level views for the hotel sector.

GLOBAL HOTEL TRENDS

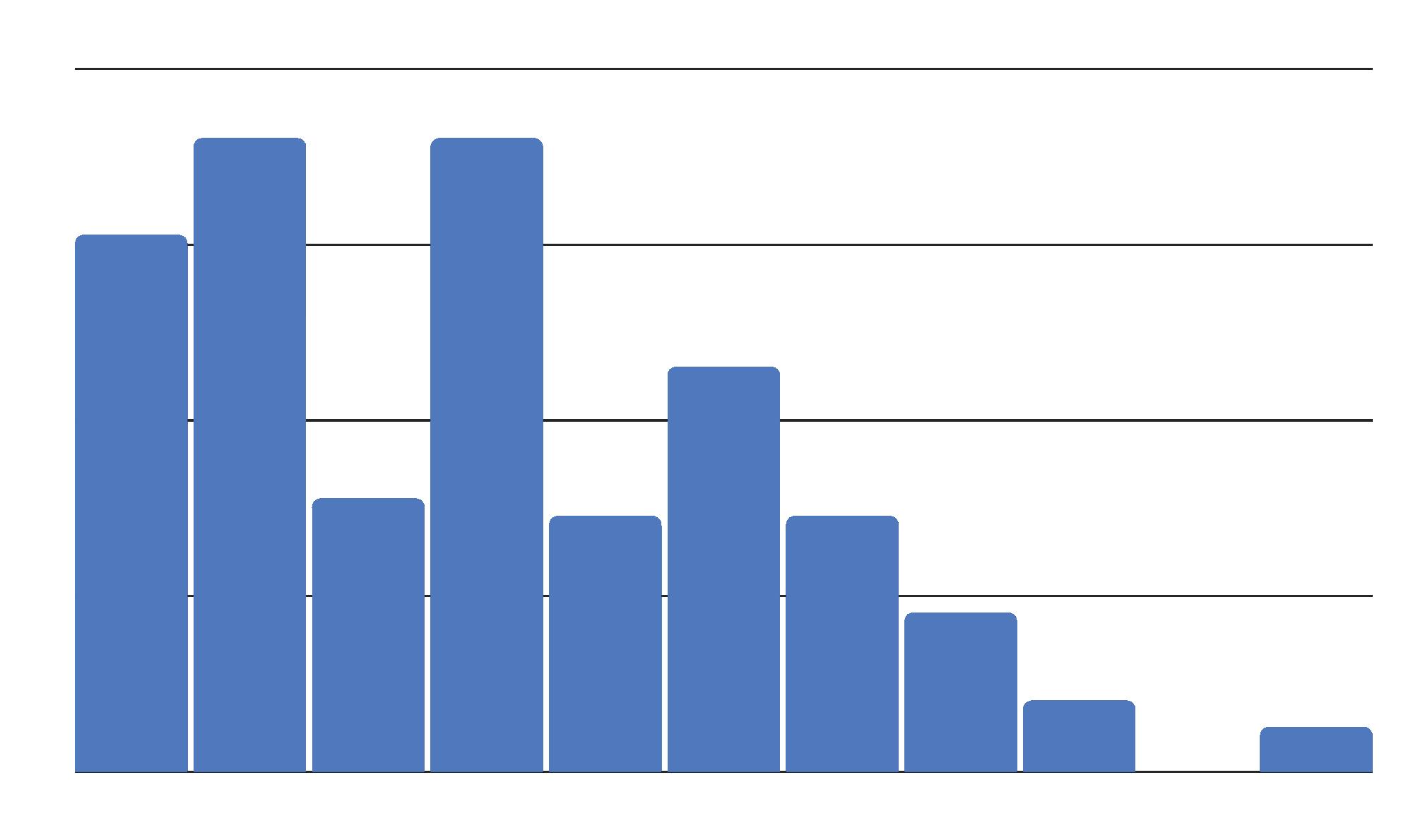

Given hotel performance is generally tied to GDP growth, the economic slowdown in 2019 had an effect on hotel performance as well. Skift Research estimated 2018 RevPAR growth of 3-percent, and according to different sources the actual performance came in just below that at 2.9 percent.

The year 2019, however, has been a year of downgrading expectations. In the United States, RevPAR remains positive but has taken a significant hit with growth for 2019 and 2020 expected to fall below the 1-percent mark. This does not seem to be down to a decline in demand, which is actually at record levels. It is instead a result of rapid increase in total room supply, including short-term rentals, leading to uncertainty around pricing. Average daily room rates (ADR) growth has been strained, growing below inflation according to hotel data company STR.

Also in other parts of the world, hotel performance has been struggling, and in most cases RevPAR is actually in full contraction mode.

8

7.2% SC 7.2% SC

Asia-Pacific relies heavily on Chinese tourists, but outbound travel from China has been hit by the U.S.-China trade war as we have explored earlier. Japan and South Korea, meanwhile, find themselves in their own trade war. The unrest in Hong Kong adds to this downturn.

Occupancy stands out as a clear winner in the Middle East and Africa for the first nine months of 2019, and this is despite rampant oversupply in markets like Dubai as it gears up for Expo 2020. The stronger dollar impacted ADR in the region and would have made the region less attractive to non-dollar visitors from Europe and Asia.

The strong dollar also impacted the hotel sector in Europe, which followed a similar trend as the Middle East and Africa. As traveling outside Europe got more expensive, it is likely that hotels in the region benefited slightly from more intra-regional travel. Europe also benefits from a stronger base of source markets within its region.

The slowdown in RevPAR, in most cases driven by lower ADR, means a squeeze on revenues while supply continues to outperform room sales. We expect to see a slight slowdown in supply in 2019, although this is likely to pick up in 2020 with the expectation that supply increases to 18.5 million rooms by the end of 2020.

Note that this figure is based on definitions set by hotel data company STR, containing only hotels with 10 or more rooms. The actual available supply in the market will therefore be larger.

Room revenue, meanwhile, is also set to slow down in 2019 and 2020 but will break the $540 billion mark in 2020.

U.S. RevPAR Growth (2015-2020)

6

6.1%

4

2

3.1% 4.6% SC

2.9%