95 minute read

News

Multi-million EUR contract in the pipeline

Saipem has been awarded an offshore energy and construction contract by Enimed, a subsidiary of Eni S.p.A, worth approximately 300 million Euro. Saipem will fulfil the transportation and installation of an offshore gas pipeline connecting the four wells of Argo and Cassiopea Fields to the Sicilian coast.

With a length of 60 kilometers and a maximum water depth of 660 meters, the pipeline will be installed by globally-recognized pipelay vessels.

The Cassiopea project represents a strategic and complementary addition to the infrastructure of Italy’s gas supply, which has been affected by the recent geo-political situation. The contract positions Saipem as one of the main partners able to effectively support clients and provide tangible solutions to the current energy crisis.

Pump up

Netzsch Pumps North America, LLC, announces the new TORNADO® T1 pump. Small and compact, the pump produces high flow at low to medium pressures. Ideal for applications in biogas and biomass plants, the pump can handle a wide range of viscosities, solids, temperature, abrasion, and corrosive/acidic process fluids and environments.

Extremely versatile for just about any orientation and installation, its robust design offers longevity, operational flexibility and dry-run capabilities. The front pull-out feature provides easy access for maintenance and inspection. Additionally, the Gearbox Security System (GSS) protects the gearbox from the process side of the pump.

Netzsch continues to improve the design and develop its capabilities to enhance durability and extend operational life. Netzsch’s vertically-integrated manufacturing allows for better control of tolerances and variations, adding longevity to your production processes.

Floating offshore wind

Technology developer X1 Wind has successfully laid its dynamic cable and is now ready for final installation of its floating wind prototype, PivotBuoy, at the PLOCAN test site in the Canary Islands.

“The 20kV dynamic cable will allow us to fully validate the floater and wind turbine performance, feeding the electricity to PLOCAN’s smart grid, as well as transmitting data through its fiber optic connection,” explains X1 Wind’s Electrical Engineering Manager, Adrian Oliva.

With the tradewinds now blowing strong in the Canary Islands until mid-September, the Barcelona-headquartered firm will wait for a suitable weather window to complete the towing and hook-up of the prototype.

X1 Wind’s technology offers a unique approach to floating wind. The prototype is fitted with a turbine in a downwind configuration, enabling the structure to weathervane and orientate passively to maximize energy yields. It drives greater structural efficiency with a light and flexible design, which further supports future mass production at a lower cost. The platform uses a Tension Leg Platform (TLP) mooring system which reduces the platform and cable dynamic motions, minimizes the footprint on the seabed, and enables installation in deep waters.

A strong collaboration with international and local supply chain partners including Noatum Logistics, Hengtong, Trames, Ditrel Industrial, Electrimega, Partnerplast and Gateway, has been instrumental in the successful installation of the dynamic cable.

Supported by four million EUR from the European Commission H2020 Program, with a consortium coordinated by X1 Wind, PivotBuoy aims to substantially reduce the current Levelized Cost Of Electricity (LCOE) of floating wind.

Worth its salt

Norway-headquartered well integrity specialist company HydraWell has marked an important diversification milestone by completing two significant geothermal projects totalling 350,000 EUR in the Netherlands. The company’s ingenious HydraHemera™ patented Perf, Wash & Cement (PWC®) solution was originally developed for the energy sector. Now, in a significant step towards embracing a growing number of diversification opportunities, the technology has entered new territory thanks to the successful completion of two scopes of work in the Netherlands – one for a leading tomato producer and the other for a salt mining client.

Erlend Engelsgjerd, Sales Manager of HydraWell, commented: “The successful completion of these projects is important acknowledgement not only of the trust placed in us, by clients in brand-new sectors, but also in our team’s ability to step up and seize the opportunity to diversify into fresh and exciting contemporary marketplaces. This winning combination will stand us in good stead and helps us to look to the future with confidence and optimism.” The popular HydraHemera™ portfolio for wellbore specialist applications has played a pivotal role in realising HydraWell’s ongoing drive to re-think existing well integrity operations. The latest applications are further clear indication of its adaptability in rising to new challenges.

Pioneering power

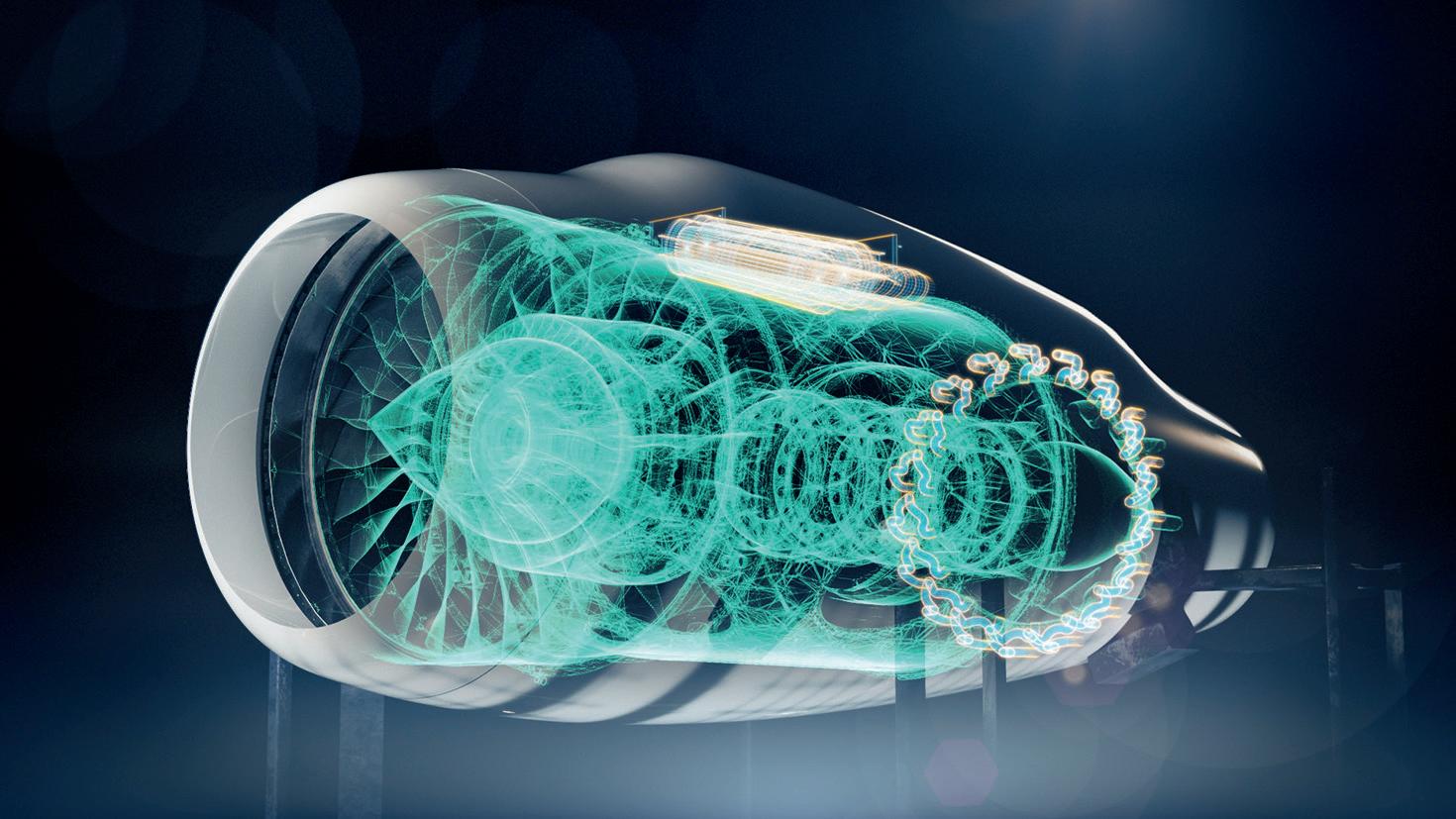

Rolls-Royce has announced a new leading-edge hydrogen programme and given a further update on its research into hybrid-electric power as it continues to pioneer new forms of aviation sustainability.

Together with its commitment to continually improve gas turbine efficiency and demonstrate compatibility with Sustainable Aviation Fuel, this work ensures it will continue to play a leading role in the drive to Net Zero aviation.

Rolls-Royce is planning a comprehensive series of rig and engine tests to prove the fuel can safely and efficiently deliver power for small to mid-size aircraft from the mid-2030s onwards. With further ambitions to move this on to a flight test phase as part of the programme in the long term.

The programme follows market research carried out by the UK Aerospace Technology Institute’s Fly Zero team and Project NAPKIN (New Aviation Propulsion Knowledge and Innovation Network), which concluded there is market potential for hydrogen-powered aircraft.

Rolls-Royce’s hybrid electric research has been carried out on its Power Generation System 1 (PGS1) demonstrator. It is now taking that huge amount of learning and carrying out further work to understand how a production version of PGS1 might be achieved and discussing with air framers what their future requirements may be.

Siemens Energy announced that it was selected as the single solution supplier for the all-electric wood fiber Liquified Natural Gas (LNG) project near Squamish, in British Columbia, Canada. The environmentally friendly LNG facility will be located at the site of a former pulp and paper operation. It will be sized for 2.1 million tonnes per annum and will utilize clean, renewable hydroelectricity, reducing its greenhouse gas emissions by more than 80 percent.

Siemens Energy’s scope includes all equipment associated with the main refrigeration trains, which are components of the liquefaction process, producing the LNG that will eventually be stored in tanks and then transported to tankers for shipping abroad.

“LNG will play an essential role in a more sustainable future as we continue looking at ways to decarbonize the natural gas chain,” said Thorbjörn Fors, Executive Vice President, Industrial Applications at Siemens Energy.

“This project is important; it will help support the journey by exporting to Asian economies currently driven by coal.”

“Wood fiber LNG is working to incorporate a sustainable approach into as many aspects of our project’s engineering and design as possible,” said company president Christine Kennedy. “This includes using safe, efficient equipment for the LNG refrigeration process – like that Siemens Energy will supply – to build what will become the world’s lowest-emission LNG export facility.”

The project is expected to reach substantial completion in 2027 and begin commercial operation by September of that year.

Sustainable future

Major maintenance contract

Bilfinger has been awarded a multi-million-dollar annual contract for the routine mechanical maintenance scope of Shell’s oil and gas platforms in the Gulf of Mexico (GoM). The industrial services provider will be responsible for all routine maintenance services and fabrication across Shell’s deepwater GoM fleet for a minimum of three years, with the option to extend for a further two years. Having supported most offshore providers in the US for over 35 years with maintenance, Insulation, Scaffolding, and Painting (ISP) and NonDestructive Testing (NDT) services, the new order expands Bilfinger’s services portfolio provided in the GoM market. “With this major contract from our long-standing customer, Bilfinger expands its global relationship with Shell as well as its growth course in the North American offshore maintenance business,” says Duncan Hall, Group COO of Bilfinger. “Our skilled team and comprehensive onestop maintenance services will contribute to Shell’s commitment to meet growing energy demands while operating their deepwater oil and gas projects safely and minimizing their impact on the environment.” “Bilfinger’s commitment to the highest safety standards ensures our customers from the oil and gas industries safe and reliable operational efficiency for their assets, supplying American energy today and for many years to come,” says Duncan. Photo: Shell Appomattox deep-water asset in the Gulf of Mexico © Photographic Services, Shell, Allison Smith

Driving the energy transition forward

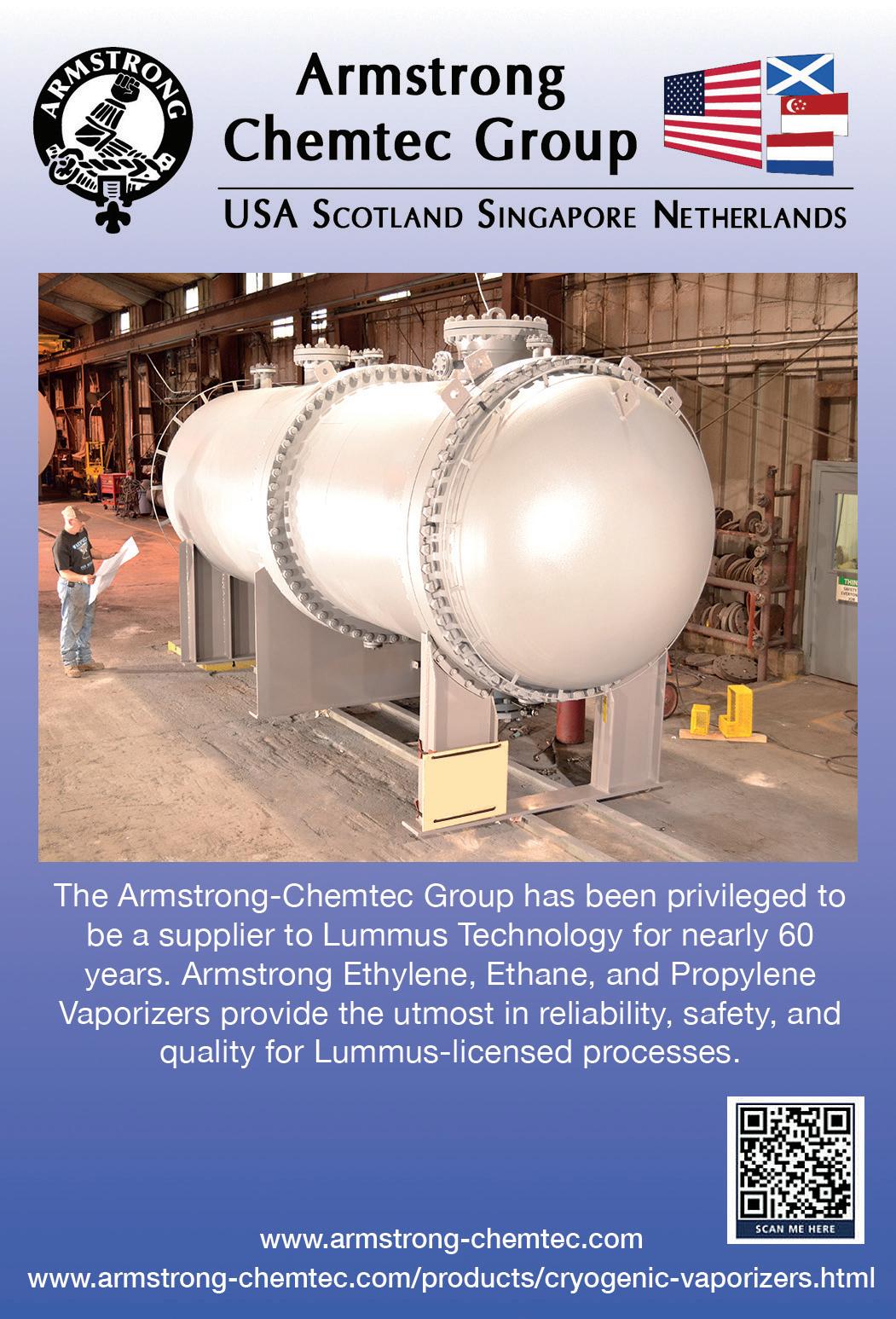

By creating technologies that increase energy efficiency and lower carbon footprints, while reducing costs and enhancing performance, Lummus Technology has carved out a strong reputation over the years – 115 of them, to be exact

It has been a year since

we last spoke with Leon de Bruyn, President and CEO at Lummus Technology (Lummus), a global leader in developing process technologies that, as the company puts it, make modern life possible.

Modern life is an interesting collocation. At a glance, it describes the present moment; however, probe a little deeper and you can feel the weight of modernity pressing down: industry, technology, and adjoining contemporary crises like climate change.

Lummus seeks to investigate that imposing intersection between modernity and

sustainability, focusing on innovative process technologies that support a low or zero carbon future, as well as supplying proprietary equipment, catalysts, and digital and lifecycle services to customers in the downstream energy industry.

It is evident that Lummus has continued to build momentum over the course of the past year. “In the last year or so, we went from creating a basis for the company, following an acquisition by Rhône Capital and the Chatterjee Group, which fundamentally established us as a standalone business, through financial, operational, and cultural

adjustments, to now firmly building on our future against the backdrop of a global energy transition,” explains Leon. “Operationally, we have changed our model to become more customer-centric. We have also harmonized our business around three core markets – polymers, petrochemicals, and clean fuels – and adapted a third pillar of services to enhance our customers’ operations.

“From a technological standpoint, we have aggressively expanded our portfolio and refined our core competencies in polymer technology,” he continues. “Indeed, essentially, we want to build out a competitive advantage, cementing our position as a global leader in the field by adding more logical and sustainable expansions to our framework, and offer more value to customers by providing value across multiple disciplines: process technology, catalyst services, proprietary equipment, and digital consultancy.”

Though Leon admits there is still much ground to cover, Lummus has been incredibly busy over the last 12 months. For instance, it has built new strategic businesses such as Green Circle and Lummus Digital.

More recently, though, the process technology pioneer announced a revolutionary Net Zero ethane cracker, which not only represents an industry first but can also negate CO2 emissions from new or existing ethylene plants.

The next generation design constitutes part of the company’s overarching decarbonization strategy to reduce greenhouse gas emissions from all its technology and is now available for commercial use. “On that project, we knew from the outset that we wanted to challenge the status quo,” asserts Leon. “Prior to our discovery, the consensus was that there was always going to be CO2 production in a cracker. With the backdrop of the energy transition in mind, we sought to cut CO2 emissions from ethylene plants. First, our customers wanted it and second, we always aim to be ahead of the curve. By offering a definitive way to make petrochemical manufacturing more sustainable, we are achieving both by making what is typically a very carbon intensive process more environmentally friendly.”

In an astonishing feat of engineering, Lummus was able to defy expectations and design a Net Zero cracker that produces ethylene to the same use and efficiency specifications without emitting any CO2 – there is no combustion of methane gas throughout the entire process. “To achieve that result, we had to make a lot of design changes, but we remained undeterred; passion fueled

the entire project,” details Leon. “We said that we wanted to make a Net Zero ethylene cracker to assist our customers in their energy transitions and we went out and did it. This technology makes up part of a comprehensive decarbonization strategy that we are currently putting in place to reduce the carbon footprint of our entire portfolio. It is, quite simply, something we must do. In fact, everyone must.”

Operating holistically through this wider network of companies, then, Lummus is firmly supporting the downstream energy industry in its transition towards a carbon neutral circular economy. Another entity operating under the Lummus brand to decarbonize the company’s extensive asset portfolio is Green Circle.

“In short, Green Circle is an incubator for new technologies,” explains Leon. “By utilizing our robust R&D centers, we are able to upscale revolutionary but nascent technologies in collaboration with scientific partners. Smart innovations are delivered to us, and, through Green Circle, we take that technology from its initial laboratory stage to a demo stage; after that, we then progress to a semi-commercial scale before fully developing it into a commercialized entity that can be integrated with existing infrastructure.

“We are fast-tracking the commercialization of these low and zero carbon technologies,” Leon summarizes. “That is important because we cannot afford to spend another ten-to-15 years stuck in the mire of development. Such

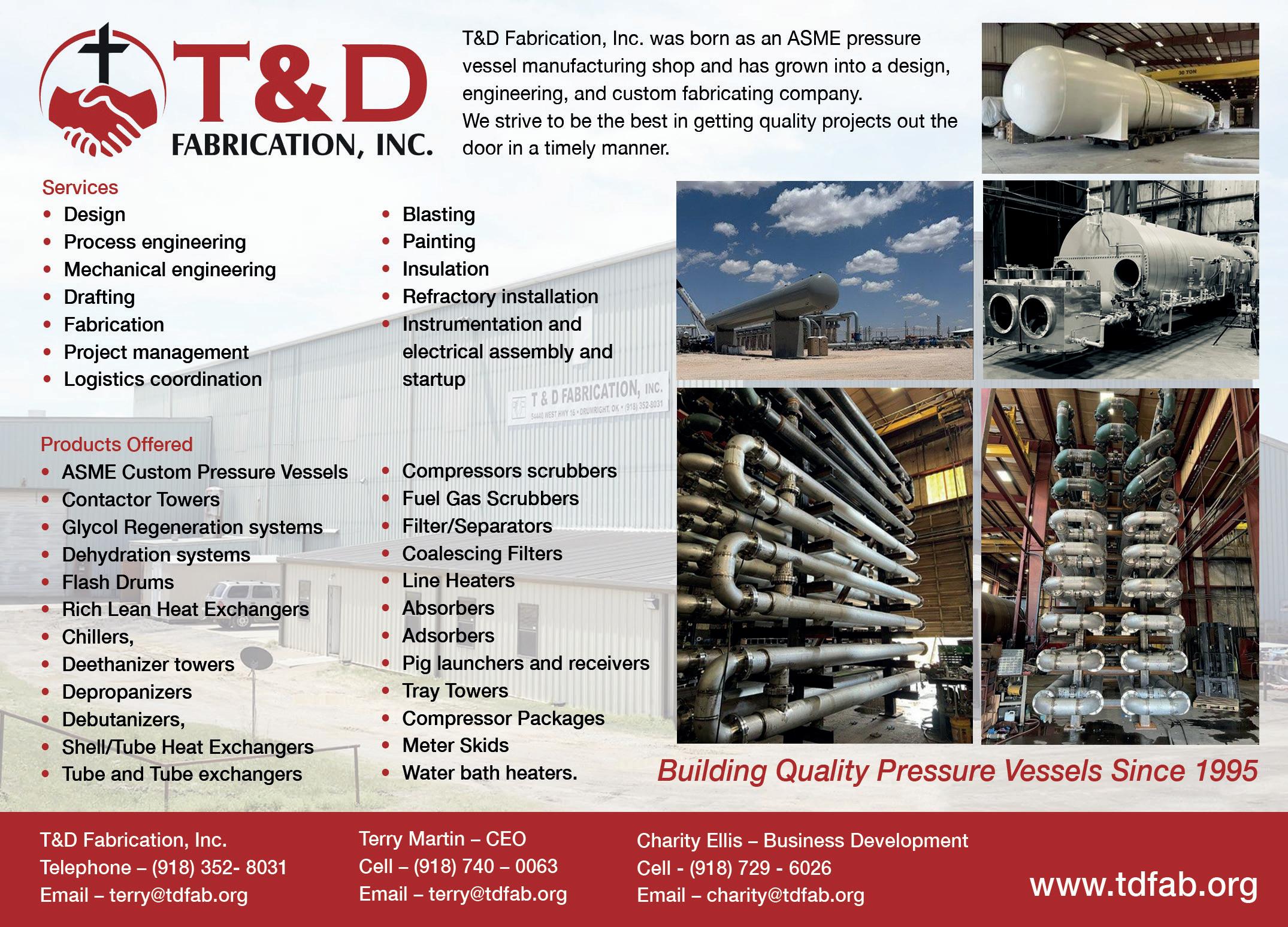

T&D FABRICATION INC

T&D Fabrication Inc is a privately-owned, full-service engineering company, with a 75,000-square-foot manufacturing shop onsite, located only a few miles from the heart of Tulsa, Oklahoma. We have been servicing some of the world’s largest producers of oil, gas, and LNG for nearly 30 years. Our mission is to be, first, a partner to our customer, and second, to set the bar for quality standards in this industry. We are the solutions company. Bring us your problem, and we will turn into your most trusted partner.

technologies are essential to the future of our planet, and we must integrate them via a comprehensive decarbonization strategy. It is also worth noting that, while our collaborators excel in the science behind these technologies, we can offer them the essential engineering and technological expertise necessary to commercialize, de-risk, and integrate their new assets with existing ones. Without that knowhow and upscaling ability, these scientific developments could be left in limbo.”

One example of Green Circle’s early success that Leon cites is Braskem, the largest biopolymer producer in the world. Through this partnership, Lummus is delivering green ethylene technology at scale, accelerating the use of bioethanol in the production of chemicals and plastics. He also cites Synthos, a Polish petrochemicals producer and leader in the global synthetic rubber market, as an example of Green Circle’s early success. Synthos recently endeavored to move away from fossil fuel-derived feed stocks to a low carbon alternative: bio-butadiene created via bio-derived ethanol technology. Though Synthos was able to develop the scientific technology to convert bio-drive ethanol to the monomer used in rubber production, the company needed additional support to commercialize these investments and upscale them for third-party use.

Enter Green Circle. In less than a year, the Lummus subsidiary had the technology market-ready. With a low carbon footprint, moreover, the new method of sustainable rubber production has hinted towards an industrial paradigm shift.

After completing a successful preliminary study in 2021, Lummus and Synthos have agreed that the bio-butadiene technology is ready for implementation and the latter has committed to building a plant that can process 40,000 metric tons of bio-butadiene per annum – twice as much as was originally planned – which stands as a testament to the trust that partners place in Lummus and its engineering capabilities.

“Clearly, the energy transition is becoming more and more important,” reflects Leon. “Yet it is also being amplified by the geopolitical and energy balance changes that we are currently seeing around the world; we must find solutions that take these into account and then begin to rapidly decarbonize our operations – as a company and as a species. We have many new initiatives in the pipeline, which will act to increase the role we are already playing in creating a more circular economy.

“Going forward, we want to continue pioneering solutions that will help our customers move away from fuel production and pivot to petrochemical production,” he concludes. “As it stands, refinery assets will either be shut down – which, frankly, would be a waste – or they will be repurposed and used for alternative means. By focusing on the latter, our incredible engineers can put their passion to work and make a difference; the whole reason they entered this industry was to make the world a better place – and by driving this energy transition forward and developing sustainable technologies, they are proudly fulfilling that.” Lummus Technology

www.lummustechnology.com ......................................... Services: Fuel and chemical process technologies

Investing in the future

With plans to expand its sustainability efforts, UGI Energy Services LLC is tackling the global climate crisis through innovation and dedication to greener practices in the gas industry

UGI Energy Services LLC

(UGI Energy Services) supplies and markets natural and renewable gas, electricity, renewable power, and liquid fuels to over 42,000 locations across Pennsylvania, New Jersey, Delaware, New York, Ohio, Maryland, Massachusetts, New Hampshire, Virginia, North and South Carolina, Rhode Island, California, and the District of Columbia. The company also conducts midstream natural gas business through its ownership of underground natural gas storage, liquefied natural gas and propanepeaking facilities. This is in addition to maintaining its pipeline and electric generation assets in Pennsylvania.

UGI Energy Services offers a wide variety of products to allow customers to hedge their energy purchases with or without renewable

energy options. Furthermore, it has been making great strides recently to expand its renewable energy offering for customers. The business’s Vice President, Shaun Hart, highlights that alongside the company’s expansive portfolio, UGI Energy Services also manages the transportation and marketing of renewable natural gas (RNG) supply across the US. For him, the diversity and reliability of the company’s asset services are what sets it apart from other names in the industry.

The journey to establishing UGI Energy Services’ operation has been extensive and layered with hard work. We learn more about this through Shaun, who elaborates on the company’s history by beginning with the fact that it is a wholly-owned subsidiary of UGI Corporation.

Incorporated as the United Gas Improvement Company in 1882, UGI Corporation became the first public utility holding company in the US. In 1985, following an FERC Order 436 on natural gas pipeline transportation deregulation, UGI Energy Services began marketing natural gas to large commercial and industrial customers. Almost a decade later, UGI Energy Services formed its own company that offered natural gas marketing services in other utility areas across the Mid-Atlantic. In 2003, the company then acquired TXU Energy’s Northeast retail business, which helped expand its customer base, as well as its management, sales, and support staff.

In 2008, the business then began exploring opportunities to develop the Marcellus Shale gas industry in Pennsylvania. “The first opportunity that we jumped on was the construction of a compressor station and pipeline interconnect to move a substantial amount of gas discovered in north east Pennsylvania to sell to the market,” shares Shaun. Since then, UGI Energy Services has had the opportunity to construct several pipelines and compressor stations, providing more locally-sourced gas into the market for customers. Furthermore, the development of Marcellus gas has provided consistently low natural gas and electricity prices, allowing for significant economic growth in Pennsylvania.

Over the years, UGI Energy Services has invested in liquefied natural gas (LNG) vaporization, storage, and liquefaction, propane peak-shaving facilities, and power generation. In 2011, the company converted an electric generation plant from coal to natural gas, and then expanded additional LNG facilities in Pennsylvania.

UGI Energy Services then increased its retail natural gas business by acquiring EQT’s retail business and South Jersey Energy’s retail business in 2015 and 2018 respectively. A year later, it expanded its natural gas midstream footprint into western Pennsylvania and eastern Ohio through the acquisition of Columbia Midstream Group, which increased UGI Energy Services’ pipeline assets in the Marcellus Shale.

Today, UGI Energy Services is one of the largest LNG and peak-shaving companies in the eastern US, while UGI Corporation continues to improve access to affordable energy by delivering reliable solutions across the 50 states and 17 countries in Europe. “The UGI family of companies includes AmeriGas, the largest retail propane marketer in the US; UGI Utilities, Inc. and Mountaineer Gas Company, natural gas utilities operations in Pennsylvania and West Virginia respectively; and UGI International, a

leading LPG distributor and natural gas marketer in Europe.

Last year, in 2021, UGI Energy Services signed a series of agreements with a subsidiary of Energy Developments Pty Ltd (EDL), headquartered in Brisbane, Australia to accept delivery of RNG into its natural gas gathering system, known as Pennant. The company is a partnership between UGI Energy Services, Harvest Midstream I, LP, and a subsidiary of Williams Companies.

“Under the agreements, Pennant will transport the RNG from the carbon limestone landfill located near Youngstown, OH, through its existing system and redeliver the gas, to EDL’s downstream markets. The carbon limestone landfill gas, which is a by-product of naturally decomposing materials in the landfill, will be processed and conditioned by EDL’s largest North American RNG facility to meet Pennant’s gas quality requirements,” Shaun explains. The project is scheduled to become operational in 2023.

Coupling with this major contract, in May 2022, UGI Energy Services entered into an agreement with MBL Bioenergy to fully fund the first set of RNG projects currently under development in South Dakota. MBL Bioenergy is a joint venture partnership between UGI Energy Services, Sevana Bioenergy and a subsidiary of California Bioenergy, with the sole purpose of

developing RNG projects in South Dakota. The first set of projects will be built on three farms located north of Sioux Falls, and is expected to be completed in 2024.

“This project brings with it some further exciting developments. Dairy waste from the farms will be anaerobically digested and then piped to a central upgrading facility before it is delivered into the interstate natural gas system, near Dell Rapids. Through our wholly owned subsidiary, GHI Energy, we will be the exclusive marketer for MBL Bioenergy,” Shaun divulges.

This venture is a massive step forward in the direction of the company’s sustainability efforts. In 2020, UGI Corporation announced its commitment to invest at least one billion dollars in renewable energy through 2025. “We made our first large investment in RNG by acquiring GHI Energy, a Houston-based company that sources RNG from landfills and bio-digesters, and supplies it to vehicle fleets in California. Since 2020, we have entered into a number of strategic RNG partnerships in Idaho, Kentucky, New York, Ohio, Pennsylvania, and South Dakota,” says Shaun. These dairy farm, landfill, and food waste partnerships capture fugitive methane, which is the by-product of waste decomposition, and prevent it from being released into the atmosphere. UGI Energy Services is quickly becoming a leading RNG marketer in the US.

According to Shaun, the group’s green strategies are crucial to its overall success. “UGI Corporation has introduced a number of commitments in its annual ESG reports over the past several years to demonstrate its focus on progress towards key metrics. UGI Corporation has also committed to reducing Scope One emissions by 55 percent in the next three years, and decreasing its overall methane emissions by 92 percent by 2030. This will then be followed by a further 95 percent for 2040. Tying in with that, UGI Utilities has committed to replacing all cast iron pipelines by 2027, and all bare steel pipelines by 2041. The corporation also announced its commitment to invest at least one billion dollars in renewable energy by 2025.”

He also recognizes that none of these developments would be possible without the UGI team, who have shown exemplary dedication to maintaining the company’s prosperity. “UGI Energy Services started as a company of eight employees in 1995, and we are now a group of 400 strong. During this growth, I am particularly proud of how we have been able to maintain a small-company family atmosphere. I believe that UGI Energy Services’ diverse and dynamic environment attracts talented individuals who want to be part of a company that contributes significantly to the profitability of the larger corporation. We have created a culture in which individuals feel included, and are all working towards the same goals,” he expresses.

He then brings the conversation to a close by turning his thoughts towards the future. “Looking ahead, UGI Energy Services will continue to make smart investments and follow through on its ESG commitments by investing at least one billion dollars in renewable energy by 2025. Above all, I look forward to seeing us maintain our reliable and flexible services with our legacy retail and midstream businesses,” says Shaun.

From what we have learnt, UGI Energy Services will continue to be a leading energy supplier and marketer across the United States, while striving to be a pioneer in renewable energy supplies for the energy and gas industry. UGI Energy Services LLC

https://ugies.com/ ............................................ Services: Supply and marketing of natural gas

...with exciting plans for new developments, upgrades and refinery expansions on the agenda, the business can be viewed as a leading light for not just Pakistan but for the wider energy industry

Record-breaking performance

Chesapeake Utilities Corporation is gearing up for a new era of sustainable energy, with trials already underway to blend hydrogen and natural gas at its Eight Flags Combined Heat and Power (CHP) plant in Nassau County, Florida

The history of Chesapeake

Utilities Corporation (Chesapeake Utilities) stretches back to 1859, with the founding of the Dover Gas Light Company in Dover, Delaware. It was not until 1947 that the company was officially incorporated under its current name, a reflection of the company’s growing service territories. Today, Chesapeake Utilities delivers energy to over 300,000 customers in nine mid-Atlantic and Southeastern states. Still headquartered in Dover, the company remains focused on delivering essential energy services to meet customer demand as well as the needs of its communities.

Chesapeake Utilities’ foundational regulated natural gas transmission and gas and electric distribution utility operations represent approximately 80 percent of its total assets. Complementing its regulated businesses, the company operates several non-regulated businesses, including natural gas gathering and processing systems in Ohio, a CHP plant

in Florida, a mobile compressed natural gas transport business serving customers across many parts of the country, propane distribution to customers in eastern states from Florida to Pennsylvania, and an emerging renewable energy business.

“Over a long period, we’ve built a stable business that effectively manages risk, sticks to a time-tested strategy, and consistently produces attractive results,” insists Jeff Housholder, President and CEO at Chesapeake Utilities. “Our strategy dates back to 2004, when we formally adopted a fundamental and straightforward growth strategy that even today, continues to apply and serve our stakeholders well: to build on our solid foundation of growing regulated energy delivery businesses, and to invest in related non-regulated businesses that provide opportunities to produce returns greater than those of the regulated units.

“On the surface, that sounds fairly obvious,” Jeff continues. “However, executing that strategy requires the discipline to optimize growth in our regulated units, control costs, and walk away from deals or projects that don’t align with our strategy or financial targets. It’s not growth just to get bigger. It is managed growth, operating an intentionally designed portfolio of regulated and non-regulated businesses that are similar in function and frequently work together to provide creative customer solutions and opportunities for enhanced margins.”

It’s been a busy few years for Chesapeake Utilities. After navigating the challenging economic conditions imposed by Covid-19, the company has welcomed a number of significant developments across its businesses. In 2021, Aspire Energy completed Chesapeake Utilities’ first RNG pipeline project, while Eastern Shore Natural Gas Company and Chesapeake Utilities successfully expanded their natural gas service

to Somerset County, Maryland, displacing wood chips and fuel oil. In addition, Sharp Energy’s acquisition of propane assets in North and South Carolina expanded the company’s Eastern Seaboard service territory, during a year in which the company eclipsed an impressive $2 billion in total assets.

For Jeff, Chesapeake Utilities’ success is thanks in part to a track record of tackling adversity. “We have a long history of responding to natural disasters,” he points out. “When you operate utility systems in hurricane-prone Florida, planning and executing a recovery response is second nature. While managing a viral pandemic is different in many ways from managing a storm event, the fundamental principles of staying calm, focusing on keeping people safe, working the plan, communicating expansively, and finding solutions to whatever comes up, are much the same.

“Our company ended 2020 strong, and we reported yet another year of record performance,” Jeff goes on. “The challenges from 2020 continued into 2021, and we added a few hurricanes, energy price volatility, and the transition back to more typical customer billing practices. Despite that, we performed strongly and achieved record performance in 2021. It’s difficult for me to adequately express my pride and appreciation for the focus, dedication, and hard work exemplified by our team members. As a direct result of their efforts, we kept our workforce safe, and grew diluted earnings per share from continuing operations by 12.4 percent in 2021, the 15th year in a row that we reported record earnings performance.”

Chesapeake Utilities is continuing its growth into 2022. Earlier this year saw Sharp Energy’s acquisition of Davenport Energy’s Siler City propane division, expanding the company’s operating footprint further into North Carolina. This was preceded by Marlin Compression’s launch of a high capacity compressed natural gas (CNG) truck and tube trailer fueling station in Port Wentworth, Georgia, at the thriving Port of Savannah, in what is one of the largest public access CNG stations on the East Coast. In addition to CNG, the new fueling station will

offer a renewable natural gas (RNG) option to customers in the near future.

“We continue to find opportunities to grow our traditional natural gas, propane, and electric businesses, even as we look to increase our renewable energy portfolio,” Jeff reflects. “Our businesses continue to organically add new natural gas customers across our service territories at levels well above the national average. Annual residential customer growth for the second quarter of 2022 was 5.7 percent and 4.1 percent in Delmarva and Florida respectively, and the company’s Delmarva natural gas distribution operations surpassed 100,000 customers during the second quarter of 2022. While the housing and lending markets have shifted as of late, our home building partners see continued demand in the communities we serve. Our significant natural gas distribution investments reflect the strong customer interest in natural gas service in residential and nonresidential markets.”

One of Chesapeake Utilities’ most significant recent sustainability achievements came in February, when the company successfully blended hydrogen with natural gas to power its Eight Flags Energy CHP plant in Nassau County, Florida. Part of a test program intended to refine the operational practices and requirements for the safe transportation and injection of hydrogen into a distribution system, it follows the

...with exciting plans for new developments, upgrades and refinery expansions on the agenda, the business can be viewed as a leading light for not just Pakistan but for the wider energy industry

company’s strategic decision to actively support and expand the sustainability efforts of the communities it serves.

“Our company vision is to lead the way in delivering energy that contributes to a sustainable future,” Jeff says. “Included in that is an active engagement in environmental stewardship and the development of lower carbon energy sources. The results of the Eight Flags CHP hydrogen test program will help to develop hydrogen operating and safety processes, and serve as a model for industrial gas customer emission reductions.

“We see a number of opportunities to support customers of all types and sizes as they pursue lower carbon energy options,” he continues. “A number of large energy companies are engaged in research to determine the feasibility of system-wide distribution of hydrogen. We also see opportunities for more immediate deployment of hydrogen as an industrial fuel, as many industrial customers are looking to reduce carbon emissions, but prefer a high heat-producing fuel for their processes. Blending hydrogen with natural gas provides even lower carbon impacts without sacrificing the qualities that make natural gas a desired industrial fuel choice.”

The Eight Flags CHP plant is a statement of Chesapeake Utilities’ commitment both to sustainability and innovation. But it’s also a

reflection of the hard work and dedication of the company’s employees. “You need great people to build a great company,” Jeff emphasizes. “Chesapeake Utilities’ employee-centered culture is dedicated to equity, diversity, and inclusion, and attracts, develops, and retains highfunctioning team members who share the values that drive our business. We see the benefits of diverse ideas and solutions from employees who feel included in our strategy and decisionmaking, and we understand that investing in the development of our people encourages ingenuity and creative problem-solving.”

In 2019, the company identified several scenarios that projected significant change for the energy industry. Alongside an inevitable transition to more sustainable energy sources, it became evident that the company should expect to double in size within the next few years.

“We took a hard look at our existing organizational structure, employee skill sets, internal processes, and business technology,” Jeff confirms. “That internal review launched a business transformation process. We restructured our operating units, began a continuous improvement process, developed a multi-year technology upgrade plan, and launched an employee engagement initiative. Since then, we’ve been working to strengthen the level of engagement among all employees. This year, we plan to link our individual employee goal setting and performance review process to our mission, vision, and values. We’ve also instituted a change management process to ensure we communicate effectively, thoughtfully consider employee input, and continue to transform our business.”

Equipped with this strong, diverse, and engaged workforce, the future is bright for Chesapeake Utilities. The company continues to increase its operational efficiency, modernize its infrastructure, and invest in advanced technologies as it looks to position itself for the future. Through collaboration with industryleading organizations on the development and supply of lower-carbon energy sources, the company is providing ever more resource options to its customers.

“We make meaningful and valuable capital investments to ensure the safety, affordability, and reliability of our energy delivery systems for the benefit of our customers and the communities we serve,” Jeff reiterates. “In 2021, we established our capital investment guidance at $750 million–to–$1 billion for the five years ending in 2025. This reflects our confidence in the expansion of our existing core businesses to meet the significant demand for the energy services provided by our business units, and to reflect the increasing opportunities in the RNG market. We remain committed to growing our stable utility operations and investing in complementary businesses, including renewable natural gas and other energy delivery solutions that position the company for long-term sustainable success.” Chesapeake Utilities Corporation

www.chpk.com ............................................ Services: Natural gas transmission and electric distribution

...with exciting plans for new developments, upgrades and refinery expansions on the agenda, the business can be viewed as a leading light for not just Pakistan but for the wider energy industry

The right side of innovation

Through dedication and commitment to pioneering freight forwarding solutions and the help of its exemplary team, Pentagon Freight Services has grown to become a leader for the oil and gas industry

Pentagon Freight Services

(Pentagon) is successful because of its people. The business, which specializes in oil and gas freight forwarding, operates across the UK and 72 additional locations throughout the world. “We don’t have a physical product to sell,” begins Michael Stal, the company’s Managing Director UK. “This is why our staff provide quality customer service to our clients, and why we empower them to make real-time decisions by equipping them with the knowledge and training needed to be their best. When the chips are down, our staff know that they can depend on every single person in the office to pull together to find solutions to any situation that may occur,” he says.

Over the years, Pentagon, which kick-started in London during the early 70s, has become the largest privately-owned oil and gas freight forwarder in the world. Almost 50 years on, Pentagon now proudly boasts an expansive business that operates across six sites in the UK - four in England (Dartford, Newcastle, Immingham, and Great Yarmouth) and two in Scotland (Aberdeen and Glasgow). Globally, its infrastructure footprint extends to over 30 countries, and employs approximately 1100 people, with six main hubs in the UK, Norway, USA, Singapore, UAE, and Australia.

“Initially, we started to support the rapidly growing North Sea oil and gas industry, and then opened an additional facility in Aberdeen

to be closer to the drilling contractors and their operations,” Michael expresses. “Following that, our facilities in Houston and Singapore quickly grew as demand for expertise increased as well.”

The business has also made a number of acquisitions, which, through strategic partnerships, has allowed for further expansion in line with industry demands. “Our most recent acquisition being Carlbom Shipping in June 2022. Carlbom Shipping, as a leading shipping specialist agent, will provide Pentagon with the platform and expertise to offer a one-stop shop to our energy client base.”

Other acquisitions included Aquatran, a Norwegian and UK haulage company, which took place in 2017, and enabled the business to relaunch as Pentagon Transport, which now hosts a fleet of 250 trailers. The business then bought Rulewave Inc and Rulewave (UK) to further support its involvement in oil country tubular goods. “Then, during 2020, we entered a strategic alliance partnership with TLC, a Swissheadquartered provider of logistics services in west Africa and the Caribbean, which allowed us to close the remaining gaps in our network,” says Michael.

In terms of Pentagon’s services range, the company realized early on that customers wanted more than a business that simply moved equipment from point A to B. “We found that clients also needed data to identify cost saving opportunities within their supply chain; they needed advice on compliance, and support on everything logistics related. Subsequently, we now offer a range of value-added services, such as dangerous goods services and training courses, customs consultancy and other relevant development opportunities and audits to identify areas of improvement.

“Our experienced project team specializes in oversized equipment, which needs special handling. By regularly chartering vessels or aircraft to meet client-centric deadlines, our project personnel are able to travel the world to ensure that equipment is handled correctly, from start to finish,” he shares with us.

He adds that the company has also incorporated a few technology advancements to assist clients with their freight forwarding requirements. “Our Insight PO Management system was developed in-house and built specifically for our usual customer base. Typically, each vessel or oil rig has its own budget, so visibility on expenditure and inventory is vital. In addition to this, we have developed a vision group to look at how we can harness our skills and experience, and replicate our success in related industry verticals, such as mining, for example, where heavy material movements are common, or aerospace, where complex paperwork may apply and deadlines are critical.

“Our oil and gas expertise has also proven to be highly transferable to the offshore wind sector, where our existing subsea customers have already turned their focus to seabed wind farm requirements, and our knowledge and experience of handling this equipment has allowed us to continue providing first-class services to them,” he says.

In a more recent development, Michael has noticed that the focus for clients has been geared towards the environment, as efforts to decrease their carbon footprint have ramped up significantly. Fortunately, Pentagon already has the means to measure and report on each of its client’s emissions according to their mode of transport, and is currently reviewing options to We have a diverse renewable clientele already, from large multinational corporations, to a number of UK-based manufacturers and start-up businesses involved in wind, solar and hydrogen. We have also had positive discussions with a number of potential clients in wave and tidal energy projects globally

offer a carbon offsetting solution that supports their sustainability measures. “We have done this by staying ahead of industry trends and thinking outside of the box, which has allowed us to find a niche in a very large pool,” he says.

The business then applied the same level of innovation and agility to the challenges imposed by the pandemic. Michael highlights that during Covid-19, Pentagon learnt to pivot to market fluctuations. “Our operation was initially severely impacted by both reduced demand from clients, and by the limited availability of global transport services. The majority of our operation transitioned to remote working - similar to most businesses. Despite some initial challenges, our team managed to successfully navigate the necessary changes, while maintaining service levels to our clients through the use of our cloud-based IT infrastructure,” he elaborates.

Covid-19 has certainly changed the freight forwarding world. Michael divulges that prior to the pandemic, pricing was a key factor for customers in forwarder selection. Now, however, customers are moving away from a purely transactional model to a more collaborative approach, and the Pentagon team is seeing a demand for superior service levels and value-addition, with less emphasis on lowest pricing. “At Pentagon, we pride ourselves on delivering a high level of service to our clients, and with the change in client mindset, our own customer base is growing rapidly,” Michael expresses.

We then steer the discussion towards the topic of sustainability to highlight the ways in which Pentagon is contributing to the fight against climate change. A few of these measures involve strategic innovation to help steer their clients towards their net zero goals. “We have a diverse renewable clientele already, from large multinational corporations, to a number of UK-based manufacturers and start-up businesses involved in wind, solar and hydrogen. We have also had positive discussions with a number of potential clients in wave and tidal energy projects globally,” he says.

With much of Pentagon’s existing customers transitioning over the last decade, the business has been involved in the movement of goods for the renewable sector for a number of years. According to Michael, the engineering, construction and installation of these projects have a lot of similarities with oil and gas. “The same similarities exist for freight movements in both industries, and the result is that with our experience and skills, we are strongly positioned to support the energy transition.”

The business has taken this one step

further by appointing a Renewables Manager, signifying that Pentagon’s energy transition is now firmly under way. “This appointment and the acquisition of Carlbom Shipping, demonstrates our commitment to our diversification into the renewables space. This appointment allows us to have a focal point to drive and grow our renewables products.”

Considering all that Michael has shared with us, the future of Pentagon looks promising. He highlights that a continued focus on service for existing customers will be one of the key goals for the business moving forward. “Consistency is crucial to our long-term associations with our customers. This will involve increasing our footprint across our key hubs to allow the continued growth of the business. With the changing outsourcing trends, we will be engaging with clients to help navigate the difficult waters of compliance, inflation and a supply chain crunch.”

To conclude, Michael strongly believes that the relationship between forwarder and client has never been more important than it is right now. As a result, he highlights that on a longer-term scale, Pentagon will remain committed to offering the highest quality of forwarding services, which will also involve developing the next generation of the company’s logistics talent. “We are determined to develop our trainee program to promote the industry and make the business more attractive to young people who are looking to start their career with us. We are already seeing a steady flow of new talent entering our operation.

“We want to be seen as the preferred name in freight forwarders and shipping agents, as well as a workplace where our team has the opportunity to show their skillsets, and the freedom to deliver a top-class service,” he says. “As long as this remains our core purpose, I believe the company will remain successful for many more years.” Pentagon Freight Services

www.pentagonfreight.com ............................................ Services: Freight forwarders

...with exciting plans for new developments, upgrades and refinery expansions on the agenda, the business can be viewed as a leading light for not just Pakistan but for the wider energy industry

Delivering excellence

From humble beginnings, Technica has grown to become a reliable partner to organizations including National Grid Gas, and is celebrating a new consortium agreement with Yokogawa UK

Formed in 2003, Technica

Ltd (Technica) is the brainchild of three former apprentices, who were approached to support Excelerate Energy, a leader in integrated LNG solutions, in the construction of a gas-port in Teesside. Success in this first project led to the award, in 2008, of a second, again with Excelerate, and based in Kuwait. Meanwhile, Technica had busied itself with growing the business, establishing a strong revenue stream by executing electrical and instrumentation upgrades for gas distribution networks in the UK. International expansion followed, with projects as far afield as Pakistan, Puerto Rico, and Argentina.

Fast-forward to the present, and Technica has established itself as a multi-disciplinary engineering solutions provider supporting the UK and international energy, petrochemical, industrial automation, and control sectors. As Richard Law, Managing Director at Technica, says, the company is “different things to different clients,” a phrase that underlines its continued versatility.

“Our services can range from the production of conceptual designs, through to pure

GGP CONSULT

GGP Consult is a privately-owned consulting engineering company with offices in Hull and York. Established in 1994, GGP provide world-class expertise in all aspects of civil and structural engineering, architecture and project management. GGP Geo is part of GGP Consult, offering turnkey site investigations, providing professional, cost-effective works to meet our clients’ specific needs. The practice has established a reputation both in the UK, and around the world, for providing highly professional and dynamic services with strong emphasis on value engineering, producing innovative, cost-effective designs. GGP Consult have been working with Technica on a wide range of challenging projects around the world, over the last 12 years.

installation, maintenance services, and everything in between,” Richard explains. “The vast majority of our revenue comes from EPC type work, where we will deliver the whole project life cycle from survey, conceptual design, detailed design, build and assembly of the systems that have been designed, installation, and then commissioning. Our project management teams are very experienced in delivering complex schemes of work, including operating as the principal designer and-or principal contractor under the CDM regulations.”

YOKOGAWA UK LIMITED

Yokogawa UK Limited has signed a collaboration agreement with Technica Limited. The agreement will merge the expertise of Yokogawa UK and Technica to provide a comprehensive range of complementary products, solutions, and services for the industrial automation and control market. Yokogawa delivers advanced solutions in the areas of measurement, control, and information. The partnership with Technica has been established to take projects from the first principles of FEED through detailed design, construction, installation, commissioning, consultancy, right up to handover and project closeout, providing a complete turnkey solution. Both organizations have agreed to pursue the ISO44001 standard for collaborative business relationships within the first two years of the collaboration period

It’s been an unusual few years for Technica. Despite the challenges thrown up by Covid-19, the company has remained steady, thanks to a robust business continuity plan that stressed the importance of keeping plans simple, communicating clearly with its teams, and continuing to focus on clients. It’s thanks to this strategy that in June 2021, Technica was able to confirm its largest ever year in new project sales, to the value of £26 million.

The first of these, for National Grid Gas (NGG), will see Technica upgrade the control, protection, metering, fire and gas detection, SCADA, UPS, and Telemetry systems at Aberdeen Compressor Station. It follows a sitewide conceptual design, already conducted by Technica, throughout 2020 and early 2021.

“As the project has matured, we’ve performed detailed designs for electrical, control, software, instrumentation, mechanical, and civils,” Richard says. “We have then taken our own designs and managed tendering processes for some of these systems whilst building others ourselves. We are also managing specialist sub-contractors on site and will oversee commissioning later this year.”

If Aberdeen represents a large-scale project, Technica is also comfortable delivering innovation projects or lower value ‘packaged solutions’. As Richard notes: “Last year, we were engaged by a client who asked us to design a bespoke system which would fiscally meter, determine the calorific value of, odorize, and then manage the pressure of bio-methane being injected into the natural gas network. The project was delivered for a very well-known brewery in the middle of the pandemic, just as supply chains were starting to creak.”

A further project within the last two years saw Technica deliver the construction phase of a project to connect an independent electricity generator to the high-pressure gas transmission network, based on designs that Technica had delivered in 2019. It’s yet another indication of the company’s varied skillset.

“The scope of supply saw us manage all aspects of design and construction for civils, mechanical, structural, electrical, control, and instrumentation,” Richard tells us. “This was on a site which took gas at 85bar, lowered it in pressure to 10.5bar, performed custody transfer metering between the client

and National Grid, gas analysis, pre-heating using a bespoke energy efficient heat recovery system, pressure management, telemetry, and then allocation metering to one of two power generation plants.”

Technica’s work on the Aberdeen Compressor Station is now well into the construction phase, and continues to this day. But it’s not the only item on the company’s agenda. In April, Technica signed a collaboration agreement with Yokogawa UK, a leading provider of advanced solutions in the areas of measurement, control, and information. It’s a partnership that is set to add value for both companies’ current clients in midstream oil and gas, whilst facilitating growth into new industries and market sectors, as Richard is keen to divulge.

“NGG had launched the tendering process for places on their next strategic electrical, control and instrumentation framework to support them delivering their RIIO 2 work packages,” Richard notes. “This was split into four lots, with the first for major projects, similar in scale and complexity to the Aberdeen Compressor Station. Having delivered previous control system and fire and gas upgrades for NGG in the past, we saw a place on Lot 1 as a critical strategic objective but lacked the necessary turnover to qualify in our own right. Meanwhile, Yokogawa viewed Lot 1 as an

HUMBER BANK INSTRUMENTS

Humber Bank Instruments offers over 25 years of instrumentation experience and knowledge on COMAH sites. We pride ourselves on a safe and professional service, offering our expertise to a vast array of industries those including the chemical, petrochemical, power generation, steel, oil, gas and pharmaceutical sectors. Health, safety and the environment are key principles to Humber Bank Instruments, we endeavor to protect our staff through comprehensive training and education. We believe our extensive health and safety policies, procedures and experiences can help assure all work is capable of being carried out in a safe manor. At Humber Bank Instruments, we are a results-driven company that prioritizes safety, cost-effective solutions and exceeding client expectations. We are members of numerous contractor competency schemes, including Achilles, Concom and ISNetworld.

attractive prospect for themselves, but lacked our inherent experience.”

What started as a conversation quickly turned into formal discussions, and ultimately, the founding of a consortium agreement between the two parties. “We were successfully awarded a place on the Lot 1 framework, and are already delivering projects for NGG. We are also aiming to have the partnership accredited to ISO44001,” Richard says. With discussions about future collaborations already underway, he adds: “The beauty of the relationship is such that we can act as the consortium when we feel it has benefits, or continue to operate independently when required.”

According to Richard, one of the driving forces behind the track record of successful project delivery, is its people. “I class myself as being privileged to work alongside and lead some of the brightest talent in the sector,” he insists. “There’s a great team spirit, and a desire to develop both together and as individuals through experience and professional training.” It’s a team that’s set to grow, too: with a view to bolstering its capacity yet further, Technica is embarking upon a significant recruitment drive.

“Many of our people have been with us for a long time, in some instances since the very start of Technica,” Richard confirms. “As we grow, we have taken care to ensure that the people who join the business demonstrate the values that we hold dear, whilst also allowing new starters to show their individuality and offer their own suggestions for how we operate as a business.

“The types of projects we support are diverse, and therefore many of the roles will be varied depending on our clients’ needs,” he continues. “Regardless, the company offers fantastic salaries, and a truly dynamic employment policy which weds together the benefits of both working from home and the office, alongside flexible working hours. Where possible, this allows our employees the freedom to work on routines that are beneficial to both them and the needs of the company. At the end of the day, we want our employees to succeed in their role – because if they’re successful, the business thrives.”

With so many projects on the go, it’s been a whirlwind financial year for Technica. Nevertheless, as Richard is keen to stress, there’s no room for complacency. “I’m not so arrogant to think that everything has gone perfectly during our transition from a £5 million business to where we are now,” he comments. “This growth placed a strain on many of our systems and procedures. We need to look at every

Below, left: Richard Law, Chair and Managing Director of Technica and right: Owner and Chairman John Davidson

aspect of our operations now to see where the cracks have started to appear, or where things are not working efficiently, and then fine tune everything so we can continue to run at this pace.

“Our recent external auditors were astounded by the quality of our audit scores, which were delivered against such rapid growth,” he continues. “This is testament to our employees and their dedication.”

Technica is now targeting yet another large multi-million contract win at the end of the financial year, although Richard is conscious of the need to focus on “the things we can control.”

“In 2019, we could not have predicted the scale of the Covid-19 outbreak or the impact this would have,” he reflects. “Likewise, the ongoing crisis in Ukraine is very unpredictable and highlights just the fragility of our current situation.

“I would like us to continue to support our client base with larger scale projects similar to those we won in 2021 and are delivering today,” he concludes. “Alongside this, we are looking to play a greater part in the shift to hydrogen and other green energy, and we are ideally placed to support the initiatives to decarbonize the

QUANTUM GROUP

Quantum routinely helps Technica ensure it has effective contractual frameworks, which positively develops client relationships and manages supply chain. We are pleased to have supported Technica for the last decade, and wish them continued growth and success. For 20 years, Quantum has provided commercial services to power, steel, oil and gas infrastructure industrial contractors. Quantum’s team of UK qualified cost engineers (RICS) also have legal training and experience. With Quantum in your team, you are equipped to plan, strategize, and deploy effective cost management and project controls. Humber region, which are taking place right on our doorstep. We pride ourselves on building excellent relationships and continue to seek new partners to work alongside as clients, and new supply chain partners to strengthen our ability to deliver success.” Technica

www.technicaltd.com ......................................... Services: Engineering solutions

Fuels for the future

From residual wood waste to carbon negative renewable diesel, Strategic Biofuels details the pioneering process it’s using to singlehandedly shake up the fuel industry

By developing a series of

carbon negative and clean-burning renewable transportation fuels from responsibly managed and sustainable forest waste, Strategic Biofuels has undoubtedly become the leader of its industry niche. The company was founded in the summer of 2020, making it a decidedly positive pandemic progeny, and has since brought together an expert team of highly experienced individuals with petrochemical, synthetic fuels, renewable fuels, and oil and gas backgrounds.

Though the pandemic proved to be an impediment to many companies, Strategic Biofuels is an impressive exception. The company continues to offer value to the environment and the communities where it works, reducing greenhouse gas emissions by 400 percent (compared to fuel production from fossil fuel-derived sources). Such a

staggering figure is attainable by doing two things: firstly, producing deeply negative carbon footprint drop-in fuels from nonfood-based biomass materials so that the fuel can be used at 100 percent (unlike biodiesel); secondly, utilizing carbon capture and sequestration technology to dramatically reduce CO2 emissions by safely and securely storing the greenhouse gas deep underground.

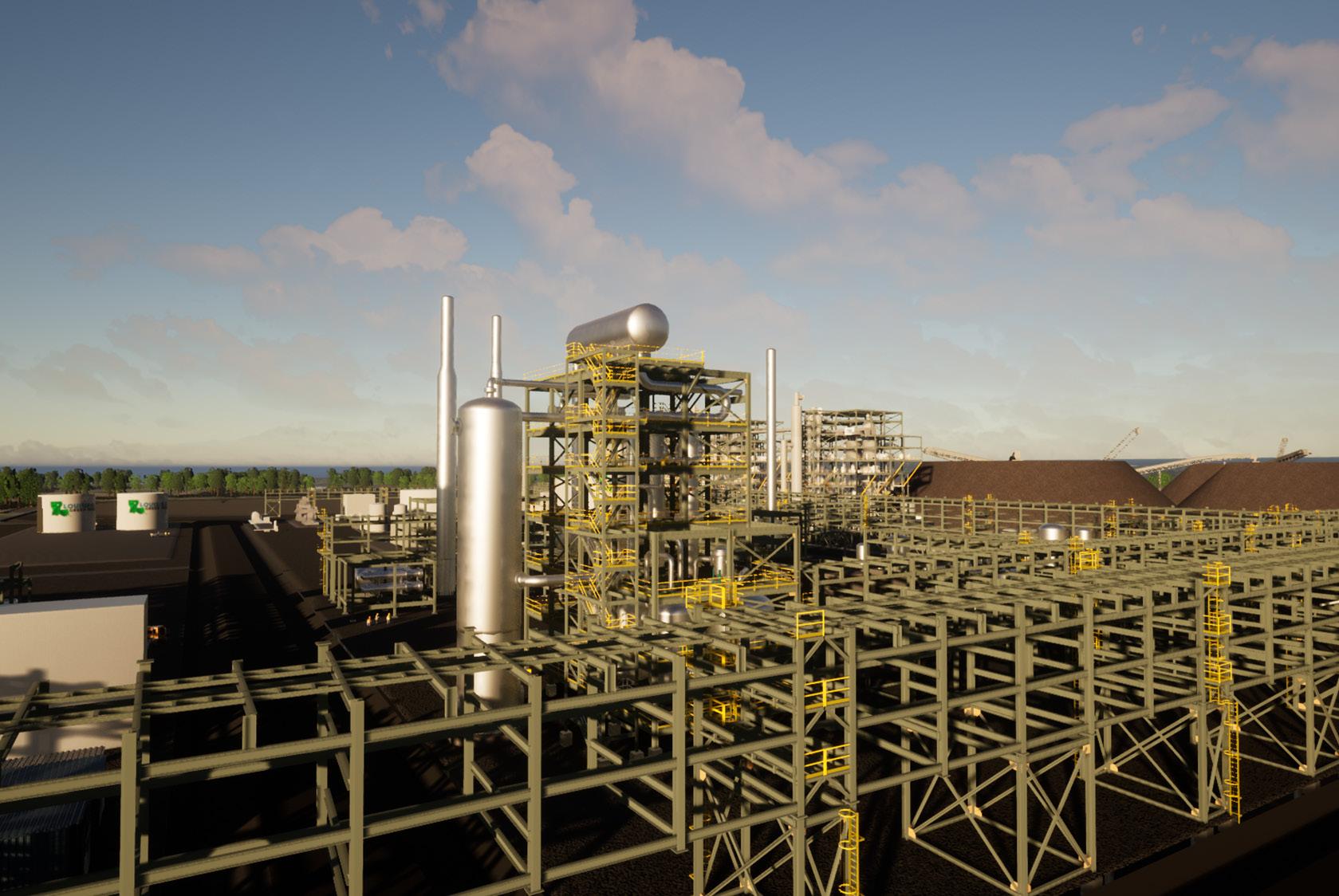

These two processes also represent the fundamental tenets underpinning the new Louisiana Green Fuels Project (LGF), which is currently being constructed on a 300-acre site at the Port of Columbia in Caldwell Parish, Louisiana. By following these two core processes, as well as a host of other pioneering methods, the plant will achieve better than Net Zero emissions and remove more carbon from the environment than it produces. Proudly talking us through the landmark project, and the ground-breaking processes behind it, is Dr. Paul F. Schubert, CEO at Strategic Biofuels.

“In total, LGF will produce approximately 33 million gallons of renewable fuel each year,” he begins. “When broken down, that equates to about 87 percent renewable diesel and 13 percent renewable naphtha. This fuel will have the lowest carbon footprint of any liquid fuel; it represents almost a 400 percent reduction in greenhouse gas emissions when compared to its fossil fuel-production

equivalents. Indeed, while the carbon intensity of our fuel has been scored by Life Cycle Associates at -294 gCO2e/MJ, fossil diesel is usually scored much higher, at around +100 gCO2e/MJ. In simpler terms, the carbon intensity of the renewable diesel we produce is extremely negative. In fact, it’s the lowest carbon intensity fuel in the world.”

Strategic Biofuels has secured more than $42 million in funding for LGF thus far, including a $15 million infrastructure improvement grant from the State of Louisiana to the Port, and will generate a total of 85.5 MW of biopower when fully operational. All of the power that LGF needs will be produced on-site through the conversion of a sawmill feedstock, which is garnered from waste generated by the lumber industry. This power will not only produce renewable fuels. It will also provide the amount of energy needed for carbon capture and the compression of the CO2 for sequestration.

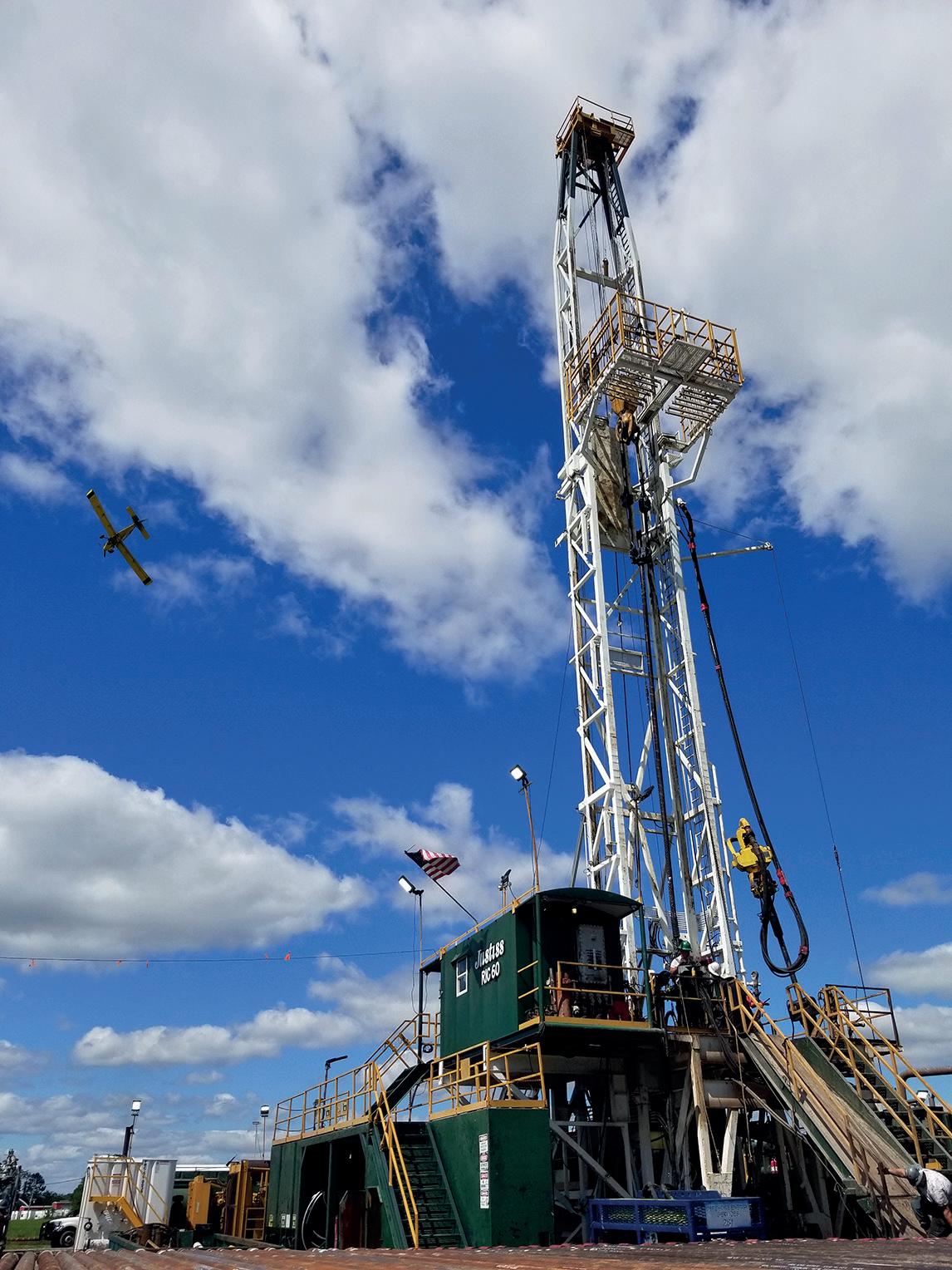

As Paul explains, carbon capture and sequestration are critical carbon mitigation methods, which, in turn, will be responsible for helping LGF achieve Net Zero status. “Strategic Biofuels has selected Louisiana as the location for its landmark project for several reasons, with one of them being the fact that Louisiana has the necessary geology to facilitate sequestration: the process in which CO2 produced alongside the making of renewable diesel is locked about a mile underground, where the same forces that have held oil and gas beneath the earth’s surface for millions of years will trap the CO2 forever.

“The sequestration is the dominant element creating the negative carbon intensity of LGF’s fuel,” he adds. “Louisiana has a visionary legislative and regulatory framework that supports carbon sequestration. This includes defining that the surface owner holds the right to inject CO2 beneath their land under so called ‘pore rights.’ There is an eminent domain right for a sanctioned project to acquire those pore rights from individuals, meaning that no owners can block the project. Furthermore, after the project ceases CO2 injection and has validated that the lockedin greenhouse gas is secure, the state has created a fund to monitor and remediate the CO2 storage – those funds will come from the initial operating revenues of the facility. We expect to sequester roughly 1.4 million tonnes of CO2 per year.”

For Paul, the most important part of the project was completing the sequestration test well in the first half of 2021. The company recognized that the project’s economics all depended on this one test as it would demonstrate whether LFG’s geological foundations were, in fact, tenable. “The effort could’ve failed, and investors could’ve lost their money,” says Paul. “In our case, however, the sequestration test well was a complete success. The combination of our technology set and its use at scale is unprecedented. The technologies used in the plant are not new; they’re all well-established. However, it’s their new configuration, as applied at LGF, which makes them unique.

“We are using gasification and partial oxidation to produce syngas (CO plus hydrogen) from a solid, carbon containing feedstock,” he details. “This is followed by hydrocarbon synthesis via the Fischer-Tropsch process to make paraffinic wax and oil, which are then hydrocracked using standard refinery technologies. These technologies have been utilized at a commercial scale with coal (a much more difficult feedstock) since at least the 1950s. At LGF, though, we make the

process unique by combining carbon capture and sequestration techniques with a non-foodbased biomass feedstock.”

Since we’ve covered the former, let’s now turn to the latter: the non-food-based biomass at the metaphorical heart of the industrial process. By utilizing pre-commercial thinnings – that is, excess trees taken from sustainable forestry plantations, which have been removed to allow the natural maturation of more dominant trees – Strategic Biofuels has ensured that its fuel feedstock is sustainable on multiple fronts.

“First, it creates a new use for from forestry byproducts, improving economic returns in the timber industry,” explains Paul. “Second,

TOPSOE

Set the future in motion with today’s renewable fuels technologies

When it comes to decarbonizing heavy transport, every pathway matters. Topsoe’s extensive portfolio of licensed technologies let you produce green and blue fuels using a variety of processes, including renewable hydroprocessing, syngas production through Fischer-Tropsch or Methanol-to-Gasoline, electrolysis, and others. Enter a growing market with solutions for the world’s most challenging sectors, and collaborate with a one-stop provider of peerlessly engineered technologies, catalysts, and services. We’ll work with you from the initial feasibility study until your plant is producing on-spec products, and we’ll be there to support your business well into the future. It’s why we’re the ideal partner for pursuing the most innovative answers to the world’s greatest sustainability challenges. Contact your Topsoe representative today, and let’s talk about setting the future in motion.

since thinnings are non-food based and overly abundant, the feedstock doesn’t compete with food production and hence maintains food security. Unlike other crops, thinnings are produced all year. The amount of renewable fuel that can be produced per acre per year from thinnings is about 497 gallons, with a feedstock cost of about $0.53 per gallon of renewable fuel. Whereas, in contrast, soybeans yield about 53 gallons per acre per year, with a feedstock cost of about $6.00 per gallon. Soybeans also compete for the allocation of arable land which would otherwise be used for growing food.

“The ultimate result of this process is an extremely high-performance synthetic diesel,” he adds. “Just like synthetic motor oil is superior to traditional motor oil, our synthetic diesel is superior to traditional diesel: it has a much higher cetane (the measure for diesel like octane is for gasoline), creates lower engine emissions with essentially zero sulfur, and is both non-toxic and biodegradable. Biodiesel is severely limited in terms of the amount which can be blended into diesel fuel; conversely, our renewable diesel can be used in any concentration – including 100 percent. All this makes it truly sustainable.”

However, sustainability does not refer to solely environmental factors. In fact, sustainability is a broad, wide-ranging term that also involves social and economic issues. Let’s zero in on LGF’s contribution to these two aspects of sustainability. The renewable fuels facility is, for instance, being built in the seventh poorest Congressional District (LA-5) in the US. In that region, the average household income is $36,000 per year, compared to a national average of $97,026.

“The first phase of the plant will create about 900 full-time jobs,” observes Paul. “The direct employment of the plant, once operational, is expected to generate 150 full-time positions, with an average salary of $69,000. However, indirectly, more than 750 full-time jobs will be created. Indeed, over the plant’s 31-month build schedule, the number of construction jobs available will peak at 1500. Once plant expansions in Caldwell Parish are completed, we’re also expecting to create about 600 direct and nearly 3000 indirect jobs. Needless to say, our project in Caldwell Parish will have a highly positive economic impact on the region.” In fact, LGF has already received a Community Impact Award from Trade & Industry

Development Magazine as part of its 2022 CICI Awards.

“Our engineering partner, Hatch, has also started a STEM (science, technology, engineering, and math) program in Caldwell Parish schools,” he continues. “Hatch engineers will provide mentoring to local students for their robotics competitions. This provides an unprecedented opportunity for the students in this poor community. Exposure to Hatch’s program, which is being committed to by the company for at least three years, will create vital opportunities for international interactions.”

As Paul has made clear, the work being carried out in Caldwell Parish, Louisiana is not only groundbreaking – it’s truly sustainable, and in more ways than one. Over the next 10-to-12 years, Strategic Biofuels intends to grow, carrying out a three-phase expansion that will create new job opportunities and increase LGF’s production levels. Currently in phase one, the new plant is expected to make around 33 million gallons per year; however, Strategic Biofuels aims to incrementally increase its output, ultimately leading to its remarkable third phase, where a staggering 161 million gallons of renewable diesel will be produced each year. For LGF and its surrounding region, then, exciting and sustainable times are certainly ahead.

CONQUEST CONSULTING GROUP LP

Conquest Consulting Group (CCG) is a professional cost-estimating service, and cost-engineering consulting company, dedicated to serving the needs of process industry owners. CCG can prepare project cost estimates and risk analysis studies for owner companies. We also provide expert independent cost estimate review and validation services to our clients. We are proud to assist Strategic Biofuels, and their partners, in the review and validation of their project cost estimates to help maximize return on their capital investments. Strategic Biofuels’ commitment to renewable energy is an important step to a greener future. Strategic Biofuels

https://strategicbiofuels.com ......................................... Products: Renewable fuels

Beyond borders

With new technology and acquisitions driving business growth, Exolum is maintaining its status as an innovative bulk liquid solutions provider

A year ago, Energy, Oil &

Gas spoke with Spanish company, Exolum, about its 94 years in the energy industry. The company has become one of the world’s fastestgrowing bulk liquid solution providers, and it only continues to grow. When it started, back in 1927 as CAMPSA, the sector was largely staterun, but this began to change in 1992 when the market was liberalized. In 1997, the company was renamed CLH until last year, when it evolved into Exolum. As we learn from the business’s CEO Jorge Lanza, now Exolum is determined to push the boundaries of innovation to remain a key player in the energy sector.

With 39 terminals integrated across Spanish refineries and ports, the company has transformed into an impressive network, compared to its previous series of independent terminals. “We have a type of system that allows immediate product transfers between our different terminals. For example, a customer can bring in a shipment to Barcelona with an urgent need to lift their product in another location, and we can make that happen. Owing to how we operate, we can fulfil that demand as soon as possible,” Jorge shares.

In order to assist in its current growth trajectory, Exolum acquired Inter Terminals

in 2020. “The reasons for the acquisition are threefold. Firstly, it had a footprint that was similar to what we already had in the UK, so there were opportunities to synergize our operations and scale up in the UK. We can now provide a better service to our customers by merging the former CLH pipeline systems and Inter Terminals together with what we have today.

“Secondly, we wanted to expand our chemicals business, and these terminals provided that opportunity because they were already present in the industrial complexes across the UK and Germany. The expansion into chemicals is something that Inter Terminals is well-versed in.

“Finally, it provided us with better stability to tackle bigger opportunities that we could not before. Previously, we didn’t have the company size or the human capacity. The way I describe it at times is that we have moved from being four family offices to one bigger multi-country company that is able to do greater things, such as increasing our involvement in the energy transition, and we needed to have more ‘muscle’ to actually do that,” he explains.

When the company began, it had not yet mastered the art of handling chemical products. However, with this acquisition, Exolum can take on those capabilities and, in turn, open up more opportunities for growth. “We are now trying to expand our presence in the industrial complexes. Where we are, we are also looking to integrate ourselves within our customers’ supply chains to better help those that produce the products we store.”

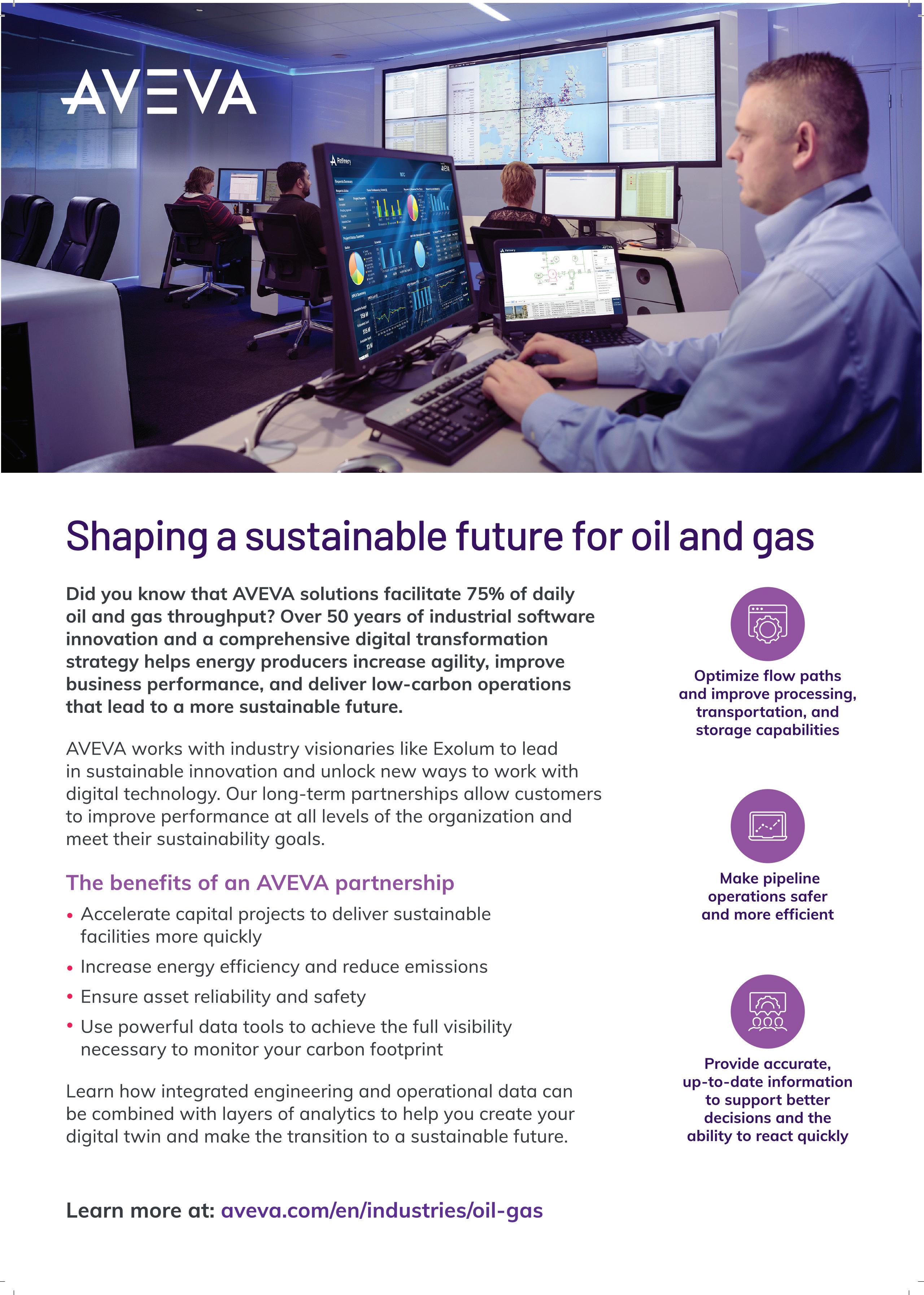

AVEVA

With more than 50 years of industrial software innovation, AVEVA supports 19 of the top 20 energy companies, over 300 refineries and 900K miles of pipeline to improve their businesses, enable agility and drive Net Zero operations through digital transformation. We are proud to work with industry visionaries like Exolum, Europe’s leading logistics company for liquid products and one of the largest in the world, to lead in sustainable innovation and unlock new ways to work with digital technology. By providing integrated engineering, operational, and carbon data with layers of analytics, Exolum can capitalize on digital twins with accurate up-to-date information to support better decisions, and get the ability to react quickly. With this long-term partnership, AVEVA helps Exolum to improve performance at all levels of the organization, increase energy efficiency, reduce emissions, and assure asset reliability and safety.

We then turn our attention to more practical developments taking place within the business, and Jorge shares that Exolum has made significant investments in automation to improve efficiency and the overall capability of its operation. “All our loading racks across our terminals, as well as the transfer between the tanks, are run from Madrid,” he says. “We initiated various digital automation projects over the years to make our plants run smoothly, and to ramp up our safety levels. For example, in our terminals, we have a proprietary technology that identifies when our trucks are loading, and there is a device that can read how much space is available on that truck, as well as the various compartments that can be utilized. The reason why we have incorporated this is to ensure that we do not overfill the vehicle – a common mistake, which can lead to spills.”