4 minute read

Auction Wrap.

As of June and heading into July, the Ray White Auckland Central Auctions have experienced a significant increase in buyer engagement and activity, indicating a positive trend in the real estate market. The average number of bidders per auction has shown a promising surge, rising from 1.9 from January to May to 2.6 in recent months.

One of the contributing factors to this boost in activity can be attributed to the encouraging figures observed in Open Home attendance. More potential buyers are showing interest in the properties on the market, resulting in a busier and more vibrant atmosphere at the Auction Rooms.

A notable development in the Auckland Central property market is the reduction in the number of apartments available for sale. The current inventory of apartments has dropped to the low 500s, representing a significant 30% decrease from the figures recorded 12 months ago. This scarcity of available apartments has resulted in heightened interest and competition among potential buyers, leading to strong activity in the properties available for sale.

Investors are capitalizing on the prevailing strength of the rental market, which is enticing them to venture into property acquisitions. The robust rental market has prompted investors to actively compete with first-home buyers and traders for the available properties in the Auckland Central area.

Overall, the market conditions in Auckland Central appear to be in favour of sellers due to increased buyer engagement, rising average bidder numbers, and decreased inventory levels. As we head further into the year, it will be crucial to monitor how these trends evolve and their impact on the property market dynamics. For now, buyers and investors alike are eagerly exploring opportunities in the thriving real estate landscape of Auckland Central.

Diana Clement: Inflation at 6%:

Should homeowners be celebrating or worrying about another rate rise?

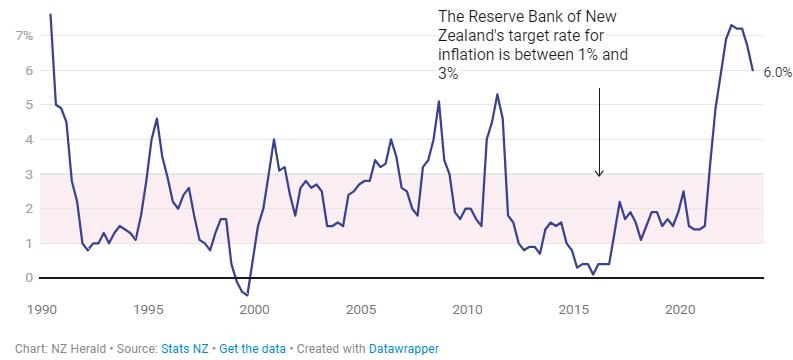

Inflation is falling, but it may be too early for homeowners to pop the champagne corks, according to economists and property experts. Consumer price index [CPI] inflation figures for April to June released yesterday show that annual inflation has fallen to 6%. That’s down from 7.3% at the peak last year. The 6% figure sits smack bang in between what the Reserve Bank of New Zealand (RBNZ) was expecting at 6.1% and the consensus among banks of 5.9%, Opes Partners economist Ed McKnight told OneRoof. It matters because the RBNZ influences mortgage interest rates by setting the official cash rate (OCR). It raises the OCR as a tool to reduce inflation by restricting people’s spending money. Look beneath the surface and it appeared

Inflation was tracking down further, McKnight said. It rose 2.2% in the September 2022 quarter, but was down to 1.1% in the most recent quarter. By the end of September this year, last year’s numbers will have dropped off, which could see the annual figure fall below 5% year-on-year, McKnight said.

He added that the CPI is one of several data points all heading in the right direction for a return to growth in house prices. “That is where that confidence starts to build up both for property investors, and for firsthome buyers as well.”

The most recent quarter’s fall in inflation wasn’t in itself going to have a huge impact on the property market, he said. Lower inflation would, however, give homeowners confidence that interest rates will fall eventually, and likely draw some buyers back into the market, he said.

CoreLogic chief economist Kelvin Davidson told OneRoof he didn’t believe the Reserve Bank would be swayed either way by the latest inflation data when it next reviews the OCR on August 16. The OCR was kept on hold at 5.5% last week and most bank economists bar the ANZ expect it has peaked.

“In the housing market, it does look like the turning point’s here,” Davidson said. “But just because mortgage rates have peaked, it doesn’t necessarily mean rates are suddenly going to fall and house prices are suddenly going to rise. We’re not going to see the OCR come down for nine or 12 months. The [Reserve Bank’s] inflation target is 1-3%, and it’s going to be a while till we get back to that target. So mortgage rates are going to be higher for longer.”

Davidson said although there may not be more house price falls, it was unlikely there will be a rapid bounce back either.

Westpac senior economist Satish Ranchhod said in his reaction to the CPI number that while inflation was lower, simmering underlying price pressures mean that it was unlikely to return to within the Reserve

Bank’s target range of 1-3% any time soon. What’s more, the fall in CPI was largely down to a drop in fuel prices of 15% yearon-year. Other prices weren’t coming down as fast as the Reserve Bank would want.

Chris Farhi, head of insights, data and consulting at Bayleys, told OneRoof it was good that CPI inflation is tracking down because that will translate into less need for the Reserve Bank to raise the OCR and/ or banks to raise mortgage interest rates. “It’s not amazing news if you’re hoping for interest rates to go down. It is great news, if you are concerned about them going up,” he said.

Farhi added: “A year ago there was real concern that we didn’t have clarity on interest rates and that they were going to go wildly out of control. Now we’re getting a sense that things are starting to get back in order. Although the annual [inflation] rate is 6%, if you look at the quarterly statistic it’s 1.1%. Multiply that by four quarters, and that shows that we’re probably going to see the annual rate track down further, which is good.”

At the same time, said Farhi, there was evidence that the housing market is starting to get to a point of stabilising and potentially recovering from later this year.