5 minute read

Huge milestone as Boresha DT Sacco asset base hits sh10billion

Established back in 1976 with 10 members, 46 years later, the society has grown to over 75,000 membership currently with sh10 billion-worth asset base.

By Joseph Kangogo

Advertisement

Huge milestone as fast growing Boresha Deposit Taking(DT) Savings and Credit Cooperative Society(Sacco) asset base hits sh10billion.

Chief Executive Officer (CEO) Jacob Mengich says Sacco's total assets grew to sh9.903 billion in the year 2022 up from sh8.954 billion in 2021, an increase of 11 percent.

"As we clinch to an upward trajectory, our Sacco targets to grow its asset base to sh13 billion by 2025" Mengich said.

He was speaking during the 32nd Annual Delegate Meeting (ADM) held at the Sacco’s headquarters, EldamaRavine plaza on April 1st 2023.

Kenya's Cabinet Secretary(CS) for Cooperatives and Micro and Small Enterprises (MSMEs) Development

Simon Chelugui who was the Chief guest, lauded members for patronizing the Sacco’s products and services.

He further challenged members to ensure they repay their loans on time so as to sustain the Sacco’s operations.

"You are called members and not customers that is why you should borrow and repay your loans because you are part and parcel of the society's growth" Chelugui said.

He took to the podium to thank the Sacco’s management for serving its membership with due diligence and true to his sentiments, he joined the Sacco as a new member.

He pointed out saying the sacco born in 1976 by 10 teachers now boasts asset base of sh10 billion and listed among few tier billionaire National clubs under Sacco’s Society Regulatory Authority (SASRA).

He termed Boresha’s upward growth a true reflection of President Dr. William Ruto’s Bottom-Up economic Model and promised to work closely with the saccco to realize it's enormous financial dreams.

Chelugui also noted Boresha

Sacco's two employees joined Hustler’s Fund Technical committee to work on Micro Loans program which will be rolled out soon.

The much anticipated Micro loan will be channeled out by Saccos via Mobile phone and will range between Sh10, 000 and Sh200, 000 at 7 percent interest rate.

Through his docket, Chelugui promised to ensure Sacco Deposit Guarantee fund bill sails through, its mandate is to safeguard members’ savings.

“The shilling at Boresha sacco is as a safe as the shilling at cooperative bank, in the event members will not have to worry”, he noted.

He also promised to ensure

Sacco-Central becomes a reality to enable Saccos borrow from each other whenever the need arise to address issues of liquidity just like banks do.

In attendance also were SASRA CEO Peter Njuguna, Boresha Sacco Chairman Albert Chebiegon and Vice Chairman Kipruto Kiptoo.

Sacco CEO Mengich further said the society’s total revenue increased from KSh1.309 billion in 2021 to Ksh1.423 billion in 2022, an increase of 8.5 percent.

He urged the shareholders to continue patronizing sacco products to increase revenue returns.

Also said society’s Share Capital grew from sh514.5 million the previous fiscal year 2021 to current sh575.6 million, an increase of 12 percent.

Mengich said each member is required to contribute at least sh200 towards individual share capital to grow their returns.

"Currently salaried member minimum share capital is 30,000 whereas for non-salaried members is sh3, 000" he said.

The CEO noted Equity shares increased from 265.2 million in 2021 to 274.2 million in 2022, an increment of 3 percent.

“The society’s strength is based on contribution of share capital and equity shares by members. Members also enjoy high return on share capital,” he said.

He said members can increase their share capital through check off, cash deposits, standing order, capitalization of dividends or through part of loan approved.

The year under review member savings and deposits rose from sh6.206 billion in 2021 to sh6.890 billion in 2022, an increase of 11 percent.

Each Boresha Sacco member is required to make at least sh2, 500 minimum monthly contributions or 10 percent basic salary.

Gross loan and advances portfolio increased from Sh7.098 billion in 2021 to Ksh8.040 billion in 2022 an increase of 1 billion reflecting 14 percent growth.

The Society active membership as at 31st December 2022 stood at 75,389 up from 71,088 in 2021.

Chairman Chebiegon noted that Sacco is not only ranked among the top performing Sacco in terms of asset base but also as best managed society in the country.

“The Sacco has grown over time due to unwavering patronage and confidence by members, loyal delegates, sterling stewardship by board of Directors and committed staff”, he noted.

Chebiegon reiterated that the

Sacco has fully adopted the Bottomup economic Model an initiative by the government to empower the members and the community at large.

Technology

According to CEO Mengich the Sacco focuses on improving efficiency by leveraging in technology to serve the members better.

“This leads to seamless processes and ensures efficiency and effective service delivery to members. More services will be pushed to mobile platforms,” he said.

Currently members are able to access salary and Dividends Advance through M-Boresha, members’ statement and dividends report is available on the member’s self-service portal (x-mobi).

“All these steps are going digital and we remain steadfast in innovating ways to even serve members effectively and efficiently,” Mengich said.

At the same time he noted rampant cases of cybercrime and online fraudsters and cautioned their members so as not to fall victims.

“As we embrace technology we also alert our members of technological challenges like cybercrime and fraudsters" he said.

The CEO further requested retirees to remain loyal to the Sacco since it has got products tailored to suit their financial needs despite stoppage of their regular salary pay.

“The rate at which older people exit service due to retirement is high. We however encourage them not to withdraw from the Sacco upon retirements since the Society’s membership policy allows retirees to enjoy products and services even after retirement,” he noted.

Member Satisfaction

According to Mengich Micro Credit Activity has now been revamped in response to the market needs and dynamics.

“New market driven products and refining existing products has been developed to increase member satisfaction, attraction and retention” he said.

So far the fast growing Boresha Sacco currently has 18 branches spread across Baringo, Uasin-Gishu, Nakuru, Nandi, Laikipia, Elgeyo-Marakwet and Trans-Nzoia counties. Plans of opening a new branch in Nairobi as enshrined in the Sacco's Strategic Plan are ongoing.

It was formerly known as Baringo Teachers Sacco with its original membership being teachers before it was rebranded in March 2012 into Boresha sacco to accommodate salaried and non-salaried members from across all sectors.

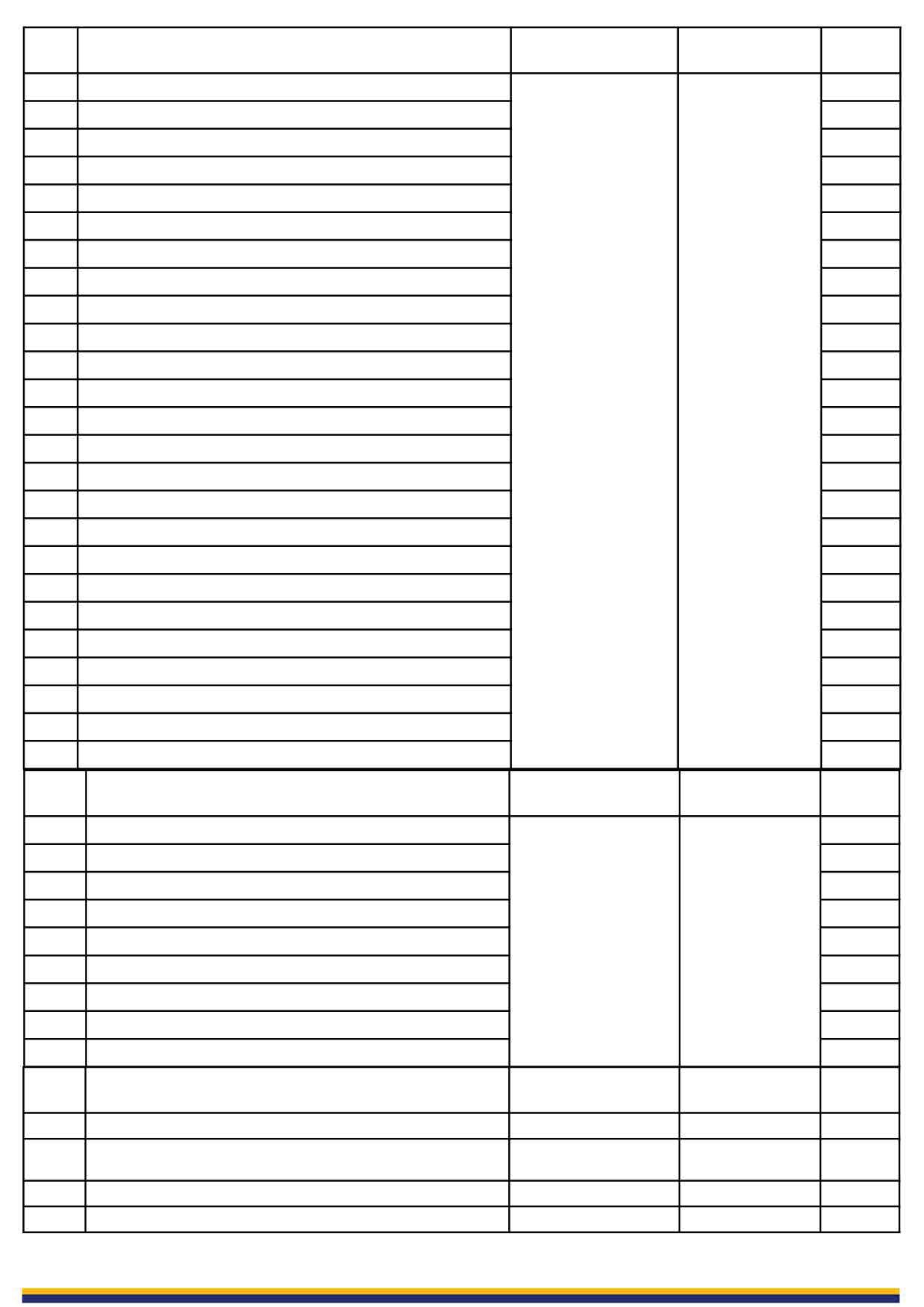

MINISTRY OF EDUCATION

STATE DEPARTMENT OF VOCATIONAL AND TECHNICAL TRAINING

E M I N I N G TECHNICAL T R A I N I N G INSTITUTE

Email: eminingtti@gmail.com WEBSITE: www.eminingtti.ac.ke

P.O BOX 208-20105, MOGOTIO, Tel: 0796098672

HIGHER DIPLOMA COURSES

Higher Diploma in Building and Civil Engineering

Higher Diploma in Electrical Power

Higher Diploma in Mechanical Engineering

Higher Diploma in Human Resource Management

Higher Diploma in Entrepreneurship Management

DIPLOMA COURSES

Diploma in Building Technology

Diploma in Civil Engineering

Diploma in Architecture

Diploma in Quantity Surveying

Diploma in Road Construction

Diploma in Water and Sanitation Engineering

Diploma in Land Survey

Diploma in Electrical Engineering (Power Option)

Diploma in Electrical Engineering (Telecommunication Option)

Diploma in Information Communication Technology

Diploma in Automotive Engineering

Diploma in Mechanical Engineering (Production Option)

Diploma in Welding & Fabrication

Diploma in Mechanical Plant

Diploma in Catering & Accommodation

Diploma in Fashion Design & Garment Making

Diploma in Food & Beverage

Diploma in Petroleum Geoscience

Diploma in Chemical Engineering

Diploma in Applied Biology

Diploma in Food Science & Technology

Diploma in Analytical Chemistry

Diploma in Housekeeping & Accommodation

Diploma in Baking Technology

Diploma in Human Resource Management

Diploma in Supply Chain Management

Diploma in Accountancy

Diploma in Co-operative Management

Diploma in Social Work and Community Development

Diploma in Business Management

Diploma in Agricultural Engineering

Diploma in General Agriculture

Diploma in Information Science/Library Science

ENTRY REQUIREMENTS

Diploma or Degree in Relevant Course

ENTRY REQUIREMENTS

18 Months

KCSE Cand Above

3 Modules

1 Year per Module

Other Courses

DRIVING CLASSES A2, A3, B Light, B Auto, B Professional, Cl, C2, D & G

Electrical, Solar

Baking Technology, Masonry, Arcwelding, Carpentry)

GRADE II (Plumbing, Masonry, Hairdressing, Electrical) to the Principal, Emining Technical Training Institute, P.O Box 208-20105, Mogotio. Tel:

Email: eminingtti@gmail.com Website: www.eminingtti.ac.ke Attach copies of ID and Certificates