7 minute read

Publisher's Column

from BOOM! May 2020

The mission of BOOM! is to serve the folks of the River Region age 50 plus with information and ideas to inspire new experiences, better quality of life and new beginnings.

Publisher/Editor

Jim Watson, 334.324.3472

jim@riverregionboom.com

Contributing Writers

Jeff Barganier

Tracy Bhalla

Greg Budell

Dean Fowler Lee Henderson Caitlin Kelly Susie Mattox Susan Moore Cheryl Popp Leigh Anne Richards Raley L. Wiggins

Cover Photography Total Image Portraits

www.totalimage.com

Advertising Jim Watson, 334.324.3472

jim@riverregionboom.com

Please Recycle This Magazine, Share with a Friend!

Facebook.com/RiverRegionBoom

Are you moving around in the River Region yet? Let me be one of the first to say Welcome Back! Welcome back to reality. I’m an optimist and I believe the more we reengage the more we’ll realize the fear we’ve been prescribed by leaders and news media during the past 60 days was unnecessary and unfortunate for the harm it has caused to many lives and livelihoods.

Jim Watson, Publisher jim@riverregionboom.com

The quicker we can find what’s been lost during this bizarre turn of events, the healthier we will become again. The momentum for opening our communities back up is growing daily, you can feel it. The desire to go and do is becoming contagious, mask or not.

If you’re still feeling the fear of COVID-19, be safe and smart about your behavior. But if you can, get outside and breathe. Go to your favorite retailer and shop. Grab a cup of coffee with friends. Find someone to laugh with and to share your story, your faith. The antidote for COVID-19 is people. Find them and engage, simply love your neighbor the best way you can, and we’ll all get well soon.

We have a great cover profile this month who published her first novel last fall, her name is Susie Mattox. Susie has been writing since the fifth grade but only in the last few years has she developed the courage and fortitude to finally publish her first novel called Fairly Strange, which you can purchase on www.amazon.com. Susie shares some of her story with us in this month’s Q & A, including her writing journey, family and inspiration. I’m always inspired by people who accomplish things as they age because there’s not a better time to start a new dream then now, Susie is that person. I hope you enjoy getting to know her, I sure did.

Also, this month we have Jeff Barganier fighting off the COVID-19 by heading up to Cheaha State Park with his bike, Special. As always, Jeff will make you laugh because his travel experiences are like no other, enjoy his journey! My friend Greg Budell shares a “Hallmark Moment” about his late mom and a TV celebrity and a doctor who shared the memory years later, Greg knows how to touch our hearts. Leigh Anne Richards shares how to stay fit if quarantined and she has learned a few things about exercising during this shutdown. I love her attitude! I hope you’ll read Susan Moore’s new column and get to know her; she is helping us all learn about our money and what to do with it. If you want to get smarter with your investments, Susan will guide you. If you’ve ever thought about cleaning concrete, brick etc. we have a special discount for our readers from Water Worx LLC. Perfect time of year for power washing, especially with a discount!

There are plenty more good reads this month and if you haven’t started receiving the digital version this is a great month to begin. Please subscribe yourself or others at www.riverregionboom.com , IT’s FREE! Please consider all of our advertisers when you have needs, they’re all on the right side of positive aging and would love to do business with each of you. Please share your thoughts on this issue or any other ideas regarding BOOM! I love to listen. Welcome Back!

Jim

The Classic Equity and Bond 60/40 portfolio has provided significant returns since the early 1980’s. However, if one examines the economic and market cycles of the last 100 years, there were substantial periods when such a portfolio would have not delivered the returns that today’s investors expect and may need. Is it possible that the coronavirus will prove to be the shock to the system that prompts a return to the long-term cycles?

Two important investment white papers were published this year that explore the risks to the conventional Equity and Bond 60/40 portfolio going forward. One is The Allegory of the Hawk and the Serpent¹ by Chris Cole of Artemis Capital. Cole explores the cycles of long-term or secular growth and secular change that the United States markets have experienced in the last 100 years. He points out that in the periods of secular growth of 1947-1963 and 1984- 2007, the conventional 60/40 portfolio performed very well. However, in the periods of secular change of 1929-1946 and 1964-1983, the conventional portfolio would have experienced significant periods of loss and underperformance.

The white paper was published in January before the coronavirus was apparent. In April, Cole did a podcast with Erik Townsend of macrovoices.com, commenting on how the virus impacted his thesis.² He said, “We have certainly come a long way in the longest bull market in American history. And that had been driven on cheap money and leverage. And now we face this catalyst that is likely to challenge our ability to continue that level of prosperity without some sort of severe recession or depression.”

There is a reasonable probability that the coronavirus speeds up transitions that could transform the U.S. economy while providing significant dislocations. The Great Depression saw a huge shift from the American labor force working in agriculture to working in factories, resulting in a painful transition that took years. Today, many jobs in retail and restaurants could be permanently eliminated as consumers shift more buying to online and take-out. Factories may shift their operations to

Financial Thoughts with Susan Moore

By Susan Clayton Moore, J.D.

Principal of Moore Wealth Management, Inc.

using more robots; drones may deliver more packages. College students may shift to an on-line experience that is less expensive with the same university. As in the Great Depression, America may emerge from this looking different but stronger. However, transitional periods like this have happened before and often proved difficult for the conventional 60/40 portfolio.

James Montier of GMO in March, Dare to be Different published the other white paper referenced above.³ He states his opinions bluntly, saying in the executive summary, “The conventional 60/40 portfolio of today is not going to generate the kind of returns that investors say they need. Investors must seek to embrace the terrifying concept of being different. As the ghosts of many great investors past have amply demonstrated, being different is the path to investment success. However, such advice falls into the simple but not easy category to borrow Warren Buffett’s expression.”

It’s possible that the U.S. will no longer experience the cycles of growth and secular change that it has experienced in the past and that starting in the 1980’s, things changed forever. However, it is also possible that we are at a critical turning point as has happened in the past that would have rewarded investors who reconsidered their asset allocation strategies in light of seminal events at the time. Is now such a time to step back and reassess your risk tolerance and the current risk level of your portfolio and its ability going forward to achieve your objectives in the time frame that you need? Is now a time to dare to be different? Perhaps it is worth considering.

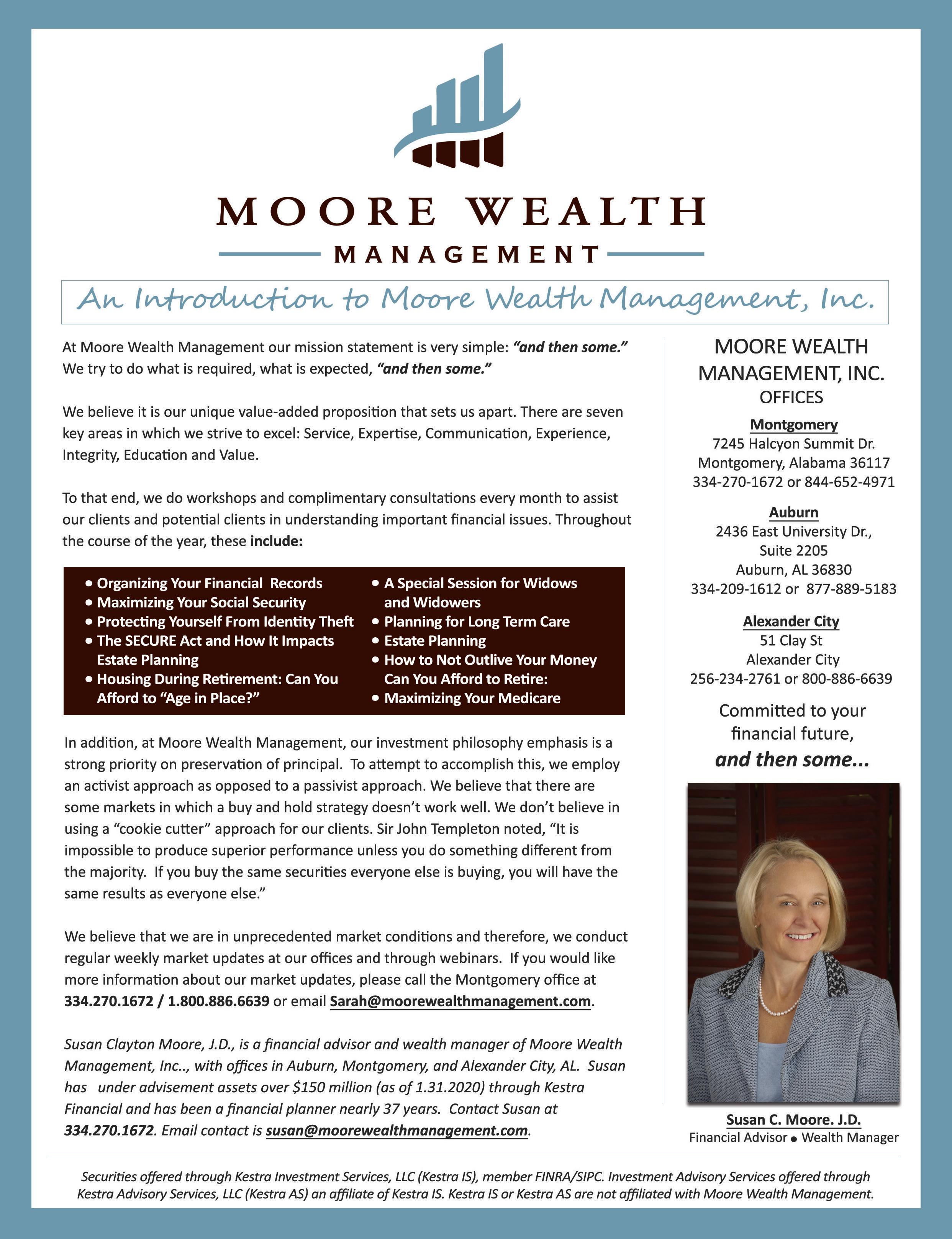

Susan Clayton Moore, J.D., is a financial advisor and wealth manager with Moore Wealth Management, Inc., which has offices in Montgomery, Alexander City and Auburn. Susan has over $150 million assets under advisement through Kestra Financial and has been a financial planner for over 37 years. She has been quoted in Kiplinger’s Magazine and Investment News. Susan earned her law degree from Tulane University in 1981.

Contact Susan at 334.270.1672 or by email, susan@moorewealthmanagement.com. We offer confidential consultations and second opinions about portfolios without cost or obligation.

In this time of coronavirus, Susan is conducting daily market updates by webinar.

During the daily market updates, Susan will discuss events that are impacting the markets, sharing her opinion and those of strategists she respects. There will be no specific investment recommendations as to any security or predictions of specific performance. She believes that we are in unprecedented times and that sharing information is a valuable resource to make it through the month ahead. If you would like to be included in the webinar, please contact Sarah at 256.234.2761 or sarah@ moorewealthmanagement.com.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Kestra IS or Kestra AS are not affiliated with Moore Wealth Management, Inc.

¹ www.artemiscm.com/ ² www.macrovoices.com/ ³ www.gmo.com/americas/research-library/

memo-to-the-investment-committee-dareto-be-different/?utm_medium=email&utm_ source=episerver-campaign&utm_ campaign=article-subscription-push&utm_ content=White-Paper&email=susan%40moorewe althmanagement.com&first_name=Susan&last_ name=Moore