8 minute read

The Financial and Emotional Costs of a Baby in the United States

from RISE No. 2

Garvita Thareja and Andrew Salter

What is parenting? We all know how to define parenting, but how it feels to be a parent can probably best be explained by a parent! As a young parent, I have faced many challenges while supporting a family with limited resources. The resources that my professors connected me to, through academia, helped me manage the cost of my baby and allowed us to thrive through my early parenting years with our given challenges Exploring and sharing these resources will not only help other parents in the community but will also highlight the issues that parents go through emotionally as well as financially to provide the best for their babies

Advertisement

Two years ago, at the young age of 19 years old, my wife (18) delivered our first child, a beautiful girl, born into the world of a novel pandemic and economic uncertainty. Throughout my wife’s pregnancy, we scrambled to figure out a plan a plan that would allow me to continue my education, set us up for success in the coming decades, and allow us to survive and support our newborn child After struggling for a few months while she was pregnant, I was able to find a position as a dental assistant, utilizing experience from my military job training. Simultaneously, I decided to advance my education and earn a degree in public health. So, I started attending university as a full-time student while working full-time and parenting full-time. To manage the cost of school and the rise in family expenses, I served in the Army Reserves and also became a teaching assistant with the help of my professor In the first semester of my senior year, my wife and I welcomed our second baby girl, a blessing and another important life to care for Yet, there have been numerous sacrifices in order to sustain a family and live independently The cost of having a baby from pregnancy to childbirth is estimated to be about $20,000 (Kaiser Family Foundation, 2022). Further, there is an additional cost of about $18,270 per year for providing a baby (Kaiser Family Foundation, 2022).Due to inflation in recent months, this cost has gone up by 9%. To manage our family’s income, I started

tracking budgets tightly with spreadsheets, calculating how many times we could eat out or go out in a month/week, how much gas we could use every week, and even planning on the foods we need to get from the store In order to stay afloat, money and expenses were monitored heavily. Our monthly expenses (Table 1.) include diapers, baby wipes, baby formula, toys, water, childcare, health insurance, doctors visit for the baby, adults' food, mortgage, car insurance, car payments, internet, phone bills, electricity, car fuel, college tuition, clothes, vehicle repairs and services, medicine, and car seats or other essential items

In early 2022, I was able to start a new position at a local hospital, working with WIC, gaining public health experience, and having access to a flexible schedule My education and mentorship from professors gave me access to resources such as increased income, health literacy, and overall knowledge of the economy, expenses, and society. This has helped me manage some of my expenses, be responsible in my spending, and exposed me to opportunities for success. However, thousands of other young families don’t have the same opportunities and resources. Failure to successfully access resources can be detrimental to physical and mental health outcomes, as well as long-term success There needs to be more help for young families

The impact of our current economic uncertainty

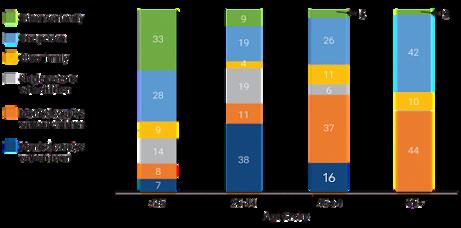

Our economy is on the brink of a crash, gas prices are higher than ever, living expenses have inflated, interest rates are at record highs, the prices of essential supplies like food are extreme, and childcare is unattainable for many The Population Bureau notes that households in the United States continue to shift towards multiplefamily and non-family living situations For example, in populations under the age of 25, only 7% of married couples with children live alone, 14% of single parents with children live alone, and 33% of the population live with nonfamily members (U.S. Census Bureau, 2017).

(Histogram depicting household makeups, US Census Bureau, 2017)

Data lacks in identifying whether multiple families are living together or not, however, the increasing amount of shared living situations suggest that multiple family living situations are more than likely to increase. This theory is easily supported by recent data suggesting that shared living among young adults has risen to levels not seen since the Great Depression (Fry et al, 2020) The average cost of rent for Colorado in 2021 was $1,437, and the average mortgage cost in Colorado was $1,927

Federal aid programs such as SNAP or food stamps have seen participation numbers increase from 20,487 households in 2020 to nearly 22,000 by the end of 2022 (USDA, 2023). Data suggests that the economic difficulties since the beginning of the pandemic have had a serious stress on families' ability to support themselves We know that socioeconomic factors can have a wide variety of impacts on overall health. The state of today's economy is exposing many families especially the young and those in underserved socioeconomic groups to negative health outcomes. These impacts include food insecurity, homelessness, lack of healthcare access, and altered lifestyles. Young families must address these obstacles in order to ensure success, health, and positive outcomes for their children.

(Graph shows rates of young adults living with parents, Fry et al. 2020)

The effect goes far beyond just being financially strained

It's equally as important to mention the emotional effects income can have on a family. According to an article published in the Journal of Emotion, high- and low- incomes can be correlated with different emotional feelings. The study analyzed 162 countries and found that families with higher incomes experience positive feelings such as pride, confidence, and determination (Tong et al, 2021) On the other hand, families with lower income experience negative feelings of sadness, fear, and shame (Tong et al, 2021) Additionally, these feelings are prolonged; a study of 4,000 Americans showed positive or negative feelings related to wealth were observed up to 10 years after the original study (Tong et al., 2021). We can be confident that families experiencing economic hardship are also experiencing negative emotional feelings, which contribute to their overall health and ability to self-advocate. These negative emotional feelings can cause chronic stress and depression, which can contribute to increased rates of Non-Communicable Diseases or NCD Not only are low-income families experiencing degraded health as a result of socioeconomic disparities, but their emotional health is also likely to contribute to poor physical outcomes, such as higher rates of NCD Studies by multiple organizations, including the Johns Hopkins School of Public Health, have found that lowincome individuals experience higher rates of stroke, heart attack, diabetes, and cancer (JHSPH, 2018). This research and data make addressing at-risk, low-income families even more critical, as it can have long-term health effects on members of the family.

Steps to improve outcomes

It's critical that families are given the resources and opportunities to ensure their financial success and, in turn, lower their risk of adverse health impacts Navigating what resources are available to families such as SNAP, TANF, WIC, Child Care assistance, Medicaid, and even educational assistance like FAFSA will be critical in allowing families to quickly address income-related needs. Case navigators specializing in young family success could be highly beneficial for new parents in a complicated world.

Additionally, educational attainment is the key to successful job placement, increased salary, and positive health outcomes Programs should be created to further enhance and provide opportunities for young parents to attend school and earn degrees, certifications, or licensure Creating more programs like the Care Forward Colorado program, which allotted 26 million in funding to provide free community college education to students in certain healthcare positions, can provide many positive economic impacts Families who receive aid in attaining an education and career will experience improved income for families and improved income for economies. In turn, this will also improve shortages in needed careers. Addressing the barriers for families to achieve higher education will improve health outcomes for all family members, support economic development within communities, allow children to grow up in positive environments, and promote mental health.

Assisting young families with case navigators and educational assistance will empower these populations to become successful, thriving, and healthy members of our community These measures will ensure a positive and enriching childhood for their children and positive generational outcomes in health and education. The short-term increase in spending on public programs will have positive long-term economic impacts with families' increased wages. More data and research are needed to assess young families' financial and living situations. Further analysis will increase awareness and emphasize the need for public health measures to promote improved outcomes in these populations.