17 minute read

Serving customers for almost 150 years

Zurich Insurance Group

Founded in Switzerland in 1872, we are one of the world’s most experienced global insurers

Providing a wide range of property and casualty, and life insurance products and services in more than 215 countries and territories

Strong investor proposition; resilient business model, clear strategy, and responsible and impactful business

Doing business in the U.S. since 1912

Approximately 55,000 experienced professionals worldwide

Approximately 9,000 employees in North America

North America contributed approximately $1.43 billion toward Zurich’s $4.2 billion in operating profit in 2020

Insurance a broad range of Middle Market customers as well as more than 95 percent of the Fortune 500

Providing multinational solutions in the U.S. for almost 50 years

Zurich North America is one of the largest providers of insurance solutions and services to businesses and individuals.

To learn more, visit www.zurichna.com

• Eligibility

• Employees enrolled in the company’s sponsored Major Medical Plan are eligible for Gap medical coverage. Employee’s dependents are also eligible for coverage.

• Eligibility waiting period

• Same as Major Medical Plan.

• Inpatient Expense Benefit – Benefits will be paid if a covered person is confined to a hospital as a direct result of an injury sustained in an accident or sickness. Benefits are limited to out-of-pocket expenses incurred by the covered person, including the deductible and coinsurance amounts the covered person is required to pay under the Major Medical Plan.

• Outpatient Expense Benefit – Benefits will be paid for outpatient treatment of an injury sustained in an accident or sickness. Benefits are limited to out-of-pocket expenses incurred by the covered person, including the deductible and coinsurance amounts the covered person is required to pay under the Major Medical Plan.

• Combined Inpatient and Outpatient Expense Benefit –Benefits will be paid if a covered person is confined to a hospital or receives outpatient treatment as a direct result of an injury sustained in an accident or sickness. Benefits are limited to out-of-pocket expenses incurred by the covered person, including the deductible and coinsurance amounts the covered person is required to pay under the Major Medical Plan. All benefits are subject to the Policy Deductible and the Supplemental Medical Coinsurance percentage for the Plan Year shown on the following pages:

• Policy Deductible – Benefits will be payable after the Covered Person has met the “Per Covered Person” Policy Deductible or after the “Per Family” Policy Deductible has been met, whichever occurs first.

• Supplemental Medical Co-insurance – The maximum percentage that will be paid under this Policy for covered expenses incurred by a covered person.

• Plan Year – A consecutive 12-month period during which a covered person’s coverage under the policy is in force.

General exclusions and limitations

This coverage does not cover any loss, treatment, or services resulting from any of the following:

1. Suicide or any attempt at suicide

2. Intentionally self-inflicted Injury or Sickness, while sane or insane

3. Declared or undeclared war, or any act of declared or undeclared war

4. Full-time active duty in the armed forces of any country or international authority

5. Any Injury or Sickness for which the Covered Person is entitled to benefits pursuant to any workers’ compensation law or other similar legislation

6. The Covered Person’s commission of or attempt to commit a felony, assault, sexual assault, riot or insurrection or any Injury resulting from the Covered Person’s provocation of an attack against them

7. Travel or flight in or on (including getting in or out of, or on or off of) any vehicle used for aerial navigation, if the Covered Person is a. Riding as a passenger in any aircraft not intended or licensed for the transportation of passengers b. Performing, learning to perform or instructing others to perform as a pilot or crew member of any aircraft c. Riding as a passenger in an aircraft owned, leased or operated by the Policyholder or the Covered Person

8. Skydiving, parasailing, parachuting, hang-gliding, bungee-jumping and participation in a contest of speed in power driven vehicles

9. Dental or vision services, including treatment, surgery, extractions, or x-rays, unless: (a) resulting from an Accident occurring while the Covered Person’s coverage is in force and if performed within 12 months of the date of such Accident; or (b) due to congenital disease or anomaly of a covered newborn child

10. Treatment or services for Injury and Sickness provided outside of the United States

11. Rest care or rehabilitative care and treatment (this does not include rehabilitation for treatment of physical disability)

12. Voluntary abortion except, with respect to the Covered Person: (a) where the Insured or the Insured’s Dependent’s life would be endangered if the fetus were carried to term; or (b) where medical complications have arisen from abortion

13. Elective cosmetic surgery (except newborn circumcision)

14. Sterilization and reversal of sterilization

15. Any expense which is not Medically Necessary

16. Prescription drugs

17. Any loss for which the Covered Person is not required to pay a Health Benefit Plan Deductible, co-payment and/or Health Benefit Plan Coinsurance under the Covered Person’s Health Benefit Plan; and

18. Any expense or benefit that is excluded under the Covered Person’s Health Benefit Plan

Health Benefit Plan Limitation

If a Covered Person does not have a Health Benefit Plan on the Covered Person’s Effective Date under this coverage, the Company’s sole obligation will then be to refund all premiums paid for that Covered Person.

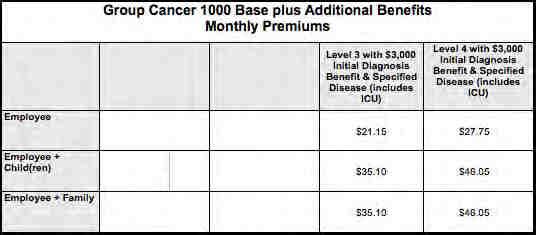

Nearly everyone has experienced or knows somebody who has experienced a cancer diagnosis in their family. The good news is that cancer screenings and cancer-fighting technologies have gotten a lot better in recent years. However, with advanced technology come high costs. Major medical health insurance is a great start, but even with this essential safety net, cancer sufferers can still be hit with unexpected medical and non-medical expenses.

Cancer coverage from Colonial Life offers the protection you need to concentrate on what is most important — your care.

Features of Colonial Life’s Cancer Insurance:

1. Pays benefits to help with the cost of cancer screening and cancertreatment.

2. Provides benefits to help pay for the indirect costs associated with cancer, such as: l Loss of wages or salary l Deductibles and coinsurance l Travel expenses to and from treatment centers l Lodging and meals l Child care

3. Pays regardless of any other insurance you have with other insurance companies.

4. Provides a cancer screening benefit that you can use even if you are never diagnosed with cancer.

5. Benefits paid directly to you unless you specify otherwise.

6. Flexible coverage options for employees and theirfamilies.

This is a brief description of some available benefits.

We will pay benefits if one of the following routine cancer screening tests is performed or if cancer is diagnosed while your coverage is in force.

Cancer Screening Benefit Tests

This benefit is payable once per calendar year per covered person.

l Pap Smear l ThinPrep Pap Test1 l CA125 (Blood test for ovarian cancer) l Mammography l Breast Ultrasound l CA15-3(Bloodtestforbreastcancer) l PSA(Bloodtest for prostate cancer) l Chest X-ray l Biopsy of Skin Lesion l Colonoscopy l Virtual Colonoscopy l Hemoccult Stool Analysis l Flexible Sigmoidoscopy l CEA (Blood test for colon cancer) l Bone Marrow Aspiration/Biopsy l Thermography l Serum Protein Electrophoresis (Blood test for Myeloma)

To file a claim for a covered cancer screening/wellness test, it is not necessary to complete a claim form. Call our toll-free Customer Service number, 1.800.325.4368, with the medical information

Inpatient Benefits

l Hospital andHospitalIntensiveCare Unit Confinement l Ambulance l Private Full-Time Nursing Services l Attending Physician

Treatment Benefits (In-or Outpatient)

l Radiation/Chemotherapy l Antinausea Medication l Blood/Plasma/Platelets/Immunoglobulins l Experimental Treatment l HairProsthesis/ExternalBreast/VoiceBoxProsthesis l Supportive/Protective Care Drugs and Colony

Stimulating Factors l Bone Marrow Stem Cell Transplant l Peripheral Stem Cell Transplant

Surgery Benefits

l Surgery Procedures (including skin cancer) l Anesthesia (including skin cancer) l Second Medical Opinion l Reconstructive Surgery l Prosthesis/ArtificialLimb l Outpatient Surgical Center

Transportation/Lodging Benefits l Transportation l Transportation for Companion l Lodging

Extended Care Benefits

l Skilled Nursing Care Facility l Hospice l Home Health Care Service

Waiver of Premium

THIS IS A CANCER ONLY POLICY.

This policy has exclusions and limitations. For cost and complete details of the coverage, see your Colonial Life benefits counselor. Coverage may vary by state and may not be available in all states. Applicable to policy form GCAN-MP and certificate form GCAN-C (including state abbreviations where used, for example GCAN-C-TX.)

1ThinPrep is a registered trademark of Cytyc Corporation.

Educator Options Voluntary Long Term Disability Coverage Highlights – Texas Palestine Independent School District

Voluntary Long Term Disability Insurance

Standard Insurance Company has developed this document to provide you with information about the optional insurance coverage you may select through Palestine Independent School District. Written in non-technical language, this is not intended as a complete description of the coverage. If you have additional questions, please check with your human resources representative.

Employer Plan Effective Date

The group policy effective date is October 1, 2013.

Eligibility

To become insured, you must be:

• A regular employee of Palestine Independent School District, excluding temporary or seasonal employees, fulltime members of the armed forces, leased employees or independent contractors

• Actively at work at least 15 hours each week

• A citizen or resident of the United States or Canada

Employee Coverage Effective Date

Please contact your human resources representative for more information regarding the following requirements that must be satisfied for your insurance to become effective. You must satisfy:

• Eligibility requirements

• An evidence of insurability requirement, if applicable

• An active work requirement. This means that if you are not actively at work on the day before the scheduled effective date of insurance, your insurance will not become effective until the day after you complete one full day of active work as an eligible employee.

Benefit Amount

You may select a monthly benefit amount in $100 increments from $200 to $8,000; based on the tables and guidelines presented in the Rates section of these Coverage Highlights. The monthly benefit amount must not exceed 66 2/3 percent of your monthly earnings.

Benefits are payable for non-occupational disabilities only. Occupational disabilities are not covered.

Plan Maximum Monthly Benefit: 66 2/3 percent of predisability earnings

Plan Minimum Monthly Benefit: 10 percent of your LTD benefit before reduction by deductible income

Benefit Waiting Period and Maximum Benefit Period

The benefit waiting period is the period of time that you must be continuously disabled before benefits become payable. Benefits are not payable during the benefit waiting period. The maximum benefit period is the period for which benefits are payable. The benefit waiting period and maximum benefit period associated with your plan options are shown below:

Options 1-6: Maximum Benefit Period To Age 65 for Sickness and Accident

If you become disabled before age 62, LTD benefits may continue during disability until you reach age 65. If you become disabled at age 62 or older, the benefit duration is determined by your age when disability begins:

First Day Hospital Benefit

With this benefit, if an insured employee is hospital confined for at least four hours, is admitted as an inpatient and is charged room and board during the benefit waiting period, the benefit waiting period will be satisfied. Benefits become payable on the date of hospitalization; the maximum benefit period also begins on that date. This feature is included only on LTD plans with benefit waiting periods of 30 days or less.

Preexisting Condition Exclusion

A general description of the preexisting condition exclusion is included in the Group Voluntary Long Term Disability Insurance for Educators and Administrators brochure. If you have questions, please check with your human resources representative.

Preexisting Condition Period: The 90-day period just before your insurance becomes effective Exclusion Period: 12 months

Preexisting Condition Waiver

If your insurance has been in force for 12 months or more, for the first 90 days of disability after the benefit waiting period, the Preexisting Condition provision will not be applied to an increase in your benefit amount. After 90 days of benefits, the Preexisting Condition provision will apply to increases of more than $300. The Preexisting Condition Provision applies immediately if you:

• Decrease your Benefit Waiting Period by more than one level; or

• Increase your Maximum Benefit Period

If your insurance has been in force for less than 12 months and your disability is found to be a Preexisting Condition, you may be eligible for up to 90 days of benefits if you are disabled and meet all applicable policy provisions. If the Benefit Waiting Period you elect under this policy is less than the Benefit Waiting Period you were insured for under the Prior Plan, your benefits will begin on the later of these two plans.

If a disability is deemed to be a Preexisting Condition, benefits are payable under your prior elections, if any.

Own Occupation Period

For the plan’s definition of disability, as described in your brochure, the own occupation period is the first 24 months for which LTD benefits are paid.

Any Occupation Period

The any occupation period begins at the end of the own occupation period and continues until the end of the maximum benefit period.

Other LTD Features

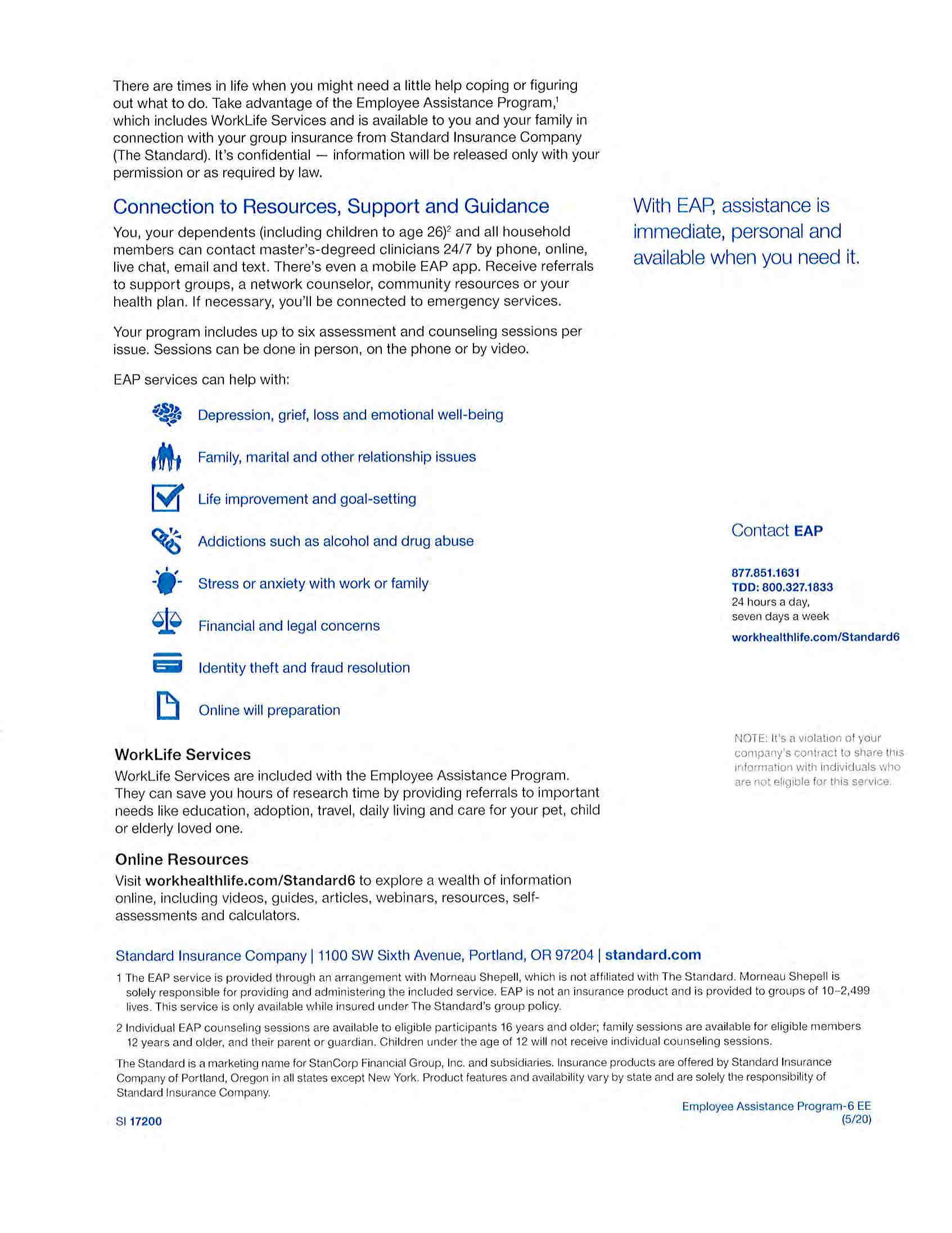

• Employee Assistance Program (EAP) – This program offers support, guidance and resources that can help an employee resolve personal issues and meet life’s challenges.

• Family Care Expense Adjustment – Disabled employees faced with the added expense of family care when returning to work may receive combined income from LTD benefits and work earnings in excess of 100 percent of indexed predisability earnings during the first 12 months immediately after a disabled employee’s return to work.

• Special Dismemberment Provision – If an employee suffers a lost as a result of an accident, the employee will be considered disabled for the applicable Minimum Benefit Period and can extend beyond the end of the Maximum Benefit Period

• Reasonable Accommodation Expense Benefit – Subject to The Standard’s prior approval, this benefit allows us to pay up to $25,000 of an employer’s expenses toward work-site modifications that result in a disabled employee’s return to work.

• Survivor Benefit – A Survivor Benefit may also be payable. This benefit can help to address a family’s financial need in the event of the employee’s death.

• Return to Work (RTW) Incentive – The Standard’s RTW Incentive is one of the most comprehensive in the employee benefits history. For the first 12 months after returning to work, the employee’s LTD benefit will not be reduced by work earnings until work earnings plus the LTD benefit exceed 100 percent of predisability earnings. After that period, only 50 percent of work earnings are deducted.

• Rehabilitation Plan Provision – Subject to The Standard’s prior approval, rehabilitation incentives may include training and education expense, family (child and elder) care expenses, and job-related and job search expenses.

When Benefits End

LTD benefits end automatically on the earliest of:

• The date you are no longer disabled

• The date your maximum benefit period ends

• The date you die

• The date benefits become payable under any other LTD plan under which you become insured through employment during a period of temporary recovery

• The date you fail to provide proof of continued disability and entitlement to benefits

Rates

Employees can select a monthly LTD benefit ranging from a minimum of $200 to a maximum amount based on how much they earn. Referencing the appropriate attached charts, follow these steps to find the monthly cost for your desired level of monthly LTD benefit and benefit waiting period:

1.Find the maximum LTD benefit by locating the amount of your earnings in either the Annual Earnings or Monthly Earnings column. The LTD benefit amount shown associated with these earnings is the maximum amount you can receive. If your earnings fall between two amounts, you must select the lower amount.

2. Select the desired monthly LTD benefit between the minimum of $200 and the determined maximum amount, making sure not to exceed the maximum for your earnings.

3. In the same row, select the desired benefit waiting period to see the monthly cost for that selection. If you have questions regarding how to determine your monthly LTD benefit, the benefit waiting period, or the premium payment of your desired benefit, please contact your human resources representative.

Group Insurance Certificate

If you become insured, you will receive a group insurance certificate containing a detailed description of the insurance coverage. The information presented above is controlled by the group policy and does not modify it in any way. The controlling provisions are in the group policy issued by Standard Insurance Company.

PLAN: SmartPremium 100/80/50/50-1250-1000

POLICY EFFECTIVE DATE: 2022-09-01

POLICY LENGTH: 24 months

MINIMUM EMPLOYER CONTRIBUTIONS: 0.0% for employee and 0.0% for dependent(s).

EMPLOYEE $30.44 monthly

EMPLOYEE + SPOUSE $65.38 monthly

EMPLOYEE + CHILDREN $70.64 monthly

FAMILY $108.72 monthly

Why Beam

Beam is the future of group dental insurance, for employers large and small. We’re pairing innovative tech with personal service to deliver an insurance experience unlike any other.

90th Percentile UCR OON

Nationwide network (Over 400,000 access points) Digital implementation and admin

Beam Perks included

Beam Perks

Plans ship with the Beam Brush included.

Beam Brush Smart, electric toothbrush.

Beam Paste

High-quality, custom formulated toothpaste.

Free shipping Delivered to your door, right when you need it.

Plan Coverage

PREVENTIVE & DIAGNOSTIC

Diagnostic and preventive: exams, cleanings, fluoride, space maintainers, x-rays, and sealants

BASIC

Minor restorative: fillings

Emergency palliative treatment: to temporarily relieve pain

Oral surgery: extractions and dental surgery

Prosthetic maintenance: relines and repairs to bridges and dentures

MAJOR

Endodontics: root canals

Periodontics: to treat gum disease

Implants: endosteal in lieu of a 2 or 3 unit bridge

Major restorative: crowns, inlays, and onlays

Prosthetics: bridges

Prosthodontics: dentures

ORTHODONTIA

100% 100%

80% 80%

50% 50%

Child Orthodontics: braces with age limit of 19 50% 50%

PLAN MAXES

Annual maximum applies to diagnostic & preventive, basic services, and major services. Lifetime maximum applies to orthodontic services.

Annual max based on Calendar Year ANNUAL MAX

Plan Deductible

The deductible is waived for diagnostic & preventive services. INDIVIDUAL

Claims Information

Beam Dental PPO Standard coverages, as of August 1, 2019

Smart Premium

How Lowering Your Premium Works

Using the Beam Brush earns you a Beam score. The better your group’s Beam score, the bigger potential drop in your premium at your renewal.*

Brush better, get a lower premium—pretty simple. Don’t worry, your rates will not increase based on your group Beam score alone. Just get rewarded for good brushing by your group.

*Premium reduction occurs at renewal (plan year or calendar year) and is based on Beam score aggregate of your group, prior year claims data analysis, and changes in dentist reimbursement contracts. The reduction stated above nor any reduction in premiums is guaranteed. Premium rates can be increased based on the factors previously stated, if determined in the underwriting process. Increases in premium will not occur based on group aggregate Beam score alone.

Additional Details

SEE ANY DENTIST

Our PPO plans allow you to see any licensed dentist. Savings in plan cost and member out of pocket expenses may be obtained by utilizing participating network dentists.

Beam has partnered with leading regional and national PPO network partners through Dental Benefit Providers, Careington PPO Dental, and DenteMax Plus Network to provide you with the most choices possible.

Note: The information contained in this proposal is not intended to be contractually binding without a written agreement executed by both parties memorializing the terms and conditions of dental benefit underwriting and/or administration anticipated to be provided by Beam and its partners. We and our partners reserve the right to withdraw this proposal at any time.

Rating Requirements

Minimum employer contributions: 0.0% for employee and 0.0% for dependent(s).

Minimum employee enrollment: 20% of eligible employees

Maximum number of subgroups: 10

Rates are valid for 90 days after 06/03/22

This proposal is based on information provided with the proposal request. If accepted, final rates and benefits will be based on verification of the information provided with the rate request.

Once eligible, Certificate Holders and their Eligible Dependents must enroll for coverage under this policy within 30 days from the date upon which such Certificate Holder or Eligible Dependents become eligible for Benefits.

A Certificate Holder properly enrolls for coverage by completing all enrollment forms required by Beam and NGL and submitting such forms to the Policyholder.

If the Certificate Holder or Eligible Dependent is not properly enrolled for coverage within 30 days from the date upon which he/she becomes eligible for Benefits, then such Certificate Holder or Eligible Dependent must wait until the next Open Enrollment Period to enroll.

Coverage Rules

CODE PROCEDURE

COVERED UNDERFREQUENCY

D0120, D0150, D9310 Periodic oral exam, Comprehensive oral exam, Consultation Diagnostic Limit of three per 12 months

D0140 Limited oral exam Diagnostic Two per 12 months

D0210 Radiographs-FMX Diagnostic One per 60 months

D0220 Radiographs-periapical (first) Diagnostic Not covered if inclusive of a procedure with x-rays.

D0230 Radiographs-periapical (each additional)Diagnostic Not covered if inclusive of a procedure with x-rays.

D0270-D0274Radiographs-bitewings Diagnostic Every 6 months

D0330 Radiographs-panoramic

D1110 Prophylaxis

D1206, D1208Fluoride

D1351, D1352Sealants, Resins

D2140-D2161Fillings

D2330-D2394Fillings

D2740, D2750 ...Crowns (N,X,A)

D2950 Core Build-up (X)

Diagnostic One per 60 months

Preventive Two per benefit period

Preventive One per 12 months

Preventive One per 36 months, per tooth

Minor RestorativeOne per 24 months, per tooth

Minor RestorativeOne per 24 months, per tooth

Major One per 60 months, paid on seat date; seat date required

Major One per 60 months

D4341-D4342Periodontal scaling and root planing (N, P, X)PeriodonticsOne per 24 months, per quadrant

D4910 Periodontal maintenance (H) Periodontics Two per year unless pregnant (3) or diabetes (4)

D6010 Endosteal Implants (N,M,X2)

Major One per lifetime

Not covered: D0350, D0364, D0470, D1330, D2962, D3110, D3120, D8093, D9230, D9248

Notes

Limited to 3 oral evaluation procedures, in any combination (D0120, D0150, D9310) per 12 month period

Can do treatment on same day; no shared freq with D0120; shared freq with D0170

Shared freq with D0330; not reimbursed within 6 months of Bitewing Radiographs

Bitewings and 7 or more periapicals will be reimbursed as FMX. Not covered on same day as D0210, D0330 or if considered a part of billed procedures

Bitewings and 7 or more periapicals will be reimbursed as FMX. Not covered on same day as D0210, D0330 or if considered a part of billed procedures

Can perform 6 months after D0210

Shared freq with D0210

Three per 12 months if pregnant 2nd/3rd trimester, four per 12 months if diabetic (N, V); not covered within 3 months of D4910

Covered under age 16

Covered under age 16, 1st & 2nd permanent molars

Multiple restorations on one surface are payable as one surface. Multiple surfaces on a single tooth will not be paid as separate restorations.

Multiple restorations on one surface are payable as one surface. Multiple surfaces on a single tooth will not be paid as separate restorations. Posterior composites covered.

See * note below for details

See * note below for details

Can perform all 4 quads in one day

After peridontal treatment; can be alternated with D1110 for one per three months

In lieu of a single tooth replacement when a 2 or 3 unit bridge has been approved for coverage when adjacent teeth are not in need of crowns on their own merit; if there are no additional teeth missing throughout the arch. Alternate benefit of a partial denture will be considered if criteria is not met.

*Exclusions include, but are not limited to: correction of attrition, abrasion, erosion, or abfraction; for teeth that are not broken down by extensive decay or accidental injury; to restore teeth with microfractures fracture lines, undermined cusps, or existing large restorations without overt pathology.

Frequently Asked Questions

Continuation of service? Covered starting on patient's effective date

Continuation of benefits? Earlier effective date is primary

Frequency of ortho payments? Monthly – submit claims for on-going treatment

Are prior extractions covered? Yes – no missing tooth clause

N = Narrative of medical necessity

P = Perio charting

X = Labeled & dated, pre-op x-rays

X2 = Labeled & dated, pre-op and post op x-rays

Timely Filing limit? 12 months from date of service unless otherwise specified by state law. Please refer to your CertificateH = Periodontal history

Is pre-authorization mandatory? No – but estimates recommended for $300+ services

A = date of prior insertion of existing crown

M = panoramic x-ray or FMX (if available), all missing teeth

V = Verification from physician (if pregnant requires due date)

DISCLAIMER: Depending on the coverage you selected, your benefits may differ from those outlined above. Please review your Certificate of Insurance for full benefit descriptions and limitations. If there are any discrepancies between this summary and the plan documents, the plan documents will prevail.