5 minute read

XM Micro Account

XM Micro Account

📌📌📌 Open XM An Account ✅

💥💥💥 Visit site: XM Broker ✅

The XM Micro Account is a popular choice among traders, offering features that cater specifically to those looking to start small but aim big. Whether you are a beginner or an experienced trader seeking precision, the XM Micro Account provides a flexible and user-friendly platform. This article will delve deep into the key aspects of the XM Micro Account, its advantages, limitations, and how it compares to other account types, ensuring you make an informed decision.

What is the XM Micro Account?

The XM Micro Account is a trading account designed for those who prefer trading in smaller volumes. It is ideal for beginners, casual traders, and those who want to test strategies with minimal risk. The account operates with micro-lots, allowing traders to start with as little as 0.1 lot size.

Key features of the XM Micro Account include:

Contract size: 1 lot = 1,000 units (as opposed to 100,000 in standard accounts).

Minimum deposit: As low as $5, making it highly accessible.

Leverage: Up to 1:888, depending on your region and regulatory requirements.

Spread: Tight spreads starting from as low as 1 pip.

Trading instruments: Forex, commodities, indices, and more.

Who Should Use the XM Micro Account?

The XM Micro Account is tailored for specific trading needs, including:

Beginners

With a low minimum deposit and small contract size, the XM Micro Account is perfect for traders new to the market.

It allows beginners to learn the ropes without risking significant capital.

Strategy Testers

Advanced traders often use micro accounts to test new strategies.

The smaller lot size enables detailed experimentation without impacting their primary trading accounts.

Risk-Averse Traders

Traders who prefer conservative approaches can use the XM Micro Account to minimize risk exposure.

📌📌📌 Open XM An Account ✅

💥💥💥 Visit site: XM Broker ✅

Advantages of the XM Micro Account

The XM Micro Account comes with several benefits that make it stand out in the competitive trading landscape:

Low Entry Barrier

With a minimum deposit of just $5, almost anyone can start trading with XM.

Wide Range of Instruments

The account provides access to over 55 currency pairs, commodities, indices, and even cryptocurrencies.

Tight Spreads

Tight spreads starting from 1 pip ensure cost-effective trading.

Flexible Lot Size

Trading with micro-lots allows for precision, making it easier to manage risks.

No Hidden Fees

The XM Micro Account is transparent, with no hidden charges or commissions.

High Leverage

Up to 1:888 leverage (region-dependent) offers the potential for higher returns.

Islamic Account Option

Traders who follow Islamic finance principles can opt for a swap-free Micro Account.

Access to Educational Resources

XM provides free educational materials, webinars, and tutorials to enhance your trading skills.

📌📌📌 Open XM An Account ✅

💥💥💥 Visit site: XM Broker ✅

Limitations of the XM Micro Account

While the XM Micro Account offers many advantages, it’s essential to consider its limitations:

Limited Lot Size

The smaller lot size may not be ideal for traders seeking larger volume trades.

Spread Costs

Spreads, though competitive, can add up for frequent traders.

Regional Leverage Restrictions

Leverage is capped at lower levels in some regions due to regulatory constraints.

No Fixed Spreads

The XM Micro Account operates with variable spreads, which can widen during volatile market conditions.

How to Open an XM Micro Account

Opening an XM Micro Account is a straightforward process:

Visit the XM Website

Navigate to the account opening page.

Complete Registration

Provide personal information such as name, email, and country of residence.

Choose the Micro Account

During the registration process, select the Micro Account as your preferred account type.

Verify Your Identity

Upload necessary identification documents to comply with regulatory requirements.

Fund Your Account

Deposit a minimum of $5 using various payment methods, including bank transfers, credit cards, and e-wallets.

Start Trading

Access the trading platform, select your instruments, and begin trading with your XM Micro Account.

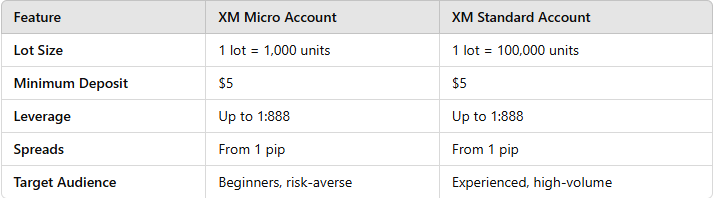

XM Micro Account vs. Standard Account

A comparison between the XM Micro Account and the Standard Account can help traders choose the most suitable option:

📌📌📌 Open XM An Account ✅

💥💥💥 Visit site: XM Broker ✅

Tips for Trading with the XM Micro Account

Set Realistic Goals

Focus on learning and developing strategies rather than chasing high profits initially.

Manage Your Risk

Use tools like stop-loss orders and appropriate position sizing.

Leverage Wisely

High leverage can amplify profits and losses; use it cautiously.

Stay Informed

Leverage XM’s educational resources to enhance your trading skills.

Test Strategies

Use the Micro Account to test strategies before applying them to larger accounts.

FAQs about XM Micro Account

1. What is the minimum deposit for the XM Micro Account?The minimum deposit is $5, making it accessible to a wide range of traders.

2. Can I trade all instruments with the XM Micro Account?Yes, the account allows trading on various instruments, including forex, commodities, indices, and cryptocurrencies.

3. Is the XM Micro Account suitable for beginners?Absolutely! Its low entry barrier and micro-lot trading make it ideal for beginners.

4. Are there any hidden fees?No, XM ensures transparency with no hidden charges or commissions.

5. Is the XM Micro Account available worldwide?Yes, but features like leverage may vary depending on your region’s regulations.

Conclusion

The XM Micro Account is an excellent option for traders seeking a low-risk, high-flexibility trading experience. With its user-friendly features, low minimum deposit, and access to a wide range of trading instruments, it caters to both beginners and experienced traders. By leveraging the advantages of the XM Micro Account and managing risks effectively, traders can build a solid foundation for long-term success.

For anyone considering a reliable and accessible trading account, the XM Micro Account is worth exploring. It’s not just an account; it’s a gateway to understanding the dynamics of trading while minimizing risks.

Read more:

✔ XM Broker Review is legit, legal, safe, real or fake?

✔ XM Broker review| It is broker good, trusted?