7 minute read

How To fund EXNESS account in Nigeria

How To fund EXNESS account in Nigeria

👉 Visit Website Exness Official ✅

💥 QR Code Exness 👇

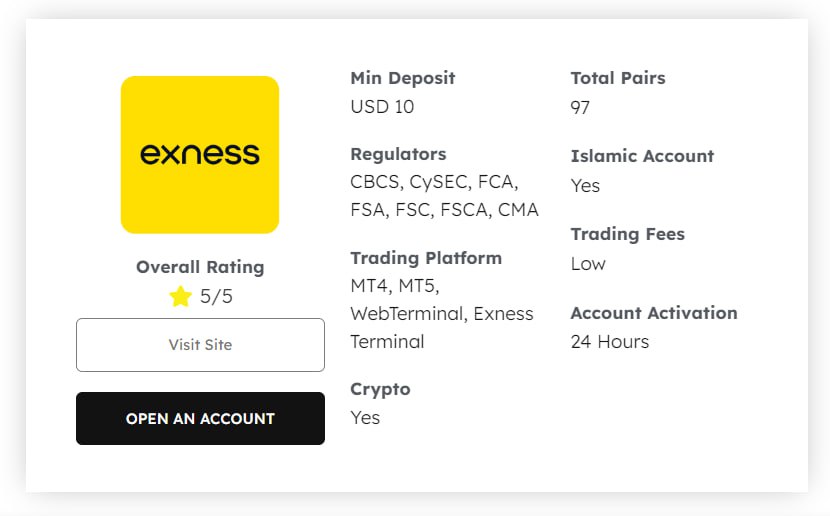

When it comes to online trading, having a reliable broker is key to making the most of your trading opportunities. One such broker is EXNESS, a popular platform used by traders across the world. EXNESS offers an intuitive platform for forex, stocks, commodities, and cryptocurrencies trading. However, before you can start trading, you need to fund your EXNESS account. For traders in Nigeria, understanding how to fund an EXNESS account is crucial for getting started.

In this guide, we'll walk you through the process of funding your EXNESS account in Nigeria at the latest, including various payment methods, common challenges, and tips for a great depositing experience. Money goes smoothly.

Understanding EXNESS: A Brief Overview

EXNESS is a leading online trading platform that has been around since 2008. Known for its robust trading tools and transparent operations, EXNESS serves traders globally, including in Nigeria. The platform offers multiple account types tailored to different traders’ needs, including ECN accounts, standard accounts, and professional accounts.

With EXNESS, traders in Nigeria can access a wide range of financial instruments such as Forex, cryptocurrencies, stocks, and commodities. However, to start trading, you must first fund your account, and there are several ways to do this from Nigeria.

Why Choose EXNESS for Your Trading?

Before diving into the deposit methods, let’s quickly review why EXNESS is a popular choice for Nigerian traders:

Competitive Spreads: EXNESS offers tight spreads on various assets, helping traders to execute trades with minimal cost.

Fast Withdrawals: EXNESS allows easy and fast withdrawal options, ensuring that you can access your funds when needed.

Multiple Account Types: Whether you are a beginner or a professional, EXNESS offers different account types suited to varying risk appetites and trading styles.

Low Minimum Deposit: EXNESS has a relatively low minimum deposit, making it accessible for traders with small budgets.

👉 Visit Website Exness Official ✅

How to Fund Your EXNESS Account in Nigeria

Funding your EXNESS account in Nigeria is straightforward. Below are the main methods you can use to deposit money into your EXNESS account.

1. Bank Transfer (Local Bank Deposit)

Bank transfers are a reliable way to fund your EXNESS account in Nigeria. EXNESS supports Nigerian Naira (NGN) deposits through local banks, making it easier for traders to make deposits directly from their bank accounts.

Here’s how you can fund your account via bank transfer:

Step 1: Log in to your EXNESS account.

Step 2: Go to the ‘Deposit’ section under the ‘Funds’ tab.

Step 3: Select the 'Bank Transfer' option and choose your preferred Nigerian bank.

Step 4: Enter the amount you wish to deposit and follow the instructions.

Step 5: Complete the payment from your bank account. You’ll need to initiate a local transfer to the bank account details provided by EXNESS.

Step 6: Once the payment is processed, your funds should appear in your EXNESS account within a few hours or a couple of business days, depending on the bank.

Note: Bank transfers may incur transaction fees, so it’s a good idea to check with your bank for any associated costs.

👉 Visit Website Exness Official ✅

2. Debit/Credit Card Deposits

Using debit or credit cards is another common method for funding EXNESS accounts. This option is fast, easy, and supports multiple international and local cards like MasterCard, Visa, and Verve.

Here’s how to deposit funds using your debit or credit card:

Step 1: Log in to your EXNESS account.

Step 2: Go to the ‘Deposit’ section and choose ‘Credit/Debit Card’.

Step 3: Enter the deposit amount and fill in your card details (card number, expiry date, and CVV).

Step 4: Confirm the transaction. You may be asked for a 3D secure code or OTP (One-Time Password) for additional security.

Step 5: Once the payment is processed, the funds should reflect in your account almost immediately.

Note: Some banks may charge foreign transaction fees for international payments. It's important to verify any additional charges with your card issuer.

3. Mobile Payment Options

With the growing use of mobile payments in Nigeria, EXNESS has integrated mobile payment solutions, including Paga and OPAY, which allow for seamless deposits directly from mobile phones.

To fund your EXNESS account via mobile payment, follow these steps:

Step 1: Log into your EXNESS account.

Step 2: Navigate to the ‘Deposit’ page and choose your preferred mobile payment option.

Step 3: Enter the desired amount to deposit and confirm the transaction.

Step 4: Complete the payment through the selected mobile payment method on your phone.

Step 5: The funds will be credited to your EXNESS account promptly.

This method is one of the quickest ways to fund your EXNESS account in Nigeria.

4. Cryptocurrency Deposits

If you're into crypto trading, EXNESS offers the option of depositing funds via popular cryptocurrencies like Bitcoin, Ethereum, and others. This method is gaining popularity because of its low transaction costs and faster processing times.

To deposit via cryptocurrency:

Step 1: Log in to your EXNESS account.

Step 2: Go to the ‘Deposit’ section and choose the cryptocurrency option.

Step 3: Select the cryptocurrency you wish to use (e.g., Bitcoin, Ethereum).

Step 4: Follow the instructions to generate your EXNESS wallet address and transfer the cryptocurrency from your wallet to EXNESS.

Step 5: Your funds should reflect in your EXNESS account once the blockchain transaction is confirmed.

Cryptocurrency deposits are relatively fast, with funds typically appearing in your EXNESS account within minutes, depending on the blockchain.

👉 Visit Website Exness Official ✅

5. Third-Party Payment Providers

EXNESS also accepts payments through third-party payment providers like Skrill, Neteller, and Perfect Money. These services are often preferred by traders who want to avoid direct banking fees or use an intermediary.

To fund your account using these services:

Step 1: Log in to your EXNESS account.

Step 2: Choose your preferred third-party provider under the ‘Deposit’ section.

Step 3: Enter your payment details and the amount to deposit.

Step 4: Complete the payment via your selected payment provider.

Step 5: Your funds should appear in your EXNESS account shortly after the transaction.

These third-party services can be beneficial for traders who wish to keep their banking transactions separate from their trading activities.

Tips for Smooth Fund Deposits in Nigeria

Verify Payment Method Fees: Different payment methods come with different fees, so it's important to verify any hidden charges before making a deposit.

Use a Reliable Payment Method: For faster deposits, use a payment method with quick processing times like debit cards, mobile payments, or cryptocurrency.

Check Exchange Rates: If you're using a foreign payment method, ensure that you are getting a fair exchange rate when converting from NGN to the trading currency (USD, EUR, etc.).

Secure Your Account: Always enable two-factor authentication (2FA) for additional security when making deposits.

Common Challenges and Solutions

While depositing funds into your EXNESS account is typically smooth, you might encounter a few challenges. Here are some common issues and how to address them:

Transaction Delays: Sometimes, deposits may take longer than expected. This can be due to processing times on the payment provider’s side. If the funds do not appear within the specified time frame, contact EXNESS support for assistance.

Payment Declines: If your payment is declined, ensure that you have entered the correct payment details and that your bank or payment provider allows international transactions.

Currency Conversion Issues: If you're making deposits in NGN, the exchange rate might impact the final amount deposited. Consider using a payment method that directly supports NGN to avoid extra charges.

Conclusion

Funding your EXNESS account in Nigeria is an easy and straightforward process. Whether you prefer using a bank transfer, credit/debit cards, mobile payment options, cryptocurrencies, or third-party providers, EXNESS offers a variety of methods to suit your preferences.

By understanding the different deposit methods and preparing in advance, you can ensure a seamless funding experience. Always check for any hidden charges, ensure the security of your account, and select the payment method that best fits your trading needs.

Now that you know how to fund your EXNESS account, you’re ready to dive into the exciting world of online trading. Happy trading!

Read more:

Exness minimum deposit in Nigeria

How Much Leverage Does Exness Give

How to Withdraw from Exness to Skrill