16 minute read

How To deposit money in EXNESS to bank account

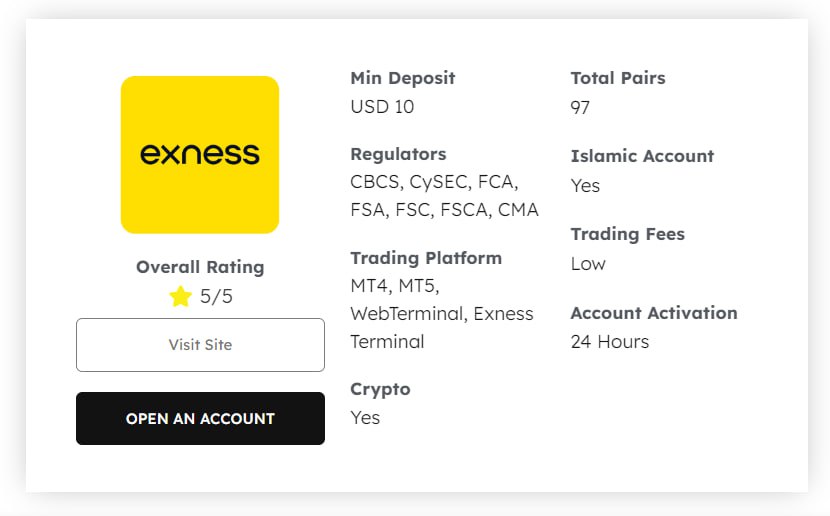

When it comes to trading and investing, understanding the process of transferring funds is vital. Knowing how to deposit money in EXNESS to bank account can significantly enhance your trading experience and ensure that you make the most of your investments. This article delves into various aspects of depositing money with EXNESS, offering a comprehensive guide designed for both beginners and experienced traders alike.

👉 Visit Website Exness Official ✅

💥 QR Code Exness 👇

Understanding EXNESS Deposit Methods

EXNESS offers a variety of deposit methods to cater to its diverse clientele. Each method has its advantages and drawbacks, and selecting the right one can depend on several factors including speed, security, and transaction fees.

In this section, we’ll explore the various deposit methods available through EXNESS, providing insight into how they work and which might best suit your needs.

Types of Deposit Methods Offered by EXNESS

EXNESS supports multiple payment options, making it easier for traders across the globe to fund their accounts. The most common types of deposit methods include:

Bank Transfers: Traditional but reliable, bank transfers are widely used, particularly by traders who prefer conventional banking systems.

E-Wallets: Services like Skrill, Neteller, and others offer fast transactions and added security, making them popular among traders who value convenience.

Credit/Debit Cards: Visa and MasterCard deposits are quick and straightforward, allowing immediate access to funds for trading.

Each of these methods has unique features that can benefit different types of traders. For instance, while e-wallets provide instant deposits, bank transfers may take longer but often come with lower transaction fees.

Evaluating the Pros and Cons of Each Method

When choosing a deposit method, it's essential to weigh the pros and cons.

Bank Transfers:

Pros: High limits, secure transactions

Cons: Longer processing times, potential fees from banks

E-Wallets:

Pros: Instant deposits, high security

Cons: Fees may vary depending on the service

Credit/Debit Cards:

Pros: Quick and easy, widely accepted

Cons: Higher transaction fees, limitations based on card issuer policies

Understanding these factors can help you make an informed decision about how to deposit money in EXNESS to your bank account.

👉 Visit Website Exness Official ✅

Importance of Choosing the Right Deposit Method

Selecting the right deposit method goes beyond convenience; it affects your overall trading experience. A method that allows for quick deposits can facilitate timely trades, while those with higher fees could eat into your profits. Additionally, if you plan on withdrawing funds back to your bank account, ensuring compatibility between your deposit and withdrawal methods is crucial.

In summary, understanding the deposit methods available through EXNESS will not only streamline your trading experience but also provide an avenue for maximizing your financial gains.

Step-by-Step Guide: Depositing Funds into Your EXNESS Account

Depositing funds into your EXNESS account is a straightforward process, and following a clear step-by-step approach can save time and eliminate confusion. Whether you're new to trading or have experience, these instructions will guide you seamlessly through the process.

Creating an EXNESS Account

Before you can deposit money, you need an active EXNESS account. Here's how to get started:

Visit EXNESS Website: Go to the official EXNESS website and click on the 'Register' button.

Fill Out Registration Form: Provide the necessary details including your email address, name, and password.

Verify Your Email: Once registered, you will receive a confirmation email. Click on the link to verify your account.

Creating an account is the first step toward funding your trading endeavors. Ensure that you provide accurate information during registration, as inaccuracies could lead to complications down the line.

👉 Visit Website Exness Official ✅

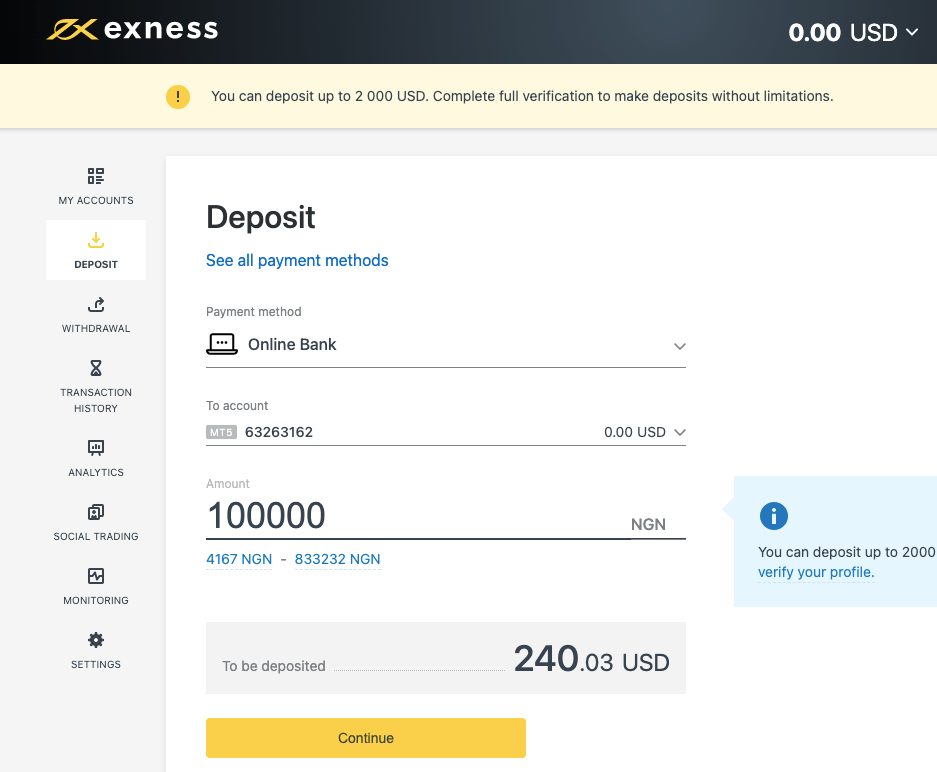

Selecting Your Preferred Deposit Method

Once your account is set up, choose your preferred deposit method:

Log In: Access your account using the credentials you've created.

Navigate to the Deposit Section: Look for the ‘Deposit’ option in your account dashboard.

Choose a Deposit Method: You'll see a list of available methods. Select the one that suits your needs best.

Choosing the correct deposit method is crucial to ensuring that your funds are transferred quickly and securely.

Completing the Deposit Process

After selecting a deposit method, follow these steps to finalize your transaction:

Enter Deposit Amount: Specify how much money you want to deposit into your EXNESS account.

Provide Payment Information: Depending on your selected method, fill in any required payment details (e.g., bank account number, card details).

Confirm Transaction: Review all the information carefully before submitting the transaction.

Completing these steps accurately is essential to avoid any delays or issues with your deposit.

Confirming Your Deposit

After completing the deposit process, it's important to confirm that the funds have been added to your EXNESS account:

Check Your Account Balance: Visit your account dashboard to ensure that the amount has been credited.

Review Transaction History: You should see a record of your deposit in the transaction history section.

Contact Support if Necessary: If you don’t see the funds after a reasonable amount of time, reach out to EXNESS customer support for assistance.

Confirming your deposit ensures that you're ready to start trading without unnecessary delays.

👉 Visit Website Exness Official ✅

Choosing the Right Deposit Method for Your Needs

The choice of deposit method may seem trivial, but it can significantly impact your trading strategy and experience. Understanding your individual needs and preferences can help you make the right decision.

Assessing Your Trading Style

Your trading style plays a critical role in determining which deposit method is best for you:

Day Traders: If you're engaged in high-frequency trading, opting for methods that allow instant deposits, such as e-wallets, can be advantageous.

Long-Term Investors: If you plan to hold positions for an extended period, the slower processing times associated with bank transfers may not hinder your trading activities.

Being aware of your trading style allows you to align your deposit method with your trading objectives.

Analyzing Transaction Fees

Fees can accumulate over time, impacting your profitability. Consider the following when evaluating fees:

Compare Different Methods: Always check the fee schedules for each deposit method before making a selection.

Consider Total Costs: Factor in both deposit and withdrawal fees, as some methods may charge low deposit fees but high withdrawal fees, or vice versa.

Understanding the cost implications of your chosen deposit method will aid in maintaining your profitability.

Security Considerations

Security should always be a priority when choosing a deposit method. Here are a few tips:

Reputable Payment Providers: Use well-known and trusted payment platforms with strong security measures in place.

Two-Factor Authentication: Whenever possible, enable two-factor authentication to add an extra layer of security to your transactions.

Making security a fundamental part of your decision-making process ensures that your funds remain safe throughout the trading journey.

👉 Visit Website Exness Official ✅

Common Deposit Methods and Their Associated Fees

As we've established, EXNESS provides various deposit methods, each with unique characteristics and associated costs. Understanding these options and their respective fees is vital for making informed decisions.

Overview of Popular Deposit Methods

Analyzing the most popular deposit methods available through EXNESS can provide insights into what will work best for you:

Bank Transfers: Generally consider low fees, though processing takes longer—often several days.

E-Wallets: Typically offer low to moderate fees with instant processing times, making them attractive to many traders.

Credit/Debit Cards: Usually incur moderate fees, but deposits are processed quickly compared to traditional banking methods.

Having a comprehensive overview of these methods allows you to pick one that aligns with your financial strategy.

Breakdown of Fee Structures

Let’s delve deeper into the fee structures for each deposit method:

Bank Transfers: Most banks may charge a flat rate or a percentage-based fee for international transactions. EXNESS itself does not impose additional charges but be vigilant of your bank's policies.

E-Wallets: Service providers like Skrill and Neteller usually charge a small percentage for transactions. While these fees are generally manageable, they can accumulate with frequent trading.

Credit/Debit Cards: Similar to e-wallets, card services typically charge a small fee per transaction. Check with your card provider for any additional costs.

By understanding the fee structures, you can better gauge the total cost involved in maintaining your trading practice.

Importance of Keeping Track of Fees

Monitoring transaction fees is pivotal for long-term success in trading. Here's why:

Budget Management: Understanding your costs can help you maintain a functional budget for trading activities.

Profit Calculation: Accurate fee tracking enables you to calculate your net profit more effectively, leading to smarter trading decisions.

Keeping an eye on transaction fees will empower you to optimize your trading strategies.

👉 Visit Website Exness Official ✅

Verifying Your EXNESS Account for Secure Deposits

Account verification is an integral component of using EXNESS, ensuring compliance with regulations and securing your trading environment. A verified account adds another layer of security when depositing or withdrawing funds.

Why Verification is Essential

Verification serves multiple purposes:

Preventing Fraud: By confirming the identity of users, EXNESS minimizes the risk of fraudulent activity, providing a safer trading experience for everyone involved.

Regulatory Compliance: Financial institutions are required to adhere to specific regulations. Verification helps EXNESS meet these standards, promoting transparency and trust.

Without proper verification, you may encounter restrictions on your account, limiting your ability to deposit or withdraw funds effectively.

Steps to Verify Your Account

To complete the verification process, follow these steps:

Prepare Required Documents: Commonly needed documents include a government-issued ID (passport or driver’s license) and proof of residence (utility bill or bank statement).

Upload Documents: Log in to your EXNESS account, navigate to the verification section, and upload scanned copies of the required documents.

Wait for Approval: Once submitted, your documents will be reviewed by EXNESS. Approval times may vary, so be patient.

Your diligence in this process ensures that your account remains secure and compliant with regulatory standards.

Checking Verification Status

After submission, staying informed about your verification status is important:

Email Notifications: Keep an eye on your email for any updates from EXNESS regarding your verification status.

Account Dashboard: You can also check the verification section in your account dashboard for real-time updates.

Understanding your verification status will prevent future inconveniences and ensure a smooth trading experience.

👉 Visit Website Exness Official ✅

Troubleshooting Common Deposit Issues

Even with a simple deposit process, issues can arise from time to time. Knowing how to troubleshoot common problems can save you from frustration and delays, enabling you to focus on your trading goals.

Common Deposit Problems

There are several typical issues traders may encounter when depositing funds into their EXNESS accounts:

Transaction Declined: Sometimes, payments may be declined for reasons related to insufficient funds, incorrect information, or bank policies.

Delayed Processing: Depending on the method chosen, processing delays can occur, particularly with bank transfers.

Technical Glitches: Occasionally, platform-related issues may prevent successful transactions due to server errors or maintenance.

Recognizing these common problems is the first step toward finding solutions.

Solutions to Deposit Challenges

Here are practical solutions for addressing common deposit issues:

For Declined Transactions: Double-check the information you’ve entered, ensure sufficient funds are available, and contact your bank to inquire about any restrictions.

For Delays: Be patient and wait for the processing window indicated by EXNESS. If it exceeds that timeframe, reach out to EXNESS support.

For Technical Issues: Refresh the page or try a different browser. If the problem persists, contacting EXNESS support is recommended.

Taking prompt action to resolve these challenges will enable you to continue trading seamlessly.

Contacting Support for Assistance

If you face issues that you cannot resolve independently, reaching out to EXNESS customer support is imperative:

Live Chat: EXNESS offers a live chat feature for immediate assistance.

Email Support: You can also send an email outlining your issue for more detailed inquiries.

Knowledge Base: Utilize the FAQ section on the EXNESS website, which covers common questions and solutions.

Leveraging customer support resources ensures that you receive the help you need to overcome any deposit obstacles.

Withdrawing Funds from Your EXNESS Account to Your Bank Account

Once you've successfully deposited funds into your EXNESS account, knowing how to withdraw them back to your bank account is equally essential. This section outlines the processes involved, enabling you to manage your funds effectively.

Withdrawal Eligibility and Requirements

Before initiating a withdrawal, ensure that you meet the requirements:

Verified Account: Your EXNESS account must be fully verified to process withdrawals.

Minimum Withdrawal Amount: Different methods may have varying minimum withdrawal amounts. Familiarize yourself with the specifics before proceeding.

Understanding these prerequisites will streamline your withdrawal process.

Steps to Withdraw Funds

Withdrawing funds is a straightforward process. Follow these steps for a seamless experience:

Log In to EXNESS Account: Access your account as you normally would.

Navigate to Withdrawal Section: Click on the 'Withdraw' option in your account dashboard.

Select Method: Choose your preferred withdrawal method. It’s advisable to use the same method you used for deposit.

Enter Amount and Confirm: Specify the amount you wish to withdraw and review the details before confirming.

Monitor Withdrawal Status: After submitting your request, you can track the status within the withdrawal section of your account.

Following these steps will ensure that your funds are withdrawn efficiently.

👉 Visit Website Exness Official ✅

Understanding Withdrawal Processing Times

Withdrawal times can differ significantly based on the method chosen:

Bank Transfers: Often take several business days to process due to banking protocols.

E-Wallets: Typically offer faster processing, often completed within hours.

Credit/Debit Cards: May take a few business days, akin to bank transfers.

Being aware of these timelines allows you to manage your expectations regarding fund availability.

Security Best Practices for EXNESS Deposits and Withdrawals

Keeping your funds secure should be a top priority when dealing with online trading platforms. Implementing best practices can safeguard your investments and ensure a worry-free trading experience.

Utilizing Strong Passwords and Two-Factor Authentication

One of the simplest yet most effective security measures is to utilize robust passwords and enable two-factor authentication:

Strong Passwords: Create complex passwords that include a mix of letters, numbers, and symbols. Avoid easily guessable information.

Two-Factor Authentication: Enabling this feature adds an extra layer of security. This means that in addition to your password, you'll need another piece of information, such as a verification code sent to your mobile device.

These practices help mitigate risks associated with unauthorized access to your account.

Monitoring Account Activity Regularly

Regular account monitoring is crucial for identifying unusual transactions or signs of fraud:

Check Transaction History: Frequently reviewing your transaction history allows you to spot any discrepancies or unauthorized transactions.

Set Account Alerts: Use notifications to alert you to significant changes in your account balance or unusual login attempts.

Proactively monitoring your account can help catch issues before they escalate.

Keeping Personal Information Safe

Protecting your personal information is essential in today's digital landscape:

Avoid Phishing Scams: Be cautious of emails or messages requesting sensitive information. Always verify the source before responding.

Secure Internet Connection: Only perform transactions over secure and private internet connections, avoiding public Wi-Fi networks where possible.

Staying vigilant about your personal information can significantly reduce the likelihood of fraud.

👉 Visit Website Exness Official ✅

Understanding Processing Times for EXNESS Bank Transfers

Processing times can vary based on several factors and understanding these can influence your trading strategies and cash flow management.

Factors Influencing Processing Times

Various elements can impact how long it takes for bank transfers to process:

Bank Policies: Different banks have their own processing times and cut-off periods, which can affect the speed of fund transfers.

Geographical Location: International transfers may take longer than domestic ones, influenced by currency conversion and local banking regulations.

Transaction Type: Standard transactions may take longer to process compared to expedited or premium services offered by some banks.

Being aware of these factors can help you plan withdrawals or deposits according to your trading needs.

Typical Timeframes for Bank Transfers

While actual times can vary, here are general timeframes to expect:

Domestic Transfers: Usually processed within 1-3 business days.

International Transfers: May take anywhere from 3-7 business days based on the country and banks involved.

Public Holidays: Additional delays can occur during public holidays or weekends when banks may not operate.

Understanding these timeframes allows you to anticipate when funds will become available.

Communicating with Banks for Clarity

If you frequently find yourself frustrated with transfer delays:

Contact Your Bank Directly: Reach out to your bank for clarification on their processing times and any potential holds on your accounts.

Ask About Transfer Options: Some banks offer expedited transfer options at an additional cost. Understanding these can help in managing your funds more effectively.

Effective communication with your bank can alleviate concerns and provide clearer expectations around transfer times.

Contacting EXNESS Customer Support for Assistance with Deposits

Should you encounter challenges while depositing funds into your EXNESS account, knowing how to contact customer support can be invaluable. EXNESS offers various means of communication to assist you.

Multiple Channels for Support

EXNESS provides a range of channels to ensure that you can obtain help when needed:

Live Chat: For instant support, EXNESS’s live chat feature connects you directly with a customer service representative.

Email Support: If your inquiry is more complex, sending an email may provide the opportunity for a detailed response.

Phone Support: Depending on your location, you might be able to call for immediate assistance.

Selecting the appropriate channel based on your urgency will enhance your support experience.

Preparing for Customer Support Communication

When reaching out for assistance, being prepared can expedite the resolution process:

Have Relevant Information Ready: Compile details such as your account number, transaction ID, and a description of the issue.

Be Clear and Concise: Clearly articulate your problem without unnecessary details to facilitate a quicker response.

Preparation allows for an efficient dialogue, minimizing the back-and-forth often associated with customer support interactions.

Following Up on Outstanding Issues

If your initial contact did not resolve your issue:

Request Escalation: Don't hesitate to ask for further assistance or to escalate your issue to a supervisor if needed.

Track Communication: Keep records of your interactions with customer support to reference later if necessary.

Following up diligently on outstanding issues ensures that your needs are addressed promptly and effectively.

Conclusion

Knowing how to deposit money in EXNESS to bank account is crucial for anyone looking to navigate the world of trading and investment. With a variety of deposit methods available, understanding each one's advantages, fees, and security implications can substantially enhance your trading experience.

From the intricacies of selecting a deposit method that suits your trading style, to troubleshooting common deposit issues and ensuring a smooth withdrawal process, being informed is key. Moreover, leveraging EXNESS customer support and implementing security best practices will protect your investments and provide peace of mind.

By taking a proactive approach to your financial activities on EXNESS, you’ll be better equipped to succeed in your trading journey. Happy trading!

See more:

👉 How to change time zone in Exness

👉 Exness Social Trading Minimum Deposit

👉 Does exness have volatility index

👉 How do I deposit and withdraw money from my Exness account?